Bitcoin Price Surge Explained: What’s Next for BTC After Hitting $111,980 All-Time High?

Bitcoin was on an upward trend of six weeks, pushing the price beyond the crucial psychological barrier of $ 110,000.

Despite increasing concerns that the rally can face a saturation point or a potential withdrawal, recent Bitcoin performance and historical trends suggest that King Crypto is far from finished, with more gains probably on the horizon.

Bitcoin investors report additional growth

Historically, one of the key indicators of a bull cycle on the cryptocurrency market is the decrease in the average age of bitcoin. Over the past five years, three major bull markets have been preceded by this trend. Since April 16, the average age of a bitcoin has increased from 441 days to 429 days.

This trend is a strong signal of a continuous ascending movement for Bitcoin. The younger parts in circulation mean that new investments enter the market, which suggests a strong continuous interest. If this trend persists, it justifies the expectation of additional bull behavior, potentially prolonging the current rally and propelling Bitcoin to new price milestones.

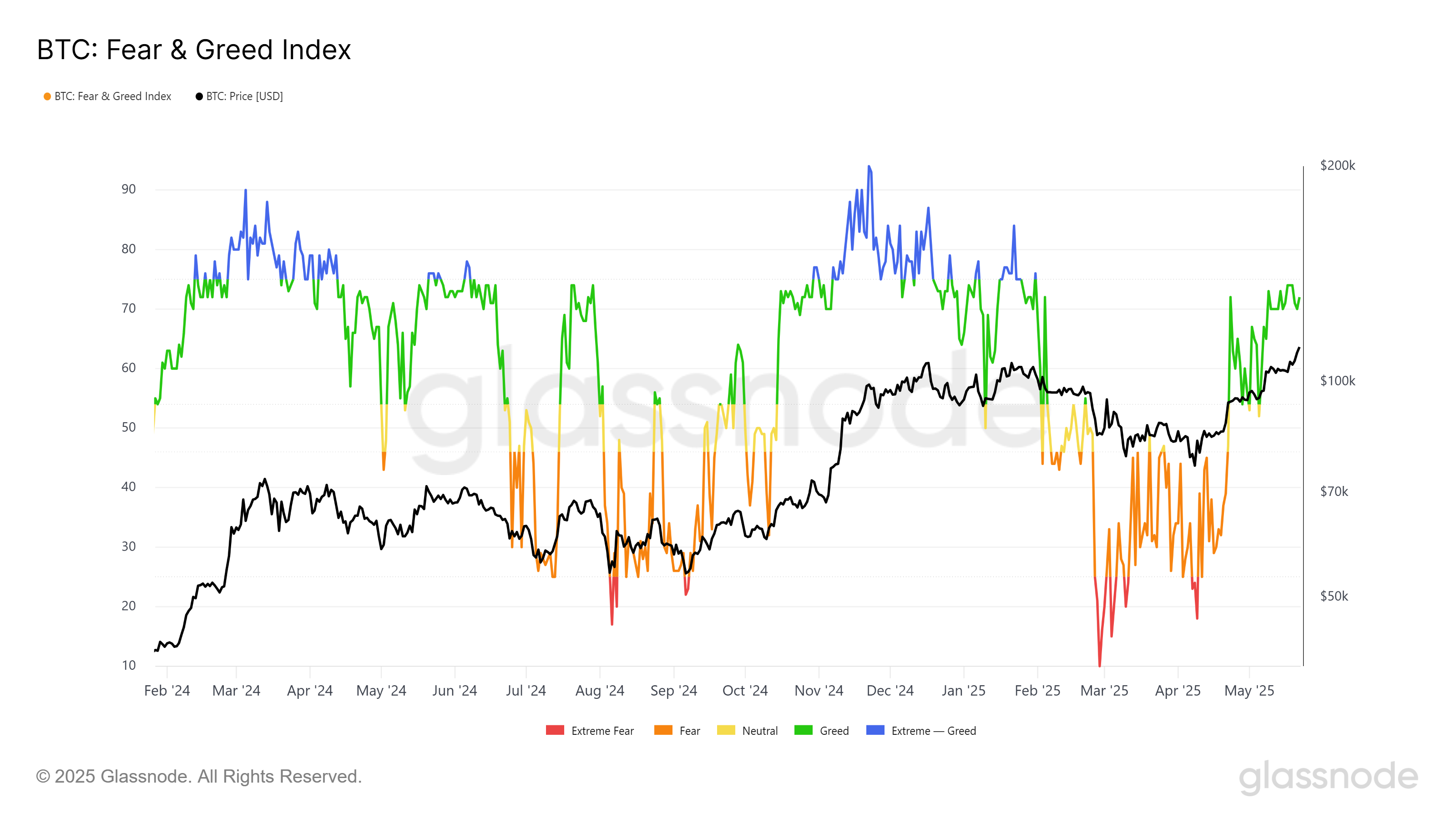

The index of fear and greed also indicates that the bullish momentum of Bitcoin has not yet saturated. Historically, when the index violates the extreme cupidity zone, it was followed by a significant increase in the price of bitcoin.

However, Bitcoin has not yet reached this threshold, leaving room for new price increases. This suggests that the market is not yet in the exaggerated territory, and there is still a significant increase in increase. The position of the index in the greed zone indicates that investors remain optimistic about the trajectory of future bitcoin prices.

BTC Price aims to continue the upward trend

The Bitcoin price has experienced a regular increase in the past six weeks, culminating in a new summit of all time (ATH) of $ 111,980. Lennix Lai, OKX CCO world, stressed macroeconomic factors, such as favorable market conditions and increasing institutional interest, contributing to the recent Bitcoin gathering.

“Bitcoin pierces that $ 111,000 to a new summit of all time shows how strong its technical configuration has become. I am particularly impressed by the way in which he managed the demotion of the American credit of Moody with barely a hiccup before pushing higher … It is not your typical crypto media cycle and companies allow us to write a bital of the Senate.

For the future, the Bitcoin price is about to unravel its current ATH and potentially reach $ 115,000. This continuous growth will probably attract more investors, further supplying the rally. If the positive momentum continues, Bitcoin can consolidate its position as a market leader on the market.

However, if investors start to sell their assets to obtain profits, Bitcoin could experience a short -term decline. A drop below $ 106,265 would point out to weaken the feeling of investors, which would drop around $ 102,734. If this happens, the upward perspectives can be invalidated, causing a temporary consolidation phase for the price of Bitcoin.

The overvoltage of the Bitcoin price explained: What is the next step for BTC after reaching $ 111,980 more? appeared first on Beincrypto.