Bitcoin Price Consolidates Around $103,000-Here’s What May Happen if it Rises & Secures above $105,000

Cryptographic markets are currently motionless because most tokens, including bitcoin, consolidate in a narrow beach. After the last resumption, the slow behavior in progress can be considered as an accumulation of bullish force, which could trigger a strong increase below. Consolidation generally breaks once the BTC price decreases above the local resistance which has triggered a rejection in the nearby past.

The range of $ 105,800 has launched a withdrawal in recent days. Does this suggest that the rupture of these levels can push the price directly to a new ATH, or another consolidation follows just below the summits?

Many things have been developed in the past two years, in particular after the inclusion of institutions in cryptographic space. Some of the data suggest low interest and a commercial activity of retail traders, while institutions have taken over the cryptography market. Large companies like Strategy and Blackrock have more than 500,000 BTCs with them, which could strongly have an impact on the BTC price rally. Meanwhile, the price seems to have found local resistance at $ 105,000 and the rupture of this can liquidate millions of shorts.

- Read also:

- Is altcoins consolidate in a narrow beach-was the Alts-season postponed to the third quarter or the fourth quarter of 2025?

- ,,

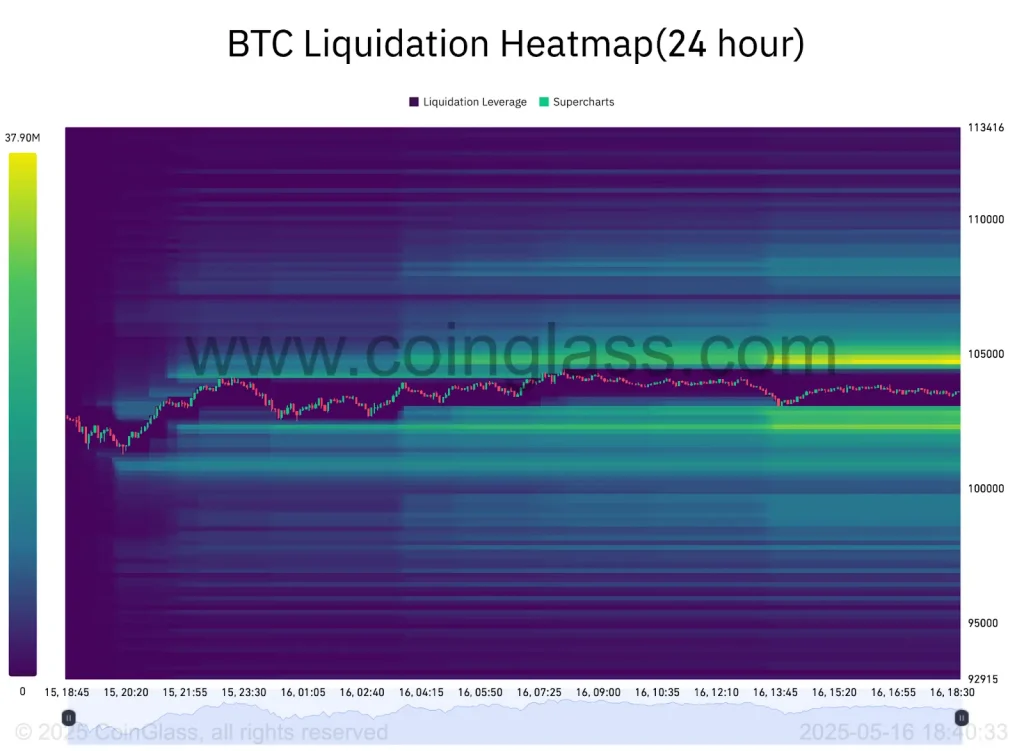

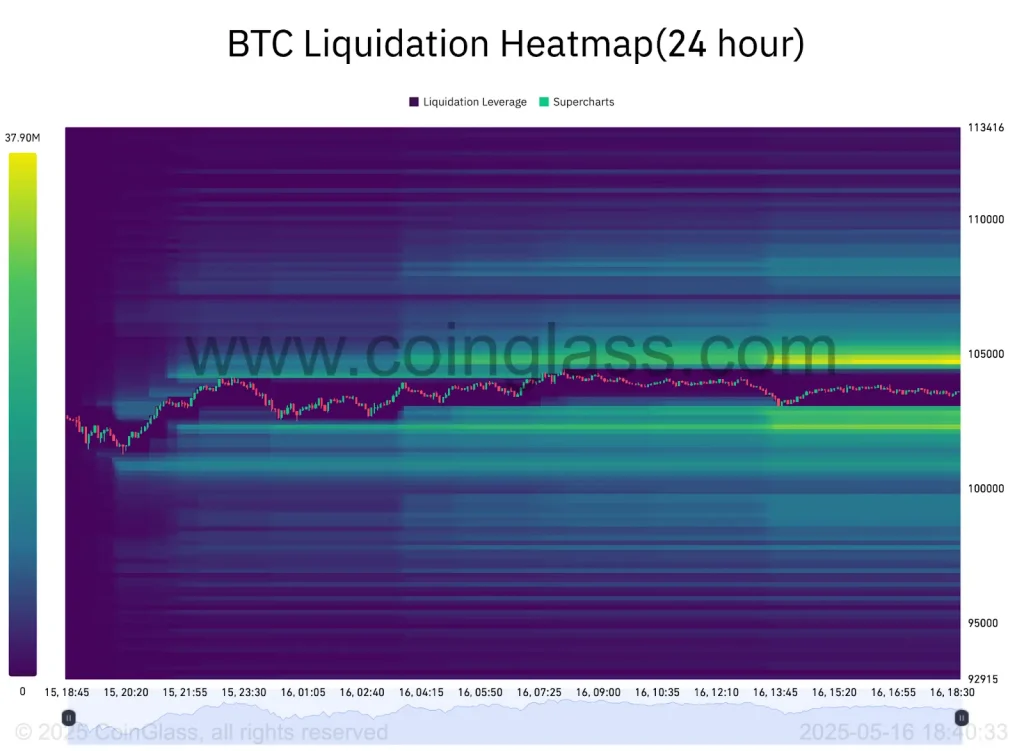

Nearly $ 100 million in shorts have been accumulated between $ 104,700 and $ 104,900, in accordance with Coringlass data. The shorts have started to accumulate nearly $ 105,000, and the rupture of these levels is extremely crucial for the Bitcoin price rally. On the contrary, some of the longs are also accumulated below $ 102,500 and, therefore, the rupture of these levels can push the price lower while maintaining the psychological barrier of $ 100,000.

Given the current commercial configuration, the price of the BTC is consolidated in a linked beach while constantly trying to break the beach. The short -term lowering flag has been removed, which makes a lower low -cost movement. However, the indicators failed to drop completely down, and the bulls prevented it each time. Consequently, the coming weekend could have a huge impact, as an increase of $ 104,000 could easily raise the levels above $ 105,000, while a failure could trigger a lower action nearly $ 100,000.

Never miss a beat in the world of cryptography!

Stay in advance with the news, expert analysis and real -time updates on the latest Bitcoin, Altcoins, DEFI, NFTS, etc. trends

Faq

Yes, institutional actors like Blackrock hold more than 500,000 BTCs, dominating the influence of the market on retail traders.

According to the BTC price forecasting of Coinpedia, the Bitcoin price could peak at $ 168,000 this year if the haus feeling suffered.

If BTC falls below $ 102.5,000, it could test the support of $ 100,000 because the long positions below can start to relax.