Will Buyers Push XRP Further?

The market bounces after Trump interrupted plans to increase prices, and recent inflation data (ICC and PPI) have shown signs of slowdown. For this reason, Altcoins holds hard and XRP seeks to take a big step beyond the $ 2 mark. With several indicators showing growth, buyers seem to control and push to send the even higher XRP price.

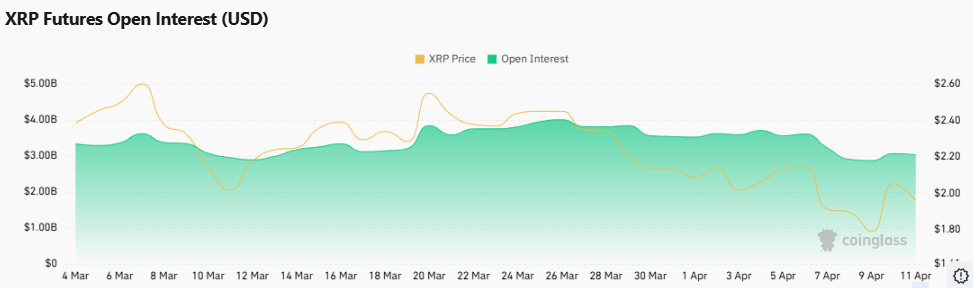

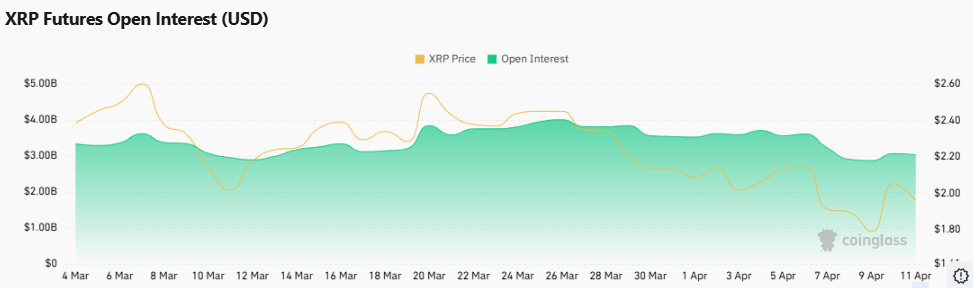

The open interest of XRP increases in the middle of the upward demand

XRP buyers hope for a solid price rally while the economy is starting to cool off. According to Coinglass data, XRP experienced $ 5.21 million in liquidations in the last 24 hours. As a result, 1.59 million dollars came from long positions during closing and $ 3.6 million came from sellers who left their positions.

In addition to that, there was a large XRP transaction today. Ripple moved 200 million XRP – Worth about 402.78 million dollars – to an unknown wallet. The transfer was followed by Whale Alert, showing that he came from the Ripple portfolio “RBG2F … 1O91M” and went to “RP4X2 … SKXV3”.

Read also: Price prediction XRP 2025, 2026-2030: $ 3 are they now out of reach?

Some people think that Ripple could prepare for something large, perhaps involving regulatory movements or major private trades (over-the-counter transactions). Others think it could be simply to reorganize their internal portfolios. Ripple has not yet said anything publicly.

This transfer also occurred just after Ripple and the SEC in the United States asked the court to suspend their legal battle, which could be a sign that they are trying to reach a more fluid resolution now than key parties of the case have been sent.

On the other hand, the launch of the XRP ETF caused a big jump in the volume of XRP trading and its open interest. The data show that the open interest (OI) in XRP is up by almost 5%, now totaling more than $ 3.1 billion. This launch has strengthened investor confidence, and there has been a significant increase in the number of active portfolios.

What is the next step for the XRP price?

XRP went up above $ 2 level, but it is now found in the EMA resistance of 100 days, which is around $ 2.1. However, buyers could soon overcome this level from purchase. During the editorial staff, the XRP price is negotiated at $ 2.04, increasing more than 4% in the last 24 hours.

If the price drop in EMA100 level, sellers could try to push the XRP / USDT pair to the key support at $ 1.73. Buyers are likely to strongly defend this area, because if it breaks, the price could drop to around $ 1.3.

On the other hand, if XRP manages to break above the 100-day EMA and holds above the descending resistance line, this would point out that buyers are preparing for other gains. In this case, the price could go to the resistance line at $ 2.6, where sellers will probably intervene again.

Currently, the long / short ratio for XRP is at 1.2, which means that more traders are betting that the price will increase. About 52% of the positions are long, showing that the overall feeling is raised.