Crypto Trends

Bitcoin long-term holders capitulate at levels seen during FTX collapse ⋅ Crypto World Echo

Tag : CryptoSlate

Quick Take

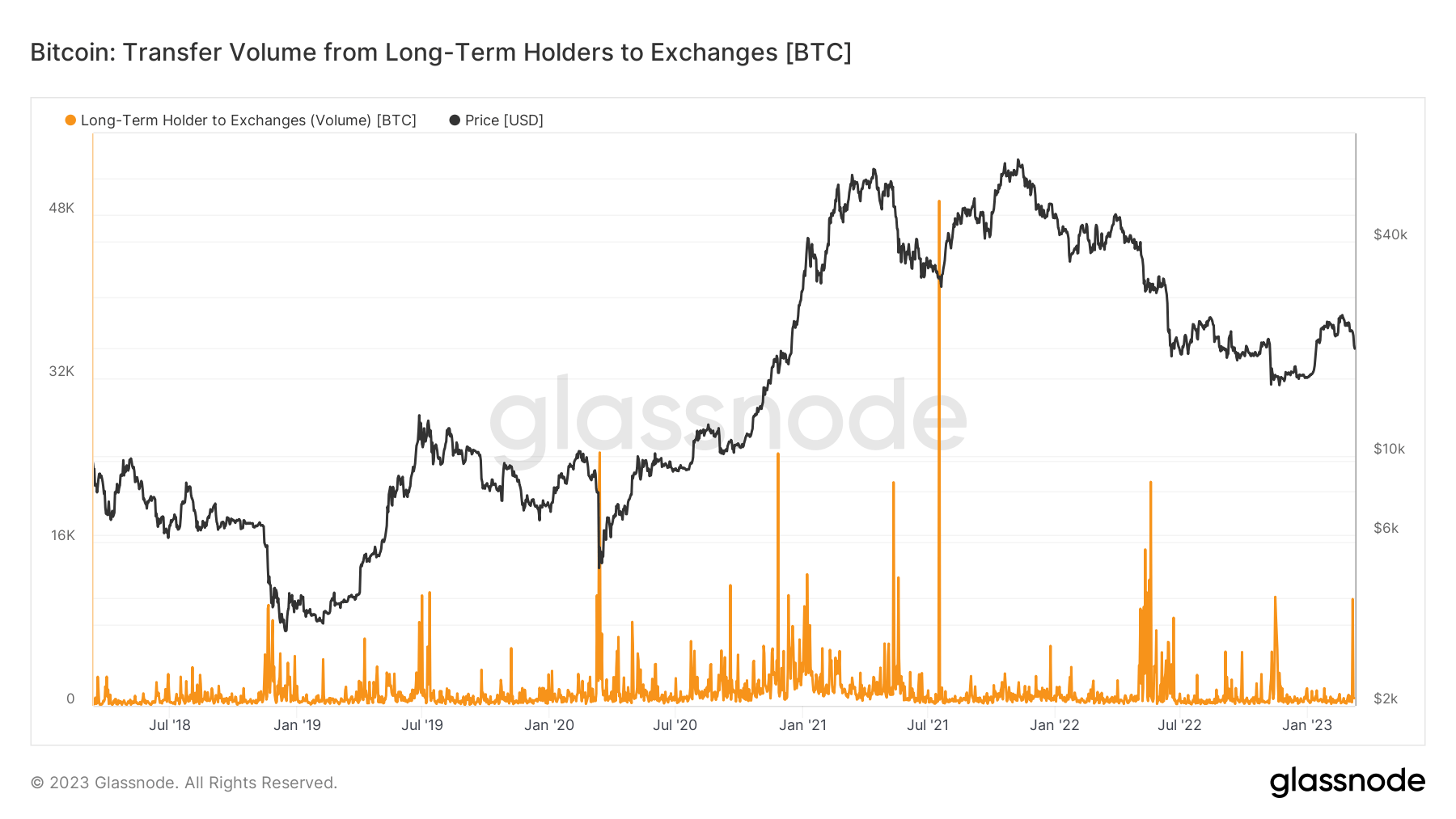

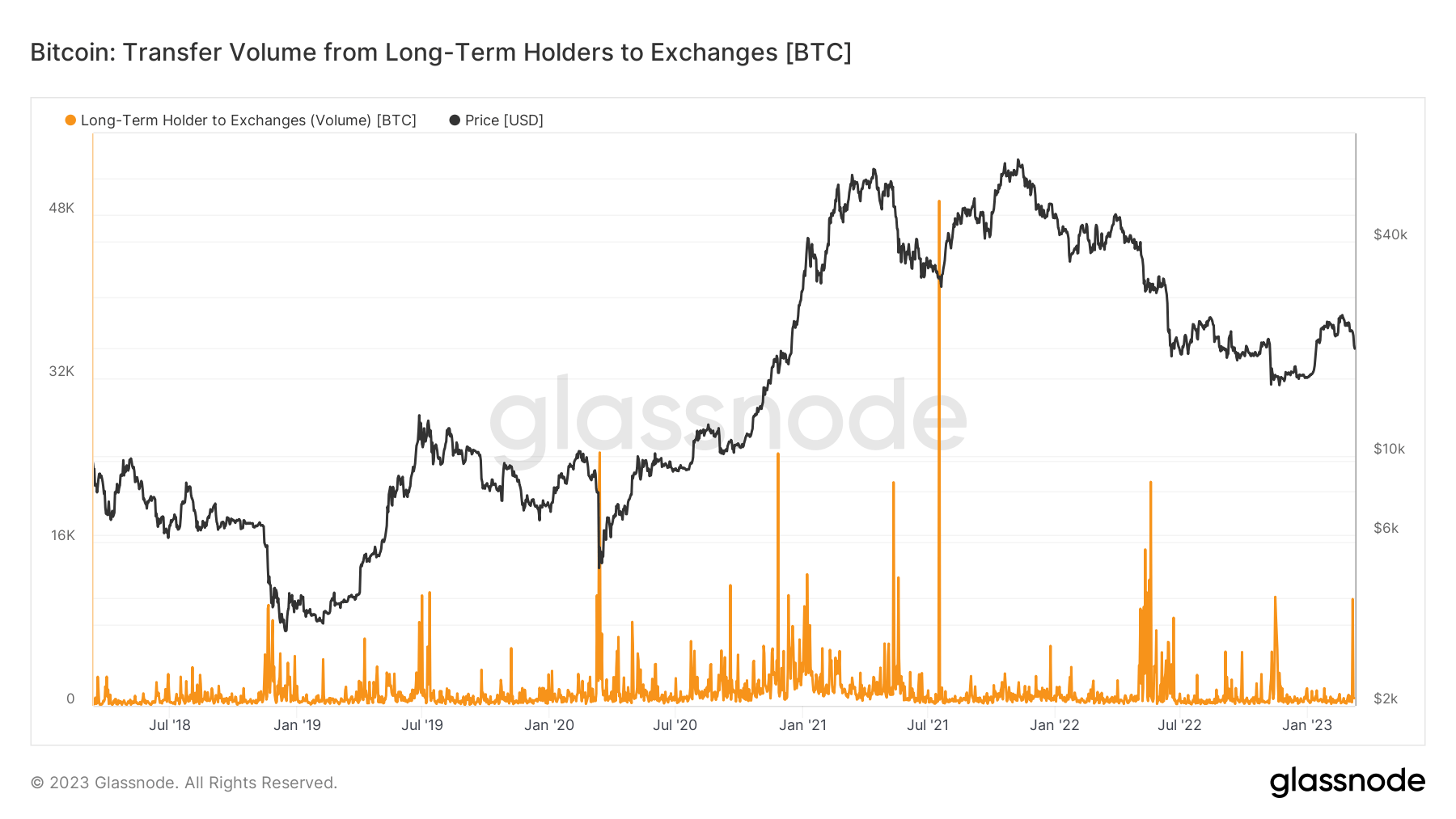

- Bitcoin long-term holders (LTHs) are defined as investors who have held Bitcoin for longer than six months and are considered the smart money of the ecosystem. Typically they will buy Bitcoin when the price is suppressed and distribute in bull markets.

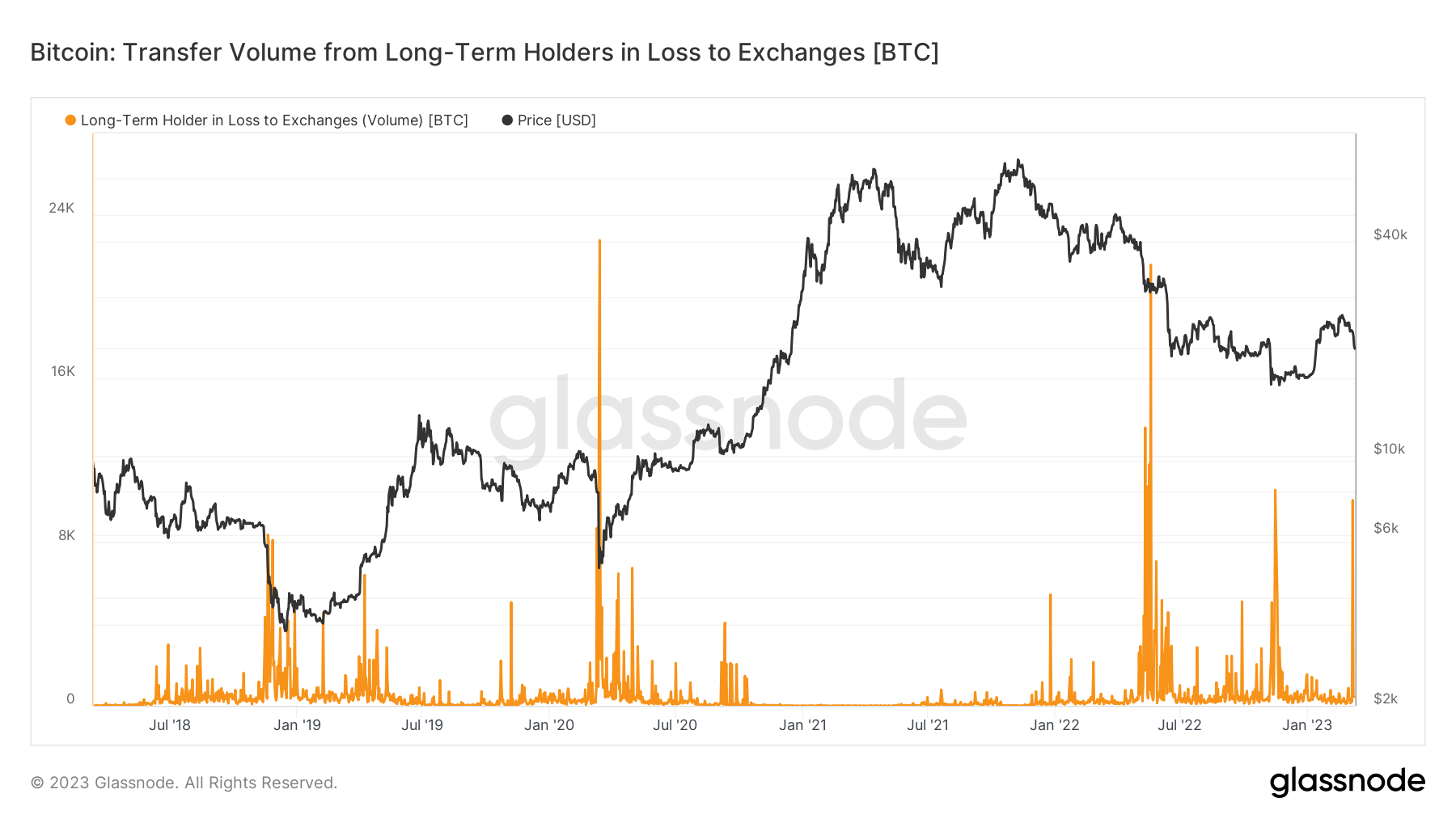

- However, LTHs do capitulate and sell Bitcoin when panic and fear occur in the market, this can be seen below with these on-chain metrics.

- These metrics show when LTHs sell Bitcoin to exchanges, considerable spikes happen in moments of fear and capitulation. These events include the LUNA and FTX collapse, the China ban in May 2021, and now significant capitulation due to the fallout of Silvergate and then Silicon Valley Bank.

- Long-term holders have capitulated to levels similar to the FTX collapse. Roughly 10,000 Bitcoin were sent to exchanges, all sold at a loss.

- Capitulations, especially with long-term holders, can mark bottoms in Bitcoin cycles. However, the fallout and contagion from the banking and financials sector are still unknown, which will be short-term bearish for Bitcoin price action.

The post Bitcoin long-term holders capitulate at levels seen during FTX collapse appeared first on CryptoSlate.

I detected you have an ad blocker installed in your browser. Advertising is a way of earning a small compensation for the work I put in to create this site.

If you like my site and appreciate my efforts to create an informative site, would you consider buying me a coffee? I would greatly appreciate it 🙂