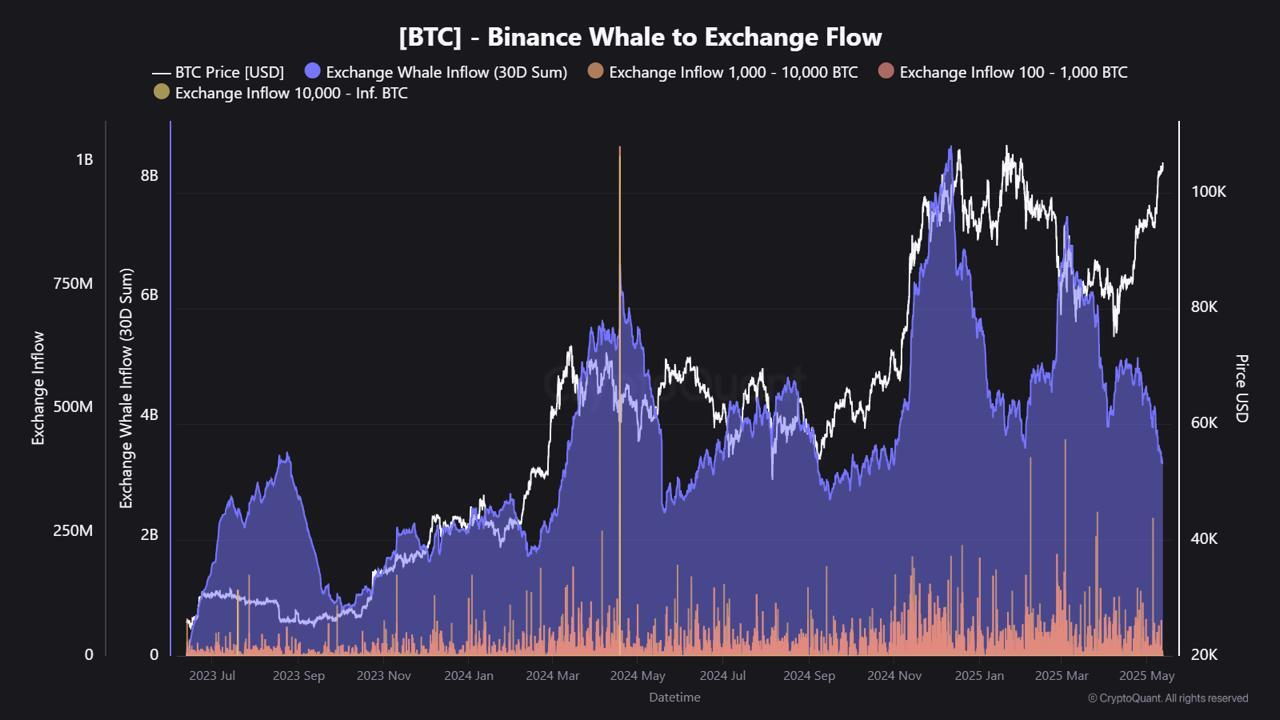

Bitcoin whale inflows to Binance hit a six-month low at $3.27 Billion

Bitcoin whales have spent only $ 3.27 billion in BTC in Binance in the last 30 days. This figure marks the influx of the lowest whales since November 2024, according to Cryptochant.

Consequently, this decline signals the drop in sales sales of the main holders. Fewer coins entering exchange control books often take out support for higher prices.

Bitcoin whales continue to hold

Cryptoque analyst JA Maartunn explains that in March and November 2024, whale entries exceeded $ 6.17 billion and $ 8.44 billion. These peaks coincided with strong withdrawals, while whales have locked gains at higher prices.

In addition, moderate whale deposits suggest that holders now prefer to keep or move the parts out of the exchange. Many can move the BTC to cold or over -the -counter storage places, reducing visible supply.

As a result, the market faces stricter liquidity. The lower sales walls on the binance create space for prices progress. Traders often consider this as an optimistic backdrop.

On the price front, Bitcoin recently climbed to around $ 104,000. This rally found the support in part because large -scale sales orders have failed to materialize. Last week, cryptocurrencies showed that “new Bitcoin whales” hold most of the capital.

These whales bought at an average price of $ 91,922, so they are likely to be a much higher sale price.

However, macro-factors still influence market orientation. FED political decisions, quarters of regulations and geopolitical events can trigger sudden overvoltages.

In addition, chain metrics show that long -term holders increased their positions. Such accumulation often precedes sustained movements, because the parts actually disappear from the power supply.

However, the moderate whale activity does not guarantee uninterrupted gains. The feeling of retail, the positioning of derivatives and institutional flows can revive volatility.

In the end, the lowest of six months in the entrances to Binance whales reflects provisional confidence among the big holders.

If the whales keep this reservoir, Bitcoin can find a firmer foot above $ 100,000. However, market observers will follow any change in whale behavior for early alert of the evolution of feeling.

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.