Has Bitcoin (BTC) Price Topped For This Cycle?

Bitcoin (BTC) is at a critical point of its current cycle, with signs that it can diverge from the reduction models in half past. Unlike the previous cycles, where strong rallies followed the halvings, it was more uncertain. Bitcoin market movements are now largely shaped by macroeconomic changes and new institutional influences.

Political factors, such as Trump’s pro-Crypto position and the adoption of Bitcoin at the state level, have also added unexpected variables. With these new dynamics at stake, the question remains: has Bitcoin already exceeded the cycle? Or is there still room for another rally beyond $ 100,000?

Has BTC detached from other cycles?

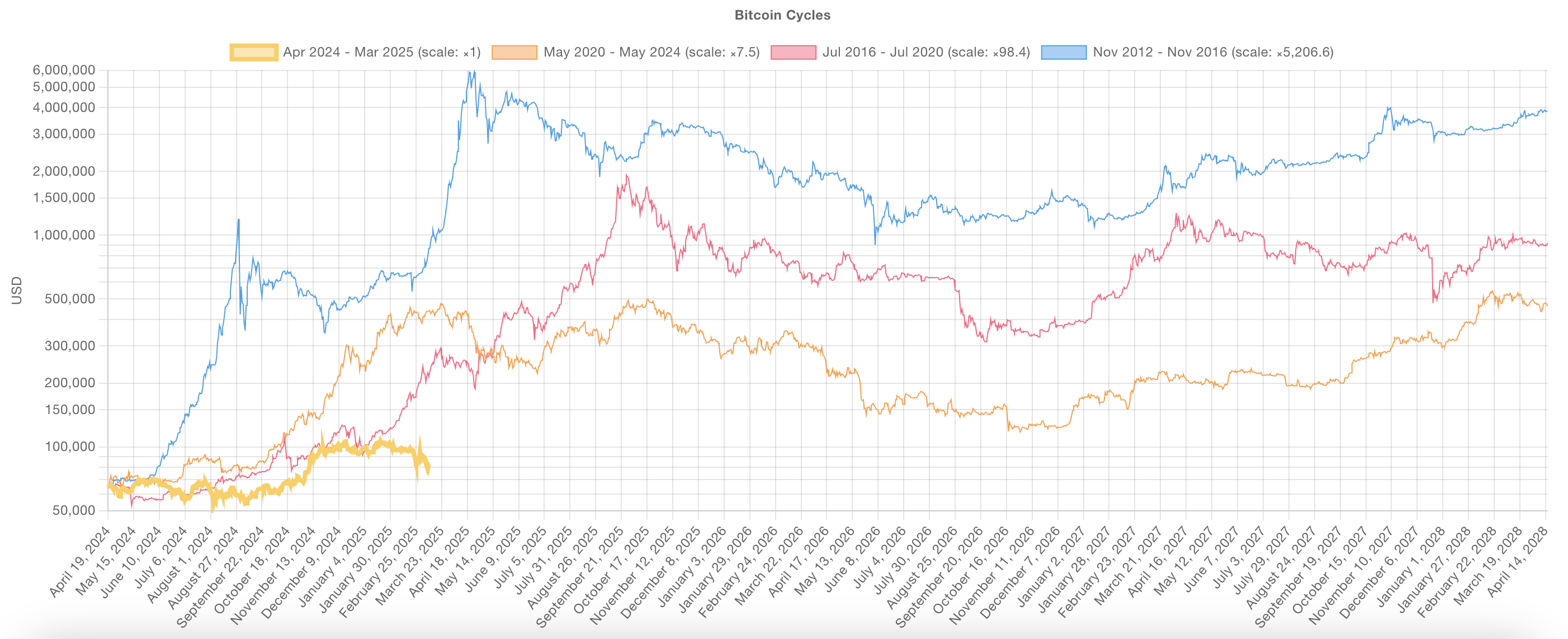

The current bitcoin cycle seems to diverge from the previous ones. It shows a different price trajectory compared to past hassles.

Historically, Bitcoin has had strong gatherings at this cycle stage, especially in the 2012-2016 and 2016-2020 phases.

However, this cycle experienced a overvoltage starting in October 2024 and December 2024, followed by consolidation in January 2025 and a correction at the end of February.

This contrasts with the previous cycles, where Bitcoin continued to rally aggressively after the overthrow. The gap suggests that macroeconomic factors, changes in market structure and the growing presence of institutional investors can change the dynamics of the traditional bitcoin cycle.

Unlike speculative booms focused on retail trade in past halvings, Bitcoin is now treated as a more mature asset class, which influences its price movement.

Another key factor is the decreasing force of Bitcoin overvoltages as cycles progress. The exponential rallies observed in 2012-2016 and 2016-2020 far exceeded those of the 2020-2024 cycle and the current cycle.

Although this is planned due to the growing market capitalization of Bitcoin, this also reflects the growing influence of institutional investors, banks and even governments. In the long term, it is likely to introduce more stability and structured market on the market.

Despite these changes, the previous cycles also had periods of consolidation and correction before resuming their upward trend. If Bitcoin follows this previous one, this phase could be a temporary reset before another movement up.

However, given the structural changes on the market, this cycle could take place differently, with less extreme volatility but an appreciation of more prolonged and lasting prices rather than the explosive parabolic summits of the past.

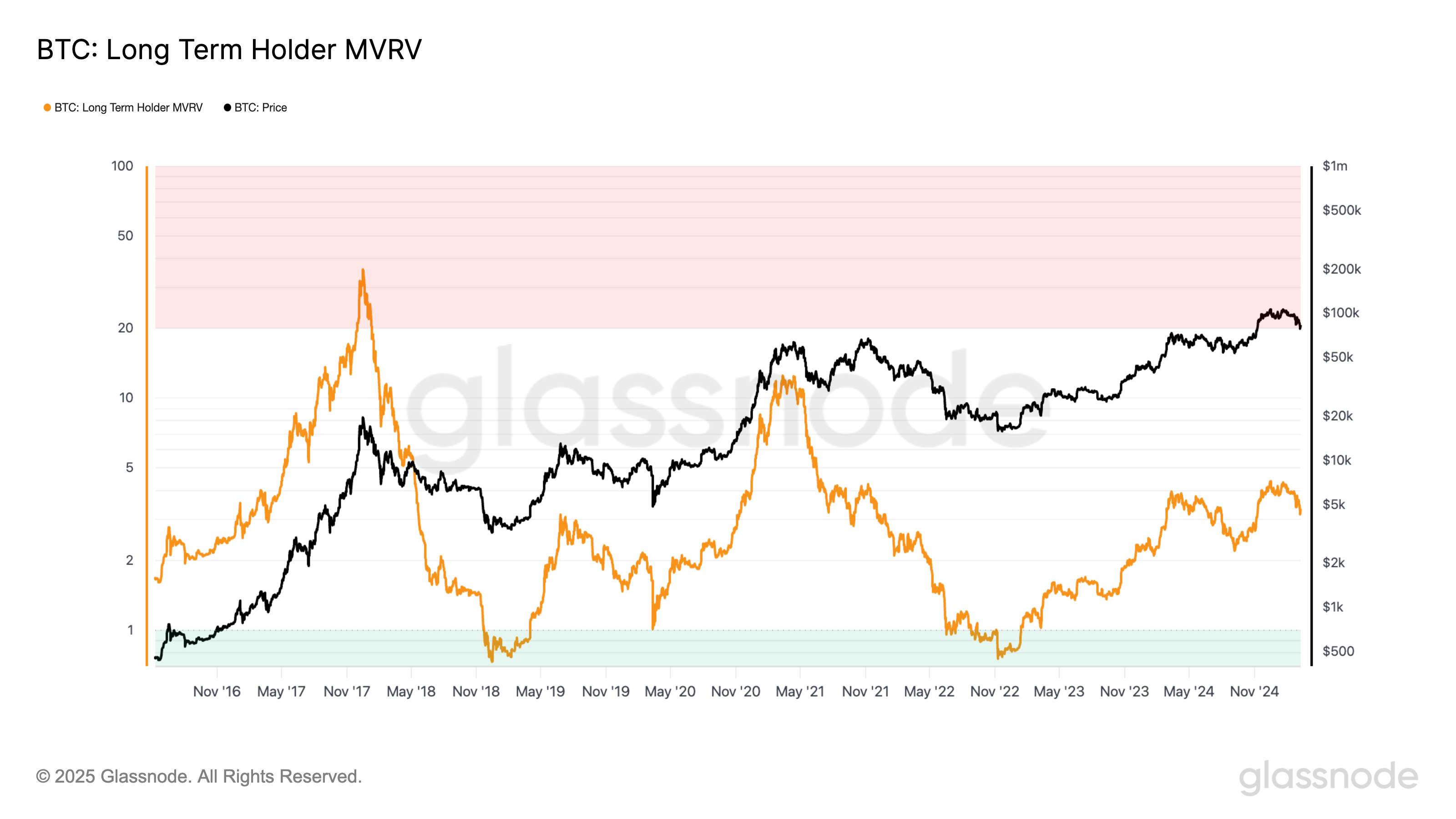

MVRV long -term support signals a cycle dynamic change

The long -term Bitcoin MVRV report clearly shows a scheme of decreasing yields through the cycles. During the 2016-2020 cycle, the LTH MVRV culminated at 35.8, reflecting an extreme level of unpaid profit among long-term holders before the start of the distribution.

During the 2020-2024 cycle, this peak had dropped significantly to 12.2. He showed a lower overall multiple of unpaid profits despite Bitcoin reaching new heights of all time.

In the current cycle, the LTH MVRV has so far reached a summit only 4.35, which indicates that long -term holders have not seen almost the same level of liquid profits as in past cycles.

This sharp decline between cycles suggests that the potential for increasing bitcoin is compressed over time, which aligns the broader trend in the decrease in yields as the assets ripens and changes in market structure.

These data imply that the cyclic growth phases of Bitcoin become less explosive. This is probably due to the growing influence of institutional investors and a more efficient market.

As market capitalization is developing, capital entries are necessary to generate the same percentage gains observed in early cycles.

Although this may suggest that the long -term growth of Bitcoin stabilizes, this does not necessarily confirm that the cycle has already reached a peak.

The previous cycles had periods of consolidation before reaching the final peaks. In addition, institutional participation could lead to more prolonged accumulation phases rather than sudden blows.

However, if the decrease in MVRV peaks will continue, this could mean that Bitcoin’s ability to provide yields based on the extreme cycle is vanishing, and this cycle can already exceed its most aggressive growth phase.

Bitcoin long -term perspectives

Despite the differences in this cycle, experts remain optimistic about the long -term Bitcoin perspectives, in particular with increasing adoption at the level of the state.

Harrison Setsky, business development director at Space ID, told Beincrypto:

“The expectations worked before the top of the cryptography of the White House on Friday, but the consequences were somewhat anticlimantic. The market has not reacted with as much excitement because the United States currently holds its confiscated BTC instead of buying more. However, there is much more to be excited than the market only makes the price. It is encouraging to see that not only the President Trump signed an executive decree for an cryptography reserve – although it may seem in practice – but we also see this conversation advancing at the level of the state. The day before the summit also saw Texas adopt Bill 21 of the Senate, which allows it to establish a state -controlled crypto reserve, made up of Bitcoin and other digital assets. A year ago, none of us could have dreamed of it. The move of Texas could open the valves so that other states follow suit, as well as the municipal and local municipalities on an international scale. »»

Nic Puckrin, founder of the coins, told Beincryptto that the short -term trajectory of Bitcoin remains linked to macroeconomic conditions. He underlines the fact that investors in the current cycle had unrealistic expectations of the Bitcoin cryptography reserve.

There was in particular an increasing perception that the United States government would buy billions of new BTCs, causing a supply shock. From any economic or political concept, this would not have been possible.

It is difficult to imagine that the congress approves such a purchase with taxpayers’ money to invest in risky assets. This unrealistic expectation was a catalyst behind current prices corrections.

“Crypto’s current sale reveals a gap between expectations and reality. The reserve will now only constitute the crypto that the American government already has in its property and it will not buy new BTCs on the market. It is also important to emphasize that neither the crypto nor the stock prices are at the top of the Trump agenda. In fact, he even rejected the accidents of the equity prices as the work of the globalists. Meanwhile, improving the regulatory landscape and the promise of integration with traditional financial rails cement the important role of crypto in the American financial landscape. It is worth celebrating this progress, instead of complaining about the dark short -term backdrop, “said Puckrin.

Based on all this, this cycle seems to be different from the previous ones. Thus, despite the recent corrections, the BTC may not have yet exceeded.

New factors such as institutional adoption, Trump’s cryptographic position and geopolitical tensions make historical comparisons less reliable. Unlike past cycles, the action of the Bitcoin price does not follow a clear rally after the yield.

At the same time, uncertainty is higher than ever. Macro-conditions, trade war and the evolution of American policies add complexity. Bitcoin is now part of the global financial system, its price reacts more than simple reduction in cycles. The path to follow is not clear, but the cycle is not necessarily finished.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.