XRP Could Surpass Ethereum by 2028, Says Standard Chartered

Welcome to the American morning briefing – your essential overview of the most important developments in the crypto for the coming day.

Take a coffee to see why Standard Chartered thinks that XRP could soon jump Ethereum, how Tether’s institutional pivot could reshape the Stablescoin market and how players like Blackrock, Galaxy Digital and the Federal Reserve could shape the next Crypto chapter.

Standard Charterd says that XRP began to outperform, could exceed Ethereum by 2028

While global trade tensions are intensifying, Standard Charterd sees a silver lining for cryptographic investors, exhorting them to focus on long -term winners ready to benefit from the disruption.

“The price noise creates the opportunity to search for long -term value / choice winners in digital assets for the next higher step. Today, we add XRP to this list of winners (BTC and Avox other identified winners, ETH identified loser). XRP market capitalization exceeds ethereum.

Kendrick also underlined Bitcoin resilience as a signal of what will happen for the wider cryptography market.

“The tariff disorder will soon be over, and the solid Bitcoin performance during noise tell us that a higher leg for the asset class will follow,” he said.

He also highlights important points on the recent performance of XRP:

“The XRP price increased 6x in the two months which followed Trump’s electoral victory, the strongest performance among the 15 best digital assets by market capitalization.

It is also important to point out that Ripple recently announced the acquisition of Prime Broker Hidden Road for $ 1.25 billion to extend institutional services.

But Kendrick thinks that fundamentals – not just politics – lead the momentum of XRP.

“We believe that these gains are durable, not only because of the recent dry leadership changes, but also because XRP is only positioned at the heart of one of the fastest uses for digital assets – the facilitation of the cross -border and transversal payments. The use of Stablecoin has increased by 50% per year in the past two years, and we expect Stablecoin transactions to increase 10x in the next four years.

Tether’s big game: institutional quality stable targets the American market

With the acceleration of institutional adoption, the Tether’s plan to launch an institutional quality stable focused on the United States could be a decisive moment for stablecoins – and a major step towards the integration of traditional cryptography.

Charles Wayn, co-founder of Decentralized Web3 Super-App Galxe, told Beincryptto that:

“The news that Tether plans to launch an institutional quality stable for the American market is fantastic for the crypto industry. There remains the privileged stablecoin of the industry, shown by its market capitalization of more than $ 144 billion, which is much higher than the size of the $ 60 billion in the USDC. »»

Wayn thinks that this decision, as well as Tether’s push for transparency, positions society as the future leader in the institutional adoption of cryptography.

“As such, this decision, combined with other recent news according to which Tether is looking for a complete audit of a Big Four accounting firm, shows that the company is not only willing to be in conformity but also to be a leader in institutional adoption. Although the USDT unfortunately has not adopted the EU directive on the United States.”

He adds that institutional impetus – fueled by players like Blackrock – is reinforced why is now a pivotal moment for stablecoins and wider stability on the market.

“As such, there is no doubt that the USDT will work hard to launch its new product in good time. While we see huge institutions like Blackrock entering the market more with another purchase of $ 66 million Bitcoin last week, as well as the rapid growth of its Rwa Buidl fund, institutional adoption is now taken off quickly. ”

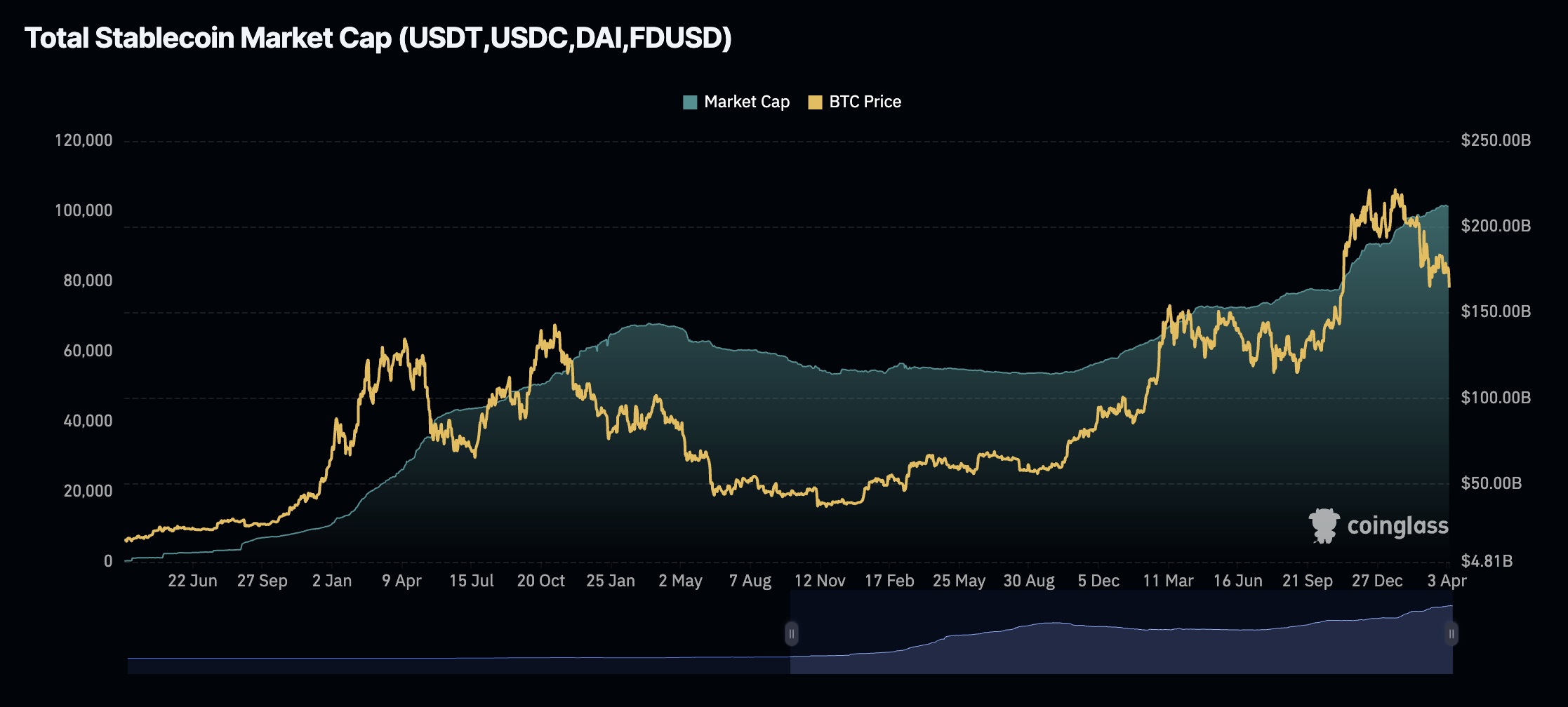

Cryptographic graph of the day

The total market capitalization of the stablescoins is currently close to its heights of all time, more than $ 210 billion.

Alpha the size of an byte

– Analysts warn that a return to quantitative relaxation in 2025 could ignite a massive cryptography rally, potentially pushing bitcoin to $ 1 million and causing an increase in altcoins.

– Zero obstacles in Bitcoin ETF and the decline in term interest suggests the customs clearance of investors’ confidence, although the increase in installation contracts and positive funding rates highlight cautious optimism.

– Galaxy Digital guarantees the approval of the dry to reorganize and evolve towards a NASDAQ list of May 2025, signaling renewed confidence in the crypto in the context of improving American political support.

– Research on binances show that during prices, RWA tokens surpasses Bitcoin, because the increase in macroelectric pressures weakens the role of BTC as a diversification intake.

– The microstrategy break in the purchase of Bitcoin last week, in the midst of $ 5.91 billion in unpaid losses, points out increasing prudence and raises questions about liquidity, debt and broader institutional confidence.

– Fed potential declines could breathe a new life in crypto by stimulating the risk appetite and weakening the dollar, although uncertainty remains in the middle of the skepticism of Larry Fink.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.