Bitcoin Liquidation Data Shows Price Could Bounce Back to $109,000

The main Bitcoin has been correct since it reached its summit of $ 111,968 on May 22. The King part slipped below the level of support of $ 105,000 to discuss $ 104,536 at the time of the press, reflecting the sale pressure.

However, data on the chain suggest a potential rebound above this level of critical support, with a possible retest of all BTC time on the horizon. This analysis breaks down key ideas.

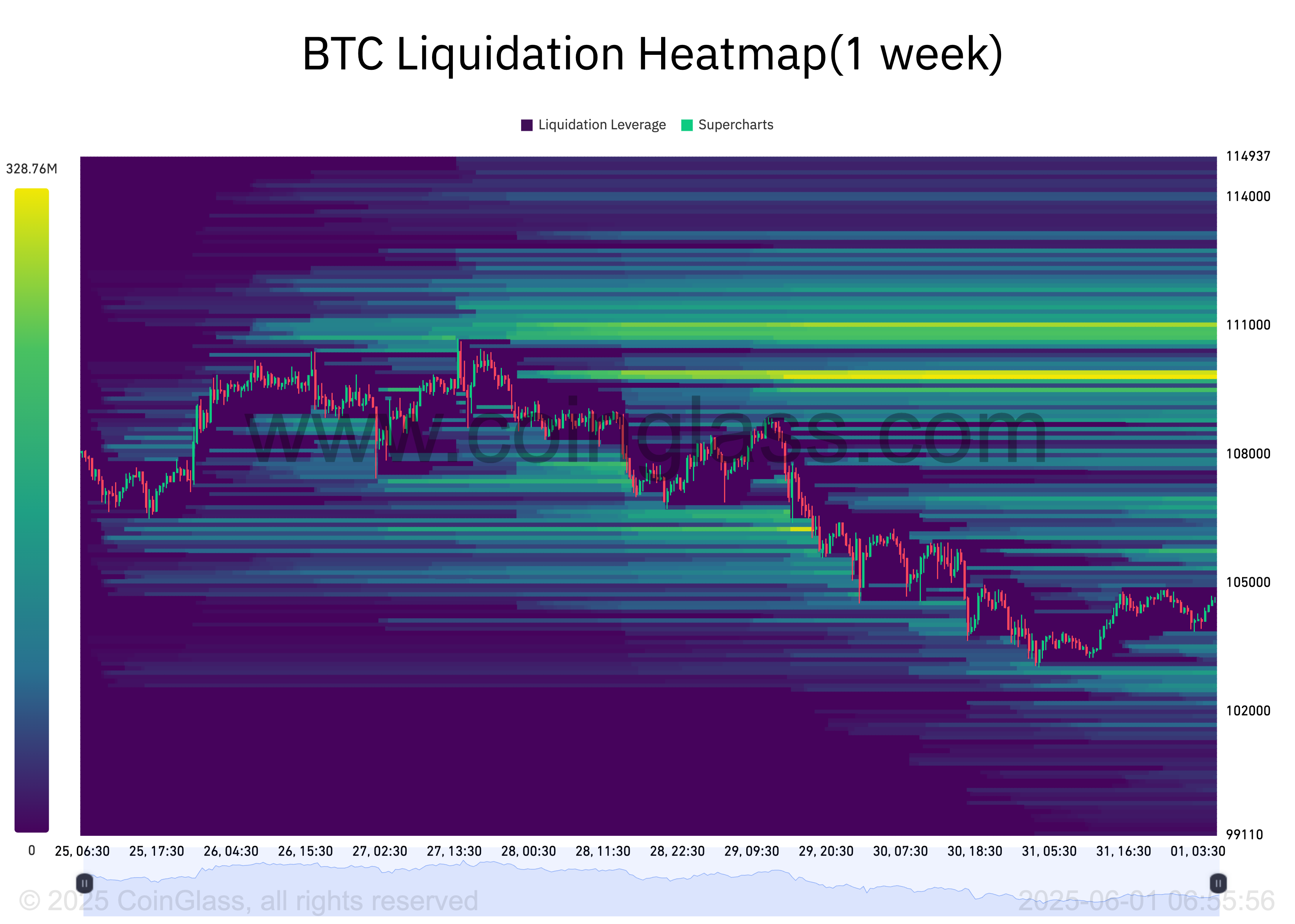

BTC liquidity clusters report an increase of $ 109,000

An assessment of the BTC liquidation thermal card shows a significant concentration of liquidity around the price zone of $ 109,933.

Thermal liquidation marks identify the price levels where large clusters of leverages are likely to be liquidated. These cards highlight the high liquidity areas, often coded by color to show the intensity, with brighter (yellow) areas representing greater liquidation potential.

Usually, these cluster zones act as magnets for prices, because the market tends to move to these areas to trigger liquidations and open new positions.

Consequently, for BTC, the convergence of a high volume of liquidity at the price level of $ 109,933 indicates a strong interest of trader to buy or close short positions at this price. He creates room for overvoltage towards the $ 109,000 mark.

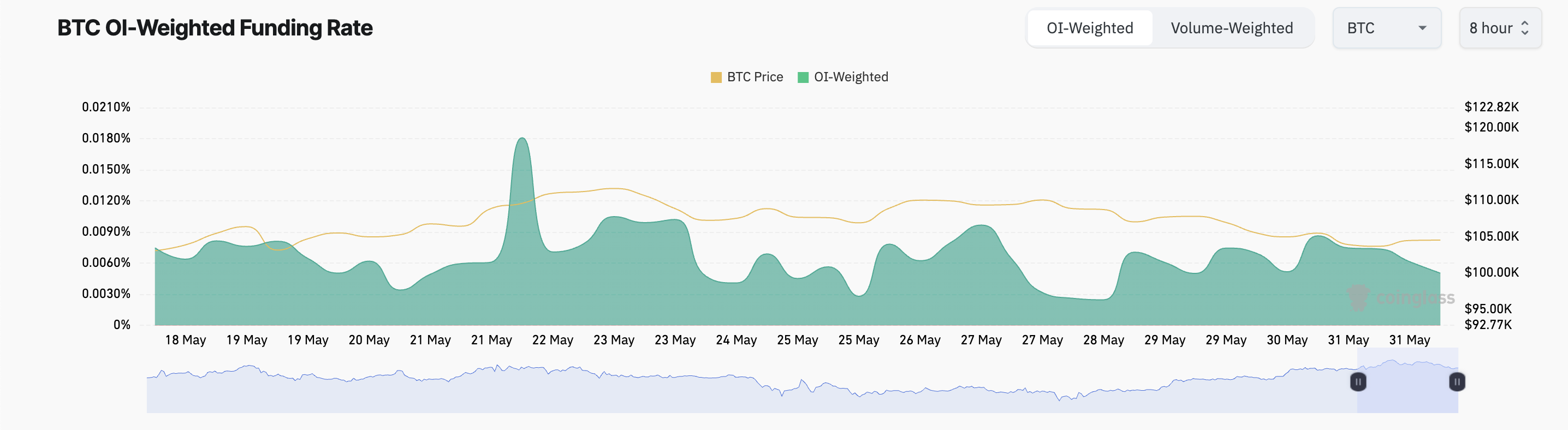

In addition, the rate of financing of the part remained positive despite its recent withdrawal. At the time of the press, this is 0.005%, by Coiglass.

The financing rate is a periodic payment between traders in perpetual term contracts to maintain the price of the contract aligned with the cash price. When the financing rate is positive, there is a higher demand for long positions.

This means that more traders continue to bet on the rise in BTC prices, even in the face of strengthening the lower momentum.

BTC Teetters Price between $ 103,000 in support and $ 109,000 liquidity zone

BTC posted a modest gain of 1% in the last 24 hours, bouncing on the support level of $ 103,952. If the demand soar, this support floor could hold up firm and push prices above the psychological barrier at $ 105,000, potentially targeting $ 106,307.

A clear break above this area can open the door to the price zone of $ 109,000 dense with lever-effect positions.

However, the increase in profit could bring back the BTC below $ 103,952, with an additional drop to $ 102,590 likely.

Post Bitcoin liquidation data show that the price could bounce back to $ 109,000 appeared first on Beincryptto.