Bitcoin Signals Breakout Above $90,000 As Bullish Cycle Builds

Bitcoin (BTC) has increased by more than 4% in the last 24 hours and more than 5% in the last seven days while it tries to recover the level of $ 90,000. The recent price rebound occurs in the midst of improvement of technical indicators that suggest growing bullish momentum.

Traders look closely if Bitcoin can recover $ 90,000 and build a stronger base for further. Several trend indicators, including the DMI, the Ichimoku clouds and the EMA lines, indicate that a potential rupture could form.

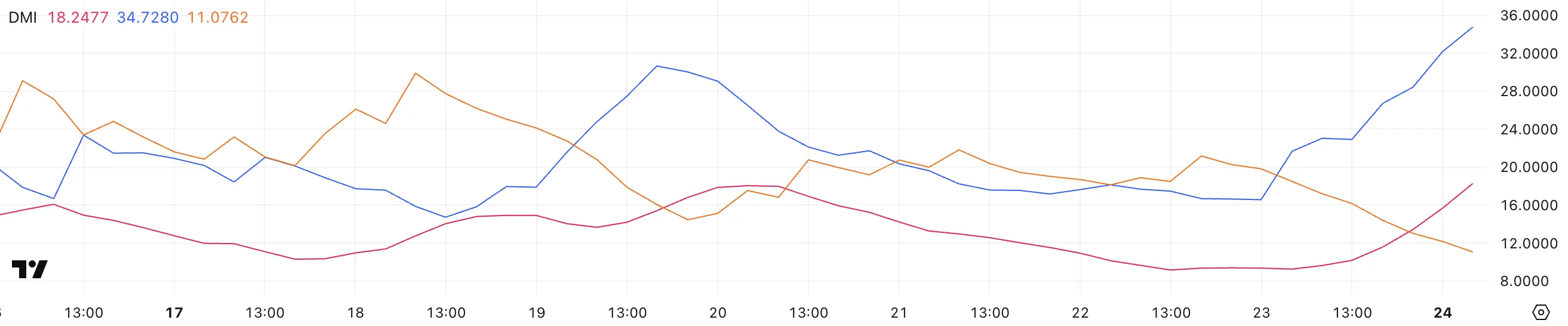

BTC DMI shows that buyers are now in full control

The Bitcoin DMI table shows a significant increase in the momentum. The ADX (average directional index) increased to 18.24 today, a notable increase compared to 9.2 yesterday, indicating that the strength of the current trend is under construction.

ADX reading below 20 generally suggests that the market is lowly trendy or is linked to the beach, so this increase could be an early sign of a development trend.

Although the ADX itself does not indicate the direction of the trend, it measures the overall force, and the reading of today suggests that the momentum begins to resume.

ADX is a widely used technical indicator that helps traders to assess the strength of a market trend. Generally, an ADX value less than 20 points out a clear lack of trend, while readings above 25 suggest a strong trend.

Next to the ADX, the + DI (positive directional indicator) and -DI (negative directional indicator) give an overview of the trend direction. Currently, the + DI went to 34.7 from 16.57 yesterday, while the -Di fell to 11.17.

This widening gap between + di and -Di indicates that the bullish momentum is dominant, because buyers seem to be overwhelming sellers. If this trend continues, it could indicate a new increase in the price of the BTC in the short term, while the market moves towards a more decisive increased trend and the FNB Bitcoin show signs of recovery.

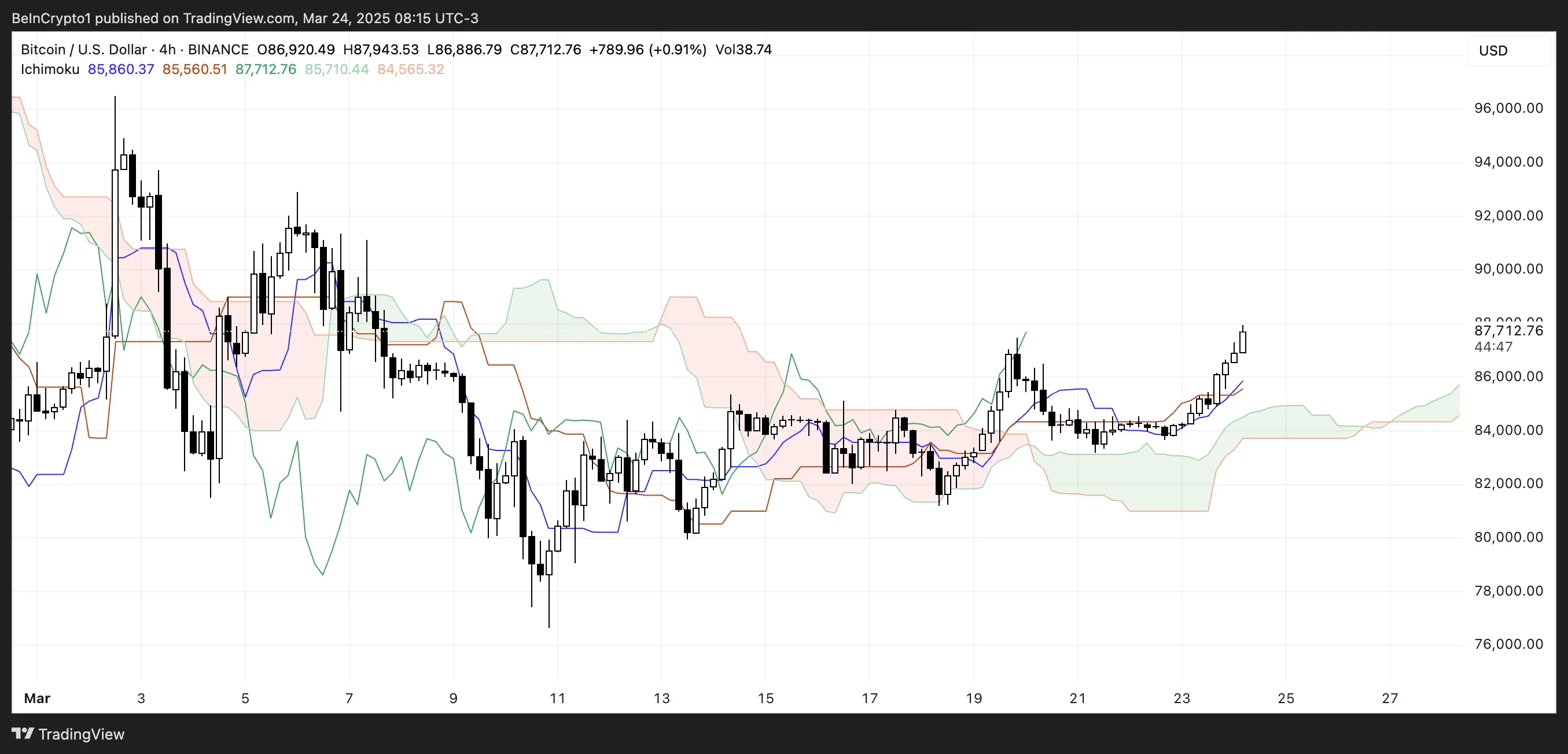

The Bitcoin Ichimoku cloud shows an increased configuration forms

The Ichimoku cloud painting for Bitcoin shows Tenkan-Sen (blue line) and Kijun-Sen (red line) crossing a bull pattern. The faster Tenkan-Sen moves over the slower Kijun-Sen, signaling a momentum.

These lines converged after a separation period, indicating conditions of reinforcement trend.

The formation of the clouds (Kumo) went from red to green in the right part of the graph, marking a passage from the lowering feeling to bullish. The price action exceeded the cloud after having tested it as a support several times in mid-March.

This emergence above the cloud indicates that the previous resistance has potentially become a support. The variable thickness of the cloud throughout the period reflects the evolution of volatility and market conviction in trendy direction.

Can Bitcoin recover $ 100,000 before April?

Bitcoin EMA lines are currently displaying mixed signals. Although the wider trend remains down, the short -term exponential medium -sized moving have started to turn upwards, and a recent golden cross suggests that the bullish impulse is built.

If this momentum continues and additional gold crosses occur, the price of bitcoin could target the levels of resistance of the keys. The first major resistance is at $ 92,920, and a successful rupture could see BTC pushing around $ 96,484.

If the upward trend is further strengthening, Bitcoin can test $ 99,472. It has the potential to exceed $ 100,000 for the first time since February 3. This could be motivated by 5 American economic events that can influence the feeling of Bitcoin this week.

However, the bullish scenario depends on the sustained purchase pressure. If the ascending momentum fades and the wider lower trend resumes, Bitcoin could first retest the level of support at $ 85,124.

A break below this level could open the door to a drop to $ 81,187, with an additional drop potentially leading the BTC below the $ 80,000 mark.

In a stronger drop scenario, Bitcoin could revisit $ 76,642, strengthening the lower bias.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.