Bitcoin and S&P500 Ratio Reaches New Peak

Welcome to the morning briefing of the US Crypto News – your essential overview of the most important developments in the crypto for the coming day.

Take a coffee while we examine Bitcoin’s performance (BTC) compared to the S&P 500, a reference for American stock market performance. With the growing influence of tradfi, the domination of bitcoin as a class of assets increases compared to traditional actions.

Crypto News of the Day: BTC / S&P 500 Ratio records all high time

Matthew Sigel, manager of digital asset research in Vaneck, underlined the historic outperformance of Bitcoin against the S&P 500.

More specifically, the Bitcoin / S&P 500 ratio reached a summit of $ 17.725 on May 8, reflecting the growing domination of pioneers’ cryptography over traditional actions.

“All the time high: Bitcoin / S&P 500 ratio,” wrote Sigel.

This step aligned with broader market trends, including the recent Bitcoin decision to briefly exceed Google on market capitalization measures, as indicated in a recent American publication of Crypto.

For Bitcoin, the wave occurs in the middle of an increasing institutional influence, and the result of liquidity that results in guest Analysts to rethink the BTC cycle theory.

“He has the impression that it is time to throw this theory of the Bitcoin cycle … It is more important to focus on the quantity of new liquidity from institutions and ETFs,” said CEO of cryptocurrency Ki Young Ju.

With increasing adoption and dominant nervousness in traditional markets, investors see Bitcoin as coverage against the financial and American treasure Risks.

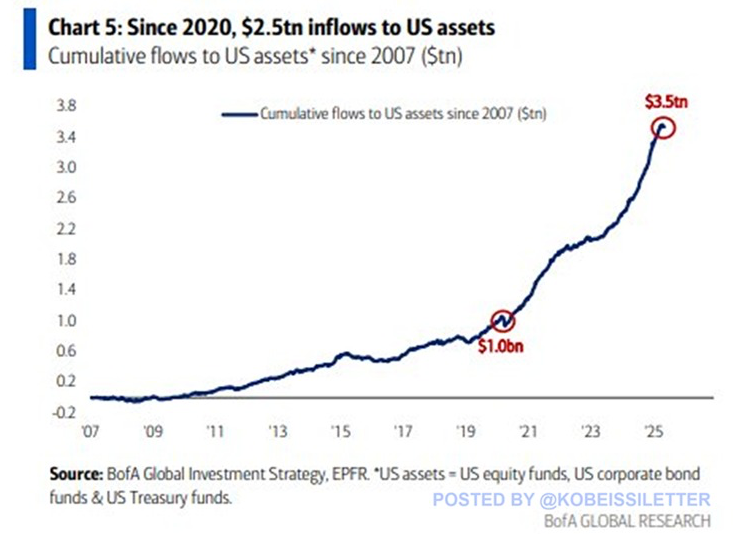

3.5 billions of dollars from entries to American stocks, corporate obligations and treasury funds

The reports indicate 3.5 billions of dollars in cumulative entries to equity funds, corporate and cash bonds in the United States since 2007. In particular, 2.5 billions of dollars in this increase occurred after 2020.

Kobeissi’s data note a strong appetite for investors for American assets. However, the tip of the Bitcoin ratio suggests a parallel change, certain investors promoting decentralized assets in the middle of global economic uncertainty, including inflationary pressures and geopolitical tensions.

American capital funds, capturing $ 1.2 billion of entries, saw a net output of $ 100 billion during the 2022 bear market.

According to Sigel, this indicates a temporary aversion of the risk that Bitcoin has apparently bypassed, because its long -term growth has exceeded the Nasdaq on several deadlines.

“Bitcoin surpassed the Nasdaq over 1 day, 1 week, 1 month, up to date, 1 year, 2 years, 3, 5 years, 10,” said Sigel.

Meanwhile, the increase in yields of the US Treasury, reaching 4.641% in early January 2025, marked the highest since May 2024. This action fund attenuated entries, which potentially led investors to bitcoin as coverage against traditional market volatility.

Graphic of the day

At a record level, the BRR index / SPX ratio means that the Bitcoin value has increased much more than the S&P 500. It indicates stronger confidence and outperformance of crypto investors in relation to actions.

Alpha the size of an byte

Here is a summary of more news from crypto in the United States to follow today:

- Raoul Pal predicts that the domination of Bitcoin has reached a peak, signaling the start of the “banana area” – a potential altcoin parabolic rally phase.

- Bitcoin Holdings of Strategy gained 50.1%, stimulated by recent purchases, including 1,895 BTC for $ 180.3 million.

- Bitcoin exceeding $ 100,000 has triggered the largest wiping since 2021, with $ 970 million in liquidations.

- Pi Network ranks 6th among the best social applications in Finland. A major announcement of the PI ecosystem is set for May 14 and users are looking forward to a possible list of binances.

- XRP jumped 8% after the Ripple regulation with the SEC, but the increase in the profits of short -term holders can limit its ability to violate the resistance by $ 2.38.

- Mara Holdings has experienced income growth of 30% from one year to the next, Cleanstark T1 2025 turnover jumped 62.5% and Hut 8 revenues dropped by 58.1%.

- Cardano’s price jumped 10%, And chain data have shown that 74.14% of ADA’s offer is in profit, signaling increased accumulation.

- Sei Labs offers SIP-3 to get the SEI network to an EVM model only, deleting Cosmwasm and the native cosmos support.

Presentation of the actions of the crypto-actions

| Business | At the end of May 8 | Preview before the market |

| Strategy (MSTR) | $ 414.38 | $ 423.18 (+ 2.12%) |

| Coinbase Global (Coin) | $ 206.50 | $ 203.30 (-1.55%) |

| Galaxy Digital Holdings (Glxy.to) | $ 27.67 | $ 28.90 (+ 4.45%) |

| Mara Holdings (Mara) | $ 14.29 | $ 14.01 (-1.95%) |

| Riot platforms (riot) | $ 8.44 | $ 7.48 (-3.73%) |

| Core Scientific (Corz) | $ 9.45 | $ 9.51 (+ 0.63%) |

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.