Bitcoin Miners Show Confidence After $95,000 Breakout

Bitcoin’s decisive rupture over the psychologically significant brand of $ 95,000 injected new optimism on the market, at least among minors.

This key step has triggered a change in the feeling of minors, with data on the chain showing a notable increase in the reserves of the BTC minor in recent days.

Minors bet on the BTC upwards while the reserve jumps lower

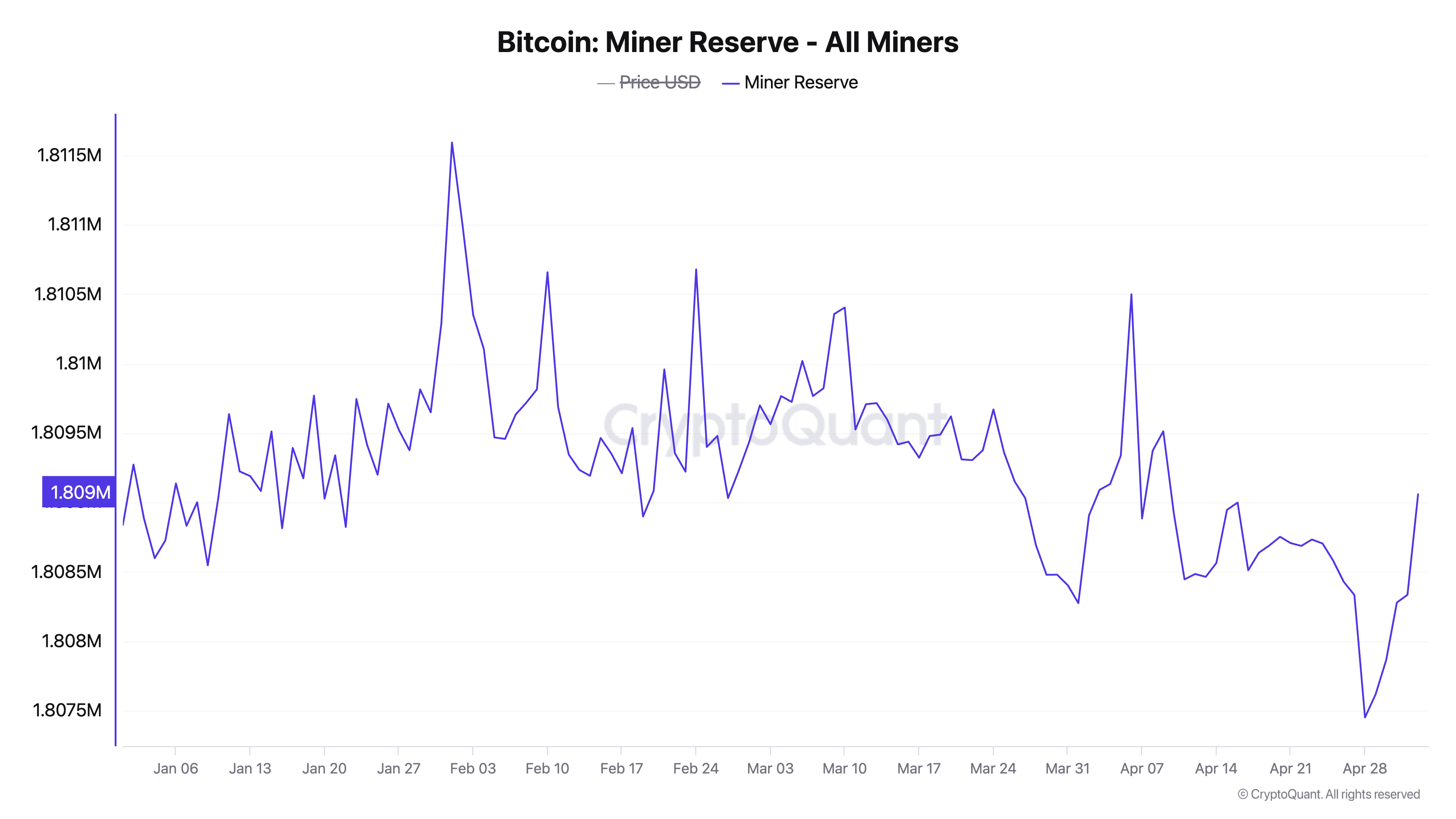

According to Cryptochant, the Bitcoin minor reserve, which had been in a sustained decrease trend, began to increase on April 29, shortly after the BTC fence above the $ 95,000 threshold.

For the context, the reserve had fallen to a hollow of the year at the start of 1.80 million BTC one day earlier before overthrowing the course and showing signs of accumulation.

The Bitcoin minor reserve follows the number of parts maintained in the miners’ wallets. It represents the reserves of coins that minors still have to sell. When he falls, minors move coins from their portfolios, generally to sell, confirming the growth of the lowering feeling against the BTC.

Conversely, when this metric is increasing, as is the case now, it suggests that minors keep their extracted parts more, often reflecting growing confidence in the future assessment of the BTC prices.

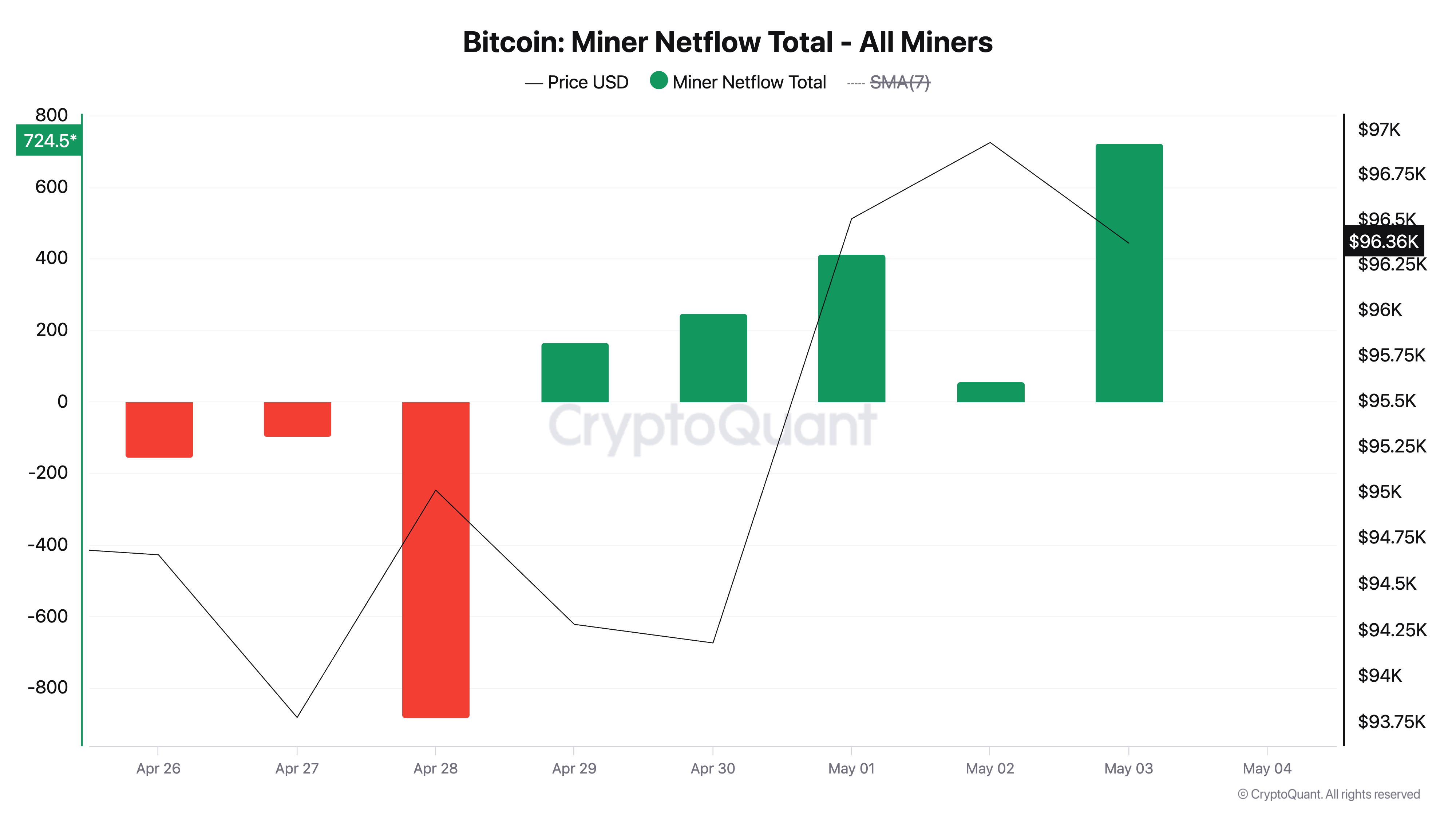

In addition, the bullish change in the feeling of minors is also supported by the positive minor Netflow recorded since April 29. This indicates that more parts are placed in minor wallets rather than unloading in exchanges.

Such behavior reflects confidence in addition to the rise, like minors, often considered as long -term holders, choose to accumulate rather than liquidate.

There is a catch

However, the feeling is not universally optimistic. While BTC minors retreat from the sale, the derivative data tells another story.

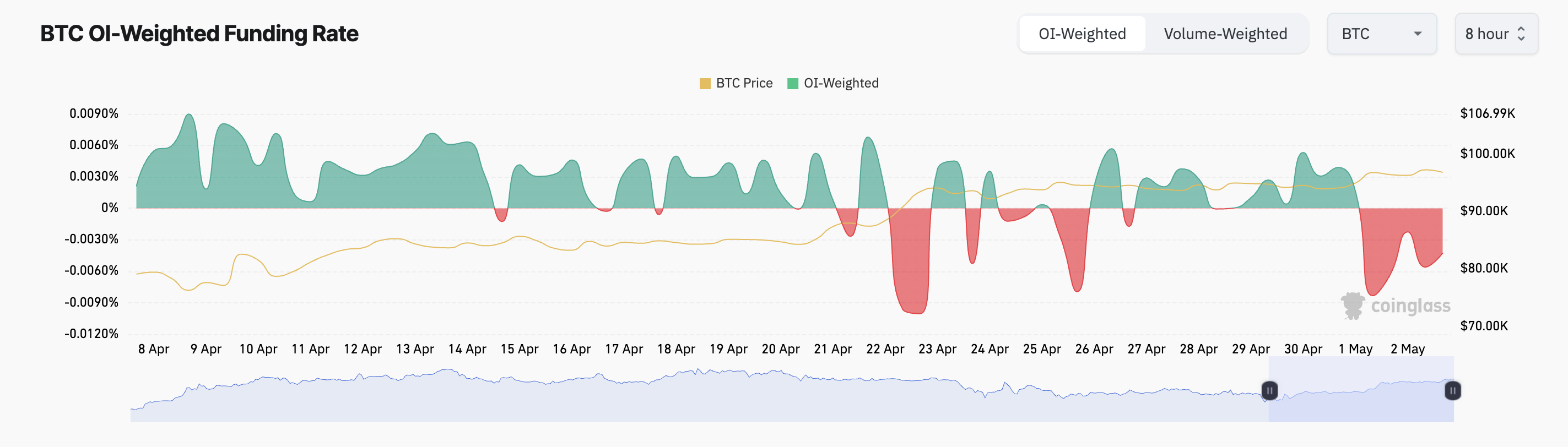

On the term contract market, the BTC financing rate has remained negative since the beginning of May, a sign that a large part of traders bet on a short -term price correction. At the time of the press, the rate of financing of the part is -0.0056%.

The financing rate is a periodic payment exchanged between long and short traders in perpetual term contracts to maintain the price of the contract aligned with the cash price.

When it is positive, this means that traders occupying long positions pay those who have short positions, indicating that the bullish feeling dominates the market.

On the other hand, a negative financing rate like this signals shorter bets than long bets, suggesting a downward pressure on the price of BTC.

Escape or breakdown as merchants and minors diverge

Although the behavior of minors can indicate renewed confidence, the constant lowering feeling in derivatives suggests that traders remain suspicious of a potential withdrawal.

If the accumulation of parts is strengthened, BTC could extend its earnings, exceed resistance to $ 98,515 and try to return to the price bar of $ 102,080.

However, if the stock market betting against the main currency victory and attended a demand deficit, its price could fall below $ 95,000 to reach $ 92,910.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.