Two Major Ethereum Whales are Buying the Dip as ETH Price Falls

Two major investors Ethereum seize the recent market correction to increase their active challenges.

During the first days of August, whale wallets collectively spent more than $ 400 million in ETH, which signals renewed confidence in the long -term value of the assets.

Ethereum whales buy the dip as chain activity increases

One of the most notable transactions came from a portfolio followed by Arkham Intelligence. Over a three -day period, the portfolio acquired around $ 300 million from ETH via the Galaxy Digital Free Commercial Office.

The portfolio currently has an unrealized loss of around $ 26 million.

However, the scale and the rapid pace of purchases suggest long -term strategic accumulation rather than short -term speculative exchanges.

Another key player in this purchase series is the company focused on Ethereum Sharplink.

According to Lookonchain, the company added 30,755 ETH to its balance sheet in two days, spending $ 108.57 million at an average price of $ 3,530 per token.

Sharplink now holds 480,031 ETH, with its current reserve worth around 1.65 billion dollars.

These acquisitions occurred while Ethereum fell to a hollow of several weeks almost $ 3,300. According to Beincrypto data, ETH has recovered slightly and is negotiated about $ 3,477 at the time of writing this document.

Industry experts noted that these whale activities reflect a broader and optimistic perspective for Ethereum.

In July, ETH exceeded $ 3,900, driven by record institutional entries, growing exposure to ETF and a stablecoin challenge expansion.

Experts argue that this is not a short -term rally but a sign of the extensive role of Ethereum in global finance.

An increase in network chain activity supports this view.

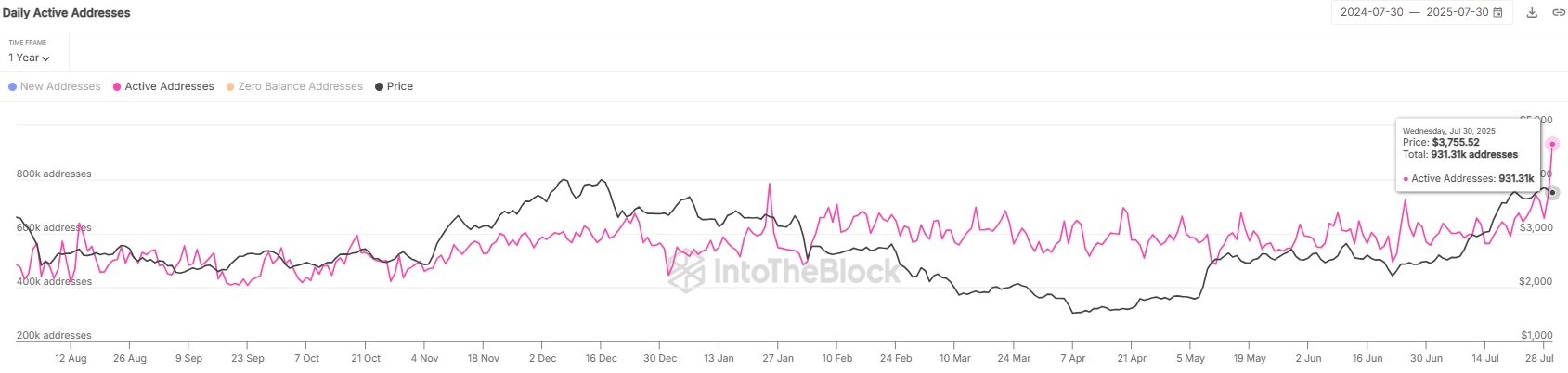

Sentora (formerly Intotheblock) recently reported that Ethereum had recorded 931,000 active addresses in a single day, its highest count in almost two years. This increase highlights an increase in the commitment and interest of users on the network.

In addition, regulatory trends can further strengthen Ethereum’s prospects, as US officials are ready to drive global finance in an era based on blockchain.

The popular venture capital Thomas Lee from Fundstrat has suggested that if Ethereum continues to dominate as a favorite intelligent contract platform for Wall Street companies, its evaluation could increase considerably, which could reach $ 60,000.

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.