Bitcoin Dominance Could Reach 71%, Dashing Altcoin Hopes

Key indicators to predict an Altcoin season – such as the domination of Bitcoin (BTC.D) and the Altcoin season index – took place to show negative trends in June. These developments make the prospect of an altcoin rally more and more unlikely.

As political tensions are increasing between the United States and Iran, investors seem to restructure their Altcoin portfolios to reduce risk.

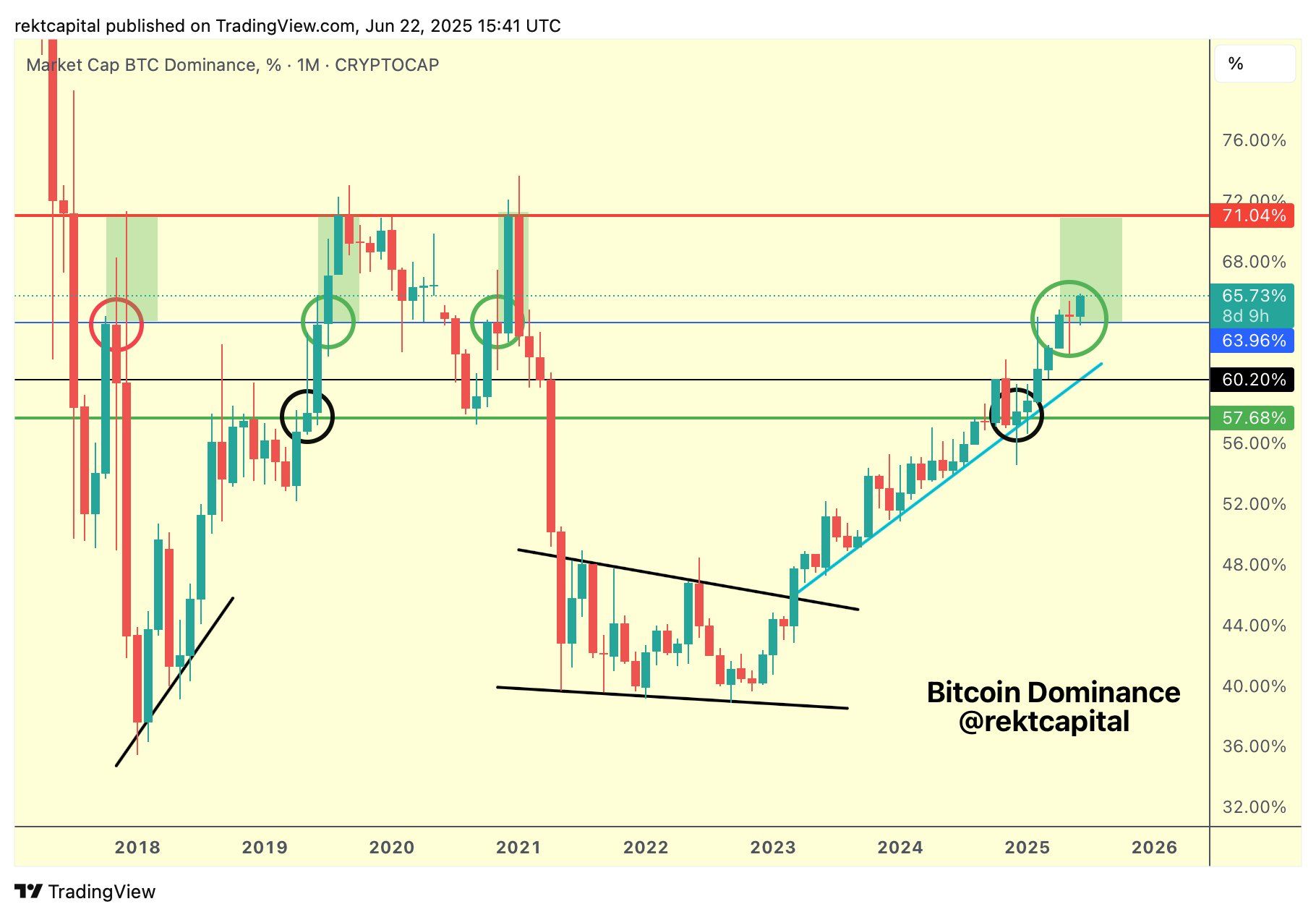

Bitcoin Dominance has reached the highest level since 2021

At the time of writing this document, Bitcoin Dominance (BTC.D), which measures the Bitcoin market capitalization in percentage of the total crypto market, has reached a new summit for 2025. It now exceeds 65%, marking the highest point since February 2021.

TradingView data show that BTC.D has increased by seven consecutive quarters without a single quarterly correction. This trend reflects strong long -term confidence in the bitcoin of retail and institutional investors.

Crypto Rekt Capital analyst has made a daring prediction that Bitcoin domination could reach 71% in the near future.

If this happens, it could trigger a strong correction on the Altcoin market. A similar scenario took place in February 2025, when Bitcoin’s domination culminated and led to a lowered drop in many major altcoins.

“Now, the domination of bitcoin is only 5.5% of 71%. Altcoins will not be zero. Instead, they can react similarly to February 2025,” predicts Rekt Capital.

In February 2025, the Altcoin market capitalization (Total2) increased from $ 1.4 billion to $ 1 billion. If the prediction of Rekt Capital is true, the Altcoin market capitalization could drop below $ 700 billion.

Nic, co -founder of Coinbureau, also suggested that BTC.D could reach 70% – a prediction close to Rekt Capital. Raoul Pal, founder and CEO of Realvision, shared the same perspectives. He thinks that altcoins will bleed more than Bitcoin during any correction.

The growing tensions between the United States and Iran, marked by air strikes and threats of larger military deployments by President Trump, caused unexpected market volatility.

Although the leaders of the cryptographic industry remain optimistic, their feeling does not extend to altcoins.

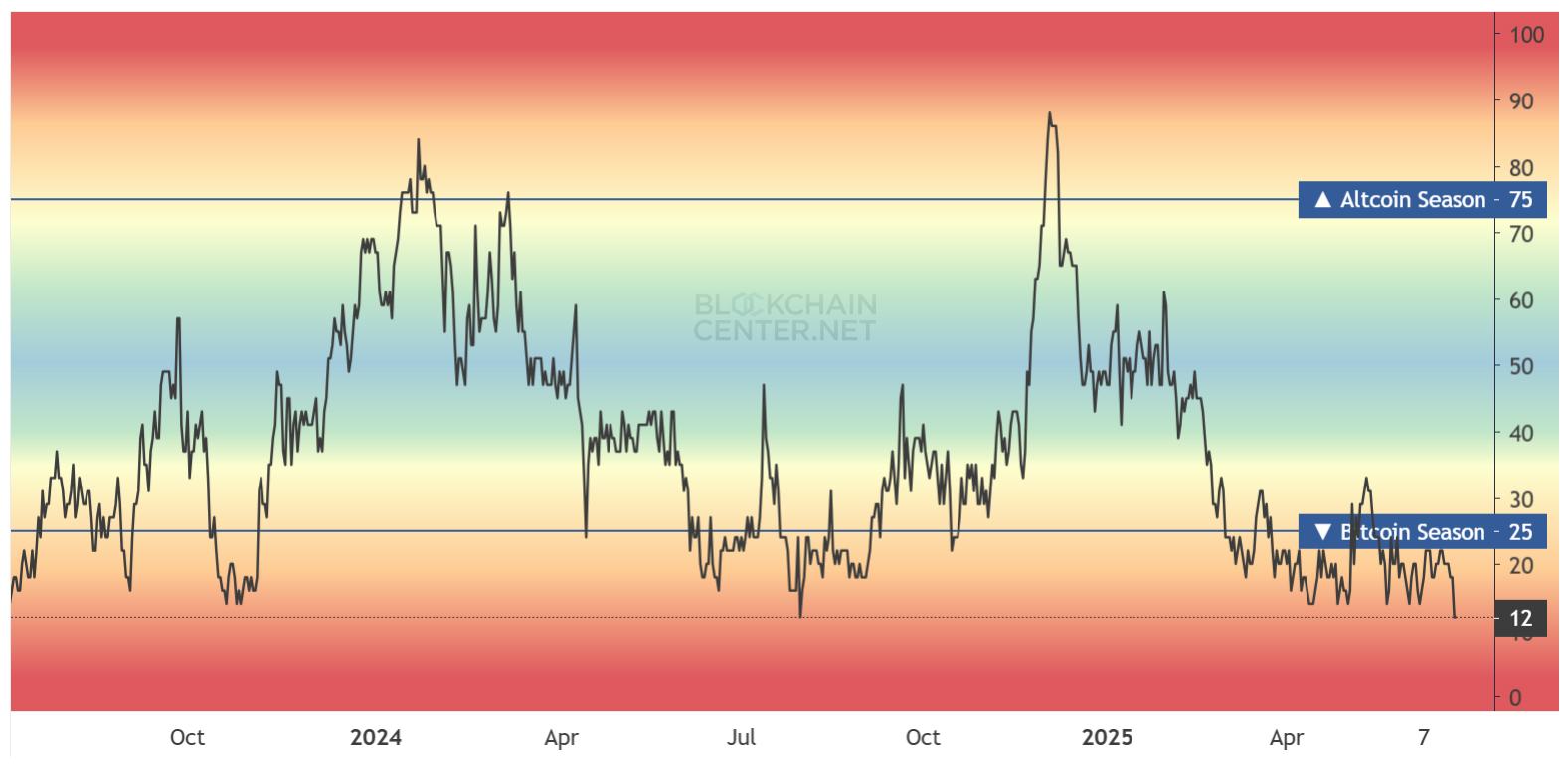

The Altcoin season index hits the bottom of the rocks

As of June 23, the Altcoin season index fell to 12 points, which is the lowest level in two years. This index follows if altcoins have outlined bitcoin in the last 90 days. A score of 75 or more generally indicates an Altcoin season. Current reading is far from this threshold.

“It is now the furthest that we have had from the Altcoin season in almost a year. It is if you believe the” Altcoin season index “, said Nic.

However, the renowned crypto analyst Michaël Van de Poppe underlined an interesting model. In recent years, the Altcoin season index has tended to manage in June or July.

This suggests a seasonal trend: investors tend to move Bitcoin capital at the start of summer, then potentially shoot in altcoins in July or August.

The 0xNobler analyst also thinks that the Altcoin seasons generally start in summer. This is aligned with the previous predictions according to which the domination of Bitcoin can still reach 71% before undergoing a correction.

Consequently, these analysts say that patience is essential for Altcoin investors, despite the surprises of the ongoing geopolitical conflicts.

However, a recent Beincrypto report has highlighted several reasons why the Altcoin winter could last longer. And even if an Altcoin season occurs, it may not benefit all projects currently on the market.

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.