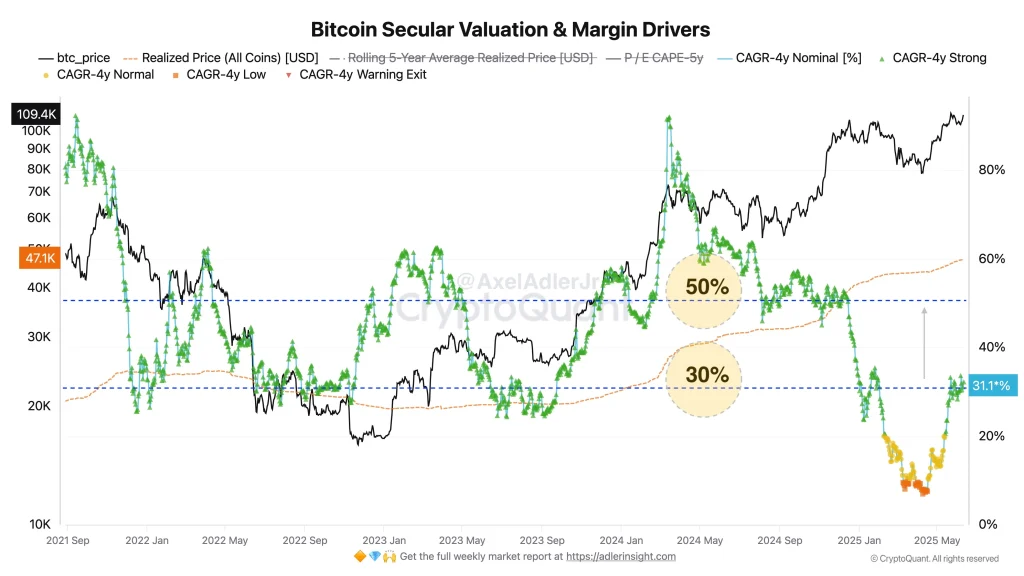

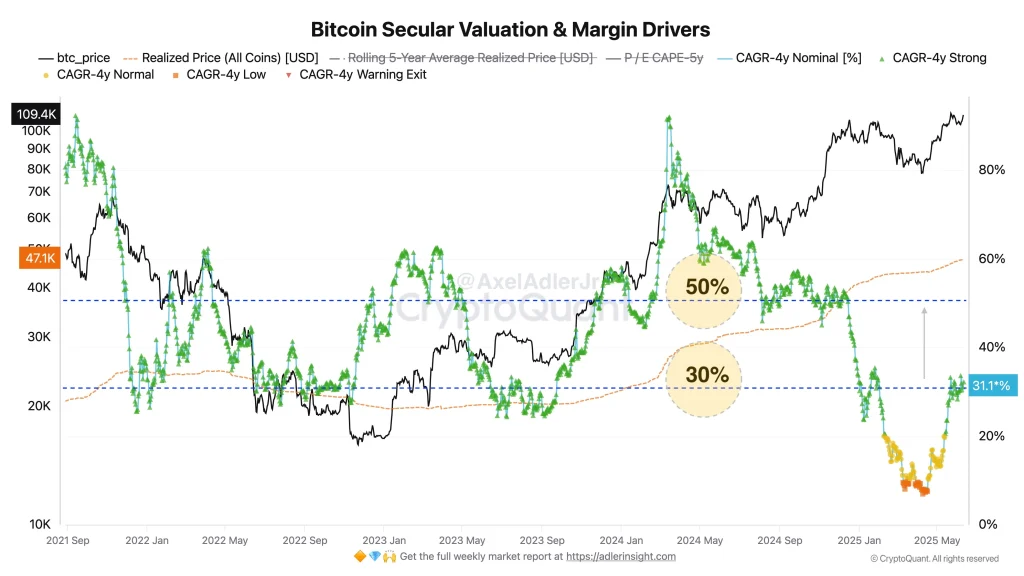

Bitcoin Bull Run Incoming as BTC CAGR Hits 31%

Bitcoin’s solid performance in April and May rekindled the hopes of a major bullish escape. From April 9 to May 22, the Bitcoin price jumped 46.32%, including a rally of 18.48% between May 5 and 22. Price resumption has also pushed its compound annual growth rate (TCAC) – The renewed signaling of market optimism.

BTC Cagr Pic while the price recovers

Cryptographic analyst Axel Adler JR Recently highlighted a notable peak in the TCAC at 4 years of Bitcoin. In April 2025, he fell to 7%Reflecting the volatile start of Bitcoin of the year. In January, the BTC increased by 9.54%, but the following months experienced a sharp drop –Down 17.5% in February And 2.19% in March. The price even affected a hollow of $ 74,446.79 in April.

However, the market has strongly rebounded. By June 2025Adler reports that Bitcoin TCAC has returned to 31%.

“This net rebound shows how speed the long -term trend can change when a strong dynamic of buyers enters the market,” said Adler.

However, he notes that 31% TCAC is still below peaks in the historic Haussier marketinvolving more room for growth.

$ 168,000 BTC by October?

Axel Adler JR provides a possible Bitcoin Price targets $ 168,000 by October 2025assuming the momentum in the Under -term market and leverage Continue.

He bases this projection on the acceleration of growth and historical patterns observed during previous bull races.

Adjustment for risk: TCAC vs standard deviation

In the discussion thread, X User Manu suggested a more refined way to interpret TCAC – by dividing it by the standard deviation to eliminate volatility and highlight Risk adjusted yields.

Adler agreed with the approach, declaring that he offers a cleaner vision of market performance, but also underlined another critical point:

“The real inflection point occurs when investors are starting to take advantage depending on the expected yields.”

According to him, the risk of a lowering market increases once the BTC negotiation volume crosses 1 million parts, because taking advantage on a large scale can disrupt the balance of the offer.