Bitcoin and Solana ETF Filing Signal Rising Demand For Crypto

The cryptocurrency market is experiencing a wave of exchange-traded fund (ETF) applications, reflecting a trend toward widespread adoption.

Recent filings include the Solana futures ETF and the Bitcoin-linked convertible bond fund, demonstrating a move toward diversified investment options.

Solana Futures ETF

On December 27, Volatility Shares took a major step forward by filing a futures-based Solana ETF, aiming to capitalize on the growing interest in altcoins.

The fund intends to mirror Solana’s price movements by focusing on futures contracts on exchanges regulated by the United States Commodity Futures Trading Commission (CFTC). Its strategy may also include financial instruments linked to Solana, with the asset value derived from these investments. This approach could open the door to broader institutional interest in Solana.

At the same time, market analysts noted the bold timing of this filing, as Solana futures are not yet actively traded. Some suggest that the approval of this ETF could pave the way for a spot Solana ETF in the future.

“It’s wild. Solana futures ETF deposits bf Solana futures even exist…that’s probably a good sign that Solana futures are on the way, which probably bodes well for spot quotes,” said Bloomberg ETF analyst Eric Balchunas.

A wave of Bitcoin ETF applications

Meanwhile, Bitcoin-related ETFs are seeing a wave of new applications. Nate Geraci, president of ETF Store, noted that four cases had been filed in the last 48 hours.

REX Shares has proposed a Bitcoin Corporate Treasury Convertible Bond ETF, targeting bonds issued by companies holding Bitcoin holdings in their treasuries. Similarly, Strive Asset Management plans to introduce a fund that invests in bonds from companies like MicroStrategy, known for their substantial Bitcoin allocations.

Bitwise has also joined the movement with its Standard Corporations Bitcoin ETF. This is designed to invest in companies holding Bitcoin as part of their financial reserves.

Meanwhile, ProShares is seeking approval for ETFs tied to major indexes like the S&P 500 and Nasdaq-100, as well as gold, all denominated in Bitcoin. This unique approach combines traditional assets with exposure to cryptocurrencies through Bitcoin futures.

“Basically a long position in the underlying stocks or gold and then short USD/long BTC using BTC futures. I call these BTC-hedged ETFs,” Geraci said.

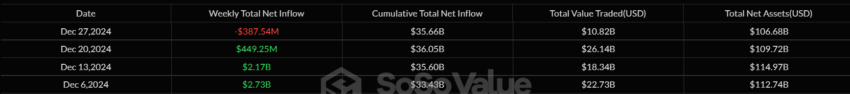

These documents highlight the growing confidence in cryptocurrency as a dominant asset class. Industry experts believe that 2025 could mark a turning point, with the influx of institutional capital into these innovative funds. Indeed, Spot Bitcoin ETFs have already demonstrated success this year, attracting over $35 billion in net inflows and managing assets in excess of $100 billion.

Disclaimer

In accordance with the Trust Project guidelines, BeInCrypto is committed to providing unbiased and transparent reporting. This news article aims to provide accurate and current information. Readers are, however, advised to independently verify the facts and seek professional advice before making any decision based on this content. Please note that our Terms and Conditions, Privacy Policy and Disclaimer have been updated.