Berachain Controversy as Co-Founder Sells BERA Tokens

Only a few days after its launch and its Airdrop, the Berachain community is concerned about the visible favoritism of the project towards private investors. There are also allegations concerning the main developer of the network exchanging large amounts of Bera tokens.

Despite this, however, Berachain has the possibility of rebuilding public confidence. If its system of proof of liquidity is implemented and becomes operational, it would be a really new project.

Doubling decisions of Berachain developers

Berachain, the new layer-1 blockchain network, has created a notable commitment in cryptographic space due to its launch Airdrop and Mainnet last week. Although the company has a clear vision of becoming a new network with its unique mechanism of “proof of liquidity”, its marketing and its overhauling evoke the culture of the same.

Its pre-launch liquidity platform attracted $ 2.3 billion in deposits. Berachain also launched one of the largest air terminals this year with its main launch on February 6. Her Bera token also received a list of binance immediately after TGE, as well as other major exchanges.

However, the troubles have prepared. When the aerial platform occurred, users have complained that the Testnet farmers have obtained tiny bera tokens.

Berachain’s blockchain is designed as an autonomous system of three tokens: Bera, BGT and honey, which fulfill different functions. However, by stimulating and burning different tokens, users can use the system.

“Wait, so all the huge initiates of Berachain, with locked bera chips, can reach the Bera, receive BGT, burn the BGT for Bera then empty?” Please tell me that is not true. It’s almost criminal, “wrote a user after the Tokenomics Bera was revealed last week.

Ericonomic, an observer of the Berachain blockchain ecosystem, compiled a wire of pressing concerns. Essentially, more than 35% of the Bera tokens supply went to private investors, and its inflation is much higher than most projects.

In addition, private investors can mark Bera to win liquid rewards which they can easily empty. There are also concerns about a potential basic developer who poured his Bera tokens.

“A co -founder [DevBear] sells tokens from one of his Doxxed addresses. He obtained around 200,000 Bera from the air card (it is a very bad thing since he or the nucleus, designed the air card), then he exchanged some of these tokens for WBTC, ETH, Byusd, etc. “Said Ericonomic.

Berachain’s developers have revealed the nature of the ignition scheme of their blockchain until recently. In addition, although they say that Berachain’s main product will be proof of liquidity, this has not yet materialized.

Thus, all these factors make long -term sustainability of Bera questionable. It could end up being as extremely volatile as unouritness coins.

“I have always seen Berachain as a breath of fresh air in a place full of scams, something with its own culture and good morality, and I’m not going to lie – see this” bad “launch and the stuff `Shaded ” I feel a little sad. But the end, if the manufacturers continue to work as they have done in recent years, Berachain will succeed and become the best place to give in from afar, “wrote Ericonomic.

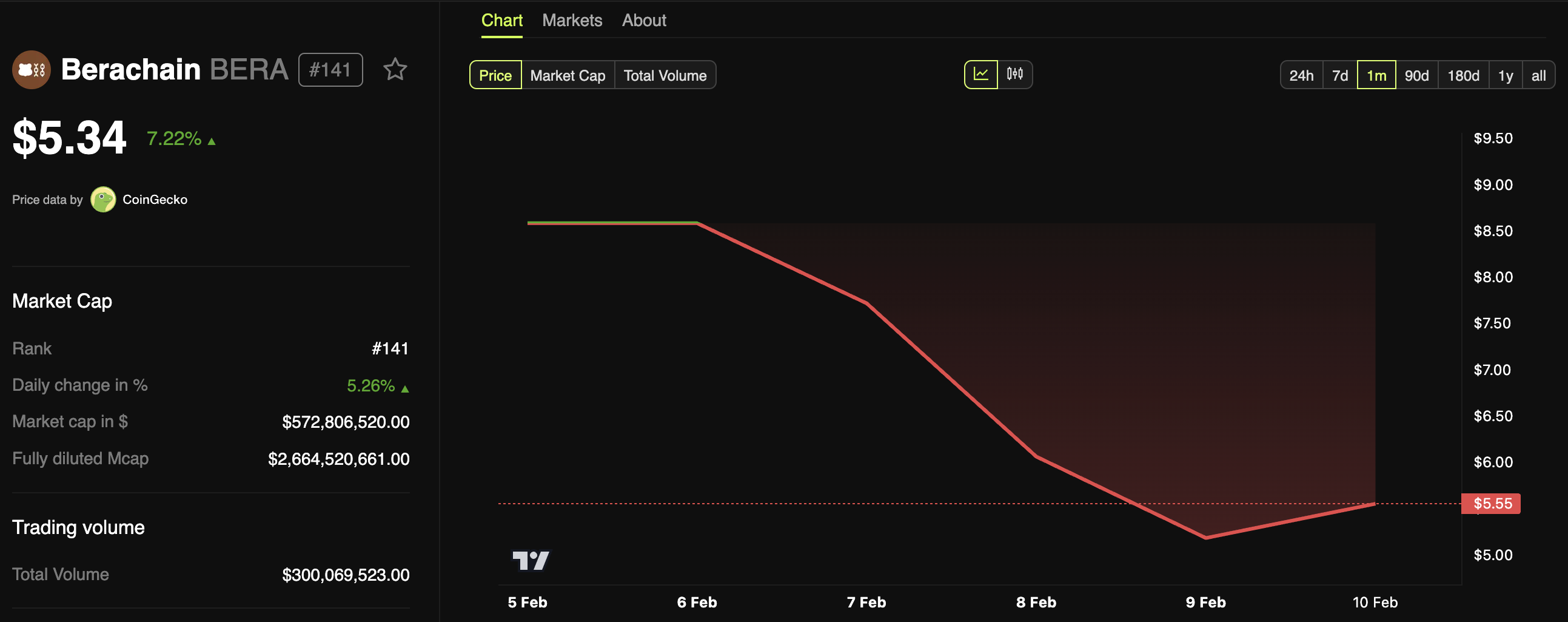

The Bera token continues to fight

As soon as the air card took place, Bera’s price began to drop like a rock. He fell by more than 50% of his intra-day peak after aerial, and he continued to fight the next day.

In appearance, Berachain tries a new type of blockchain project, but the confidence of the community was shaken and this crisis was reflected in its evaluation.

However, even despite these alarming tendencies, community members are not completely down in their predictions. There is still a lot of optimism around the mechanism of proof of liquidity (POL). The network has a significant support for developers.

Thus, if Pol is implemented and the development community remains determined to take advantage of new architecture, Berachain could probably overcome these long -term challenges.

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.