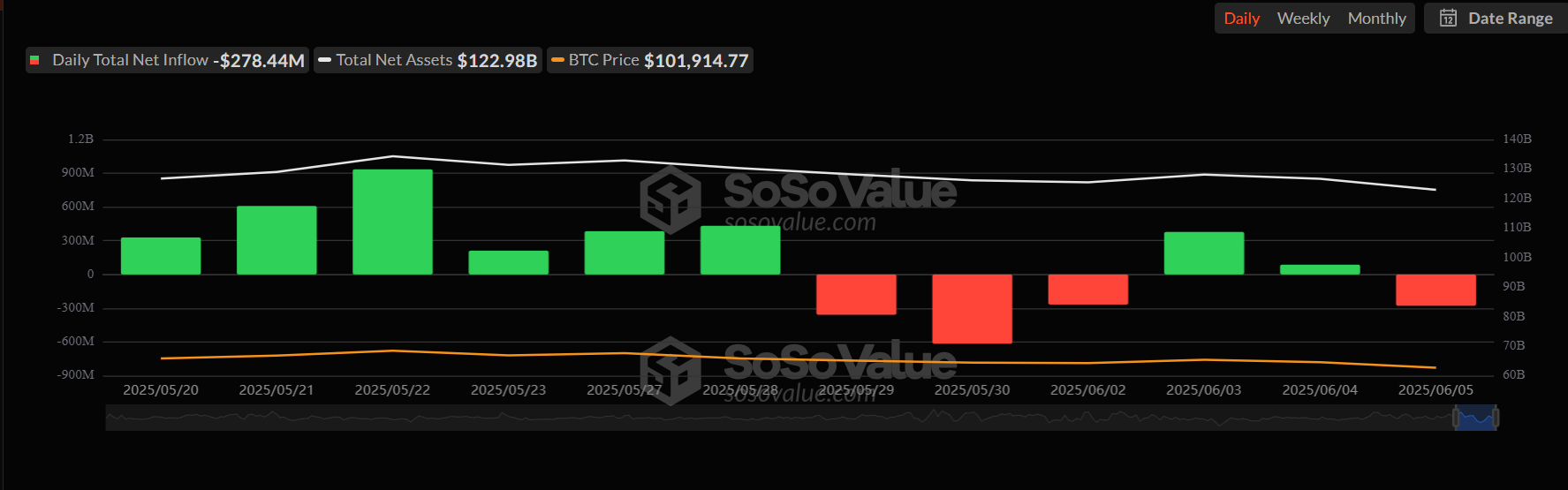

Bitcoin ETFs Face $278 Million Capital Exit

The funds negotiated in exchange for Bitcoin (ETF) recorded net outings greater than $ 250 million yesterday, extending the retirement of the bullish momentum. This comes in the heels of a sharp drop of 77% of net entries the day before.

This withdrawal follows the drop in the BTC below the psychological price zone of $ 105,000 during the negotiation session on Thursday.

The FNB BTC Spot Bleed Capital in the middle of the drop in prices at $ 101,000

On Thursday, Bitcoin Spot ETF recorded net outings of $ 278.44 million. The capital release extends the drop in bullish feeling, starting with a 77% drop in net entries the day before.

This ETF sale followed the lower move in the BTC price during the negotiation session of this day. The main part broke below the support level of $ 105,000 and fell to an intrajurnal hollow of $ 101,21, attenuating the feeling of investors.

A sustained net output of ETF BTC Spot would signal a weakening of investor confidence and a change in feeling of the market. This can exert additional sales pressure on BTC, exacerbating the drop in prices.

Arkb Arkbs from Ark 21Shares led the pack with the highest daily outings, totaling $ 102.02 million dollars yesterday. Its total historical entry at the time of the press is $ 4.67 billion.

Bitcoin down while the long -term market cools

Friday, the BTC is down 2% again the day. During the same period, his interests open in the long term have also dropped by 1%, suggesting that traders close positions rather than adding a new lever effect.

The open interest refers to the total number of current derivative contracts, such as term contracts or options, which have not been settled. When it falls, traders firmly the existing positions, indicating a reduction in market participation. This puts the BTC at risk of new price reductions.

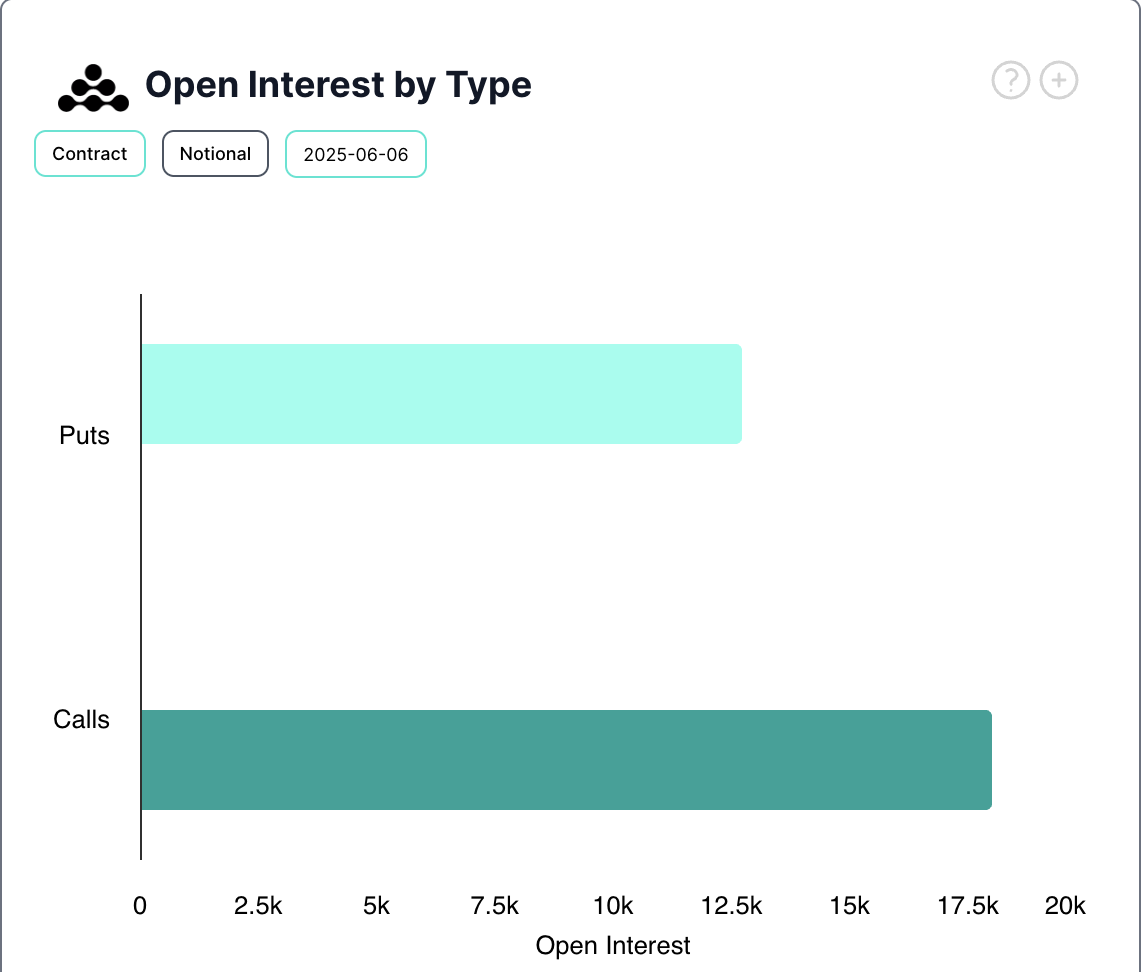

Interestingly, despite the slowdown, the options market remains in particular resilient. The request for purchase options (Paris Haussiers) continues to exceed this for the puts. When this happens, it suggests that traders anticipate the upward price movement and position themselves for a potential rally.

The combined reading of ETF flows and the feeling of options indicates that while institutional capital is withdrawing, derivative traders monitor potential.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.