XLM Price Risks Falling Below $0.40 as Buying Pressure Falls

The Stellar XLM faces a growing drop pressure after a dull performance in last week.

Technical indicators flash warning panels, with a key Momentum indicator forming a lower crossover. This points out to weaken the purchase momentum and the potential for prolonged decrease.

XLM Bears takes control: technical and social parameters align for new losses

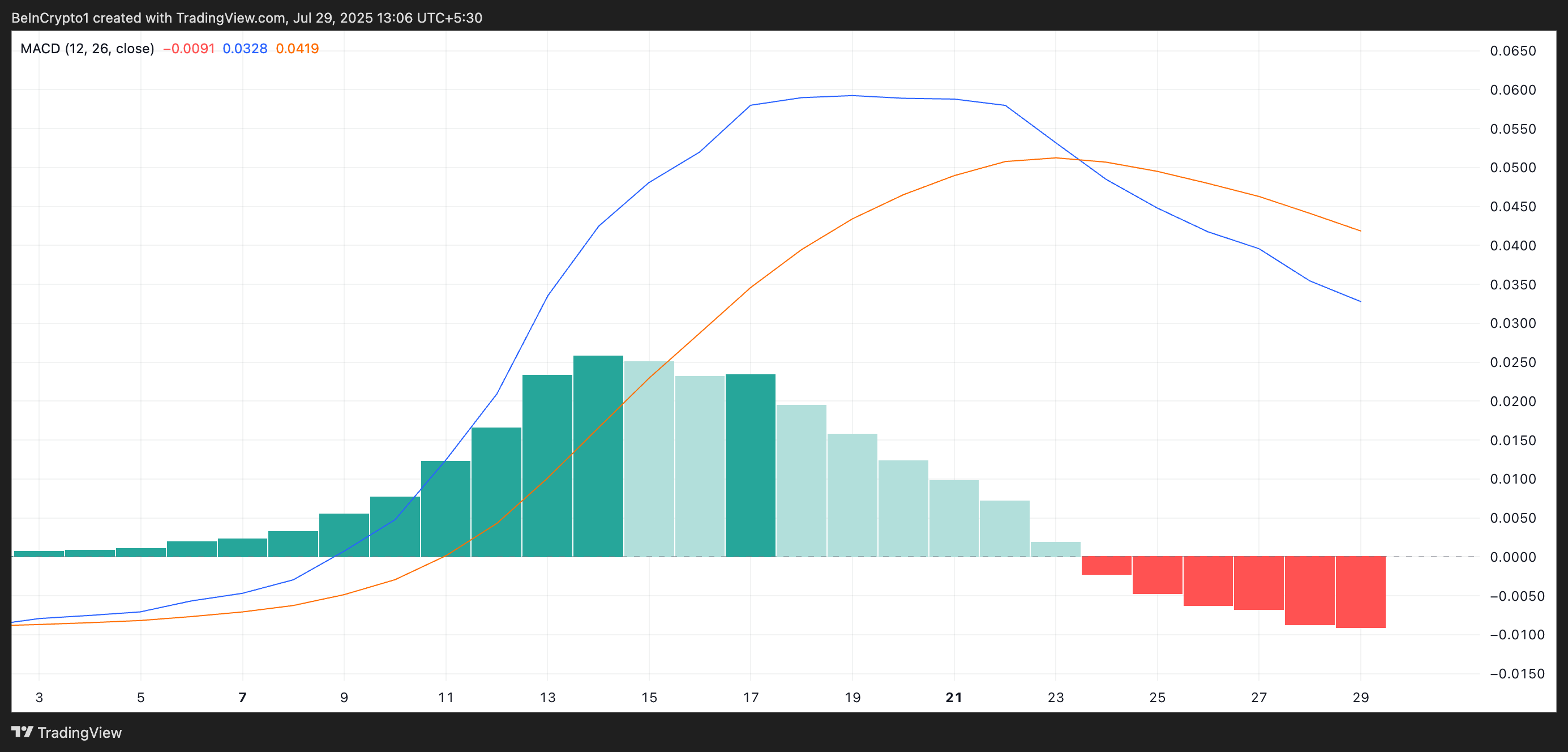

An evaluation of the graph of one XLM / USD day reveals that the indicator of divergence of Mobile average convergence (MacD) formed a lower crossing cross on July 24.

This happens when the macD line of an asset (blue) breaks under the signal line (orange). This happens when short -term momentum is weakening and decreases below the longer term trend. It often marks the start of a downward trend or a period of lateral consolidation.

For TA tokens and market updates: Do you want more symbolic information like this? Register for the publisher Daily Crypto newsletter Harsh Notariya here.

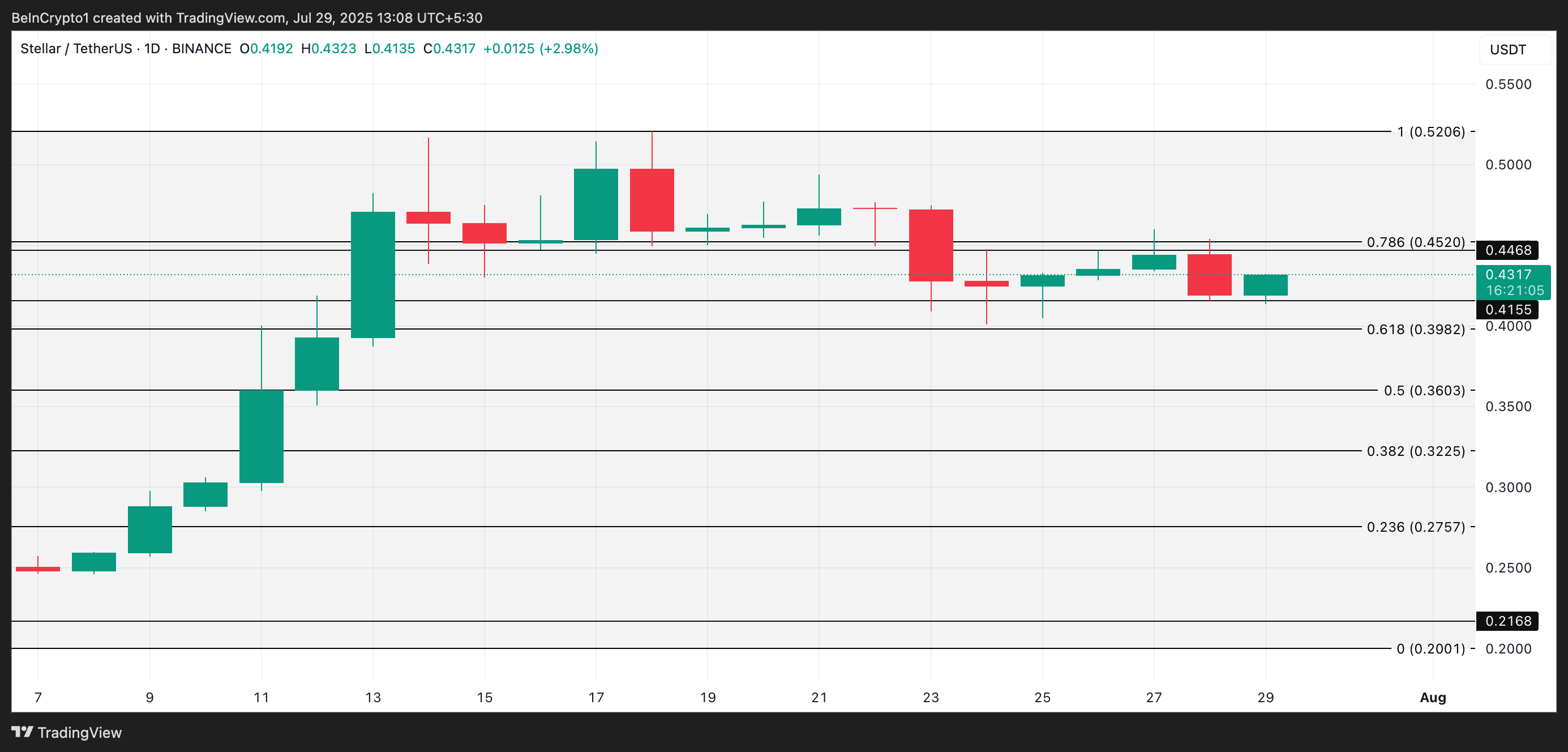

Since the crossing emerged, XLM has mainly exchanged in a narrow range, faced with persistent resistance around $ 0.44 while finding support at $ 0.41. This price action reflects a clear loss of the bullish impetus and confirms the current period of low negotiation and indecision activity among market players.

The absence of a strong directional movement reinforces the lowering perspectives of Altcoin, especially if support at $ 0.40 begins to weaken.

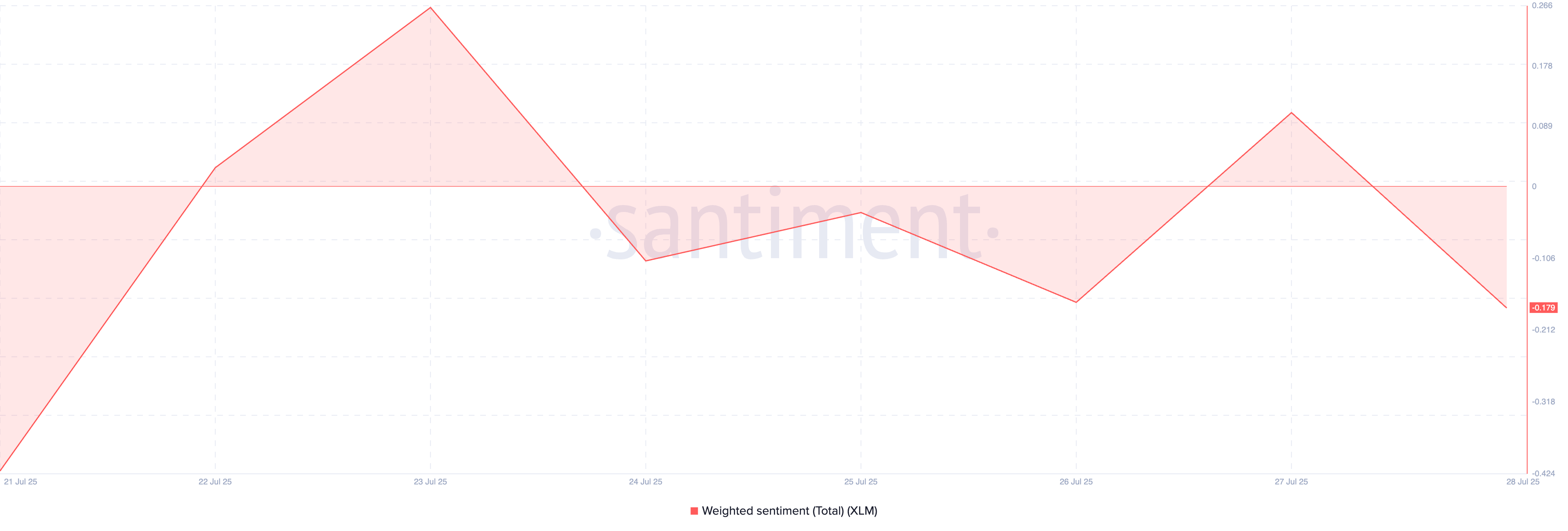

In addition, the chain feeling around XLM has also become negative, amplifying the probability of a continuous price slide. According to Santiment, the weighted feeling of the token is at -0,179, adding to the lowering pressures on its price.

The weighted feeling of an asset measures its positive or negative overall bias, given both the volume of social networks and the feeling expressed in these mentions.

When it is negative, it is a lower signal, because investors are more and more skeptical about the short -term perspectives of the token. This encourages them to exchange less, exacerbating the drop in prices.

A push could send it to $ 0.39 or trigger a rebound

XLM is negotiated at $ 0.43 at the time of the press, down 2% in the middle of the larger decline in the market. If the negative feeling is strengthened and the new request remains absent, Altcoin could get out of its narrow beach and fall to $ 0.39.

Conversely, a resurgence of bullish feeling could prevent it from happening. If the purchase activity resumes, XLM could reverse its current course, break the resistance to $ 0.44 and reach $ 0.45.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.