Can 4-Month High BTC Buying Push Bitcoin Price To New High?

The recent Bitcoin gathering has drawn the attention of investors as its price approaches $ 105,000. The main cryptocurrency gained momentum throughout last month, fueled by a strong institutional interest and a renewal of market optimism.

However, contradictory market conditions can prevent Bitcoin from reaching a new summit of all time.

Bitcoin holders accumulate strongly

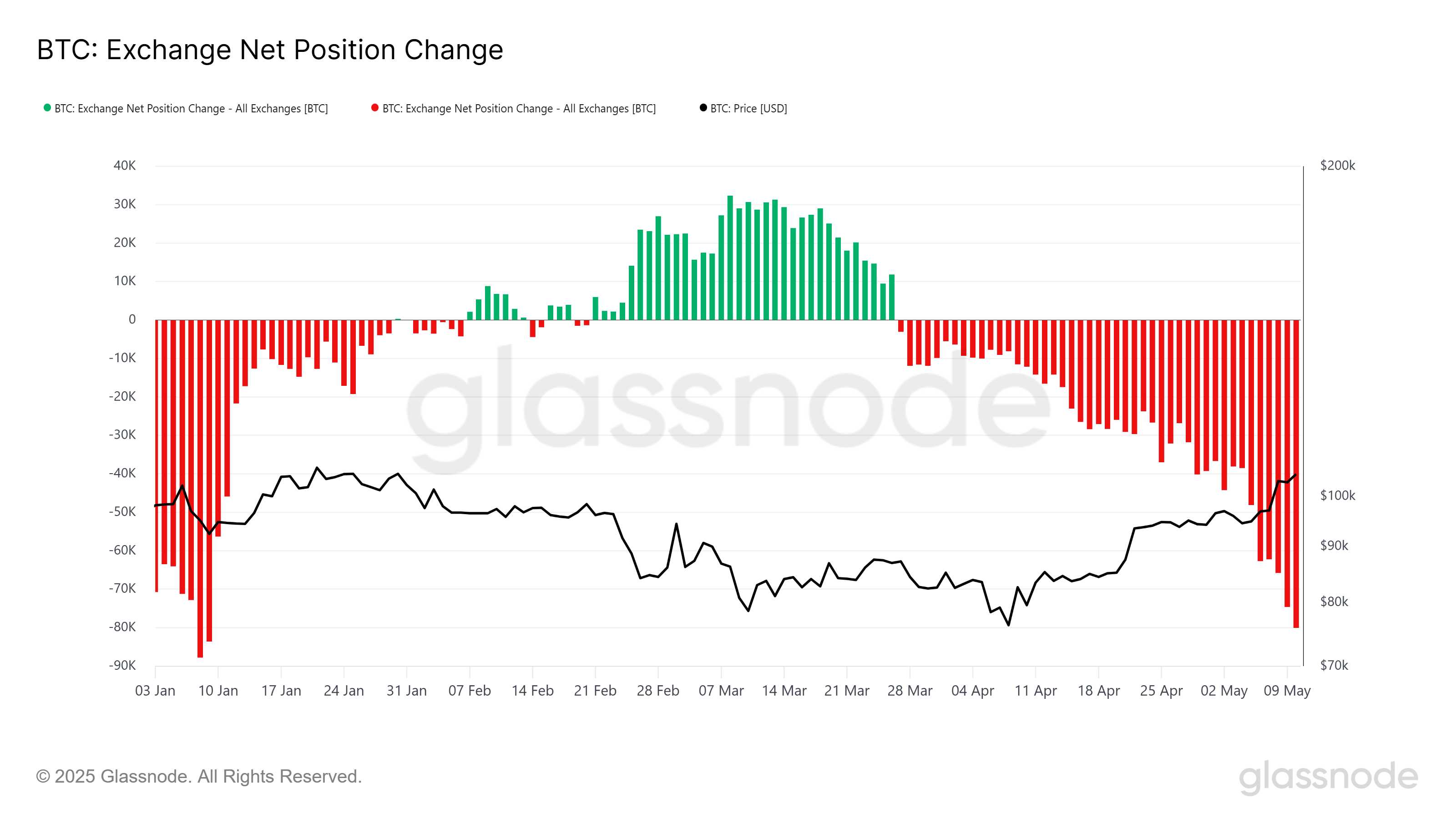

The activity of investors was extremely optimistic. In the last week only, more than 30,072 BTC, valued at more than $ 3.13 billion, were purchased. This increase in the purchase activity led the net exchange position to its lowest level in four months.

The metric indicates that more parts are removed from the exchanges than deposited, a classic sign of accumulation.

The fear of missing benefits pushes Bitcoin holders to accumulate at a quick pace. While Bitcoin hovers near its record peaks, long -term investors seem to add to their positions, betting on a new escape.

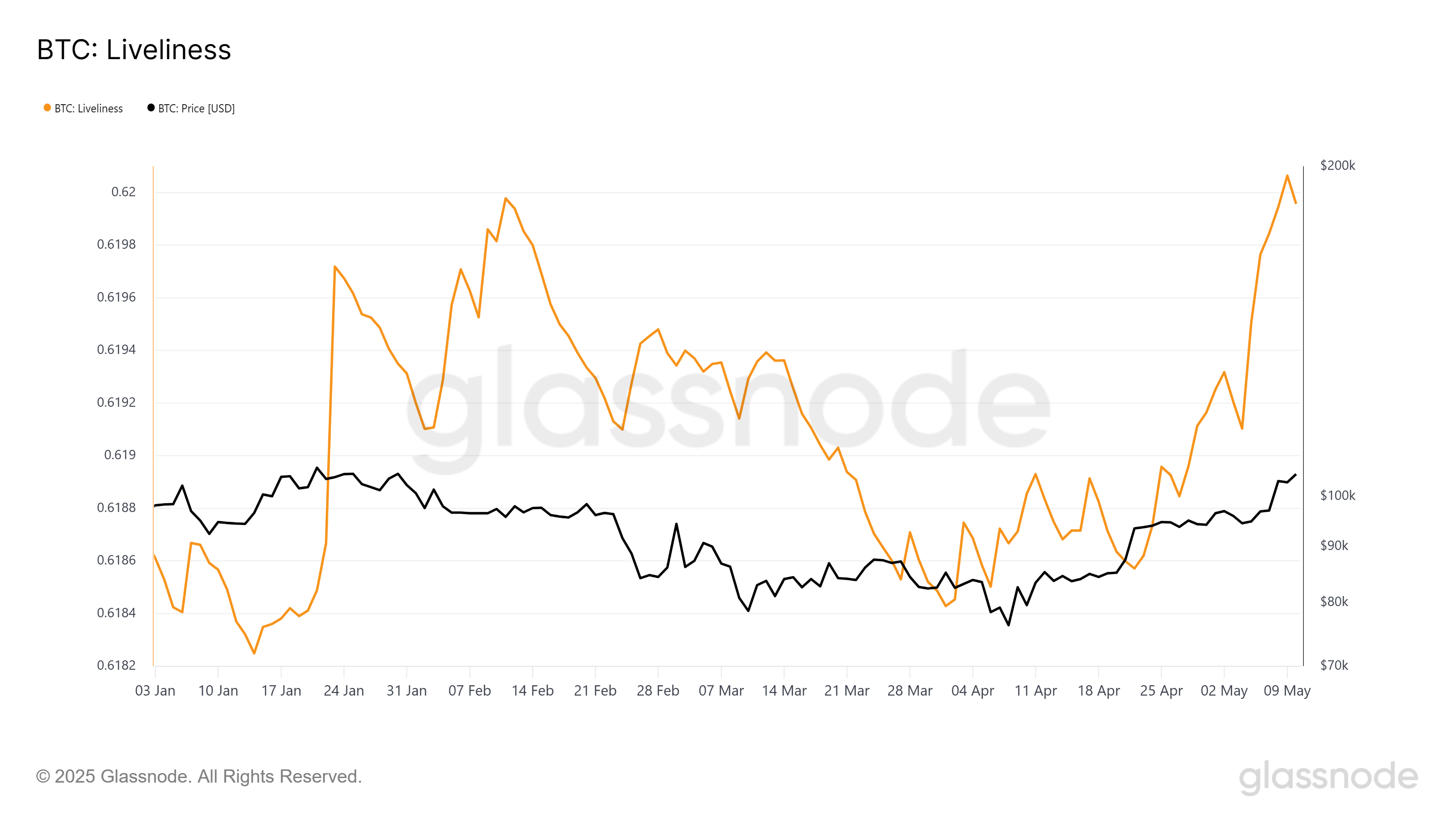

Although the accumulation remains strong, the trend macro has a mixed image. The liveliness indicator, a key metric on the chain, has experienced a notable peak since the beginning of May. Currently seated at a summit of several weeks, this suggests that long -term holders (LTH) are starting to liquidate themselves.

An increase in liveliness generally means that dormant parts become active, often pointing out that early adopters take advantage. This behavior can introduce new sales pressure on the market.

If the LTH Bitcoin continues to unload their assets, it could undermine the bullish feeling caused by a new accumulation.

BTC Price aims in New Ath

Bitcoin is currently negotiated at $ 104,231, just below the key psychological resistance of $ 105,000. However, technical data show that real resistance is $ 106,265. This price level has acted as a ceiling since December 2024, preventing Bitcoin from gaining ground.

Despite the high level of all time at $ 109,588, the $ 106,265 bar is the immediate obstacle of Bitcoin. Market dynamics – notably the sale of LTHs and the contradictory feeling of investors – make this level particularly difficult to rape.

If Bitcoin fails to overcome this resistance, a price correction at $ 100,000 remains a strong possibility.

Conversely, if BTC manages to break and return $ 106,265 in a support floor, it could rekindle the bullish momentum. Such a decision would open the way to Bitcoin to recover $ 109,588 and potentially form a new summit of all time.

Overcoming this level would invalidate the lowering prospects and could prepare the field for a race at $ 110,000.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.