XRP Jumps 8% in a Week, Holds Steady Between Key Levels

XRP has won around 8% in the last seven days. Earlier in the week, the first ETF XRP in the world was launched in Brazil. Despite the positive momentum, XRP remains taken in a tight trading range, with key resistance and support levels always defining its short -term perspectives.

Recent indicators, including the RSI rebound and a slightly raised ichimoku cloud structure, indicate cautious optimism.

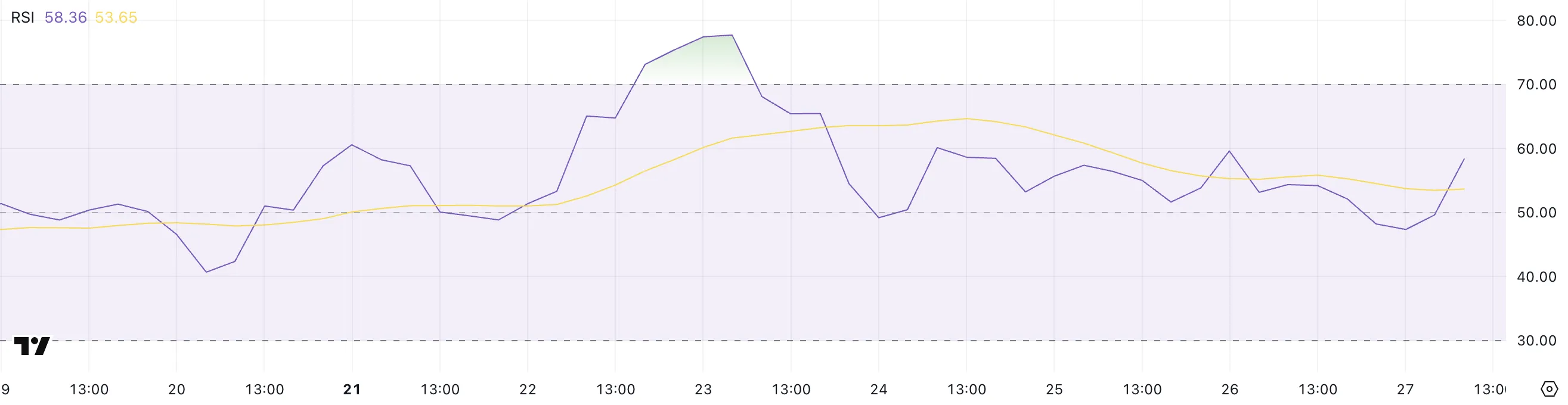

RSI XRP Bebabonds: what it means for the action of the price

The Relative Relative Force index of XRP (RSI) is currently at 58.36, going from 47.34 earlier in the day, but still down 77.7 reached four days ago.

This movement shows a recovery of recent lower levels, although it remains below the over -racket conditions observed earlier in the week.

The recent RSI trend suggests that although the bullish impulse has resurfaced in the short term, XRP has not yet found the same strength that it posted a few days ago, signaling a more cautious feeling among traders.

RSI, or index of relative resistance, is a momentum oscillator which measures the speed and variation of price movements on a scale of 0 to 100.

As a rule, an RSI above 70 points out that an asset is exaggerated and could be due to a correction, while a RSI less than 30 indicates that it is occurring and could be ready for a rebound.

With RSI from XRP now to 58.36, the asset is in a neutral bread territory, which suggests that there is still room for other gains without immediately triggering over -racket conditions.

If the purchase of the pressure continues, it could open the way to a progressive increase movement, although a lack of strong momentum can also cause a trading linked to the beach.

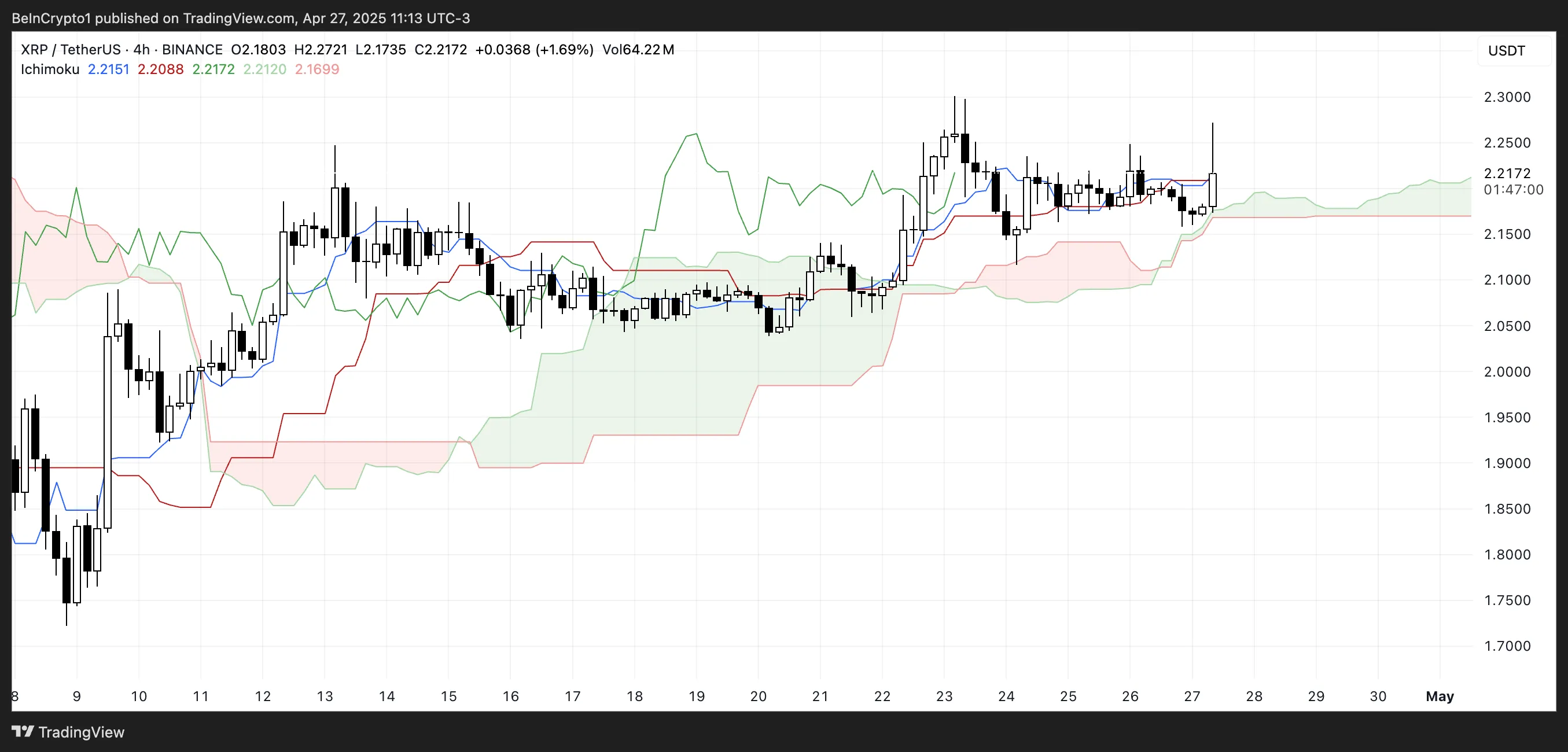

XRP hovers above the cloud in Momentum stalls

The Ichimoku Cloud for XRP has an upward structure, with the just slightly price above the cloud.

The blue lines (Tenkan-Sen) and Red (Kijun-Sen) are close to the current candle, reflecting a market with a slight bias bias but without strong momentum.

The future cloud remains green, indicating that the bullish conditions are still projected in advance. However, proximity to the lines at the price suggests a certain hesitation or short -term consolidation.

The Ichimoku system fully considers the Directorate of Trends, Elan and Support / Resistance areas.

When the price is higher than the cloud with a green cloud to come, it generally signals a favorable trend, but when Tenkan-Sen and Kijun-Sen hug the price, this may indicate a clear lack of conviction of buyers or sellers.

In the case of XRP, the upward trend remains intact, but the tight positioning of the lines points to a fragile positive trend where a net movement in both directions could easily move the structure.

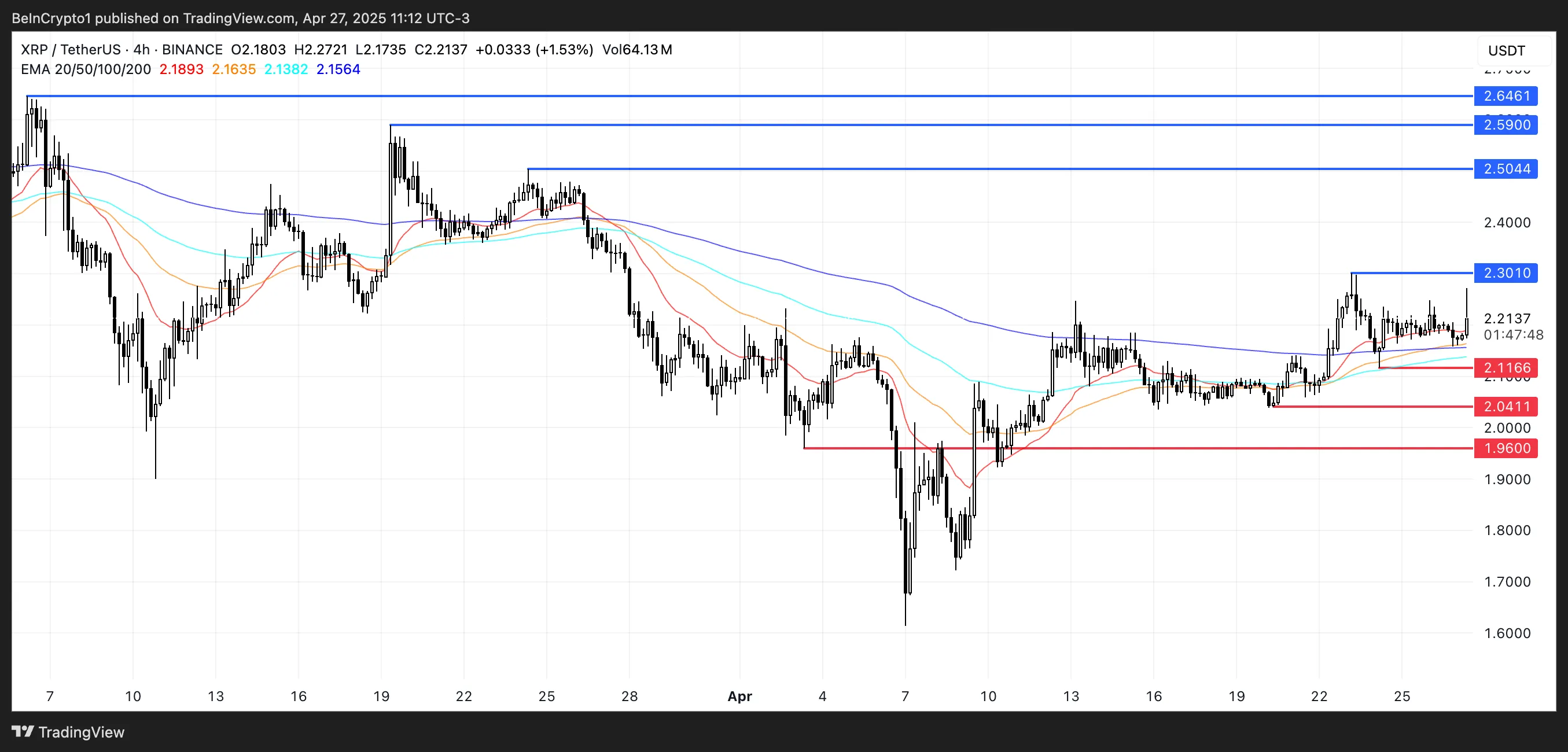

XRP perspectives: Will bulls or bears take control?

The XRP price is negotiated in a tight range, captured between a resistance level of $ 2.30 and a support level of $ 2.11.

This movement laterally occurs two days after the launch of the first ETF XRP in the world in Brazil, a development that could possibly influence the feeling of the market.

If XRP falls and loses the support of $ 2.11, this could cause a drop to the next level of support, $ 2.04.

If a downward momentum intensifies more, a deeper retrace could see XRP test levels less than $ 1.96, which makes the buyers crucial to defend the current support area.

Conversely, if XRP tests and exceeds the resistance of $ 2.30 with a strong bullish dynamic, the next increase target would be around $ 2.50.

Continuous force could push the price to $ 2,59, potentially extending to $ 2.64 if buyers maintain control.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.