Bitcoin Nears $117,000 Ahead of Trump’s Plan To Open 401(k)s to Crypto

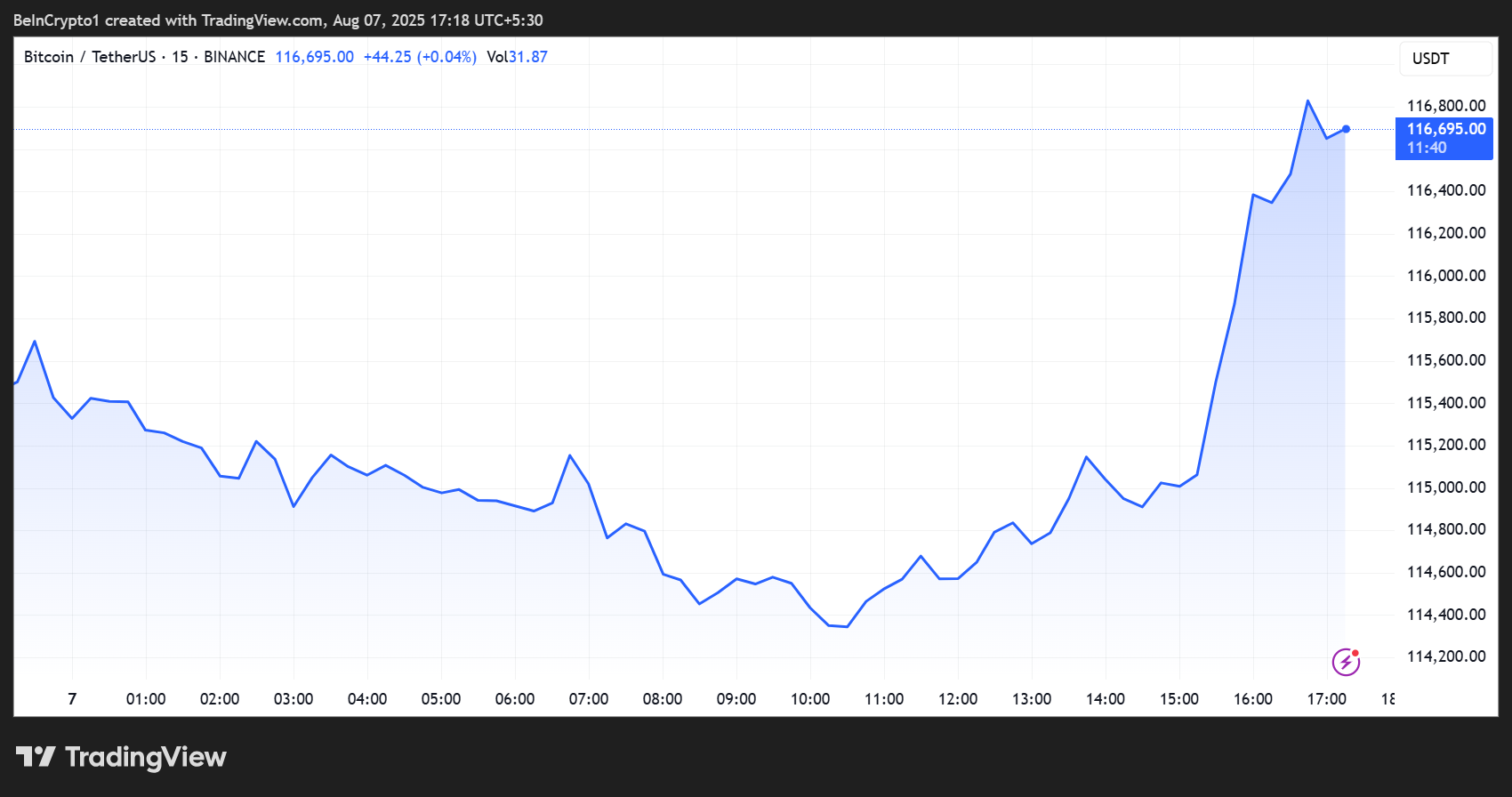

Bitcoin (BTC) recovered the psychological level of $ 116,000, approaching his peak in July.

The recovery follows the reports that US President Donald Trump is preparing to sign a radical decree allowing crypto and other alternative assets in retirement accounts 401 (K).

Trump’s imminent executive decree pushes Bitcoin nearly $ 117,000

When writing these lines, Bitcoin was negotiated at $ 116,695, a significant ascent after opening the Thursday negotiation session in the range of $ 114,000.

The sharp increase follows the reports of an imminent decree ordering the Ministry of Labor to reassess the directives under the 1974 law on the security of retirement income of employees (ERISA).

In particular, the directives traditionally excluded alternative assets such as crypto, real estate and investment capital of most of the workers’ retirement plans.

Bloomberg reports that the order asks the Labor Secretary to coordinate with the Treasury Department, the United States (Securities and Exchange Commission) and other regulators to explore rules.

Among other reasons, the objective is to relieve legal obstacles for the inclusion of cryptography in the accounts defined for contribution.

“Insanablely optimistic for crypto!” said Crypto Lark Davis analyst on X.

Davis’ remark highlights the reaction of the market to what can be a historic change in American retirement investment policy. With nearly 12.5 billions of dollars held in 401 accounts (K), the potential influx in Bitcoin and other digital assets could be massive.

Institutional investors such as pensions and allocations have long exploited investment capital and alternative markets. However, the average American saving has been excluded so far.

This decision reflects Trump’s wider Pro-Crypto program in 2025. The potential order shouldAbrog itWarning of Crypto from the Biden era for 401 (k) s.

Notwithstanding, allowing the crypto in retirement accounts will not be without challenges. Legal experts warn that 401 (k) Planning administrators could face proceedings related to high volatility and cryptography or other non -liquid asset costs.

Evaluation difficulties, childcare risks, limited understanding of participants and continuous changes in regulatory monitoring remain a concern. Based on this, fiduciary responsibilities remain a central problem.

“At this early stage of the history of cryptocurrencies, the ministry has serious concerns concerning the prudence of the decision of a trustee to exhibit participants of a plan 401 (K) to direct investments in cryptocurrencies or other products whose value is linked to cryptocurrencies,” noted the ministry.

The role of Bitcoin develops in American finance

However, supporters argue that the modern financial system has evolved. Public markets have decreased considerably since the 1990s, while investment capital has more than doubled during the decade ending in 2023.

As financial innovation accelerates, Trump’s order can unlock new diversification options for daily investors. For crypto, this decision could inject fresh liquidity on the market, this optimism already feeding Bitcoin recovery.

Beyond access 401 (K), Bitcoin makes silent but significant progress in another cornerstone of American finance, the housing market.

Beincrypto has reported a pilot initiative to provide mortgages supported by Bitcoin thanks to new credit ease to American housing.

This approach allows Crypto holders to use BTC as a guarantee to access real estate loans, to potentially fill decentralized finance (DEFI) with traditional credit markets.

However, it is not a clean scan. Bitcoin mortgage recognition is accompanied by attached regulatory channels, including strict loan / value ratios, collateral liquidity controls and increased risk disclosure.

American regulators also be wary of volatility and counterpart risk in crypto-collateralized home loans, even if they carefully have green light innovation.

The Bitcoin position approaches $ 117,000 before Trump’s plan to open the 401 (K) of S to crypto appeared first on Beincrypto.