Solana Demand Eclipses Ethereum, But Why Can’t It Break $200?

Solana (SOL) has faced a challenging price trend recently, with its decline halted, but the altcoin is struggling to reclaim $200 as support.

This difficulty persists despite Solana outpacing demand for Ethereum in recent months, highlighting a disconnect between interest and price action.

Solana does better than Ethereum

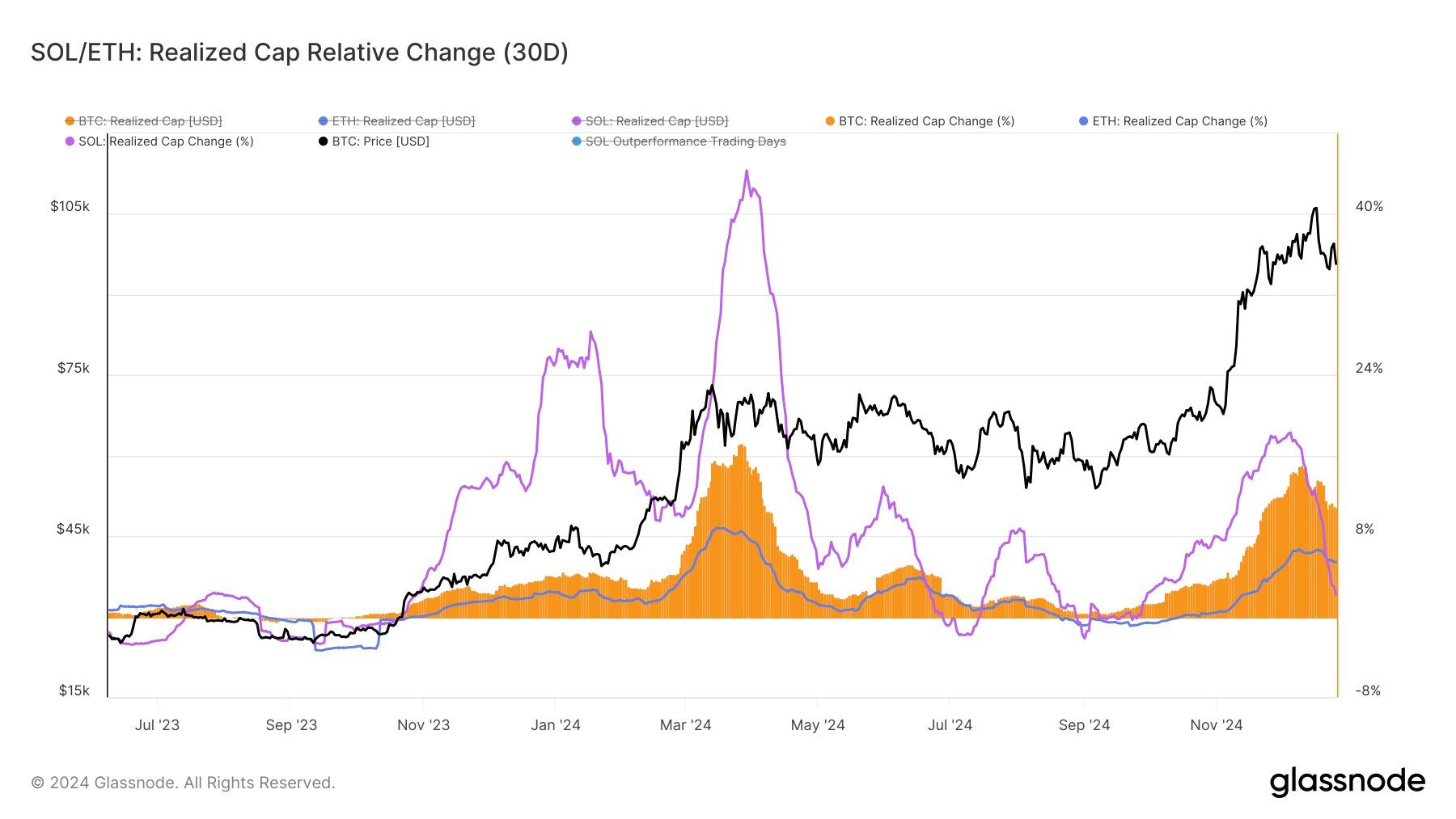

Demand for Solana has surpassed Ethereum, as evidenced by the Hot Realized Cap metric. According to a report from Glassnode, SOL’s hot cap reached $9.5 billion this week, more than double Ethereum’s $4.1 billion. This indicates continued investor interest and increased activity within the Solana network.

“Comparing the scale of new capital entering the asset between Solana and Ethereum, we can observe that new investor demand for Solana, for the first time in history, has exceeded Ethereum, highlighting its strong demand profile . Notably, the sharp increase in the hot cap for Solana before the start of 2024 marked the upward inflection point for the SOL/ETH ratio, with the influx of new capital driving growth,” Glassnode noted.

Solana’s macroeconomic dynamics present a mixed outlook. The change in realized cap for SOL only increased by 2.19%, significantly lower than Bitcoin’s 10.87% and Ethereum’s 5.43%. This disparity highlights a faster loss of momentum for Solana compared to the two largest cryptocurrencies.

This slower growth in realized capitalization portends a bearish near-term outlook, suggesting that Solana’s network activity has not kept pace with growing demand. For SOL to regain stronger momentum, there would need to be a resurgence in realized capitalization growth and broader market support.

SOL Price Prediction: Resistance Ahead

Solana price is currently struggling to reclaim $200 as support, rising to $185 at the time of writing. This is consistent with the short-term bearish outlook, indicating that SOL may continue to face resistance to surpass the key psychological level.

Above its $175 support level, Solana remains in a precarious position. Losing this support could expose the altcoin to a correction, with $155 becoming the next important support level. Such a drop would reinforce bearish sentiment and delay any recovery attempt.

However, positive market signals could allow Solana to turn $200 into support, thus invalidating the bearish thesis. Reaching this milestone could trigger a rally towards $221 or higher, restoring confidence in the cryptocurrency’s upward trajectory. Sustained demand and broader market optimism would be the main drivers of this scenario.

Disclaimer

In accordance with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to providing accurate and unbiased reporting, but market conditions are subject to change without notice. Always do your own research and consult a professional before making any financial decision. Please note that our Terms and Conditions, Privacy Policy and Disclaimer have been updated.