Nvidia Executives Offload Over $1bn in Stock as Shares Soar to Record Highs Amid AI Boom

NVIDIA leaders have sold more than a billion dollars in stocks in the past year, including $ 500 million narcotics last month, according to a Times financial report citing the data from Veritydata.

Most of the sales occurred while the course of NVIDIA’s action has crossed $ 150, triggering sales pre -arranged by the main initiates – including CEO Jensen Huang – who take advantage of the record assessment of the company motivated by the unrelated demand for the AI chips.

Sales arise while Nvidia briefly recovered its place as the most precious company in the world, eclipping both Microsoft and Apple with market capitalization nearly 3.77 billions of dollars.

Register For TEKEDIA Mini-MBA Edition 17 (June 9 – September 6, 2025)) Today for early reductions. An annual for access to Blurara.com.

Tekedia Ai in Masterclass Business open registration.

Join Tekedia Capital Syndicate and co-INivest in large world startups.

Register become a better CEO or director with CEO program and director of Tekedia.

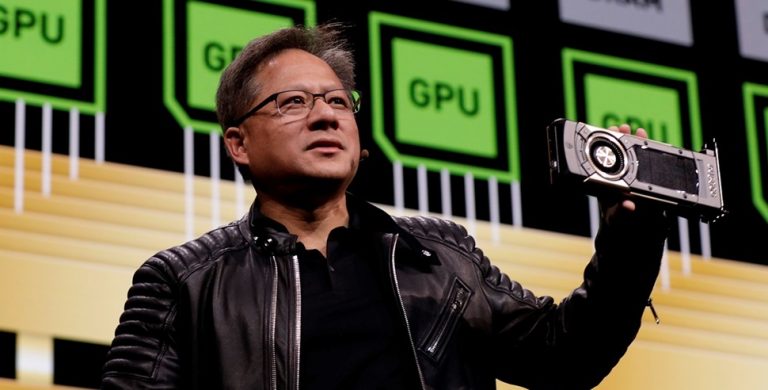

CEO Jensen Huang directs sales

Jensen Huang, the public face of the ancestry of the Nvidia AI, took into account the share of the lion of the activity of initiates. In March 2024, Huang implemented a 10B5-1 negotiation plan to sell up to 6 million Nvidia shares, which potentially reported $ 900 million by the end of the year. The securities deposits show that Huang has recently made sales of approximately $ 15 million under this arrangement.

The CEO’s net value is now about $ 138 billion, placing it 11th on the Bloomberg billionaire index. In 2023 alone, he sold more than $ 700 million in NVIDIA shares – also thanks to pre -plane transactions – marking one of the greatest liquidity of initiates in the S&P 500.

Huang is not alone. Other main initiates, including members of the Board of Directors Mark Stevens, Tench Coxe, Brooke Seawell and the executive Jay Puri, also sold tens of millions of dollars in stock, collectively carrying the total of 12 months above the billions of dollars.

The overvoltage of stocks was sold

Initiate sales have taken place in a context of explosive gains in Nvidia’s shares, which increases by more than 17% of years and more than 44% in the last three months. The push is largely credited with the domination of the company in AI equipment, in particular its GPUs of the data center, which have become fundamental of the models of generative companies like Openai, Meta, Google and Amazon.

Despite the geopolitical tensions and the export restrictions imposed by the Biden administration on the advanced expeditions of AI fleas in China, the momentum of Nvidia has barely slowed down. The company recently introduced its new generation Blackwell AI chips, further solidifying its advance in the sector and absorbing rivals hopes like AMD, Intel and personalized flea projects from Microsoft and Google.

Nvidia Eyes Robotics as the next border

During his annual shareholders’ meeting in June, Huang pointed out beyond AI, declaring robotics as the next “opportunity for several Nvidia dollars”. The company said $ 567 million in revenue from its automotive and robotic segment in the last quarter, up 72% in annual shift.

“Robotics will be the next disturbance at AI level,” said Huang, noting that Nvidia chips are increasingly adopted in autonomous driving applications, factory automation and medical robotics.

Why initiate sales do not necessarily spend problems

While $ 1 billion in initiate sellers may seem alarming, analysts note that these transactions are mainly governed by the dry 10b5-1 rule, which allows initiates to plan sales of action in advance to avoid accusations of market manipulation. Veritydata confirmed that most recent sales were aligned on these legally established plans.

However, the time of sales – coincidences with the Nvidia rally at the historical heights – has not gone unnoticed. Some market observers consider it a prudent financial decision by conscious executives of advanced assessments, while others raise questions about the sustainability of future growth in a rapidly evolving race of AI.

The market remains optimistic

Despite the activity of initiates, Wall Street remains extremely optimistic about Nvidia. Analysts continue to upgrade the price objectives, citing solid profits, an unrivaled domination in the IA infrastructure and an increasing software ecosystem, including its CUDA platform and Omnivese simulation tools.

Investor confidence is also reinforced by Nvidia’s strategic role in training the future of AI development. The company is already a key supplier for the border AI systems developed by the OPENAI GPT-5, the Meta Llama 5 and the Gemini series from Google, the demand that should remain red in the foreseeable future.

Nvidia initiate sales mark a financial windfall for its superior brass, but they do not seem to reduce the enthusiasm of investors for what many consider the most essential technological society of the AI era. While Nvidia extends beyond data centers in robotics, new generation automobile and IT, its position at the top of the world of technology seems – at least for the moment – security.