Bitcoin Whale Holdings Near Peak—Is a Breakout Coming?

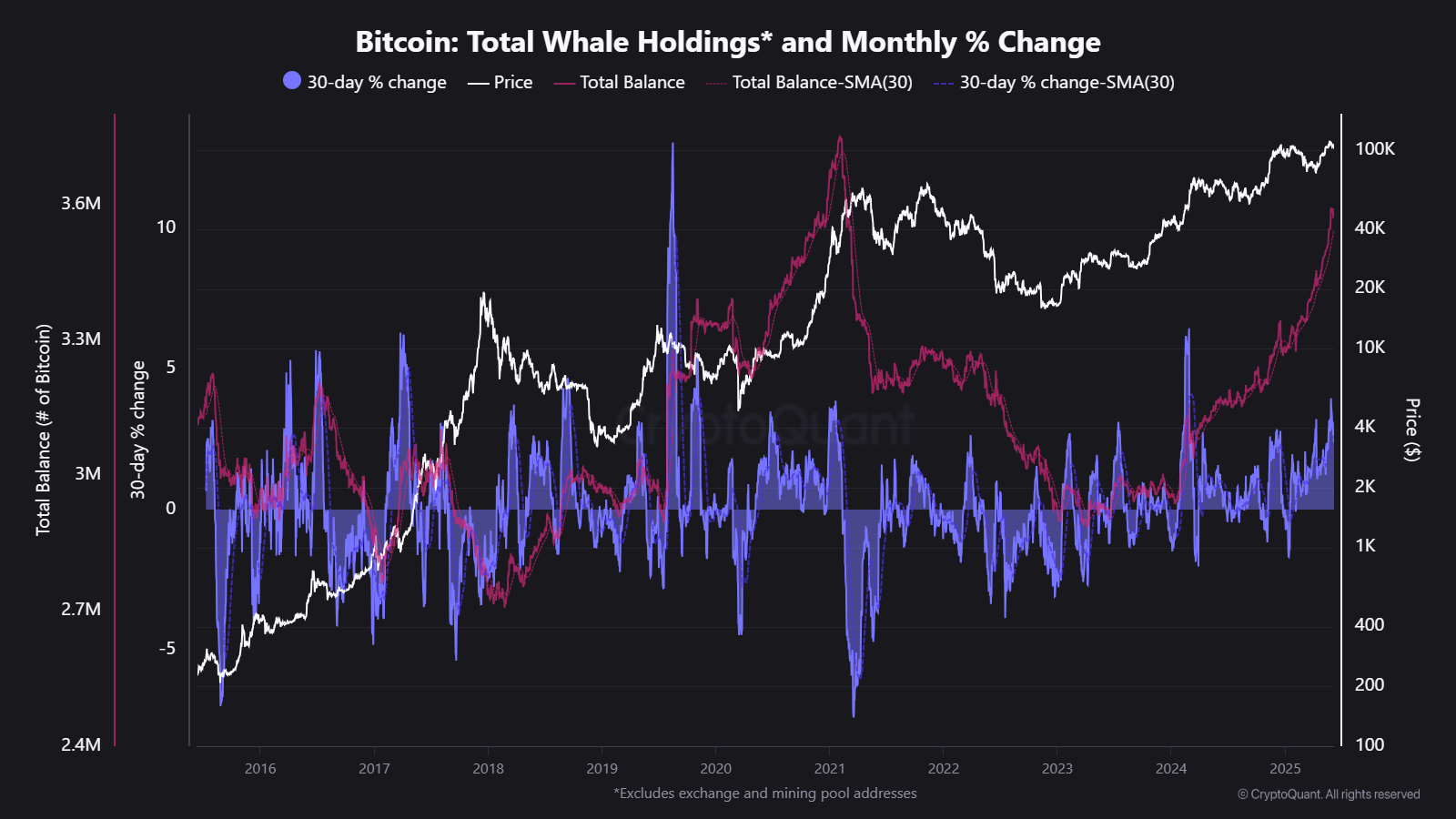

The signals of the Bitcoin whales and minors refer to a potential rally on the horizon. New cryptocurrency data reveal that major Bitcoin holders now have a balance of 3.57 million BTC.

This approaches the previous summit of 3.74 million BTC at the beginning of 2021.

Bitcoin whales increase their assets

When the whales regularly add to their reserves, they act like powerful demand wells. Their growing accumulation reduces the available offer and provides prices support.

The current trend in Whale Holdings suggests that Haute Noue institutions and investors considered decreases as purchasing opportunities and anticipate higher prices to come.

“This metric reflects the real sales of large holders by excluding the addresses of exchange and mining pool. This offers a clearer vision of strategic accumulation by major investors. It remained the growth of whale titles often signals institutional confidence and strong underlying demand, which are key engines of the longer-term bull cycles, “said cryptochant cryptochant, Ja Maartunn, outside Beincyprto.

But not all indicators point. According to Cryptochant, the metric of the hash ribbons – the constraint of a tracking minor – recently displayed a purchase signal.

This generally reflects short -term turbulence because minors are faced with profitability problems, forcing some to sell Bitcoin to remain operational.

Historically, these short -term stresses often prepare the way for sustained rallies. The capitulation of minors can trigger a drop in initial prices.

But in the end, it erases lower market players and tightens the supply.

Last week, the Bitcoin price demonstrated notable volatility. Influenced by a public stormy dispute between Elon Musk and Donald Trump, Bitcoin has briefly dropped below $ 101,000. This caused nearly a billion dollars in liquidations.

However, Bitcoin quickly returned to more than $ 105,000, indicating resilient purchase pressure.

Technical analysts are also optimistic. They highlight “cup and round” training on Bitcoin’s daily graph, suggesting a bullish escape if prices exceed $ 108,000.

In addition, institutional activity supports this increased perspective. The interests open to the term Bitcoin have increased by more than $ 2 billion in recent days, while the funding rates have remained low.

This scenario creates fertile soil for a short potential compression.

Will BTC hold the psychological support of $ 100,000?

For the moment, the accumulation of whales and the constraint data of minors identify a clear trading range. Solid support is between $ 100,000 and $ 102,000.

This means that BTC will probably maintain its $ 100,000 psychological level even during short -term corrections.

Meanwhile, the resistance awaits $ 108,000 at $ 108,000 at $ 110,000, where an escape could accelerate prices to $ 120,000.

Traders should closely monitor catalysts, such as the sale of minors, as they could quickly influence prices.

In addition, macroeconomic titles involving the Fed and World Trade Dynamics will probably maintain high volatility.

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.