Bitcoin Eyes $90,000, But Key Resistance Levels Loom

Bitcoin (BTC) increased by 9% in last week and is currently trying to establish higher support at the key level of $ 88,000. Enimony indicators such as the DMI and the Ichimoku Cloud display light bulls signals, with buyers firmly in control.

If this trajectory continues, BTC could soon test higher resistances close to $ 88,000 and potentially target $ 90,000 and beyond. However, analysts warn that the renewal of uncertainty around Trump’s commercial prices could disrupt the rally and trigger a withdrawal to the $ 81,000 support area.

Bitcoin DMI shows buyers in full control

Bitcoin DMI graph shows a significant increase in the strength of trends, the ADX climbing 29.54 from 24.07 yesterday.

This increase suggests growing momentum behind the current movement, pushing the ADX near the threshold 30 – considered as a confirmation of a strong and sustained trend.

An increasing ADX does not indicate management in itself, but when associated with directional indicators, it helps to identify the dominant force on the market.

Looking at these directional indicators, the + DI is currently at 23.47 and has remained stable between 21 and 23 in the last two days.

Meanwhile, the -Di fell sharply to 9.45 compared to 16.65, signaling a significant drop in down pressure.

This widening gap between the optimistic and bearish momentum points to buyers taking control, and if the ADX continues to exceed 30, it could validate a new increased phase for the BTC.

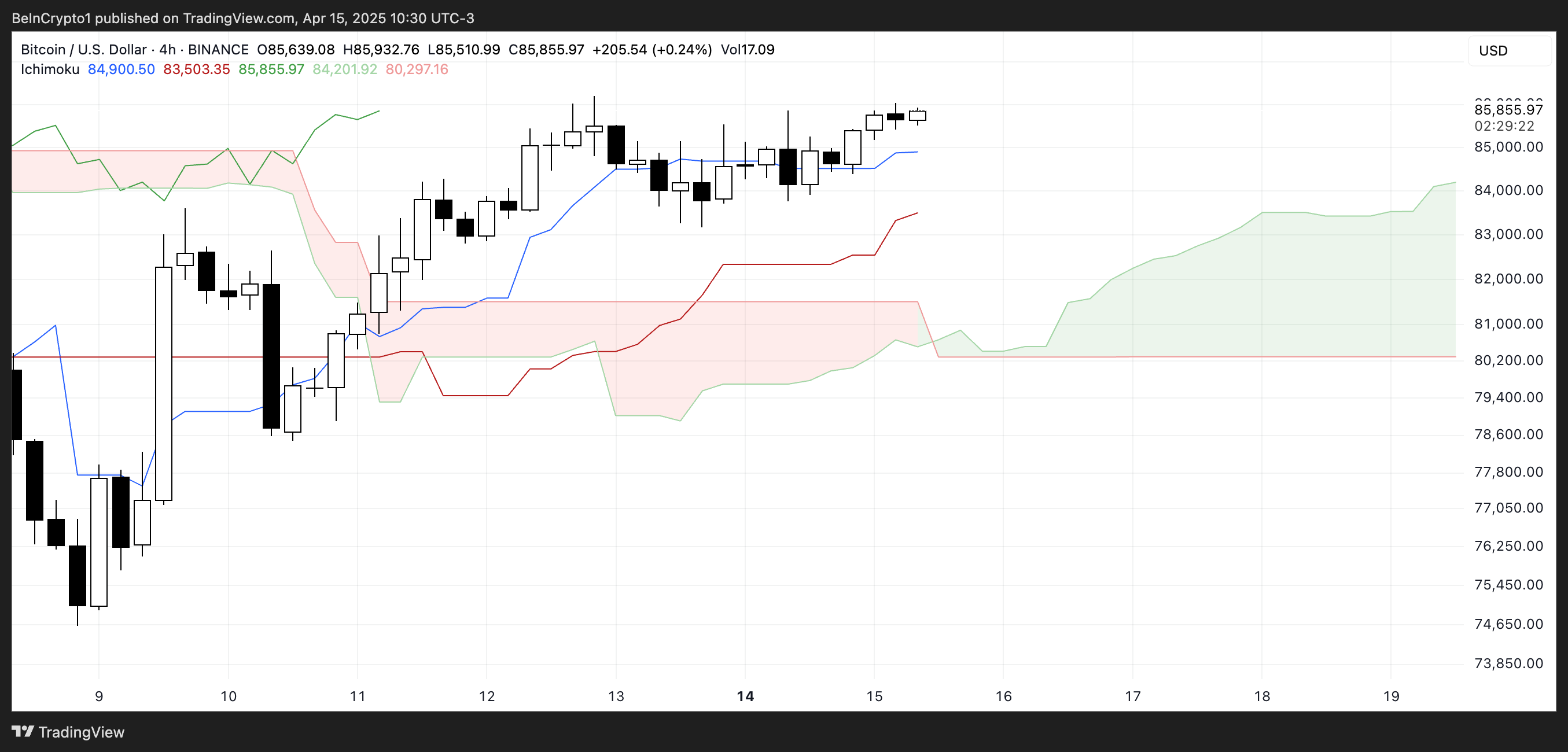

The BTC Ichimoku cloud shows a clear rise structure

The Ichimoku Bitcoin cloud table continues to look bullish, with a price firmly above Tenkan-Sen (blue line) and Kijun-Sen (red line).

This positioning suggests that short -term and medium term momentum remains in favor of buyers.

The flat nature of the Kijun-Sen could act as a solid support area, while the rise of Tenkan-Sen shows that buyers are always active on smaller deadlines.

For the future, the Kumo (cloud) is green and increases regularly, which strengthens a positive perspective for future sessions. The price is well above the cloud, indicating that the trend is optimistic and also firmly established.

There is also a clear gap between the current candle and the cloud, which suggests that the market has room to find itself without moving the global structure.

As long as the price remains above the Kijun-Sen and the cloud remains green, the upward trend remains technically intact.

Will Bitcoin soon exceed $ 90,000?

If Bitcoin Price maintains his current momentum, he could soon question resistance to $ 88,839, with $ 90,000 as a psychological step.

If the upward trend remains strong, other objectives are at $ 92,920 and potentially $ 98,484, marking a continuation of the bullish structure.

However, the crypto analyst and founder of the corner office Nic Puckrin warns that this momentum could be short -lived. He notes that a renewed uncertainty around Trump’s commercial prices could weigh on BTC:

“The warning here is that all this positive dynamic could disappear in a puff of smoke if there is a return to the prices or an unexpected shock announcement – that we all know that it is always a possibility. In fact, we continue to have constant going back and forth on the prices: the exemptions on electronics have proven to be temporary, said that Puckrin said that the prices will intervene.

He also defends that the support of $ 81,000 could be tested again:

“This, perhaps, explains why Bitcoin is, once again, in a” wait and see “model, with low liquidations at less than $ 200 million pointing to the uncertainty on the market. If we do not see external shocks, $ 88,000 at $ 90,000 are the next healthy beach and, as long as BTC remains above this threshold, it could even indicate a lasting recovery of prices “,”

Overall, it seems that the current macroeconomic factors are assessed. However, the market is careful about sudden surprises, because Trump’s recent prices exceeded any conventional economic trend and disrupt almost all global financial markets.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.