Bitcoin Hits $110,000 as Coinbase Premium and Market Greed Surge

The Bitcoin Premium coinbase, a key indicator of American institutional demand, reached its highest level in a week.

This decision has fueled speculation that the main players accumulate Bitcoin again.

Coinbase Premium Spike Signals renewed institutional appetite for Bitcoin

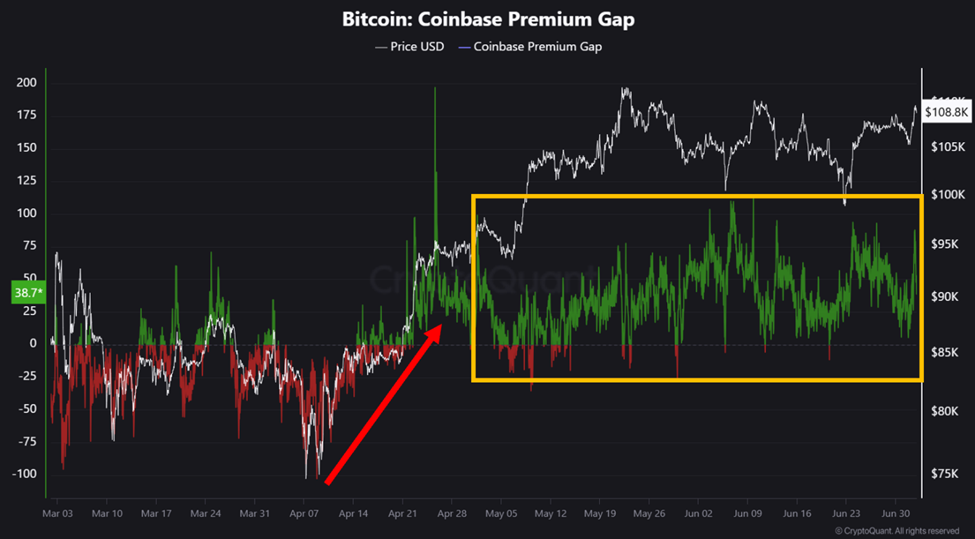

The Premium Coinbase follows the price difference between BTC / USD on Coinbase and BTC / USDT on the exchange of Binance. A positive premium generally points out an increase in demand from American institutions and high net individuals.

According to the cryptocurrency crypto dan contributor, the premium Coinbase gap has remained positive since May, reflecting a sustained American purchase activity.

“Bitcoin – Management has already changed upwards … Since April, the sale pressure of whales and American institutions has gradually decreased … Currently, their purchase pressure is maintained,” Dan wrote in a recent report.

Elsewhere, the lead of the Starkware ecosystem, Brother Odin, alluded to the feeling of the market becoming gourmet. Echoing the feeling of the Crypto Dan, the analyst also underlined the increase in premiums and the reduction in sales pressure as a sign that the wider trend could change upwards.

“American institutions [are] In accumulation mode… Coinbase Premium follows, the BTC price difference between Coinbase (USD) and Binance (USDT)… Right now, it’s positive and increasing, “wrote Odin.

This increase in institutional demand coincides with a reading of the fear and greed index of 73, when writing this article. The index firmly places the market in “greed” territory, a perspective that has persisted in recent weeks.

Although this signals a strong bullish feeling, it also increases the red flags for certain traders. Historically, readings above 70 have preceded short -term corrections in several recent market cycles.

Is Bitcoin ready for the price discovery mode?

However, the feeling among chain analysts remains optimistic. Among them, Bitbull, who highlighted the strength of the premium tip signal.

“Coinbase Bitcoin Premium has just reached its highest level in a week. It is the best signal of institutional accumulation, which means that the rally could extend. If the premium extends for a few more days, BTC will enter the price discovery mode,” suggested Bitbull.

The recent continuous increase a model that Beincrypto reported three weeks ago. In this case, a similar increase in the Coinbase premium sent Bitcoin near local vertices. This momentum seems to be consolidated now, rather than reversing.

This perspective, in which Bitcoin could enter a mode of price discovery, aligns with the feeling of Crypto Dan. The chain analyst highlighted Bitcoin’s consolidation as providing a window to resolve short -term overheating.

“Bitcoin is currently in the consolidation phase where short -term overheating is resolved,” observed Crypto Dan.

Dan stressed that if the corrections remain possible, the global market trajectory seems optimistic before the second half of 2025.

The current combination of increasing bonuses, bullish signals on the chain and renewed risk appetite placed bitcoin at a pivotal time.

If the institutional accumulation persists and the retail trade follows suit, analysts say that the market can be ready to return to price discovery mode, where new heights of all time are tested.

When writing these lines, Bitcoin was negotiated at $ 110,001, up more than 2% in the last 24 hours.

The Bitcoin station reaches $ 110,000 while Coinbase Premium and the overvoltage of market greed appeared first on Beincrypto.