Bitcoin Bull Run at Risk as Whales Sell and Retail Buys In Late

The war tug between Bitcoin bulls and bears since the assets reached its $ 122,054 summit on July 14th maintained the largely confronted prices.

During last week, BTC faced a resistance at $ 116,952 while finding support at $ 111,855, reflecting a market that has trouble choosing a direction. With the climbing of uncertainty, the signs begin to emerge that the bull phase could approach its end.

Bitcoin Bull Run can approach its end

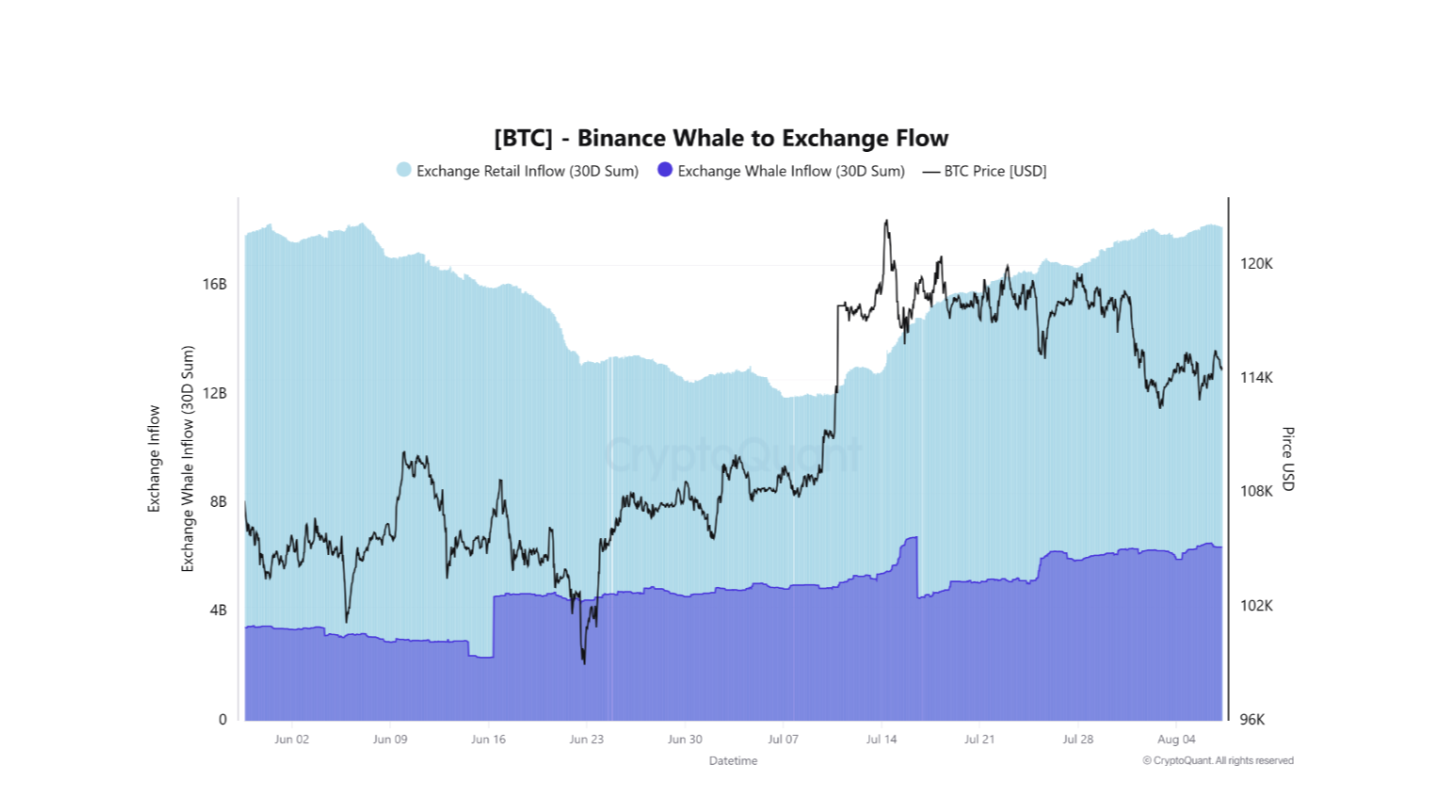

In a recent report, the Arab chain of the cryptocurrency pseudonym analyst noted that the main BTC piece could approach the final phase of its current bullish cycle. The key warning sign: a sustained influx of whales at the Binance.

According to Arab Chain, since the end of July, BTC whales have moved between $ 4 billion and $ 5 billion in exchange coins, a model associated with distribution phases.

For TA tokens and market updates: Do you want more symbolic information like this? Register for the publisher Daily Crypto newsletter Harsh Notariya here.

An increase in whale entrances to signal exchanges that large holders are preparing to sell. This can contribute to weakening the generally general dynamics and increasing the risk of additional BTC prices.

In addition, the analyst has noted that detail participation had regularly increased in recent weeks, even in the midst of the Dulne performance of the BTC. The Arab chain stressed that this “involves purchases at an advanced stage, which can face a lower risk if the correction deepens”.

It is essential to note that a peak in retail activity often has a significant positive impact on the price due to the frequency with which these traders move their parts. However, despite a strong accumulation of retail merchants in recent weeks, “the market lacks optimistic follow -up, signaling potential exhaustion.”

This trend in whale entrances supported in exchanges and the rise in retail purchases at an advanced stage painted a distribution model where major positions of unloading positions on eager retail traders. If history is repeated, this configuration indicates that the bruise of BTC fades, increasing the probability of a more abrupt market correction in the short term.

BTC Eyes $ 120,144 on Breakout, but Bears threatens a deeper drop

An increase in sales could strengthen lowering control on the BTC market and increase the downward pressure on its price. If the sale continues, the value of the part could test the support at $ 111,855. If the Bears do not defend this level, the price of the room could fall to $ 107,557.

On the other hand, if the purchase activity is strengthened, the part could break above the resistance at $ 116,952 and climb to $ 120,144.

The Bitcoin Bull Run position at risk while the whales sell and the retail purchases appeared ultimately on Beincrypto.