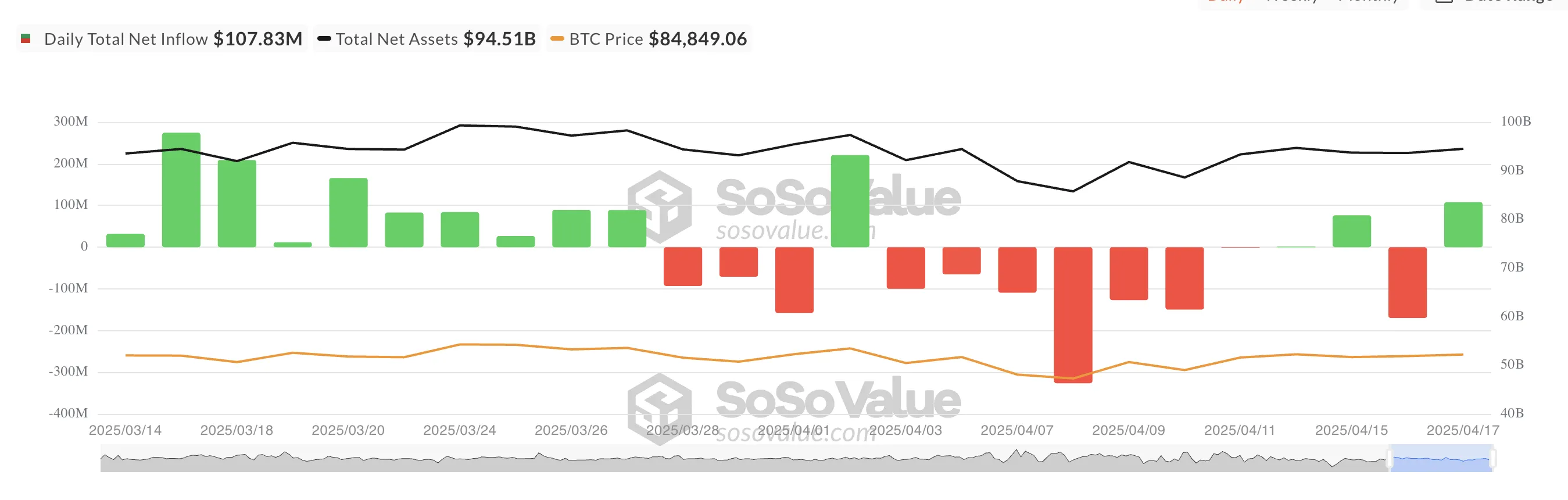

Bitcoin ETFs Rebound with Over $100M in Inflows

The FNB Bitcoin returned to the green Thursday, recording more than $ 100 million in net entries. This follows net outings of 169.87 million dollars on Wednesday, marking the only decline in one day of this week for BTC ETFs.

With a net influx of $ 15.85 million now recorded since Monday, the market seems ready to close the week on a bullish note.

Institutional confidence returns in the middle of the back of the week

This week’s resurgence in the signals of institutional entries has revived confidence among ETF investors. After the release on Wednesday, the immediate rebound in the entries suggests that the decline was only a brief setback rather than the start of another downside in the feeling of the market.

The renewed demand reflects an increasing conviction in the long -term potential of Bitcoin, even if short -term technical indicators continue to send mixed signals.

Thursday, the ETF Ibit of Blackrock recorded the largest daily net entrance, totaling $ 80.96 million, bearing its total cumulative entrances to $ 39.75 billion.

Fidlity’s FTF FBTC arrived in second place with a net influx of $ 25.90 million. Total historic net inputs of the ETF currently amount to $ 11.28 billion.

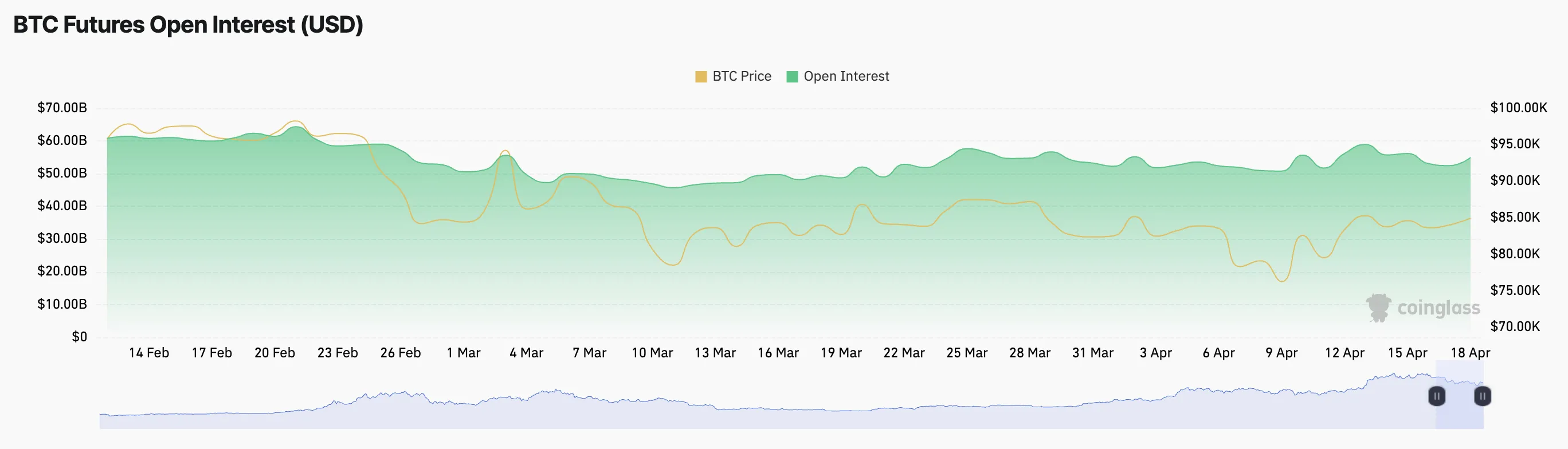

Bitcoin wins modestly in the event of interest opening up

The Bitcoin price has won a modest 0.30% in the last 24 hours. Commercial activity has also skyrocketed, reflected by its open interest in the long term. At the time of the press, it was $ 54.93 billion, climbing 5% in the last day.

The open interest of an asset measures its total number of derivative contracts in progress, such as term contracts or options that have not been adjusted or closed.

When the open interest of BTC increases with its price, it indicates that more traders enter the market, opening the new long or short positions. This confirms the growing interest of investors because it reflects increased speculative activity around the main room.

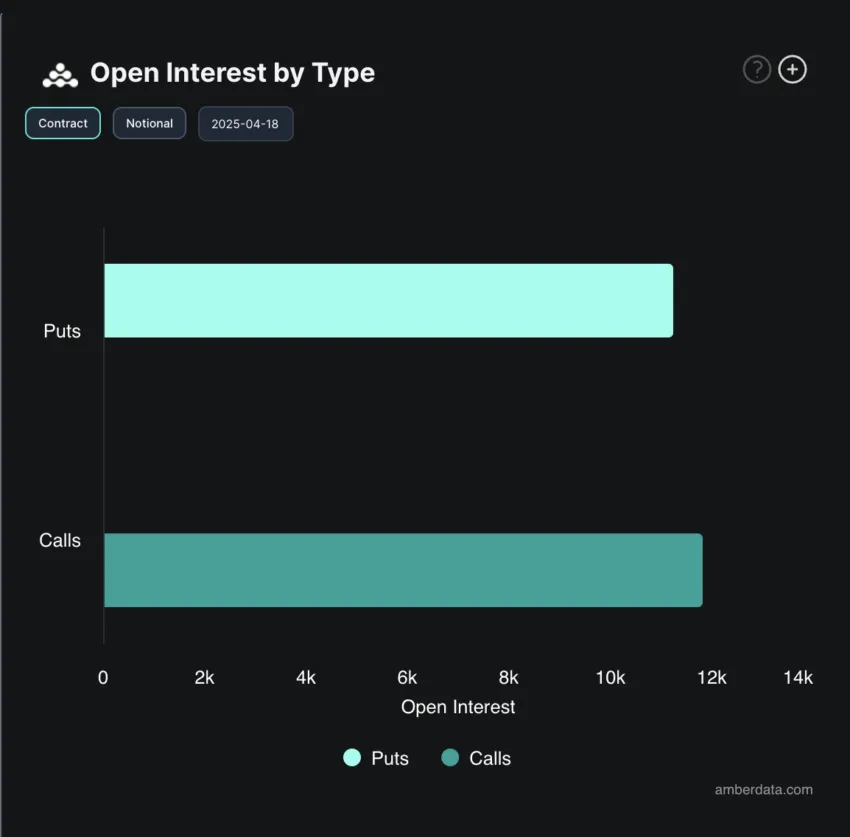

In addition, the high demand for calls on the BTC options market supports this upward perspective. The call options are used by traders who expect prices to increase, so increased activity in this segment suggests that many are positioned for an ascending movement.

However, not all traders share this bias bruise.

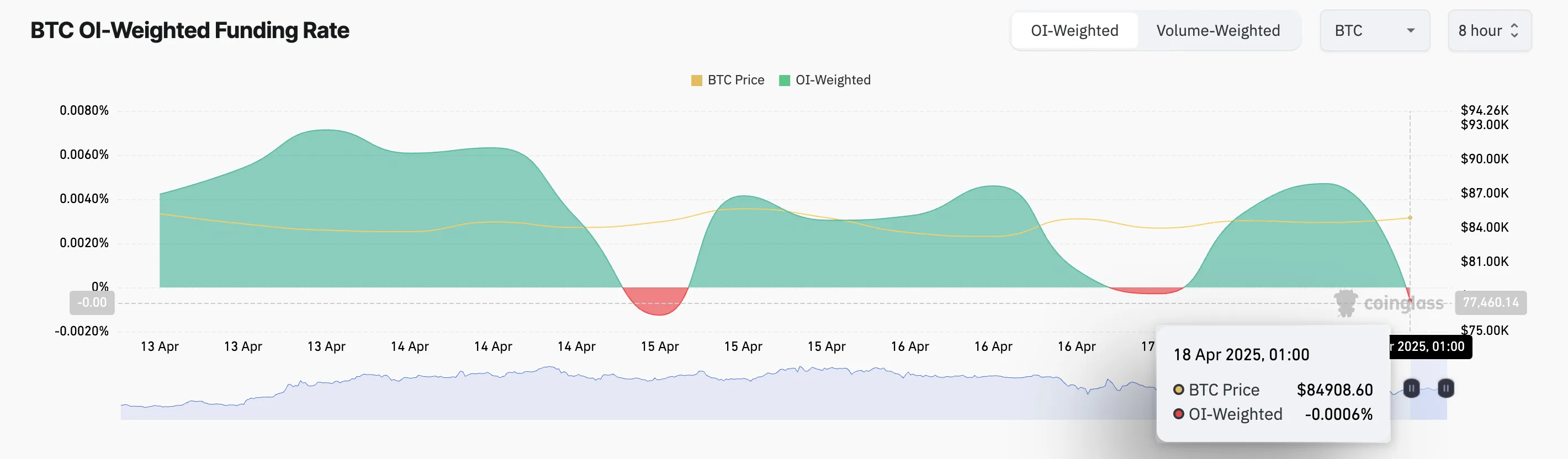

Today, the BTC financing rate has reversed negative, reporting a high demand for short positions among its long -term market players. At the time of the press, it is at -0,0006%.

When the rate of financing of the part is negative like this, the short positions pay long, indicating that the bearish feeling dominates and that the traders expect the prices to decrease.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.