Bitcoin Price Poised to Reach $95,700, Fueled by Extreme Greed

Bitcoin recently experienced a notable rally, pulling the price above $ 90,000 after more than five weeks of stagnation. Bitcoin is currently negotiating nearly $ 94,401, just less critical resistance of $ 95,761.

This suggests that Bitcoin is not yet at its point of saturation, with a more ascending dynamic possible if the key barriers are raped.

Bitcoin investors are greedy

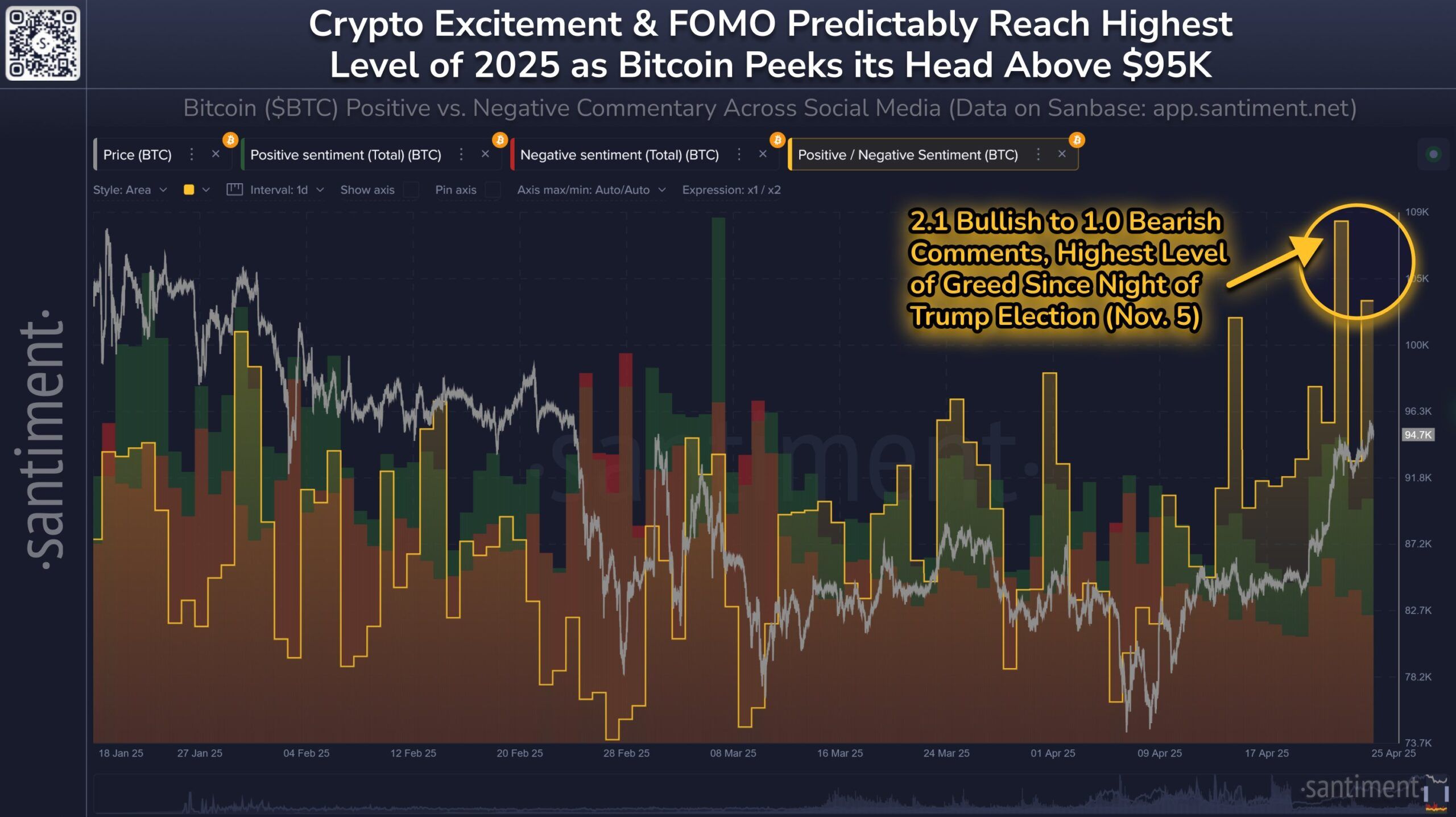

The feeling of the market surrounding Bitcoin remains extremely positive, investors showing high levels of optimism for new price gains. Publications on social networks indicate a strong increase in bullish feeling, with the number of optimistic positions (against lowering) reaching unprecedented levels since the dawn of the Donald Trump elections on November 5, 2024. This increase in positivity suggests that many investors are ready to capitalize on the potential Bitcoin growth, further fueling its rally.

However, the extreme level of greed on the market raises questions about the sustainability of this ascending movement. While the feeling of investors becomes more and more optimistic, there is a risk that it can lead to a local summit if too many traders become too greedy.

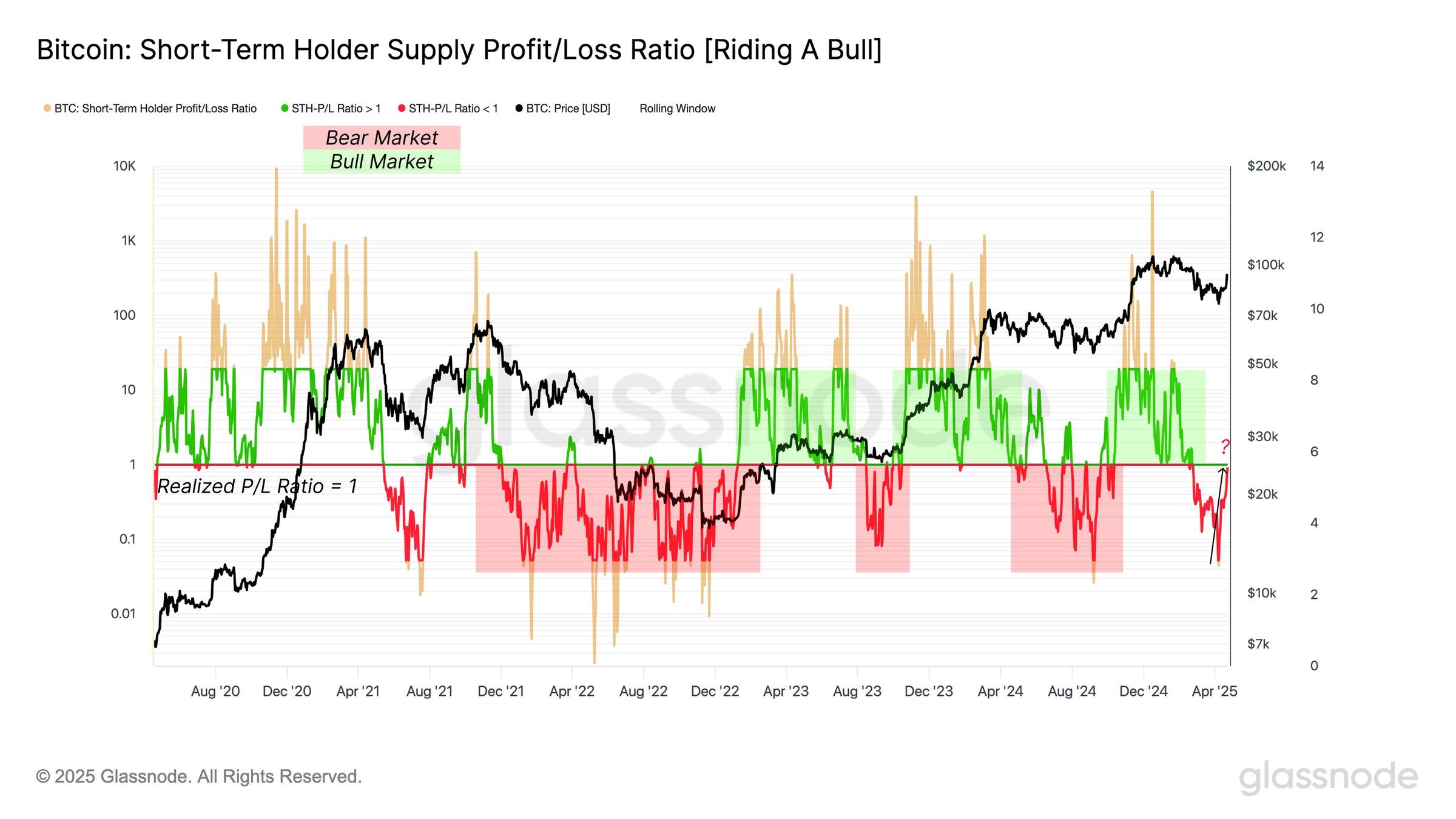

The wider macro momentum for Bitcoin signals a rebound, in particular in the profit / loss ratio (P / L), which approaches a neutral level of 1.0. This change indicates a balance between profit parts and those losing. Historically, the threshold 1.0 acted as a resistance during the bears phases, but a sustained movement above this level could indicate a stronger recovery and continued a momentum for Bitcoin.

Although the transition to a neutral P / L ratio suggests potential resistance, it also opens the possibility of selling pressure while investors seek to lock the profits. Consequently, Bitcoin’s ability to maintain the momentum will depend on how investors will react to prices movements and if they decide to sell or hold their positions.

The BTC price needs a push

The recent Bitcoin price action shows a 10% increase in the last seven days, trading at $ 94,401. The crypto king is now just below the significant level of resistance of $ 95,761, which has been stable for some time. A break above this level would put bitcoin on the right track to reach new heights, with $ 100,000 as the next important step.

If Bitcoin raped $ 95,761, growing market on the market will likely encourage investors to occupy their positions rather than sell. This will probably nourish the bullish momentum of Altcoin, pushing Bitcoin to $ 100,000, demand remains strong among traders wishing to capitalize on potential gains.

However, if Bitcoin does not maintain its position greater than $ 93,625, the price could drop to the support of $ 91,521. A deeper drop to $ 89,800 could endanger the dynamics in danger, delay any immediate recovery and increase the chances of a consolidation phase.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.