Berachain (BERA) Struggles at $6 Despite Weaker Bearish Signals

Berachain (Bera) is currently negotiating around $ 6.05, with a market capitalization located nearly $ 653 million, after deciding a recent summit of $ 7.08 reached on March 17.

The asset has consolidated after the recent drop in prices, as technical indicators suggest mixed signals. Although the lowering trends are always present, certain early signs of bullish impulse begin to emerge.

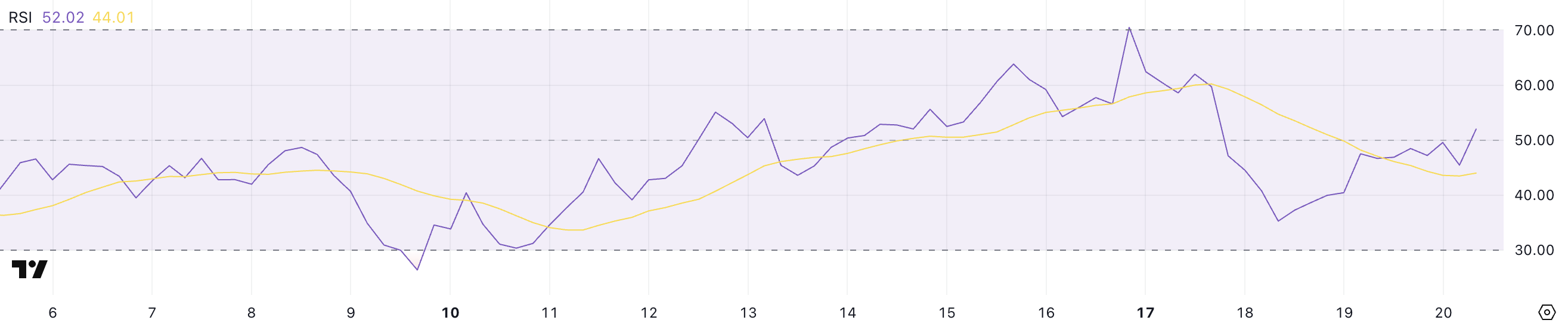

Berachain RSI shows a bullish momentum could appear soon

Berachain shows signs of stabilization after the recent volatility, his RSI being currently seated at 52, against 35 only two days ago.

This rebound follows a sharp drop in an exaggerated level of 70.5, which was reached four days ago before the RSI cools.

The climb above 50 suggests that the bullish momentum begins to find a certain control after the recent correction, although the market remains relatively balanced between buyers and sellers for the moment.

The RSI (relative resistance index) is a Momentum oscillator which measures the speed and extent of recent price changes, helping to identify the potential conditions of surface or occurrence.

As a general rule, an RSI above 70 points out that an asset could be exaggerated and due for a decline, while a RSI less than 30 points in the conditions of occurrence, which could precede a price rebound.

With the Bera RSI at 52, it is now in neutral territory, not pointing out a suracheté or a condition of occurrence. This suggests that although the sales pressure has been relaxed, buyers still have to create more momentum to cause a sustained increase trend.

Bera CMF increases, but the purchase of pressure is still building

Berachain CMF is currently at -0.01, an improvement compared to -0.23 yesterday, which indicates that the sale pressure has started to facilitate ease.

However, despite this slight recovery, the CMF still oscillates in negative territory, suggesting that the market does not yet see strong capital entries.

What is remarkable is that Bera’s CMF has not exceeded 0.10 since March 14, signaling a prolonged period of low purchase volume and a cautious feeling for investors.

The Silver Silver Flow (CMF) is an indicator based on the volume that measures the flow of money in and outside an asset over a given period.

The values above 0 indicate a purchase pressure or accumulation, while values below 0 signal or distribution sales pressure. With the CMF of Bera still almost neutral but below zero, it shows that if the sellers lose momentum, buyers must still take control firmly.

Until the CMF is decisively pushing for a positive territory – in particular above 0.10 – any upward price movement can have trouble maintaining itself without stronger hindrances.

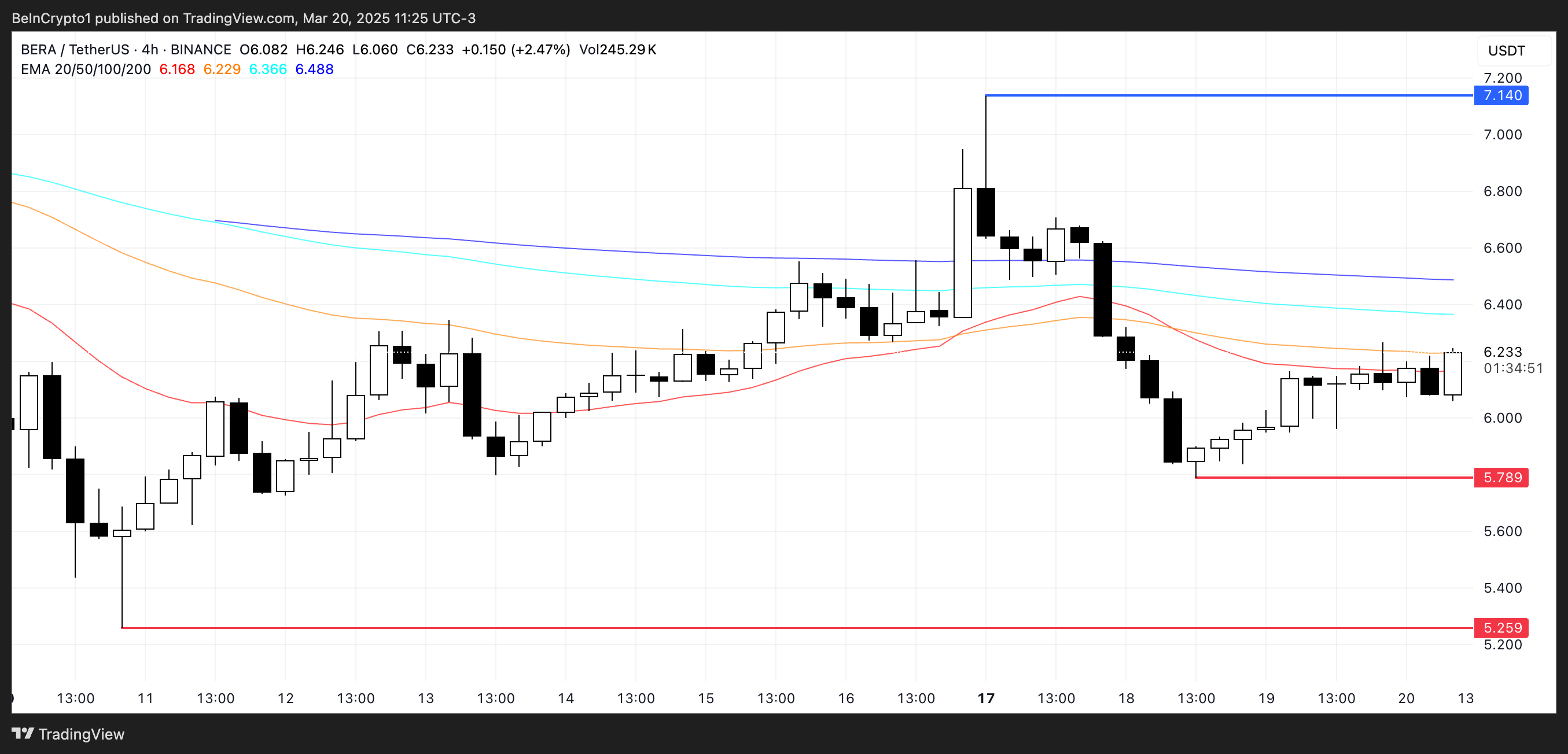

Can Berachain go to $ 7?

The EMA lines of Berachain continue to reflect a lower configuration, with short -term mobile averages positioned below those in the long term.

This indicates that the momentum still dominates the market. However, if Berachain manages to reverse this trend and create bullish momentum, the price could first target resistance around $ 7.14.

An escape above this level could open the door for a movement to $ 7.50 or even $ 8, a price level not seen since March 3.

Lower, if Bera fails to establish an upward trend and a downward momentum persists, the price could fall back to test the key support at $ 5.78.

The loss of this level would probably deepen the lower perspectives, which could reduce the price of Berachain to $ 5.25 in the short term.

For the moment, the alignment EMA suggests that the sellers always have the upper hand, but a change of momentum could quickly change the structure of the market and trigger a rally.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.