Bitcoin ETF Inflows Bounce Back After Three-Day Slump | ETF News

On Tuesday, the funds negotiated in exchange for Bitcoin (ETF) reversed three consecutive days of exits to display more than $ 350 million in net entries.

This reversal is notable because it occurred despite the closure of the BTC in the red, emphasizing a change in the feeling of investors who could point out the strengthening of the optimistic conviction.

Institutions are responsible for the Bitcoin FNB in the middle of the market laterally

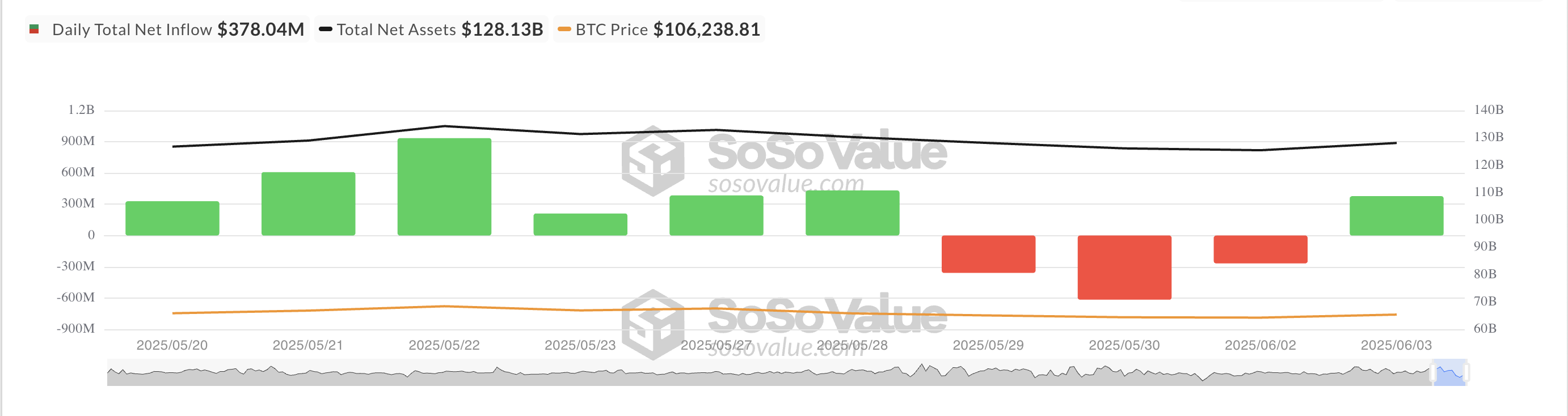

According to Sosovalue on Tuesday, investors paid $ 378.04 million in new capital in BTC -supported funds, pushing the total value of the assets of all BTC Spot ETF at 128.13 billion dollars.

While the BTC cash price has struggled to gain ground, extending its recent lateral movement tendency with only marginal gains today, ETF’s demand seems to be decoupled from the action of short -term prices. The entries suggest that institutional investors can buy the decline even if the market shows little immediate momentum.

ARK Invest and the 21Shares FNB ArkB recorded the largest daily net entrance, totaling $ 140 million, bearing its total cumulative entrances to $ 2.51 billion.

The FIDLY FNB FBTC recorded the second highest net entrance of the day, recording $ 137 million. Total historic net inputs of the ETF now amount to $ 11.69 billion.

Prudent market mood as slides of open interest

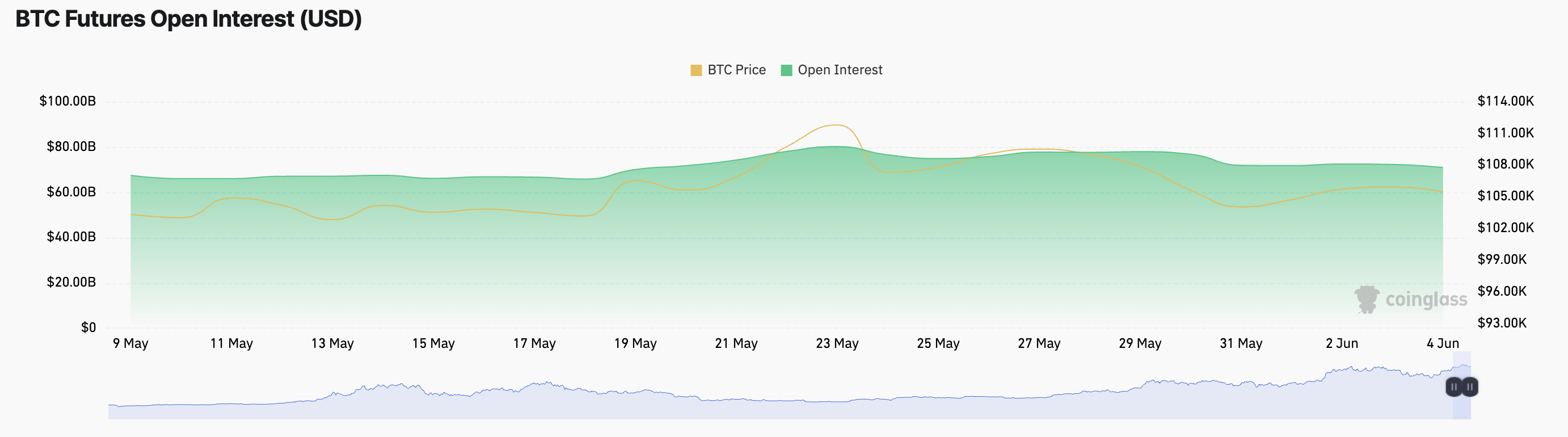

Today, an open interest in BTC’s term contracts has decreased, indicating that many derivative traders are retreating from the market. At the time of the press, it was $ 70.89 billion, diving 3% in the last day.

Open interests measure the total number of term contracts or active options that have not been adjusted or closed. When it falls while the price of the BTC is stuck in a side negotiation range, the traders firmly positions and retreat from the market due to uncertainty or lack of conviction.

This drop in participation indicates the weakening of the momentum, which makes an escape from the BTC prices less likely in the short term.

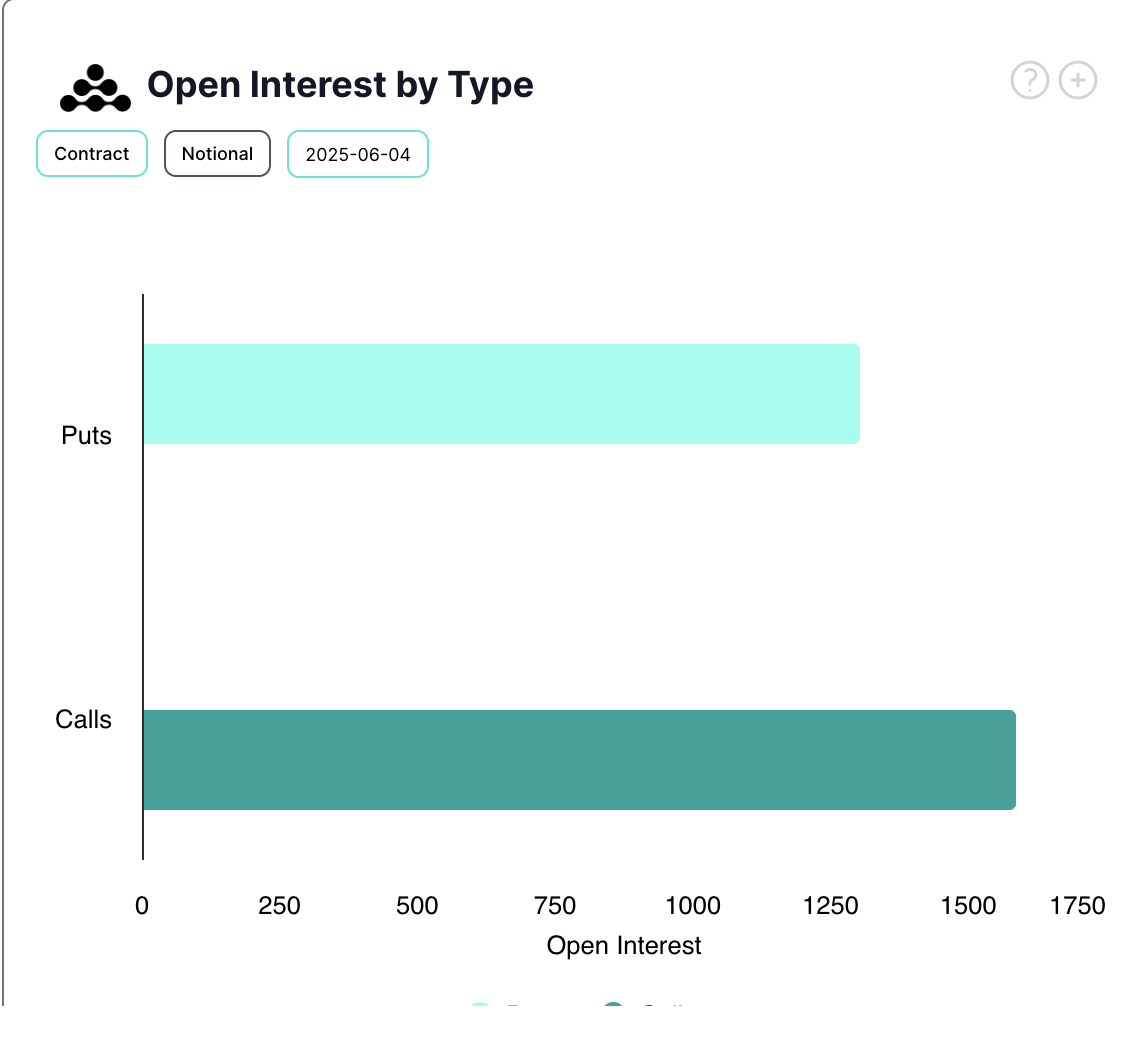

However, the request for appeal options has increased today, which implies that some traders position themselves for an upward decision. When the demand for calls exceeds, it reflects growing optimism among traders and coverage against potential escape.

Current market trends suggest an increasing underlying current of bullish feeling, which, if market conditions are improving, could open the way to a wider recovery.

Post Bitcoin ETF The entries bounce after a three -day crisis | Etf News appeared first on Beincrypto.