Asia Express – Cointelegraph Magazine

|

The grooming rumors of the Crypto University echo the scandal of the “naked loan” of China

The major cryptocurrency exchanges are under fire for allegations that they have given locking effects to the platform to university students in China to encourage speculative trade. The controversy made comparisons with the loans of loans on the country’s campus almost a decade ago, when students overwhelmed by debts were offered “bare loans” operators in exchange for bare photos as guaranteed.

Bruce Xu, co-founder of Ethpanda, said that centralized exchanges offered students non-tenure for trial funds that did not take a long-term trade funds. The profits could be kept and the students who displayed high screenshots on WeChat would be offered additional rewards. Xu described the grooming model the next generation of play games.

Crypto Media Outlet Blockbeats called on all exchanges to stop any testing of test funds targeting students, describing the campaigns as operators of a financially inexperienced demography.

While many have hypothesized that Bitget was involved due to his program as an ambassador of the February campus, Xie Jiayin (Smith TSE), the head of Asia of exchange, said that the initiative has focused on web3 and professional support, not trade. He denied that Bitget has ever distributed trial funds to students and said the program had been released in the 16 hours due to public misunderstandings.

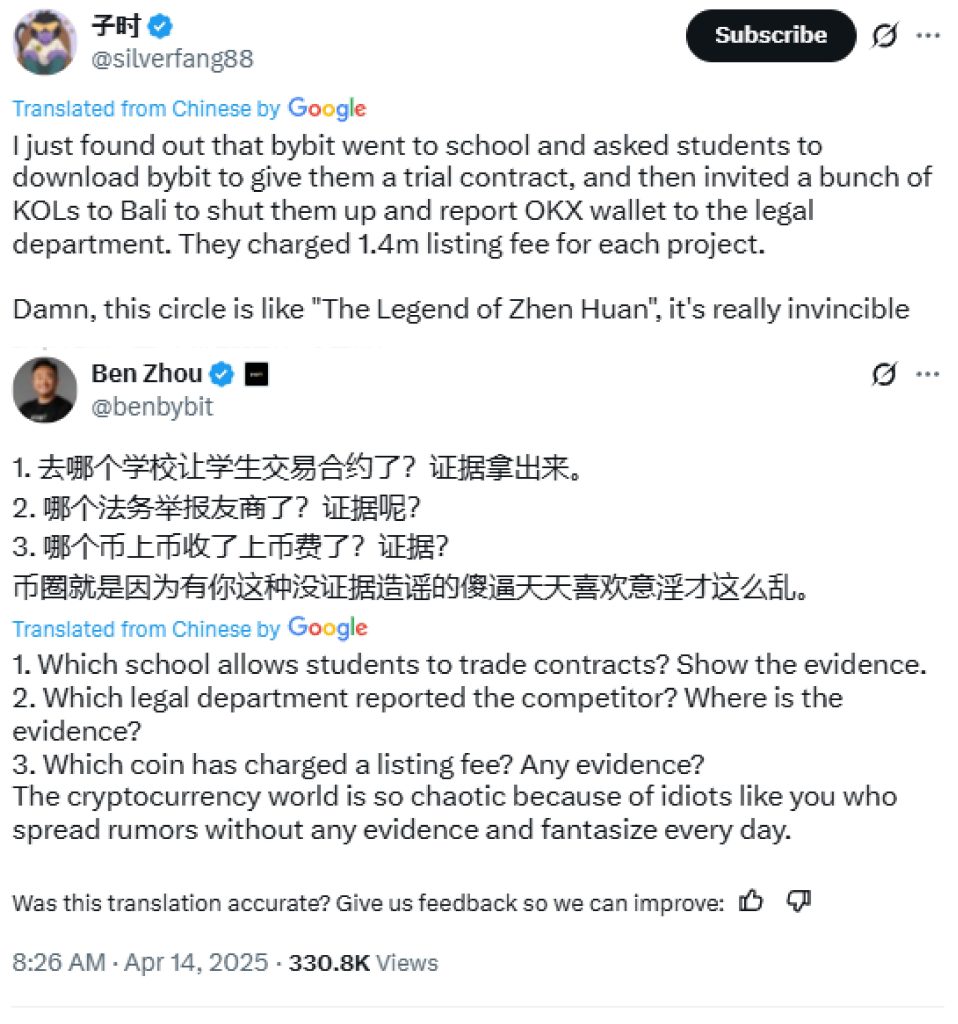

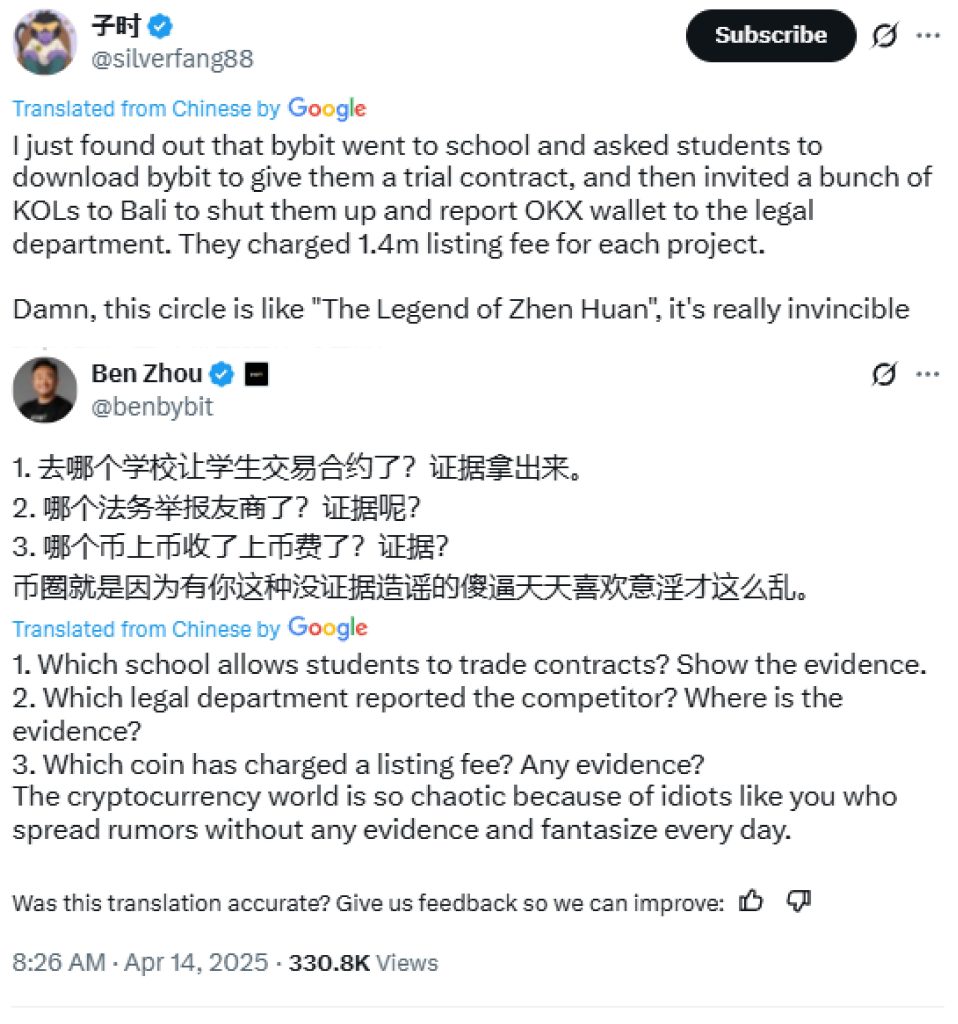

An X user has accused the part of visiting universities and distributing test funds. CEO Ben Zhou rejected complaints, asking for evidence and criticizing the spread of rumors not founded in cryptographic space.

Blockbeats compared the tumult to a fintech scandal in China ten years ago involving Qufenqi. Founded in 2014, the company offered stomach loans to students for electronics and other goods, allowing them to make monthly payments with nothing more than a student identifier. The company has physically visited university campuses with stands and leaflets to push its product.

The platform was quickly mired in controversy due to hidden costs and debt traps that let the students borrow from a platform to reimburse another. The investigations on the local media revealed a much darker side of the loans on the campus, while some students turned to the lenders of the black market to reimburse their debt. Desperate students have used what we call bare loans, where students were invited to provide naked photos or videos in warranty, with the threat of a public exhibition if they did not reimburse. Some fell into irreversible debt spirals and have reimbursed their debt with sexual favors. In the most tragic cases, some were taken to suicide.

Companies offering loans on the campus closed following a regulatory repression in 2016 and 2017. Qufenqi abandoned its loan model on the campus and repaired the Qudain and listed on the Nasdaq. But its negative image has damaged its reputation and its stocks are down more than 90% of their peak.

Nine Chinese crooks fraud 67,000 Indian men posing for Indian women

A court in the Shandong province in eastern China has returned prisoner up to more than 14 years to nine telecommunications fraudsters who have fraudd 66,800 Indian men by pretending to succeed in Indian women, according to the Legal Daily State Journal.

The fraud ring would have defrauded 517 million rupees (more than $ 6 million) from June 2023 to January 2024 in a short -term style program, using translation tools and cat applications to attract victims.

The leader, identified by the surname, admitted to having received investments in Indian rupees and converted the product into USDT, which were then laundered in Chinese Yuan thanks to third -party payment services.

To make their characters more convincing, the group used glamorous photos of the lifestyle, such as fitness selfies, travel photos and other organized images, to present emotionally vulnerable but financially successful Indian women. They geolored their social media profiles in Indian cities and created a false business to gain the confidence of the victims.

This is not the first time that Chinese crooks have emerged from rich foreign women to target men abroad. According to Chenzhou Internet police, two suspects were arrested in March 2024 for using translation applications to defraud Turkish men thanks to a false shopping and online program, pretending to be rich Malaysian women. They were supported by a team of more than 10 staff members and worked during Turkish working hours, or from 3 p.m. to 1 a.m. local time.

Police cited a member of the staff known as “Xiao A” saying: “I played the character of Lisa, a 31-year-old Malaysian-Chinese woman, divorced, with soft, long hair, about 170 cm high. She was a fashion designer with her own shop in Malaysia and an Amazonian floor. She had her own house and car. ”

All employees pretended to be divorced women at the start of the thirties with stable financial history. The company provided a four -day scripted engagement plan to guide conversations with targets.

Read

Features

Crypto indexes rush to win hesitant investors

Features

How to protect your crypto in a volatile market: OG and Bitcoin experts weigh

The dry Philippines launches the cryptographic sandbox to shape future regulations

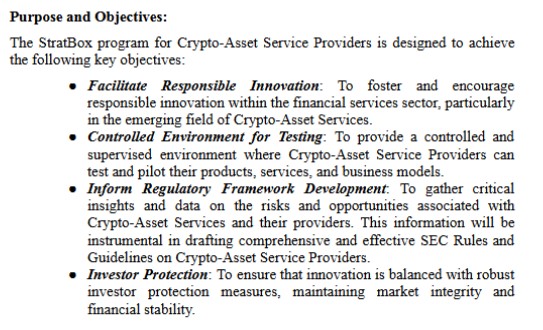

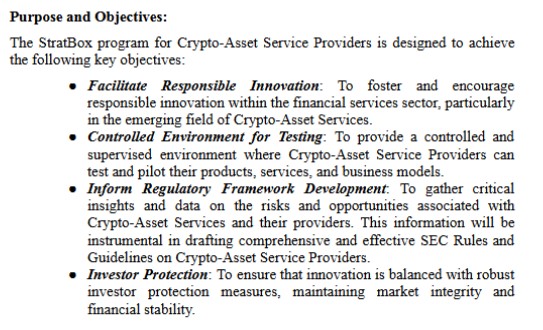

The Philippines Securities and Exchange Commission (SEC) has opened applications for its new strategic sandbox program (Stratbox), targeting crypto service providers who seek to test products under supervision.

The SEC said in a press release that the Stratbox will offer a controlled environment where eligible entities can control products, services and commercial models related to crypto. The data collected via the sandbox should shed light on the possible drafting of regulations for the country’s digital asset sector. Although focused on cryptographic companies, the program is also open to startups working on non -crypto financial innovations.

The launch of the sandbox is launched in the middle of an increasing activity of crypto and stablecoin in the Philippines. Circle, the USDC issuer, recently joined GCASH, the most used digital portfolio in the country to integrate the USDC for its almost 100 million users.

The integration of GCASH is particularly remarkable because the company looks at a potential public list. In February, the CEO of Globe Telecom, Ernest Cu, confirmed that an IPO for GCASH remains under study, although no calendar has been set.

Read

Features

How Chinese merchants and minors are bypassing the ban on Chinese cryptography

Features

Most of the backup projects barely use blockchain: true or false?

How the South Koreans pump the prices of crypto

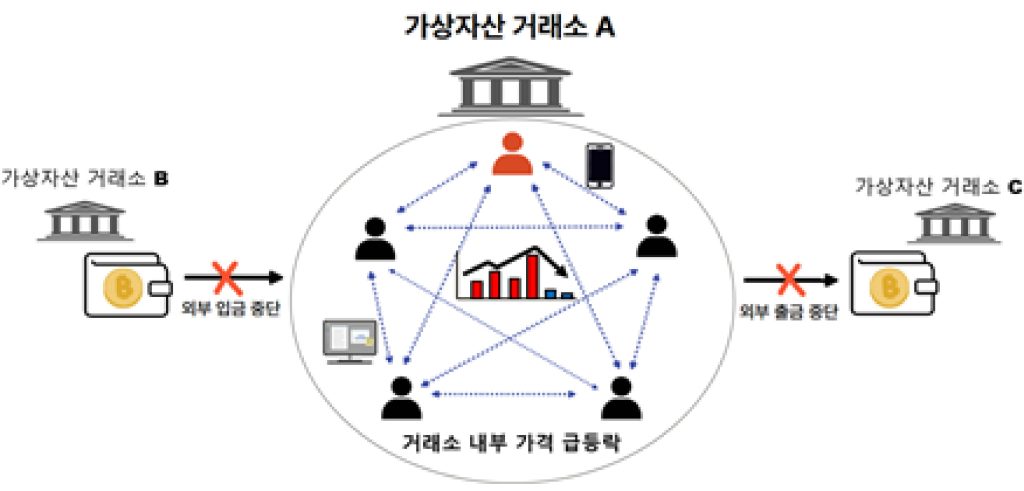

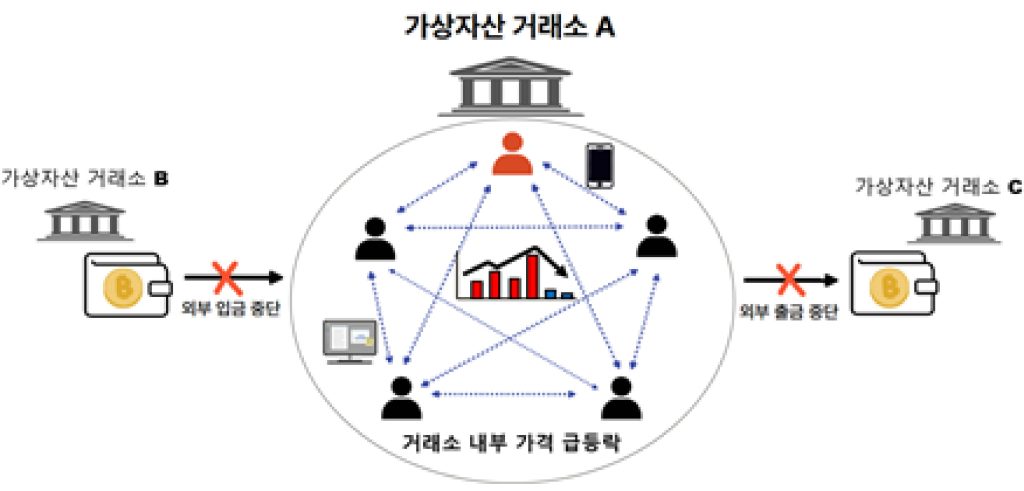

The South Korean financial regulators have returned a group of people suspected of manipulating the prices of cryptography to prosecutors while discovering two new tactics.

In a joint declaration on April 16, the Financial Financial Services Commission (FSC) and the Financial Supervisory Service (FSS) said that tactics operate the basic characteristics of the cryptography market, such as 24/7 commercial lists and multi-waste, to artificially inflate certain tokens.

The first, nicknamed the “Racehorse at X Hour” method, implies major purchases in the foreground just before or after a scholarship resets the percentages of daily price variation. Depending on the platform, local exchanges often reset at 00:00, 9:00 a.m. or 11 a.m. The suspects have manipulated the prices of pumped tokens by accumulating large quantities of a cryptocurrency, then flooded the market with fast shooting purchase orders as quickly as two per second on a window of 20 to 30 minutes, creating the illusion of the purchase of momentum and drying in retail investors.

The second method, known locally as “cage pumping”, takes advantage of situations where deposits or withdrawals of a token are suspended due to investment warnings. This reduces arbitration opportunities and limits liquidity, allowing bad players to execute manipulative transactions to increase prices on a single scholarship. The overvoltages then create a false feeling of demand, attracting other traders to buy before prices were ultimately collapsed.

“During the manipulation periods, the assigned tokens have increased by ten times on a single scholarship compared to the others, only to crash once the activity is finished,” said regulators, urging retail investors to be careful about the price movements.

Such a market manipulation is a violation of local cryptography regulations, causing criminal sanctions of at least a year in prison or fines ranging from three to five times the unlawful benefit.

Get down

The most engaging can be read in the blockchain. Delivered once a week.

Yohan Yun

Yohan Yun has been a multimedia journalist covering the blockchain since 2017. He has contributed to Crypto Media Outlet Forkast as an editor and covered Asian technological stories as an assistant journalist for Bloomberg BNA and Forbes. He spends his free time cooking and experimenting with new recipes.

Read

Hodler digest

Ethereum ends the merger, Kwon faces a arrest warrant and the Bitcoin dives after the rally: Hodler’s Digest, from September 11 to 17

7 min

September 17, 2022

The best (and worst) quotes, the salients of adoption and regulation, the main parts, the predictions and much more – a week on Cointelegraph in a link!

Learn more

Hodler digest

Bitcoin goes to $ 90,000? Solana ETF, and more: Hodler’s Digest, November 17-13 23

7 min

November 23, 2024

A Crypto trader thinks if Bitcoin will return to $ 90,000, Solana ETF deposits flood and more: Hodlers Digest

Learn more