Bitcoin Price Forms New High As Whales Offset $5.7 Billion Dump

Bitcoin has reached a new record of all time (ATH) in the last 24 hours, almost crossing the barrier of $ 112,000.

This increase follows a positive trend since the beginning of the month, reinforced by whales which have maintained their positions despite a substantial sales activity of other groups of investors.

Bitcoin holders sell, whales hold

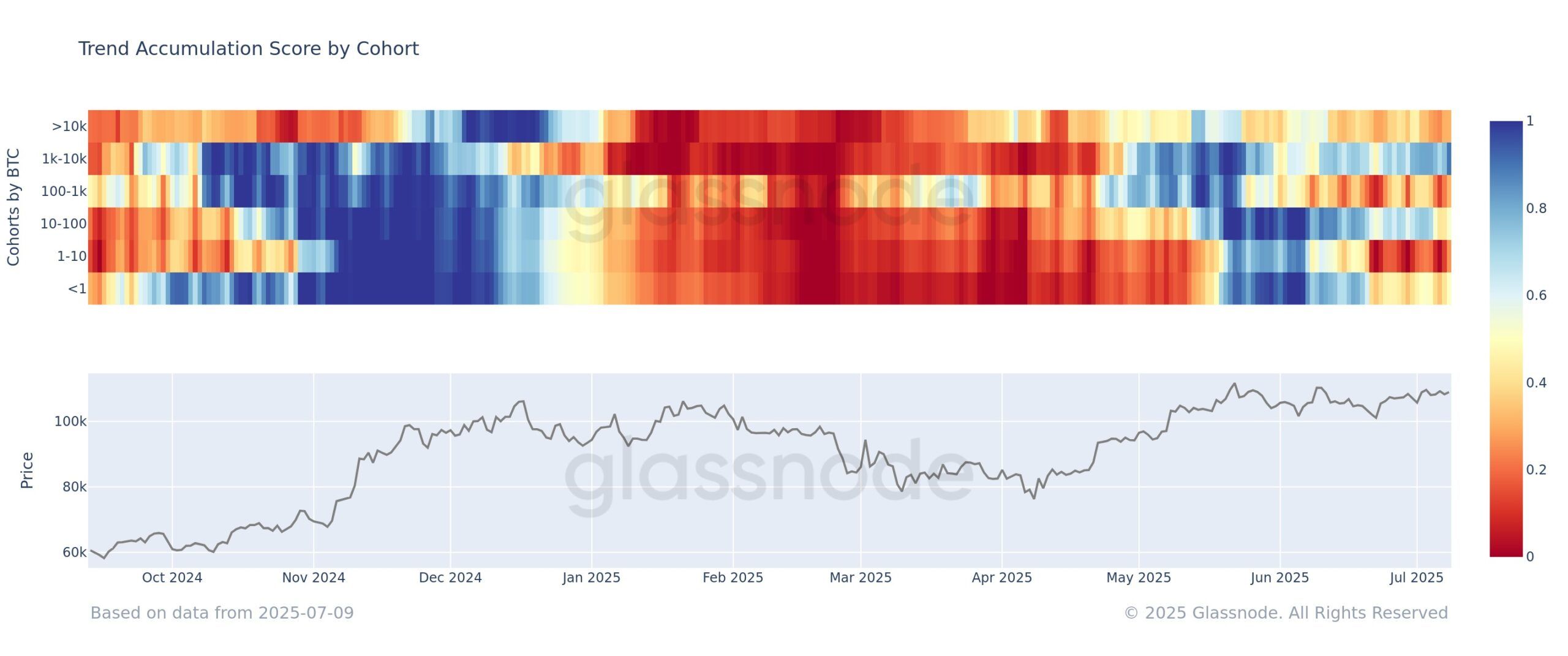

The current feeling of the market reveals that different cohorts of Bitcoin holders are in distribution mode. The retail holders, in particular those with 1 to 10 BTC, have sold, contributing to the increase in the offer on the market. This behavior has led to a certain price volatility.

However, the notable exception was entities holding between 1,000 and 10,000 BTC. These whales are in accumulation mode, a behavior that contrasts strongly with the wider sales trend. Their approach is methodical and non -emotional, guaranteeing the stability of the price of bitcoin despite the sales of retail holders.

Whales have long been the stabilization force of the Bitcoin market. Unlike small holders who react to short -term fluctuations, big Bitcoin holders generally follow a long -term strategic perspective.

Their resilience was essential to support the value of Bitcoin, in particular in times when retail sellers drive price reductions. Consequently, whales have helped prevent a significant drop in price, offering a stable base for the recent increase.

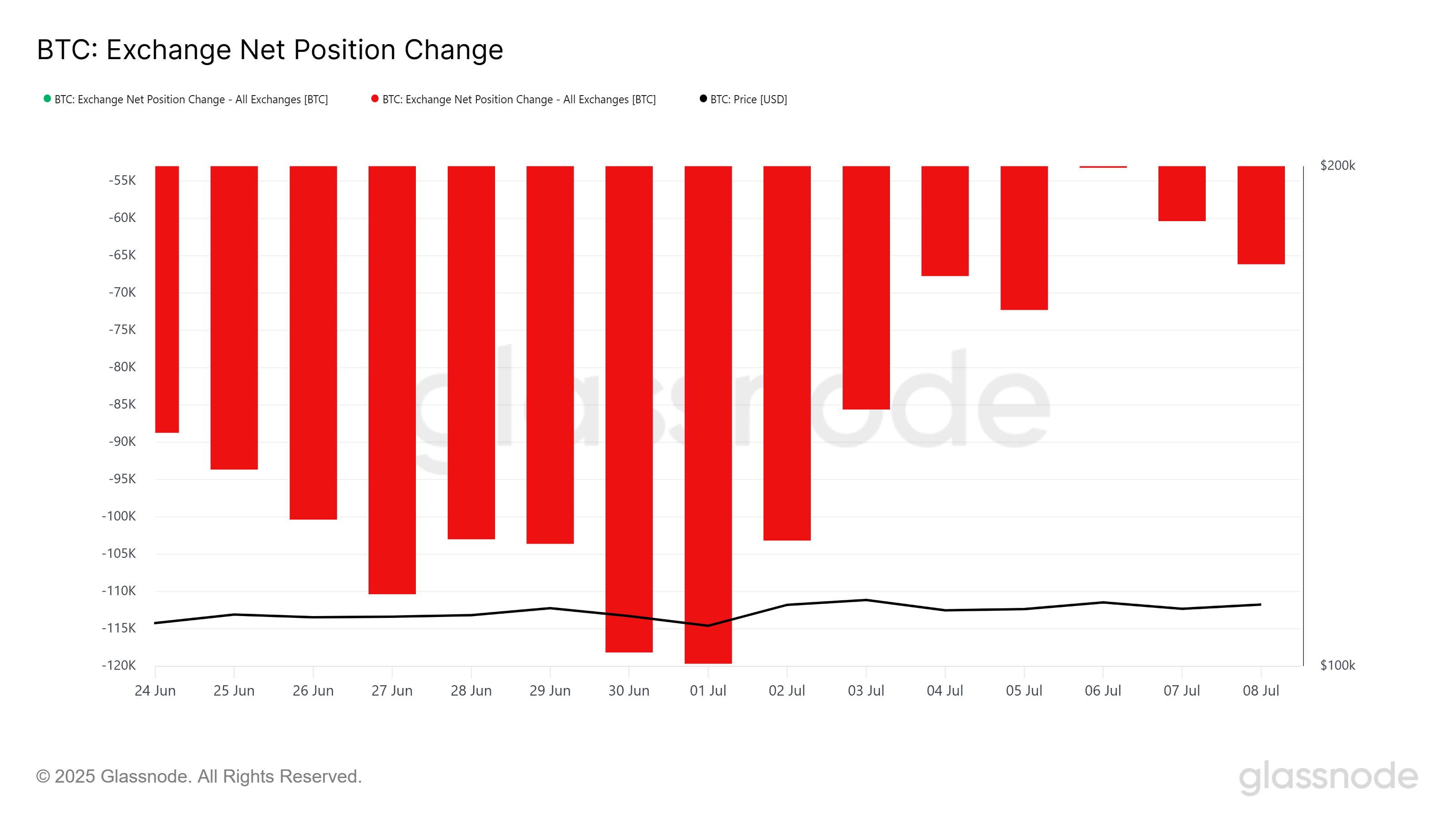

This is also visible in the change in the net position of exchanges, which tends to influence the macro momentum behind bitcoin. Since the beginning of July, more than 52,048 BTCs, worth around 5.7 billion dollars, have been sold to trade.

This high sales pressure would generally lower the price, but the impact was offset by the whales that have kept a strong grip on their Bitcoin positions. The net effect of these actions allowed Bitcoin to maintain its ascending trajectory, the bullish feeling being restored.

The BTC price forms a new top

The Bitcoin Prize recently formed a new ATH, reaching almost $ 112,000. This marks the first ATH in more than a month and a half and has invigorated the confidence of investors. The latest price movement indicates that the upward trend is alive, much expecting continuous gains while Bitcoin strengthens support for higher levels.

At the time of writing this document, Bitcoin is negotiated at $ 111,183, aimed at securing $ 110,000 as a critical support floor. If BTC can maintain this level and maintain the momentum towards the increase, it may have another chance of raping $ 112,000 and creating a new ATH. This could be the catalyst for an additional price assessment, with high demand that should advance the market.

However, if investors start to sell strongly, even whales may not be able to counter the sale pressure. If Bitcoin falls below $ 110,000, it could return to $ 108,000 or less. A sustained drop beyond this level would invalidate the current upward thesis.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.