Bitcoin Price in Danger Zone! What Happens If Whales Sell?

The Bitcoin USD price has almost doubled since US President Donald Trump returned to office, reaching a summit of $ 123,231. However, the recent transfer in consolidation has triggered investors’ concerns, and experts are in a war tug between upward and hinged opinions, creating an uncertain atmosphere for its price action.

Altcoins showing the points sold create chaos for the upper crypto, because many raise doubts that the current rally can approach exhaustion and a fall could be on the horizon. While others recommend it as a healthy stop.

Bitcoin price USD shows signs of exhaustion nearly $ 123,000

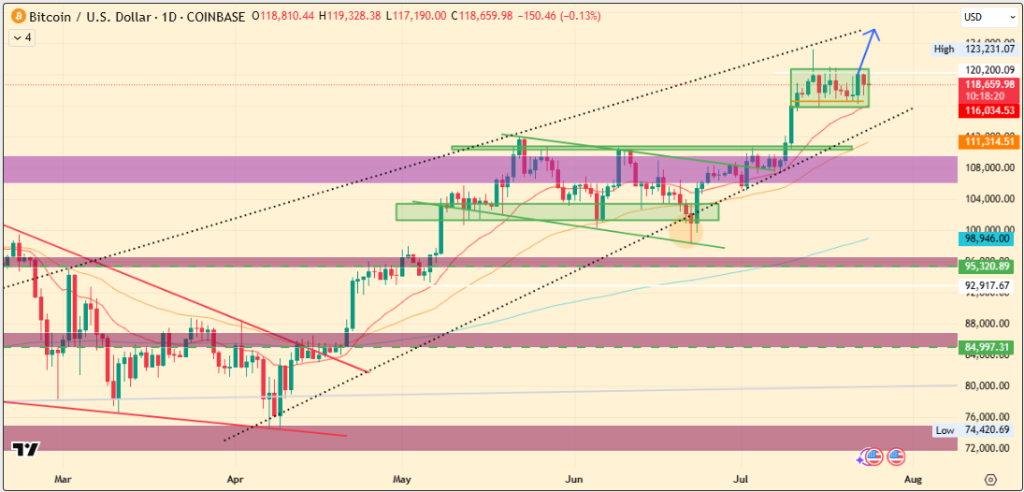

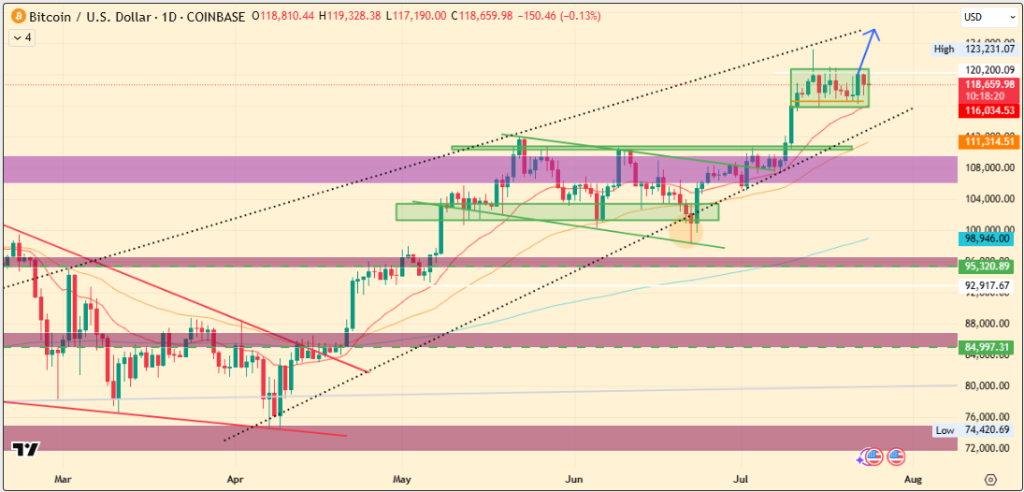

After a solid rally in the first half of the year, the Bitcoin Prize managed to mark its latest peak at $ 123,231. This level was a new record of all time, pushing the bullish feeling to new heights. However, in recent days, the rally has stopped and the price of Bitcoin USD has increased to a phase of lateral consolidation.

During the writing, the price of Bitcoin exchanges today at $ 118,681 with a volume of 24 hours of $ 73.62 billion. Overall, it remains in a broader trend on the daily Bitcoin USD graphic.

However, market observers are becoming cautious, in particular due to the training of the upper corner sole in the action of prices of several months, which increases sweat. This scheme is generally associated with the exhaustion of trends and increases the possibility of a reversal, especially if the sale of pressure is built.

Flag of

Despite the concerns, some technical analysts believe that the current behavior of the BTC prices can be a temporary break rather than a garnish training.

Before this consolidation, the price of Bitcoin USD had broken out of an upper flag model and its upward potential target should be between $ 130,000 and $ 135,000.

In addition, after the brief retirement of $ 123,231, the USD BTC prices now seems to form a smaller fan, which is a model of continuation which often emerges in mid-M-Mellye.

The escape of this pennant has already occurred, and Bitcoin seems to retest the liquidity around the zone from $ 118,000 to $ 120,000, suggesting a possible preparation for a renewed upward movement.

Retail outlet, whale entry: change of supply could lead to a next step

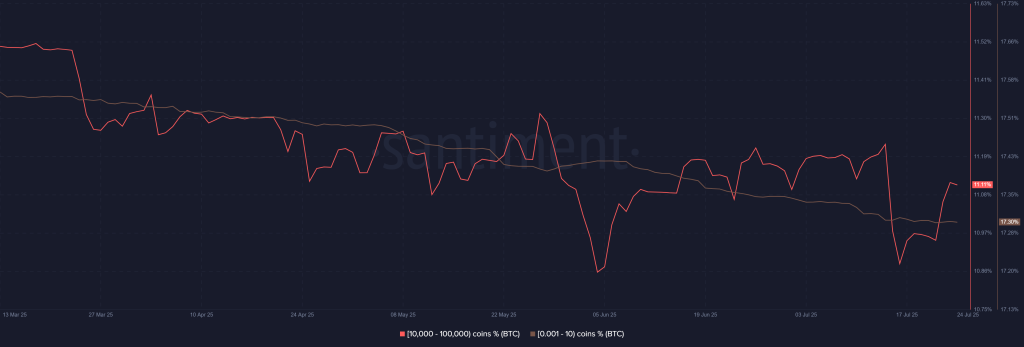

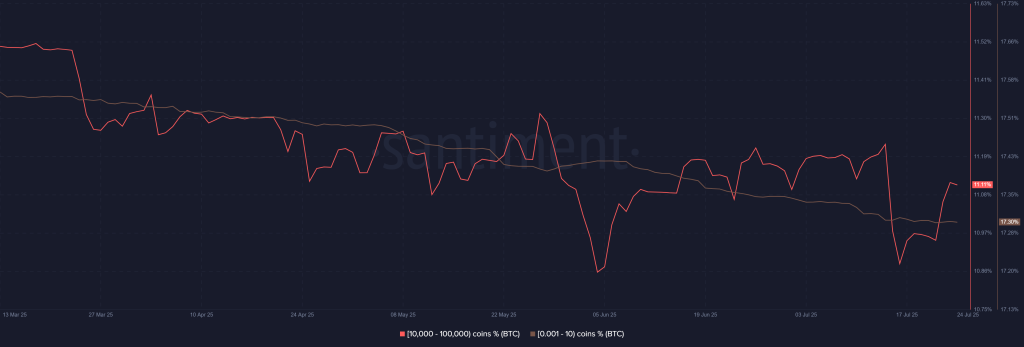

Beyond technical models, chain data is another factor that adds optimism to analysis. The data reveal that the portfolios holding between “0.001 and 10 BTC” (largely considered as retail investors) showed a constant drop in activity. This reflects a continuous trend in taking advantage and fear that consolidation can mark a market summit.

On the other hand, the whale wallets holding “10,000 to 100,000 BTC” increased their assets during this decline. This accumulation trend among major players suggests that institutional trust remains intact and that the price of USD bitcoin could still make another attempt at new heights.

Such a change of property of the retail trade offer to whale wallets indicates the continuation of the upward BTC price.

The risk of Christmas is looming if the feeling of whales changes

However, there remains a key risk that could threaten these perspectives. If the current consolidation triggers not only retail, but also encourages whales to unload their assets to secure profits, downward pressure could intensify.

In such a case, the price of Bitcoin could bring below $ 100,000, potentially extending the correction to the Christmas season.