Top 3 Altcoins Crypto Whales Are Buying Before March Ends

Crypto-beaks have actively accumulated Litecoin (LTC), UNISWAP (UNI) and the Virtuals (Virtuals) protocol before the last week of March.

These three altcoins have all experienced a notable increase in the activity of the Grand-Holder in the past few days. The accumulation of whales often signals increasing confidence and can cause stronger price movements. Here is an overview closer to key levels and trends that shape each of these altcoins at the moment.

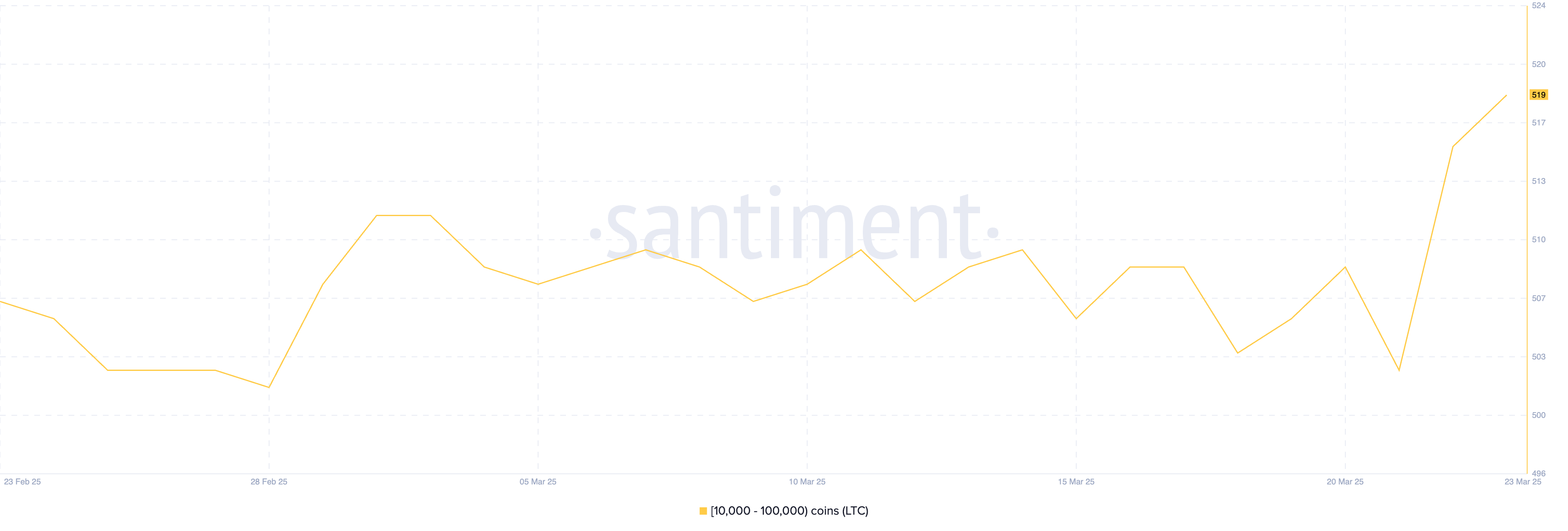

Litecoin (LTC)

The number of whales in Litecoin has climbed in recent days, showing a renewed interest in big holders. Portfolios holding between 10,000 and 100,000 LTC rose from 503 on March 21 to 519 before March 23, marking a clear increase in accumulation.

This increase in whale activity could help fuel an upward trend in the coming days. If Momentum is built, LTC could test the resistance levels at $ 97.29 and $ 109. An escape above these could open the door for a movement around $ 130 in the coming weeks.

The accumulation of whales is often considered as a bruise indicator, as large investors can considerably influence the price management. The recent increase suggests growing confidence in the short -term potential of Litecoin.

However, if Momentum does not materialize, LTC could withdraw to support at $ 87. A drop below this level could see the price drop to $ 83, weakening the bullish case.

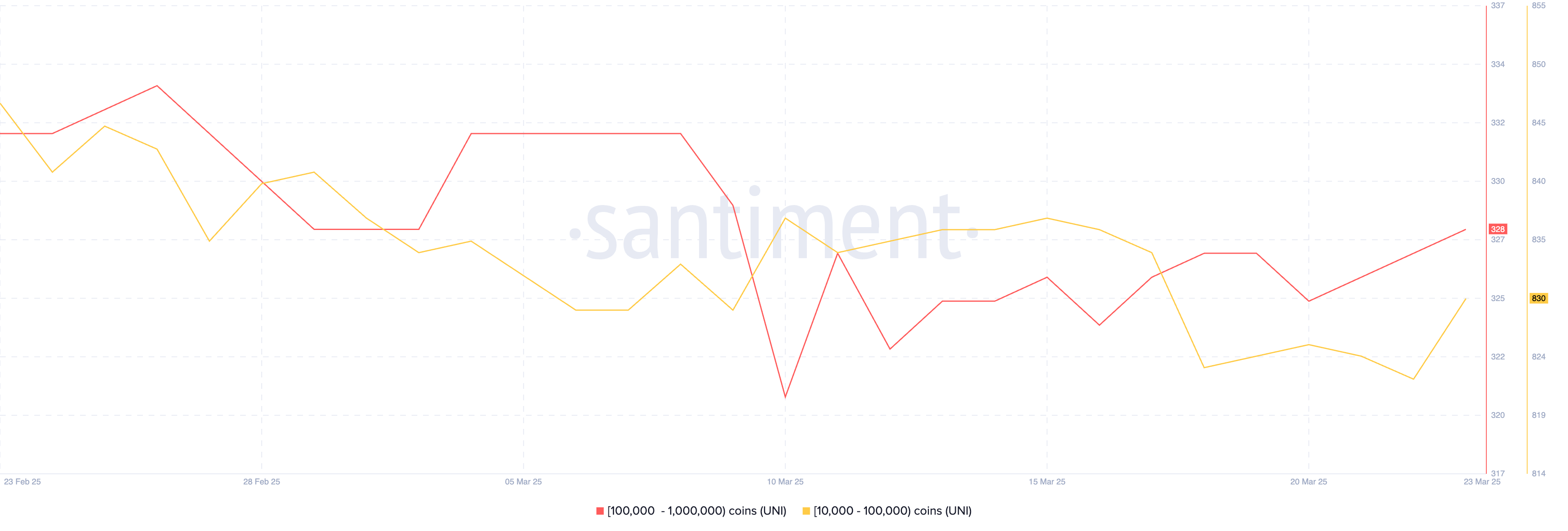

Uniswap (uni)

UNISWAP recently faced a mixed feeling after the counterou on its launch of MAINET UNICHAIN LAYER 2. However, the feeling changed following approval by the community of an investment of $ 165.5 million in its ecosystem.

In recent days, cryptographic whales have accumulated the university. Between March 20 and 23, the number of portfolios holding between 10,000 and 1,000,000 UNA has increased from 1,151 to 1,158, signaling a renewal of the interests of large investors.

If the bullish momentum continues, the United Prix could test the resistance levels at $ 7.69 and $ 8.33. A breaking higher than these could push the price to $ 9.64.

Upon decrease, if Momentum fades, Uni could reset the support of $ 6.82. Losing this level could open the door to drops to $ 5.97 and even $ 5.50.

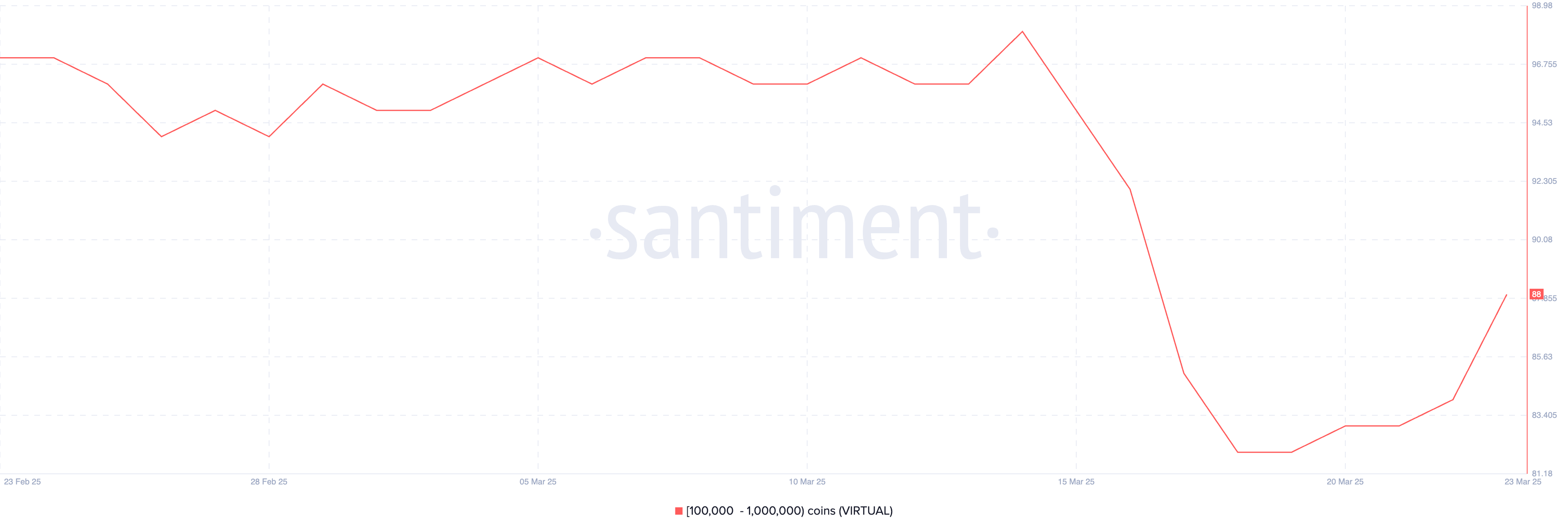

Virtual (virtual) virtual protocol

Virtuals experienced a significant increase in whale activity after reaching the lowest levels in months. In recent days, addresses between 100,000 and 1,000,000 virtuals have increased from 82 to 88.

If the crypto sector has bounced, virtuals could benefit strongly. The token could test the resistance at $ 0.97, and if it is broken, exceed $ 1 to target $ 1.24 and $ 1.49.

The accumulation of whales could help fuel this movement if a broader feeling through the agents of the crypto improved.

However, if the sector correction continues, virtuals could retest the support at $ 0.80. A deeper drop could push it to $ 0.51 and fall below $ 0.50 would mark the lowest price since November 2024.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.