What Next for Bitcoin Price?

- The price of gold is less than 2% compared to its top of all time in the middle of volatile geopolitical tensions.

- Chain data show that the Bitcoin network has experienced a renewed demand from institutional investors.

The price of gold (XAU) has won almost 3% in the last 24 hours to negotiate at around $ 3,424 per Tuesday, May 6, during the American session in the middle of the North. The high -level precious metal extended its earnings on Tuesday while India launched a military offensive attack against Pakistan following a recent terrorist attack.

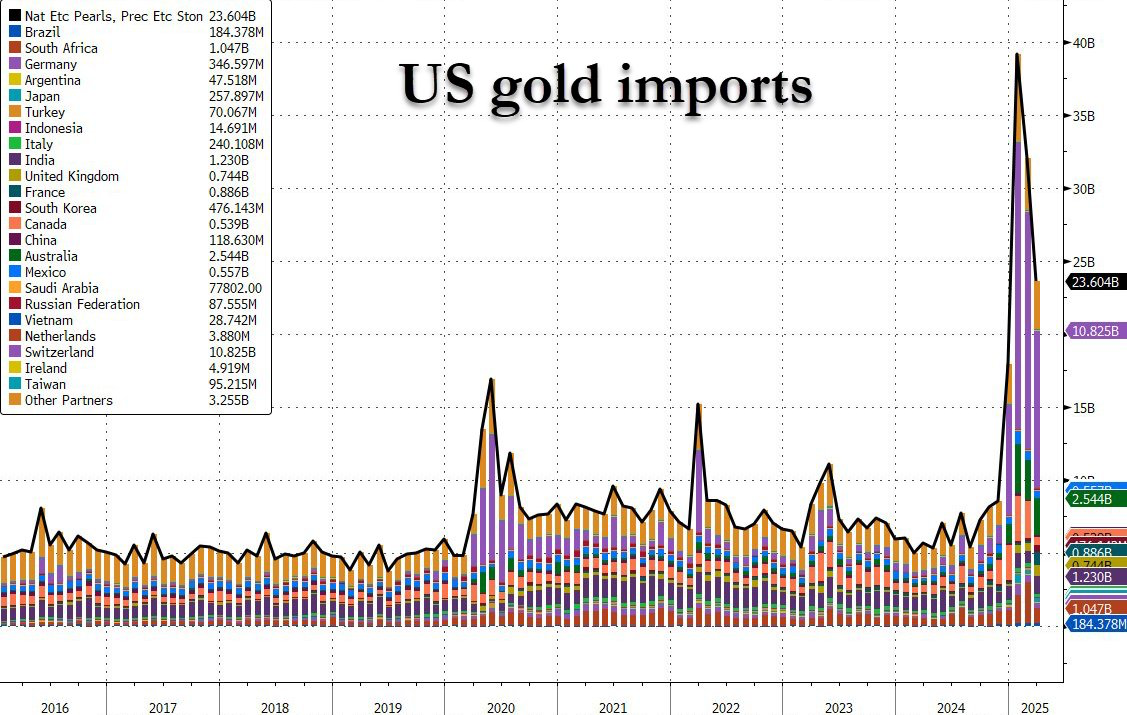

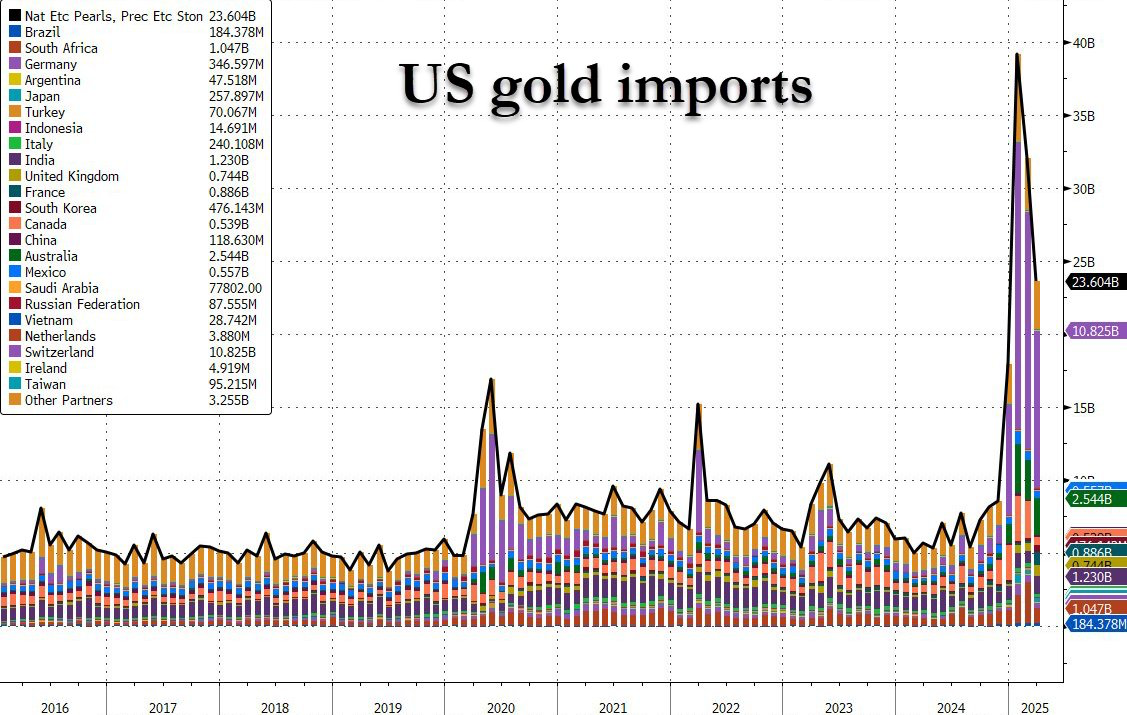

The demand for gold by the world central banks continued to increase as the US dollar has weakened compared to the main currencies led by the book, the Japanese yen and the EUR. In addition, the current world trade negotiations have had an impact on the stock markets, led by American shares.

Parabolic rally of gold eyes

From the point of view of technical analysis, the price of gold is about to experience a parabolic rally potentially similar to the 1979 rally. If global gold demand continues in the coming months, precious metal will probably collect beyond $ 4,000 per Oz before 2025z

Expected impact on the price of bitcoin

The notable rally for Bitcoin bulls at golden prices, while the flagship piece jumped by almost 1% to exchange at around $ 94.6,000 at the time of writing the present. Before the rate of Federal Funds on Wednesday and the FOMC Declaration, Bitcoin Price experienced increased volatility.

In the end, the rotation of the cash from gold to Bitcoin by institutional investors will catalyze the highly anticipated parabolic rally for BTC and the wider cryptography market in the near future. In addition, institutional investors – led by the strategy, and BlackRock – have tirelessly accumulated bitcoin in a recent past.

In addition, Bitcoin Futures Open Interest (OI) has gradually increased in recent weeks to reach around $ 63 billion when writing this article.