Bitcoin Price Nears $110,000 on Long Term Holder Maturity

Bitcoin has experienced an indecisive price of price action, leaving uncertain investors of the market management.

Despite this stagnation, the historical trends in the behavior of investors suggest that a gathering could still be on the horizon, defying expectations according to the price.

Long -term holders keep Bitcoin at Earth

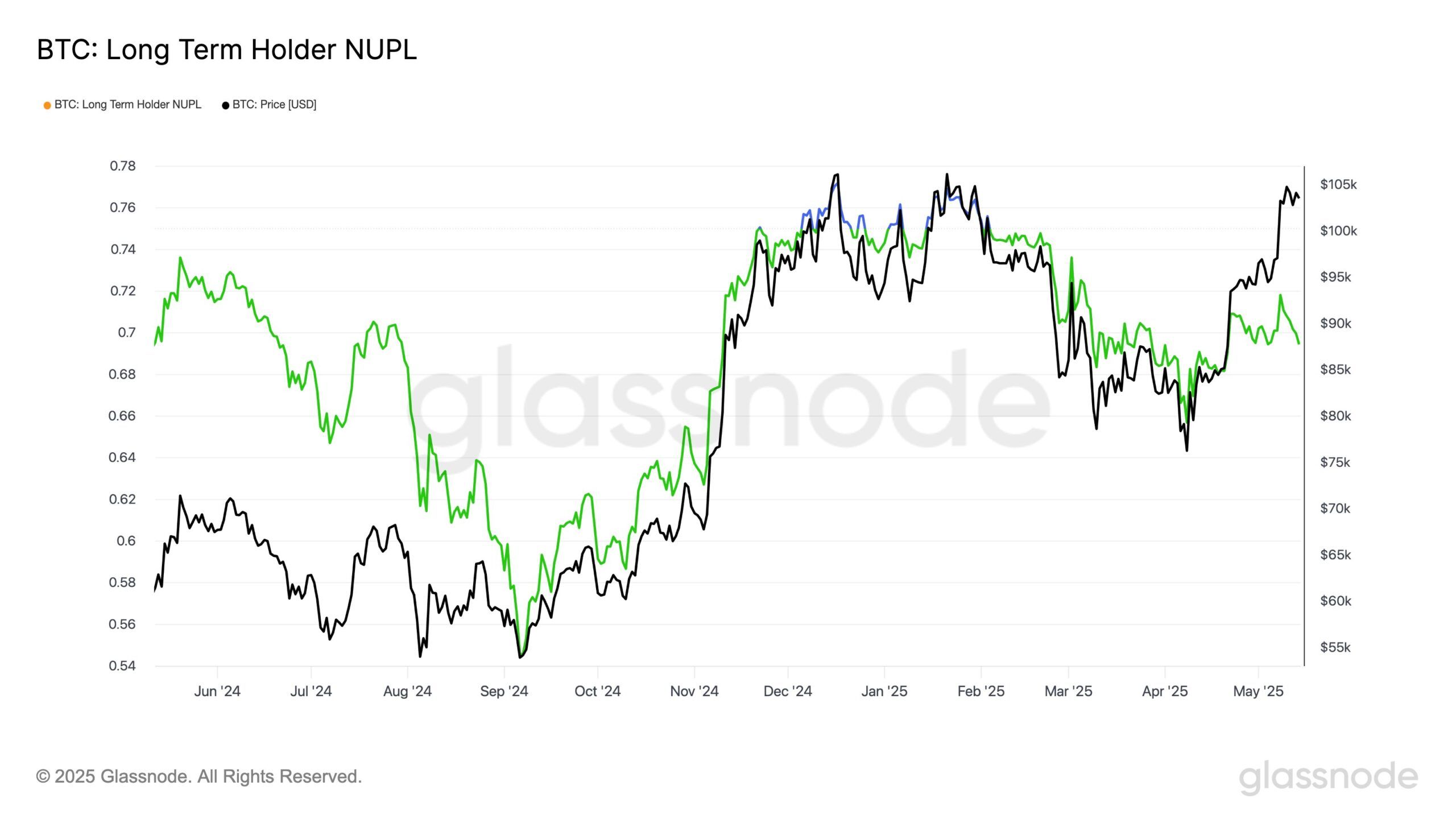

The long -term holder (LTH) net of profit / unpaid loss (NUPL) indicates that investors who bought Bitcoin in December 2024 ripen in LTHS, which requires a period of detention of 155 days. This is positive for Bitcoin, because buyers often ripen longer, reducing impulsive sales pressure.

When more investors become LTH, the parts tend to stay in strong hands, which strengthens resilience against price reductions. This behavior could support the stability of bitcoin prices and potentially generate gains as the market ripens and that short -term volatility decreases.

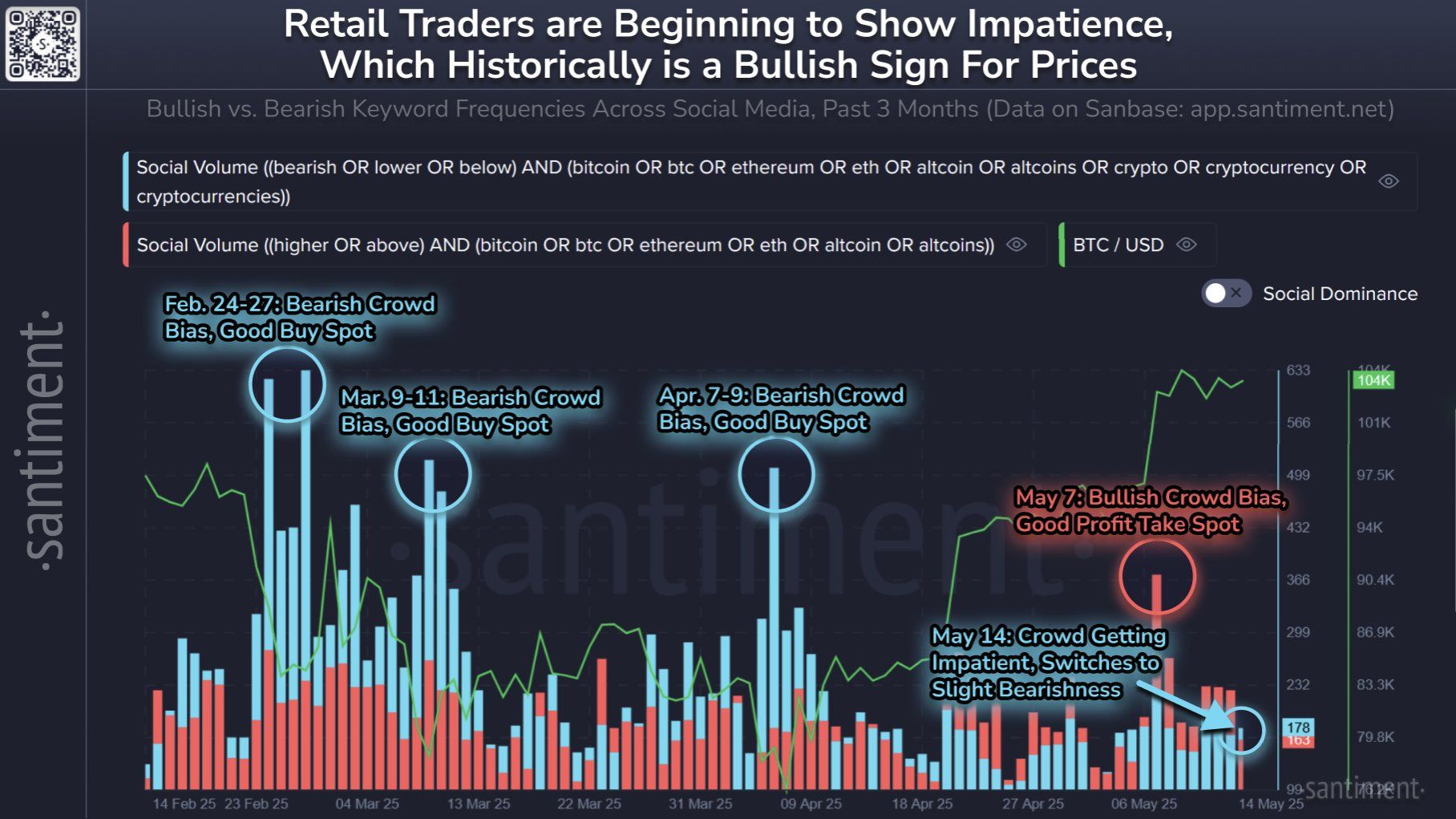

The feeling of Bitcoin investors often evolves contrary to market performance. Historical data show that the feeling of a bearish crowd generally signals an opportunity to purchase, while excess bulletin precedes sales. In the last 48 hours, the feeling has again moved to the fall in the scholarship.

This increased fear among retail investors could prepare the ground for an increase in the market, as traders are looking for value during the decreases. The growing apprehension contrasts with the fundamentals of positive prices, suggesting a potential escape fueled by a renewal of purchasing interests in the middle of prudence.

BTC Price must exceed a key barrier

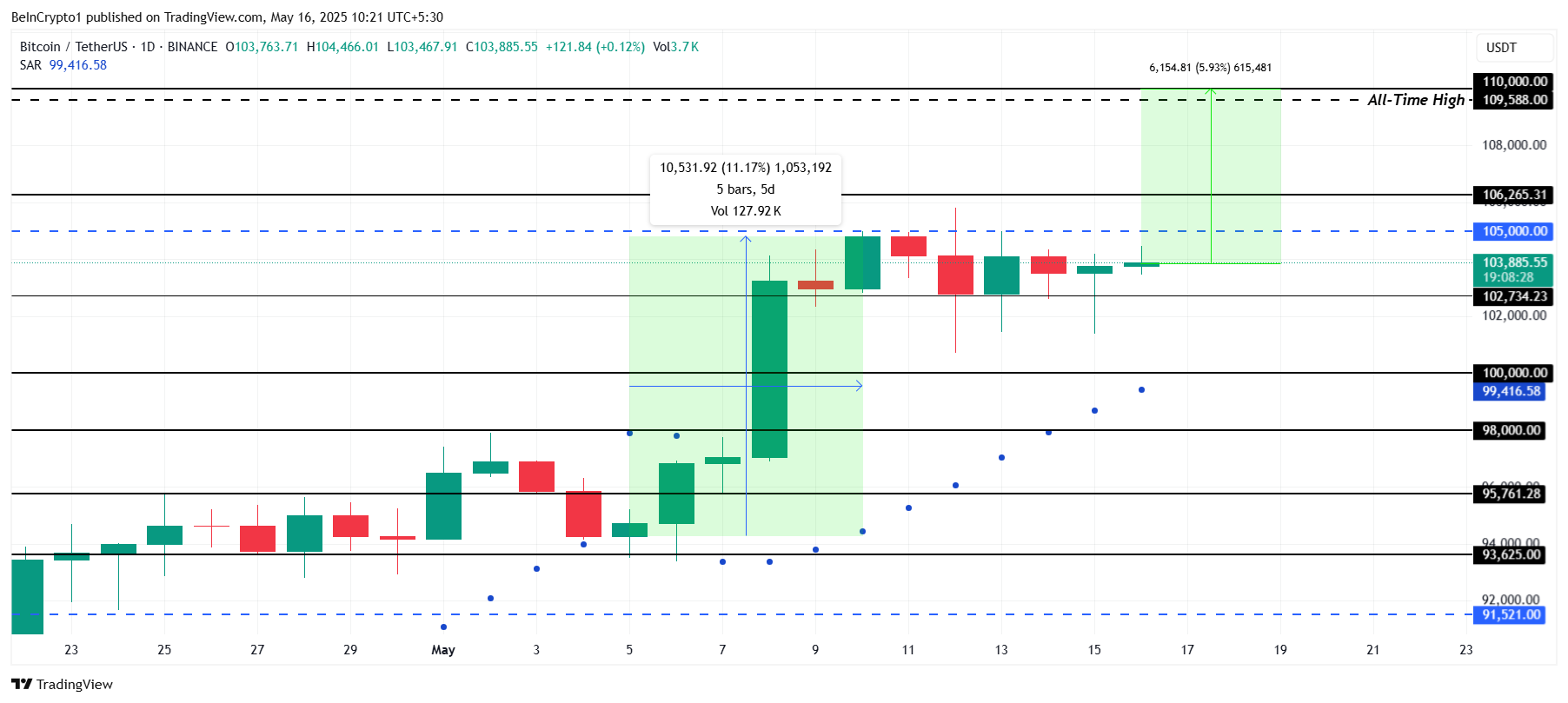

Bitcoin is currently negotiated at $ 103,885, moving laterally in a range between $ 105,000 and $ 102,734. To reach $ 110,000, Bitcoin must rally almost 6%, which is achievable with recent momentum.

Last week, Bitcoin jumped 11% in just five days, showing great potential for movement up. Key resistance after $ 105,000 is $ 106,265. The successful reversal of this level would probably confirm a push around $ 110,000 and perhaps a new summit of all time.

However, if Bitcoin continues to consolidate laterally, impatient investors could sell to avoid losses. This sales pressure could lead to the price of less than $ 102,734, potentially drop to $ 100,000 and invalidate the upward prospects for the moment.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.