Bullish Market Signs Point to a Surge

Bitcoin (BTC) has signs of a potential optimistic trend in May, driven by key indicators. Experts have highlighted factors such as the economy of minors, the network hashrate, the accumulation of long -term holders and the increase in world liquidity of the Fiat, which suggests that an increase in prices could be on the horizon.

This occurs while the largest cryptocurrency continues its recovery rally at the start of April levels, up 14.6% in last month.

Does a Bitcoin Bull Run come back?

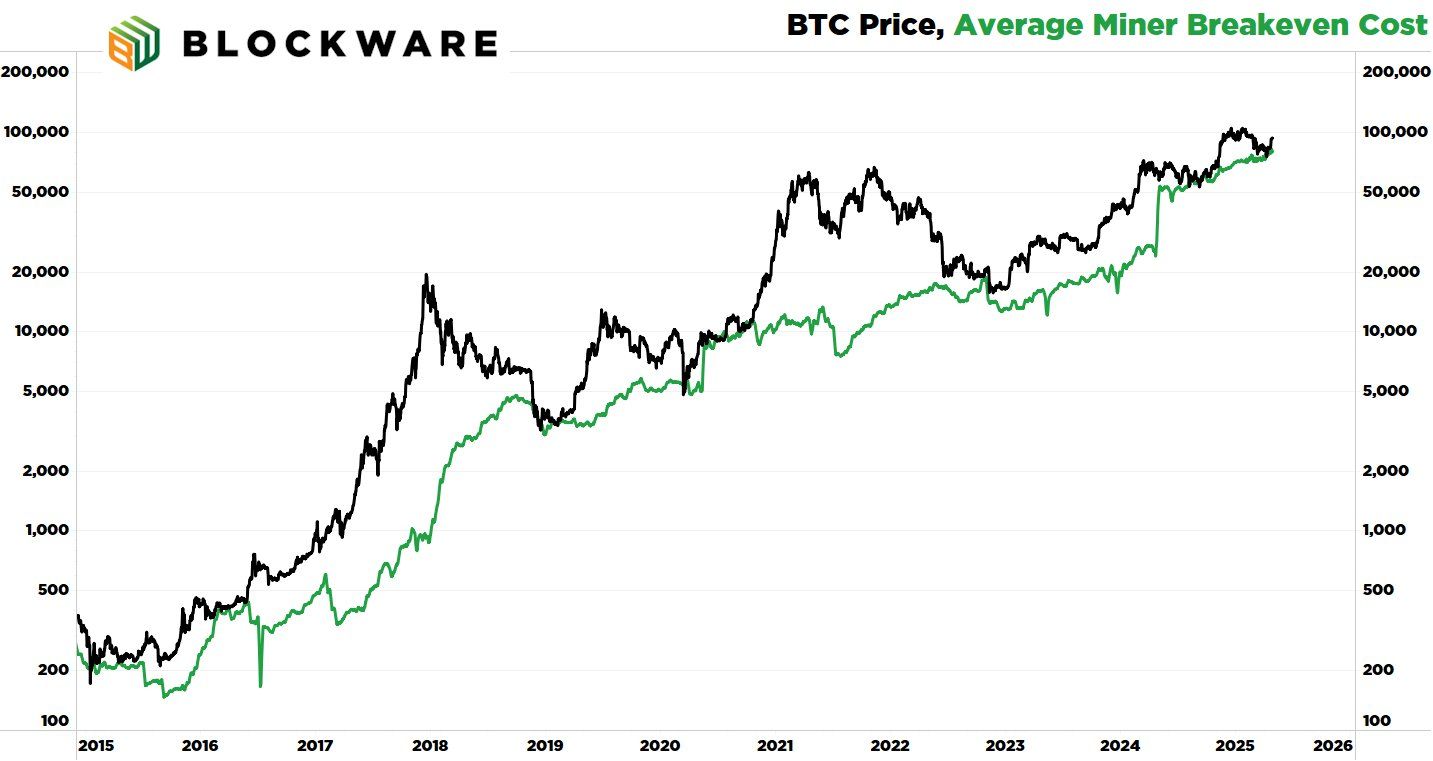

In the latest article of X (formerly Twitter), the analyst and the founder of the Wim media, Robert Breedlove, referred to data on the cost of the blockware team of the blocking team to predict that Bitcoin could be at the dawn of a bull market.

He noted that the price generally does not remain lower than this average for prolonged periods, because it represents the threshold at which minors can cease operations if they are not profitable.

“In a rational economy, assets are rarely negotiated below their production cost,” said Breedlove.

He pointed out that the index precisely identified six stockings between 2016 and 2024. In particular, it signals another background, which suggests that an increase in Bitcoin prices could be imminent.

Macromicro data also support this. At the time of writing the editorial staff, the 30 -day mobile average (MA) of the price ratio of the Cost of Mines to the BTC was 1.05.

This indicated that minors operated at a loss on average in the last month. Therefore, this could potentially lead to an upward price movement because minors operating on a loss scale, tightening the offer.

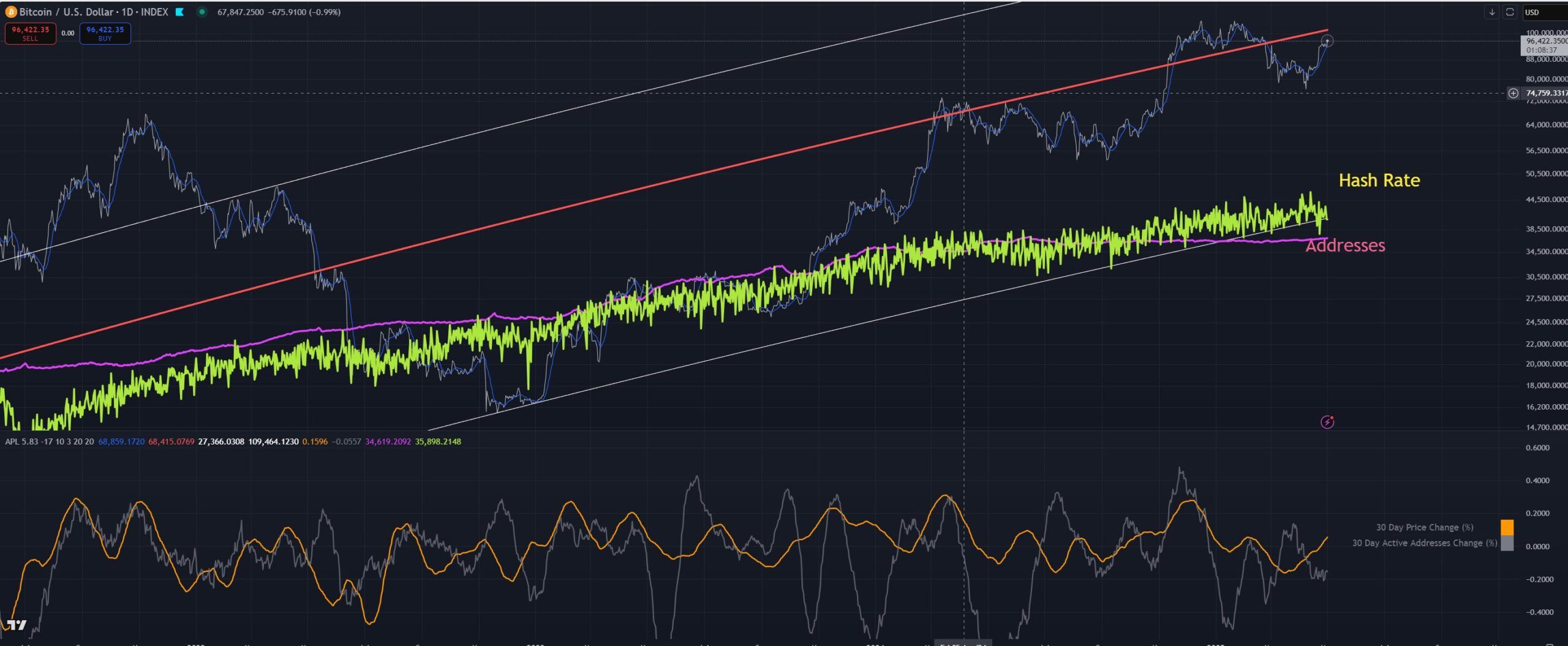

The price model of bitcoin hash rates, which assesses the Bitcoin value based on history The relationship between its price and its hash rate, adds to the upward prospects.

Analyst Giovanni commented X that the model is currently at a Bitcoin support level.

“The fact that the BTC assessment based on the hash rate is in terms of support means that we have probably reached a kind of local background,” said the analyst.

Additional market signals strengthen the case of a potential rally. Breedlove stressed that long -term holders have accumulated around 150,000 BTC in the last 30 days. This suggested a reduced sales pressure in the range of $ 80,000 to $ 100,000.

As fewer people are ready to sell bitcoin at these levels, the price could face up the upward pressure as demand remains strong, but the supply of Bitcoin available decreases.

“Basically, the price of bitcoin is simply a function of supply and demand. After an increase in the price of bitcoin, you start to see previously inactive parts move to the head. Conversely, after prolonged periods of lateral or the action of negative prices, long-term holders they begin.

In addition, the increase in world Fiat liquidity widens the capital of capital available to invest in Bitcoin. This is still reinforced by the funds negotiated on the stock market (ETF), Bitcoin cash companies and convertible obligations.

These financial vehicles provide easier access to new liquidity to enter the Bitcoin market, filling the gap between traditional finance and cryptocurrency.

“And it is not only the liquidity of the USD that increases – the liquidity of all fiduciary currencies is increasing, and Bitcoin is a global asset,” said Breedlove.

Recently, Beincrypto also highlighted some bull factors for the BTC. The apparent demand for the part has become positive, which implies an increase in interest or purchase activity for Bitcoin.

In addition, the market value ratio of the market (MVRV) rebounded from the historically significant average of 1.74. This movement previously proved to be a reliable indicator of the first stages of a bull market for bitcoin.

In the midst of these bullish signs, the BTC prices performance was quite remarkable. After briefly dropped below the 75,000 mark in early April, the price continued to recover.

During last week, BTC saw an increase of 4.3%. At the time of the press, the Bitcoin negotiation price amounted to $ 97,048, which represents daily gains of 2.3%.

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.