Bitcoin Price Faces Short Term Drop, Demand Declines

Bitcoin experienced a sustained decrease trend despite the maintenance of a wider macro-bullin perspective. While long -term projections remain positive, short -term weakness suggests that the BTC can continue to cope with the sales pressure.

The behavior of investors has not been particularly favorable, contributing to a new uncertainty on the market.

Bitcoin needs investor support

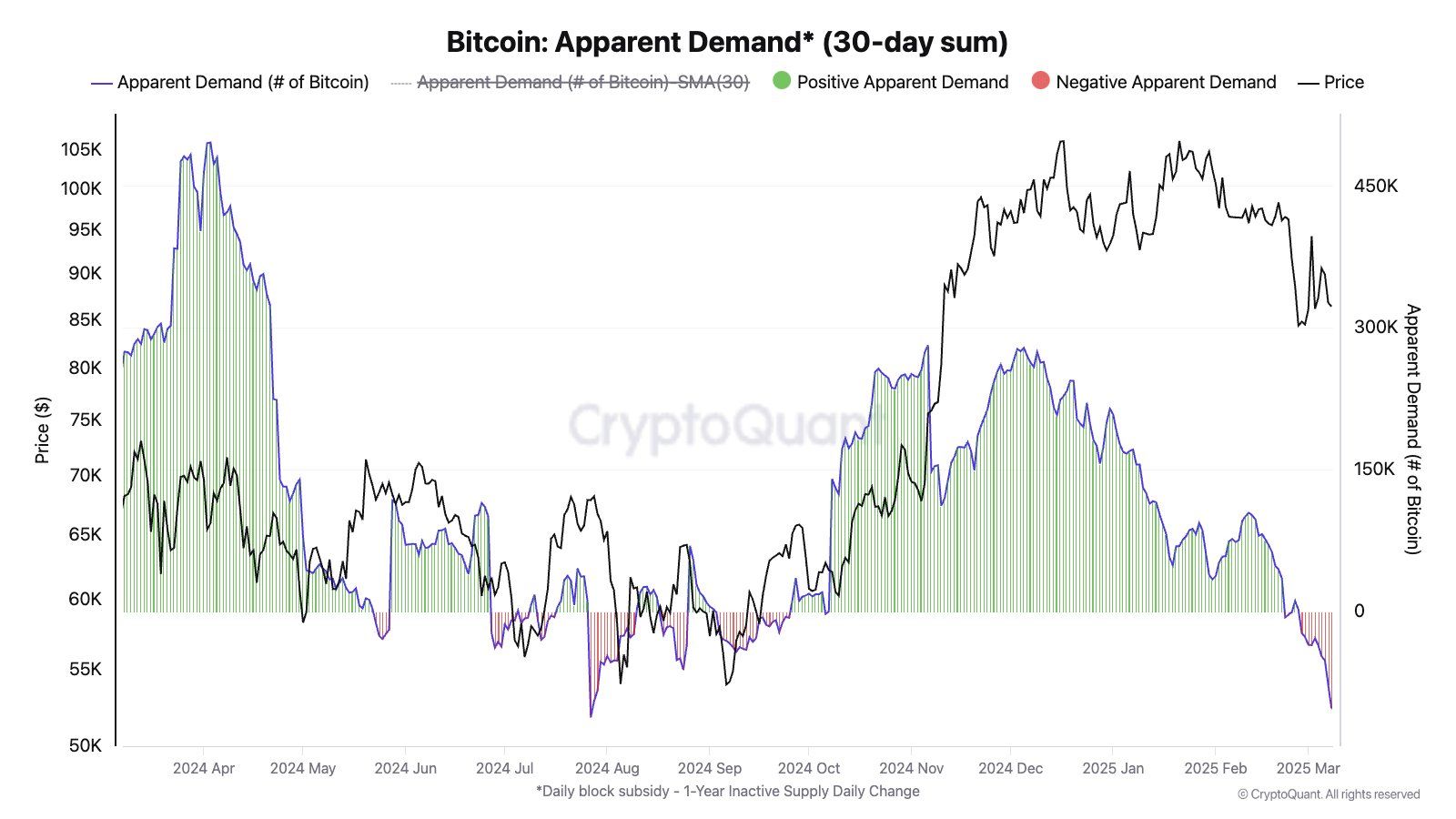

The apparent demand for Bitcoin has taken an important blow, the punctual request contracting strongly in recent days. This contraction marks the most substantial decline since July 2024 and the first body in more than four months. The decline indicates the increase in skepticism among investors, resulting in a reduction in purchase interests and an increase in the short -term lower pressure.

A request for narrowing suggests that market players hesitate to occupy new positions. If the request is not recovered soon, Bitcoin could find it difficult to maintain its current price levels, increasing the risk of additional samples.

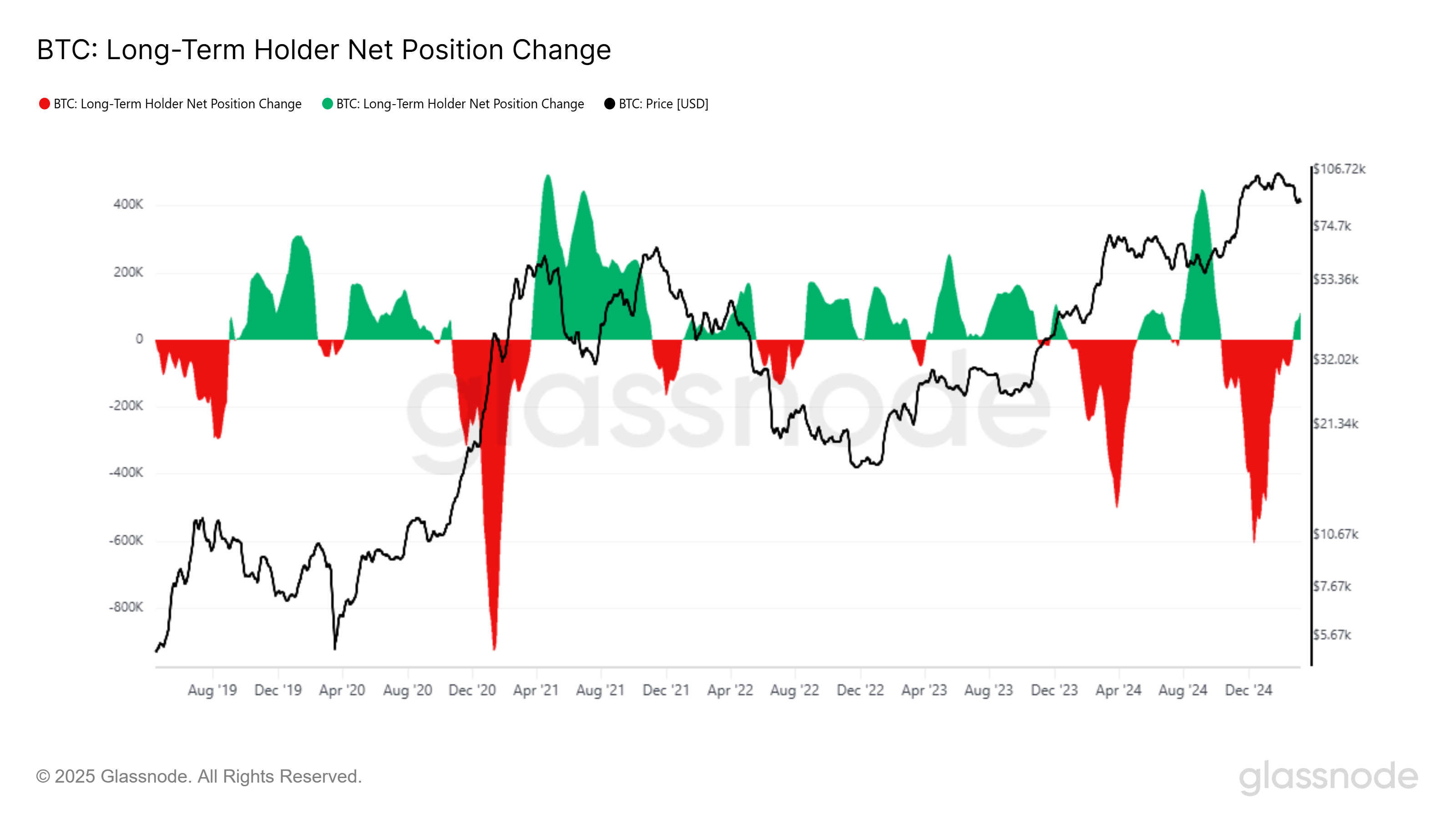

Long -term holders (LTH) have moved to the occurrence of accumulation, as shown by the metric of the Net position change of LTH. Over the past 30 days, these investors have accumulated more than 107,413 BTC. Historically, LTH accumulation signals long -term confidence, but in the short term, it has often preceded periods of low price.

LTH tends to accumulate at lower prices and start to distribute during bull races. This model suggests that Bitcoin could always face a drawback before the start of significant recovery. Although long -term accumulation is positive, the immediate impact could be additional short -term volatility and potential prices corrections.

The BTC price could drop more

The Bitcoin price, currently at $ 82,305, moves in a widen descending corner. Although this model is historically optimistic on a macro scale, in the short term, it indicates a higher probability of continuous decline. BTC may need to test lower support levels before confirming a reversal.

Given market conditions, short -term price forecast is that Bitcoin could lose the level of crucial support of $ 80,000 and fall to test $ 76,741. If wider macroeconomic factors worsen, the decline could extend more, potentially reaching $ 72,000. Such a scenario would express an additional lower pressure on the cryptography market.

However, a change in the feeling of investors could change this trajectory. If the accumulation increases in psychological support of $ 80,000, Bitcoin can resume the bullish momentum. An overtaking of $ 82,761 would open the way to BTC to exceed $ 85,000, finally reaching $ 87,041. Such a development would invalidate the lowering perspectives and pointed out the renewed market force.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.