Binance Coin (BNB) Eyes $1,200 After Overtaking Nike in Market Capitalization

BNB is currently dominating the exchange of exchange tokens and attracts capital entries from institutions and the community.

If the current trend continues, BNB could stay at the center of the next Altcoin wave. However, short -term volatility and for -profit pressure are factors that require close surveillance.

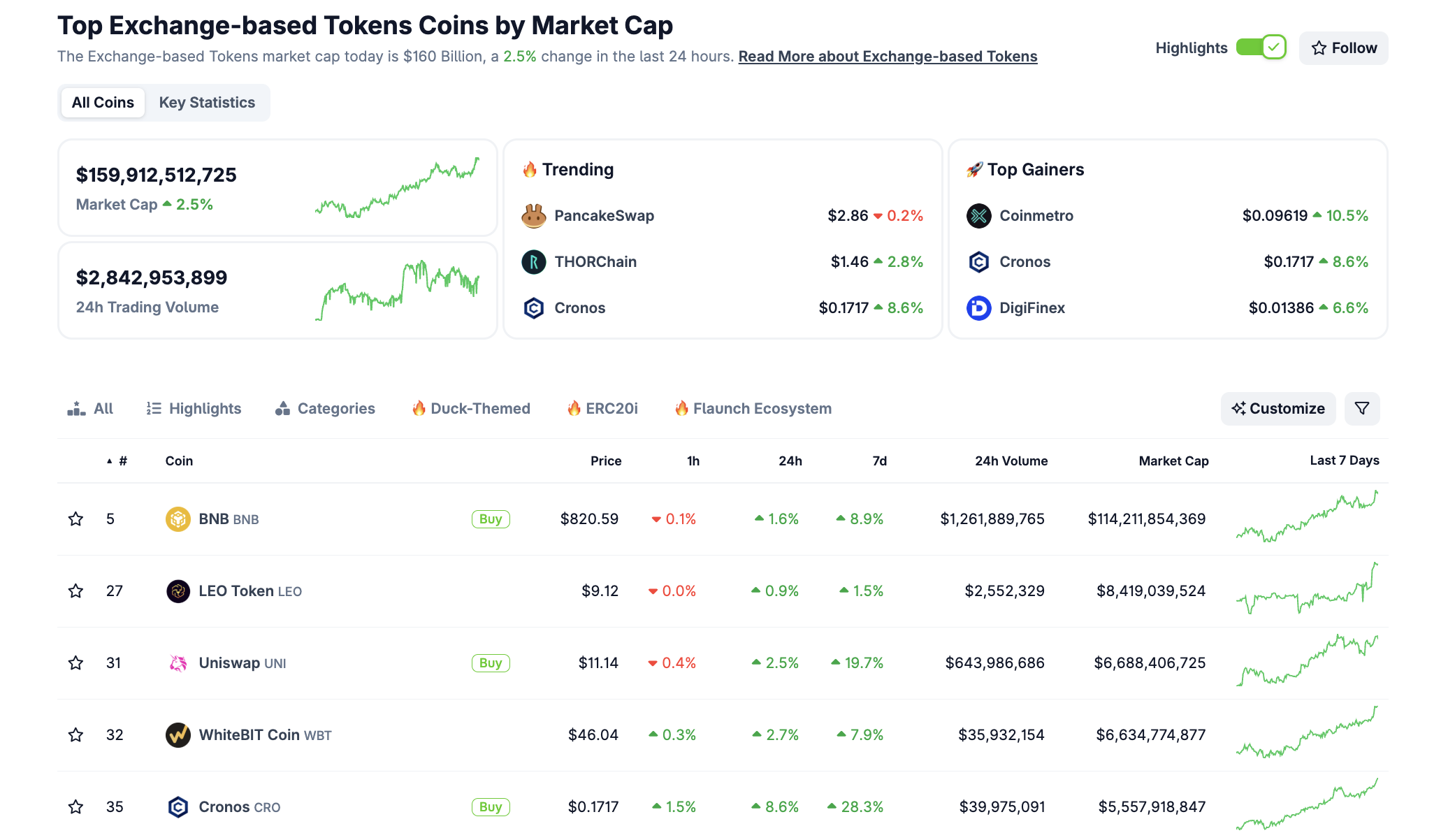

Dominant position in the segment

Binance Coin (BNB) reached its top of all time (ATH) at the end of July. Although the price of BNB has been slightly corrected compared to its previous ATH, it is still negotiated at $ 811 at the time of the editorial staff.

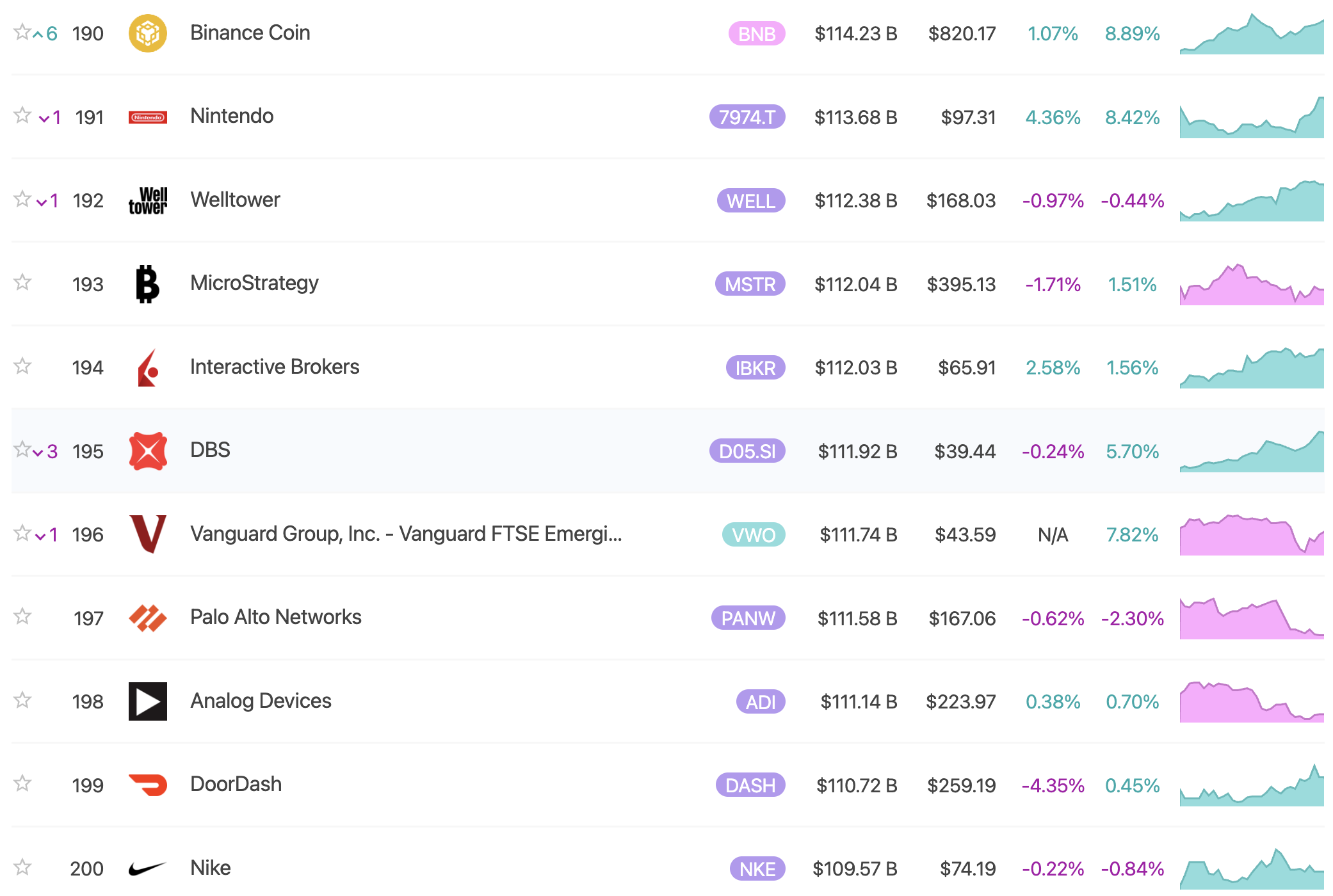

This pushed BNB’s market capitalization at 114.36 billion dollars, officially exceeding Nike and Microstrategy.

“This force is not cosmetic – it feeds both binance and BNB chain, and the current burns tightens the supply as activity on the chain is developing,” commented Daniel Nita, the user of X.

With this strong growth, BNB dominates the exchange token segment. It currently represents 81% of the total market capitalization of all tokens on the stock market.

This reflects the strength of the brand of Binance and the attraction of the ecosystem of the BNB channel in Defi, NFTS and Rwas.

Pancakeswap, the largest protocol DEFI on the BNB channel, also benefits from this price rally. The BNB ATH has attracted new capital entrances to the cake, thanks to the close liquidity and the market feeling of the market between the two tokens.

Beyond Bitcoin and Ethereum, BNB has become a target for institutions that seek to create strategic reserves. Recently, the company listed at the Nasdaq BNC (formerly Vape) spent 160 million USD to buy 200,000 BNB, making BNC the largest BNB institutional holder in the world.

Previously, Windtree Therapeutics also sought to increase USD 520 million to build a BNB reserve. This could mark the expansion of the trend of the “BNB treasure” among companies.

Potential to reach $ 1,200

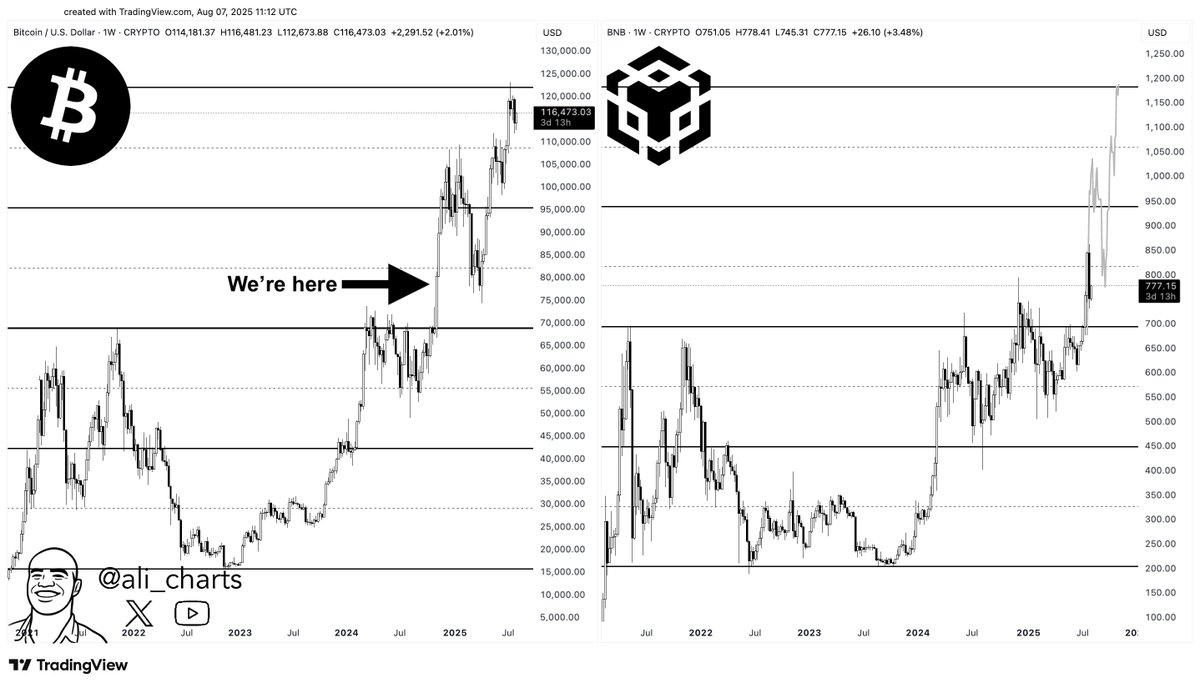

In addition, Crypto Ali analyst shared on X that the Binance Coin prices structure reflects the action of bitcoin prices. Based on this observation, Ali thinks that BNB could enter the early phase of a gathering to the $ 1,200 bar.

While the future price prospects for BNB seem optimistic, Beincrypto observed that when BNB recently reached its new ATH, some medium -term holders began to sell their BNB, creating some sales pressure. Consequently, investors should be careful with their lever -effect positions to avoid liquidation during strong BNB rallies.

The post Binance Coin (BNB) Eyes $ 1,200 after having exceeded Nike in the market capitalization appeared first on Beincrypto.