Bitcoin Long-Term Holders Lead the Charge in Profit-Taking Wave

The brief Rally of Bitcoin above the psychological price bar of $ 105,000 sparked an increased activity among its long-term holders (LTH).

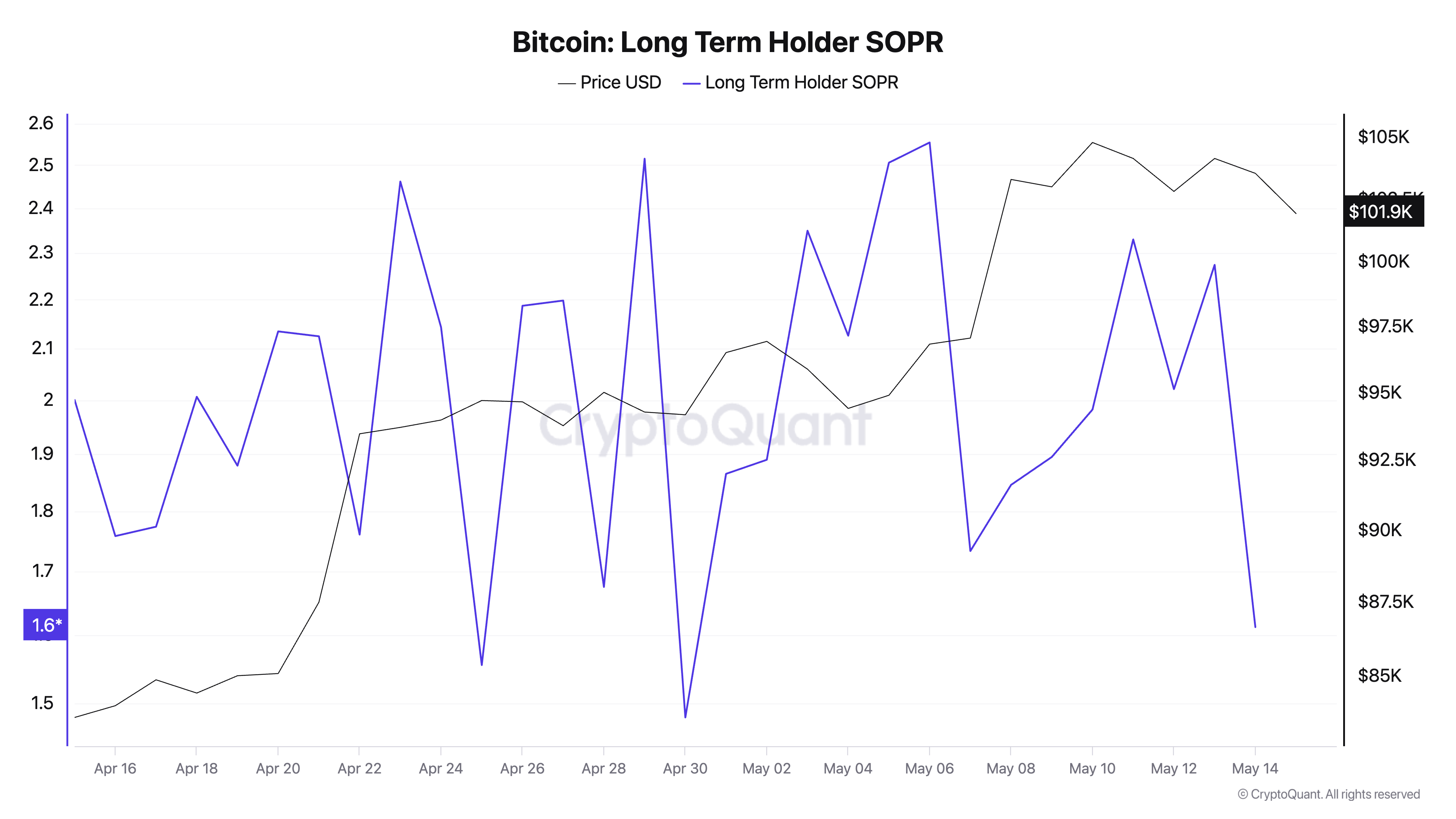

According to data on the channel, there is a notable peak in the profits made within this group in the past few days. This trend suggests that many LTH investors are starting to take advantage of the gains of sharp price by selling parts to profit.

Long -term BTC investors increase the profits

In a new report, the cryptocurrency analyst, Carmelo Alemán, noted that the BTC LTHs – investors who have held their parts for more than 150 days – have considerably increased their profit in recent weeks, according to chain data.

Alemán noted that the long-term BTC holder spent the profits ratio (LTH-SOPR), which measures if investors who have held a particular asset for more than twelve months are for profit or not, reaching an annual hollow of 1.32 on March 12.

However, as the feeling of the market improved, it regularly climbed to 2,274 by May 13. According to Alemán, this marks an increase of 71.33% of the profits made over two months, which suggests that the parts spent by LTHs are sold on much higher beneficiary margins than earlier in the year.

To date, the metric is 1.612.

“This suggests that LTHs are starting to capitalize on their accumulated earnings, perhaps in anticipation of future corrections or in response to a global improvement in the feeling of the market. This achievement could be essential to understand the upcoming price movements, as historically, these periods preceded significant price fluctuations in Bitcoin,” said historically.

Historically, the BTC LTH-SOPR points have coincided with the distribution phases, where experienced investors begin to sell their assets before potential slowdowns. However, “the market is still far from its cycle peak,” wrote Alemán.

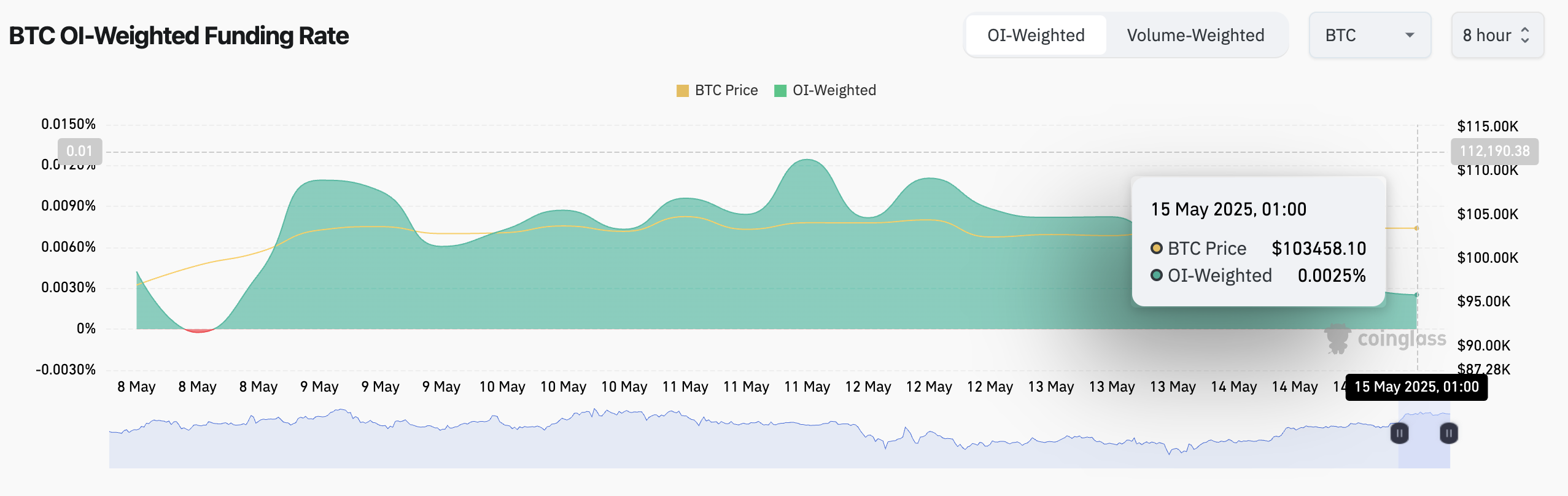

This can be assigned to the persistent positive financing rate of the BTC. This amounts to 0.0025% at the time of the press, reporting a high demand for long positions among the actors of the term market.

A positive financing rate like this means that traders occupy long positions (Paris the price will increase) pay costs to those that occupy short-term positions, indicating a bull’s market on the BTC market.

BTC faces a pressure after $ 105,000

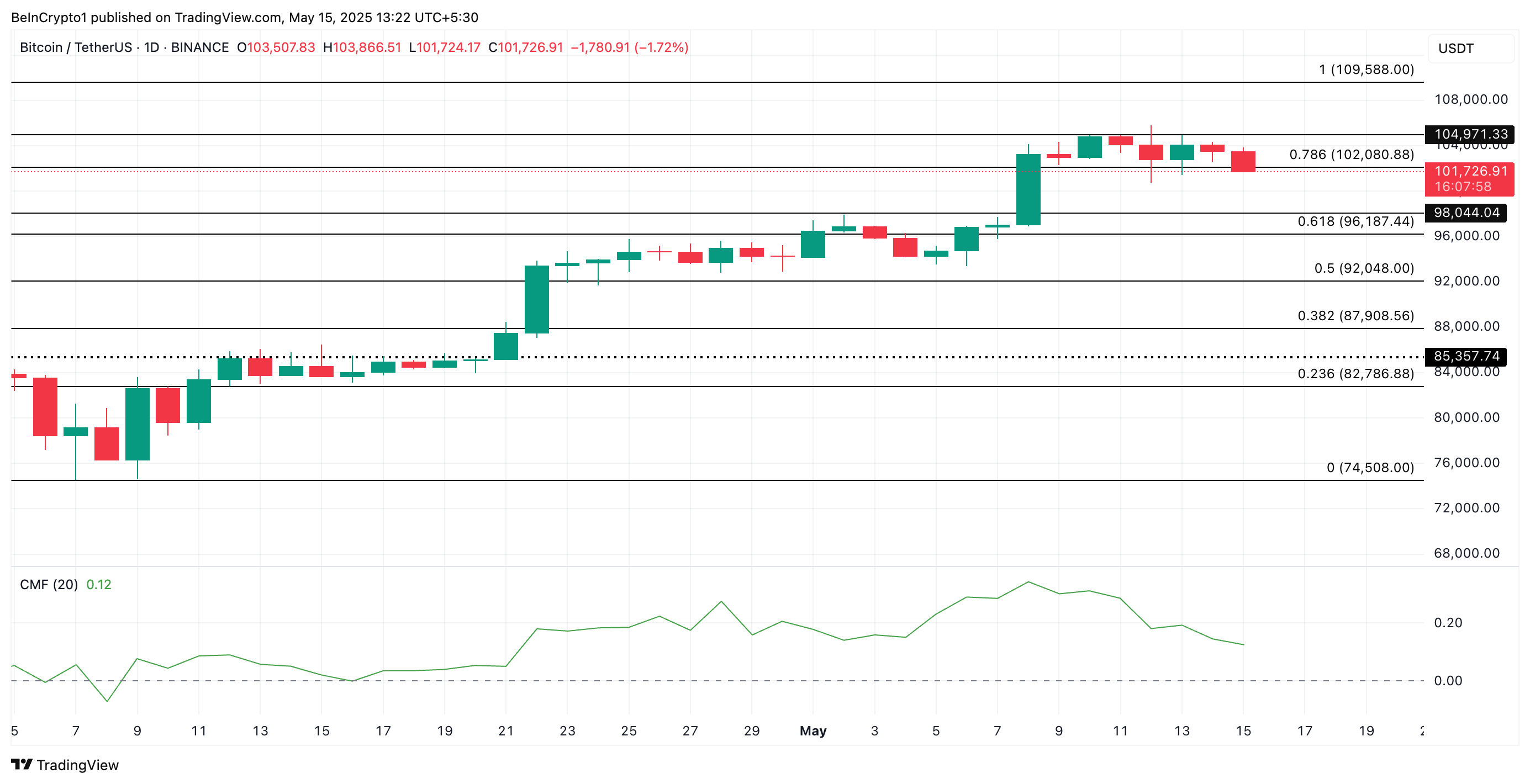

At the time of the press, BTC is traded at $ 101,726. The price of the King Coin is down 2% during the last day, reflecting the wider decline in the market.

On the daily graphic, the Chaikin monetary flow of the room (CMF) tends to decrease, highlighting the drop in demand as a profit activity among the traders and investors of the BTC.

The CMF indicator measures how silver flows in and outside an asset. When it decreases, this indicates to weaken the purchase pressure or the increase in sales pressure. This means that less capital goes into the BTC while market players capitalize on the recent increase in the part beyond the price bar of $ 105,000.

If sales are strengthened, downward pressure on BTC climbs and could force its price at $ 98,044.

On the other hand, if the accumulation resumes, the part could break the resistance at $ 102,080 and get back to $ 104,971.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.