Bitcoin ETFs Battle $5.3 Billion Loss, Recovery Signals Emerge

Despite the strong performance of last year, market volatility changed the prospects of the negotiated funds in exchange for Bitcoin (ETF) in 2025. A series of major sales erased almost all the entries that ETF received earlier in 2025.

This slowdown coincides with the continuous decline in bitcoin prices, leaving the ETFs that fight to maintain their momentum to changes in investors.

The FNB Bitcoin are faced with a major setback in 2025

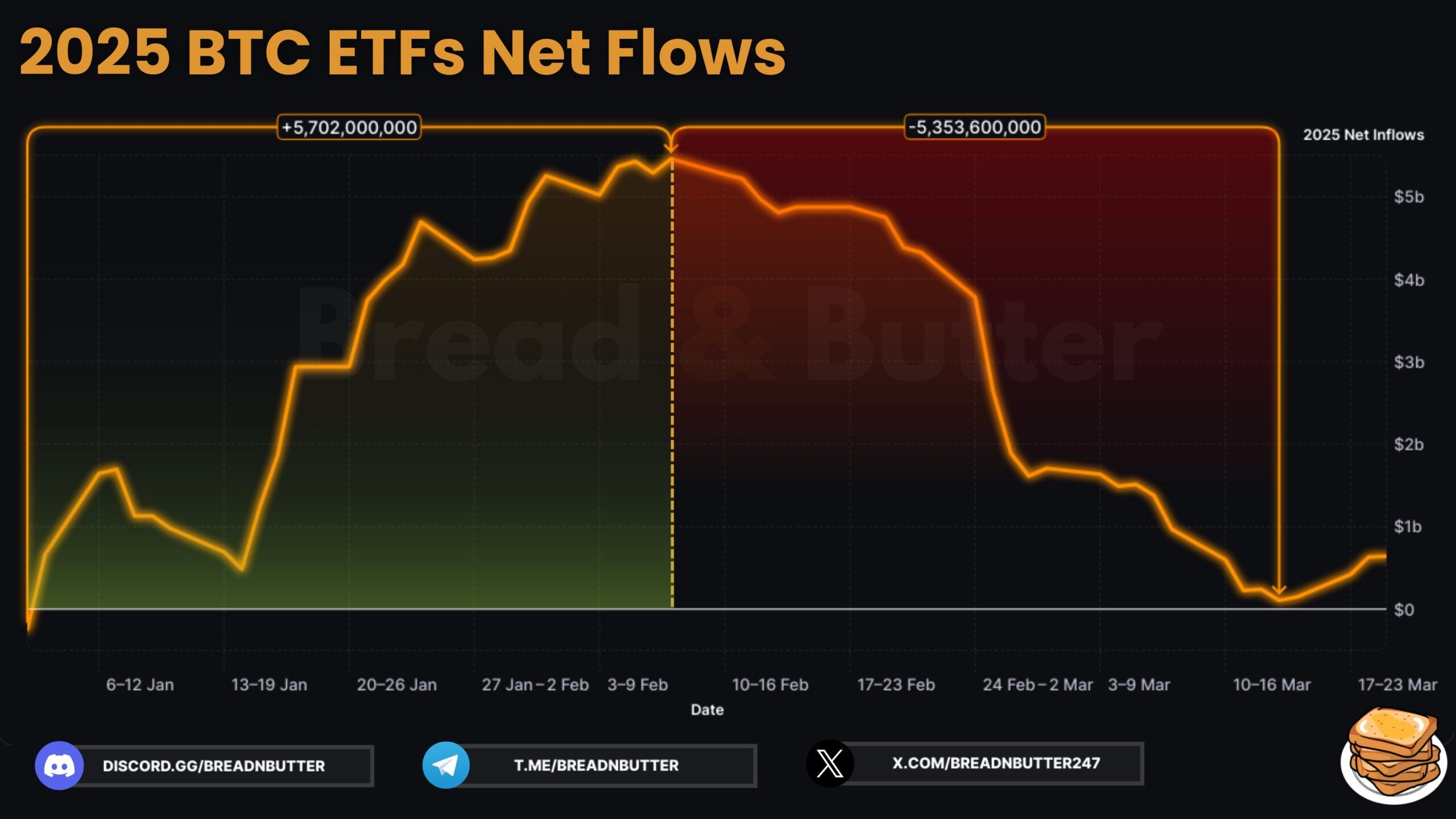

According to a recent article by Breg & Butter on X (formerly Twitter), Bitcoin Etf experienced a promising start to the year. Between January 1 and February 7, they saw cumulative entries of $ 5.7 billion.

However, a substantial sale quickly followed, erasing $ 5.3 billion from these earnings. As a result, the net entries of the year plunged a hollow of $ 106 million.

In fact, the biggest weekly net outing was recorded in the last week of February, with 2.7 billion dollars. That’s not all. Since the ETF started to exchange, they have experienced outings in three distinct months. February is distinguished as the most important, with a failure of $ 3.5 billion recorded as the largest monthly outing to date.

Nevertheless, the post revealed a positive change, noting that the entries in the Bitcoin ETF have taken over. Since March 14, the ETFs have recorded consecutive days of the entries, pushing the net entries at the beginning of the year to more than $ 600 million.

In particular, on March 17, the BTC ETFs recorded their entry into a highest day in 41 days. In the midst of this renewed impulse, Beincrypto stressed that asset managers Fidelity and Ark Invest acquire substantial quantities of Bitcoin, contributing to an increased trend.

At the end of the latest data, the Total Daily net influx reached $ 165.7 million on March 20. However, this growth was uneven in the 11 ETF.

Only four inputs recorded, with Ishares Bitcoin Trust ETF (IBIT), leading to $ 172.1 million, followed by the Fidelity Wise Origin Bitcoin Fund (FBTC) with $ 9.2 million, Graycale Bitcoin Mini Trust ETF (BTC) with $ 5.2 million and Vaneck Bitcoin etf (HODL) Millions of dollars.

Meanwhile, four ETFs have seen zero flows and three – Bitcoin Trust (GBTC), Bitwise Bitcoin Etf (BitB) and Franklin Templeton Digital Holdings Trust (EZBC) – Experienced outings, reflecting a mixed market performance.

“It remains to be seen if it marks the start of a supported rebound or simply temporary relief,” said the post.

This occurs while the Bitcoin price continues to navigate in turbulent waters. The cryptocurrency was faced with significant setbacks due to the movement of macroeconomic conditions, leading to a significant drop.

According to Beincryptto data, BTC depreciated 12.1% in the last month and 2.0% in the last 24 hours. At the time of the press, he negotiated at $ 84,147.

However, analysts suggest that the worst can be finished. Arthur Hayes, former CEO of Bitmex, underlined a potential quarter of work, citing his personalized American credit supply index, which was moving up.

“This does not mean that we have finished pouring, but the chances are changing more increases,” he said.

Market observers also have Compared Bitcoin to gold. They Predict that BTC can follow a similar trajectory and emerge from its current “false” phase. Others believe that bitcoin is in a bear trap that could soon END.

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.