Bitcoin Whales Return as BTC Price Struggles

Bitcoin (BTC) is down 6% in the past eight days after reaching new heights of all time, and recent technical signals suggest growing uncertainty on the market. The activity of the whales, which has briefly refused, began to recover, suggesting that some major holders can return to accumulation.

However, the lowering indicators go up, the Ichimoku cloud showing weakness and a BTC exchange below key support levels. While Price oscillates just above $ 104,584, the threat of another death of death and the deeper decline remains unless the bulls can recover the dynamics above the resistance.

The number of Bitcoin whales rebounds after a strong decline

The number of Bitcoin – additional whales holding between 1,000 and 10,000 BTC – has slightly rebounded at 2,006 after falling at 2,002 earlier this week.

This brief decrease followed a clear drop of 2,021 on May 25, marking a significant short -term reduction in major holders. However, recovery suggests that some whales can return to accumulation.

Although fluctuation is low, such changes are closely monitored, as they often precede changes in market or price action.

Monitoring the behavior of whales is essential because of their disproportionate influence on the liquidity and volatility of Bitcoin. A drop in the number of whales may indicate profits or distribution, often signaling prudence or potential market recharge time.

Conversely, stabilization or an increase – such as that observed now – can facilitate the concerns of investors and support price resilience at high levels.

The number of large holders recovering after a clear drop can report renewed confidence among key players, reducing the immediate risk of high sales pressure and helping bitcoin to maintain its current beach.

Technical indicators become lowered while the BTC struggles below key levels

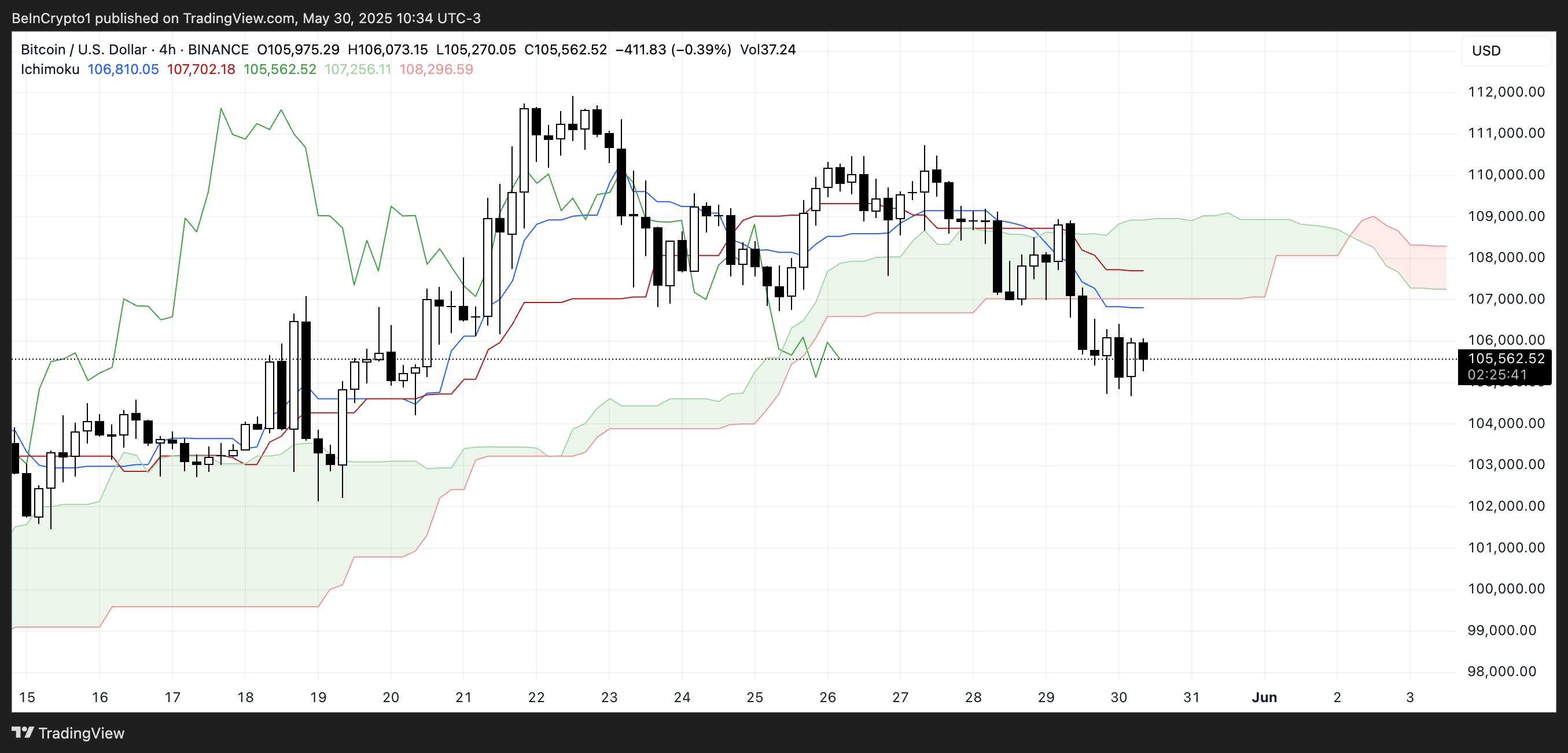

The Ichimoku cloud painting for Bitcoin shows a short -term lower structure.

The price action is currently positioned below the Kumo (cloud), which is shaded in green and red – indicating that Bitcoin exchange in an area of weakness compared to the historic and projected momentum.

The upcoming cloud is red, which suggests that the trendy bias for the near future is less than a reversal is breaking through the upper border.

Tenkan-sen (Blue Line) is below the Kijun-Sen (red line), confirming the momentum down in the short term. The two lines are tilted downwards, another lowering signal.

The Span Chikou (green offset line) is lower than both the price and the cloud, strengthening this current amount of movement lacks bullish confirmation.

The future cloud is also shrinking, which can refer to a potential balance or a future consolidation area. For the moment, the components of Ichimoku align with a downward perspective. A bullish change would require the price breaking down above the cloud and returning the future Kumo from red to green.

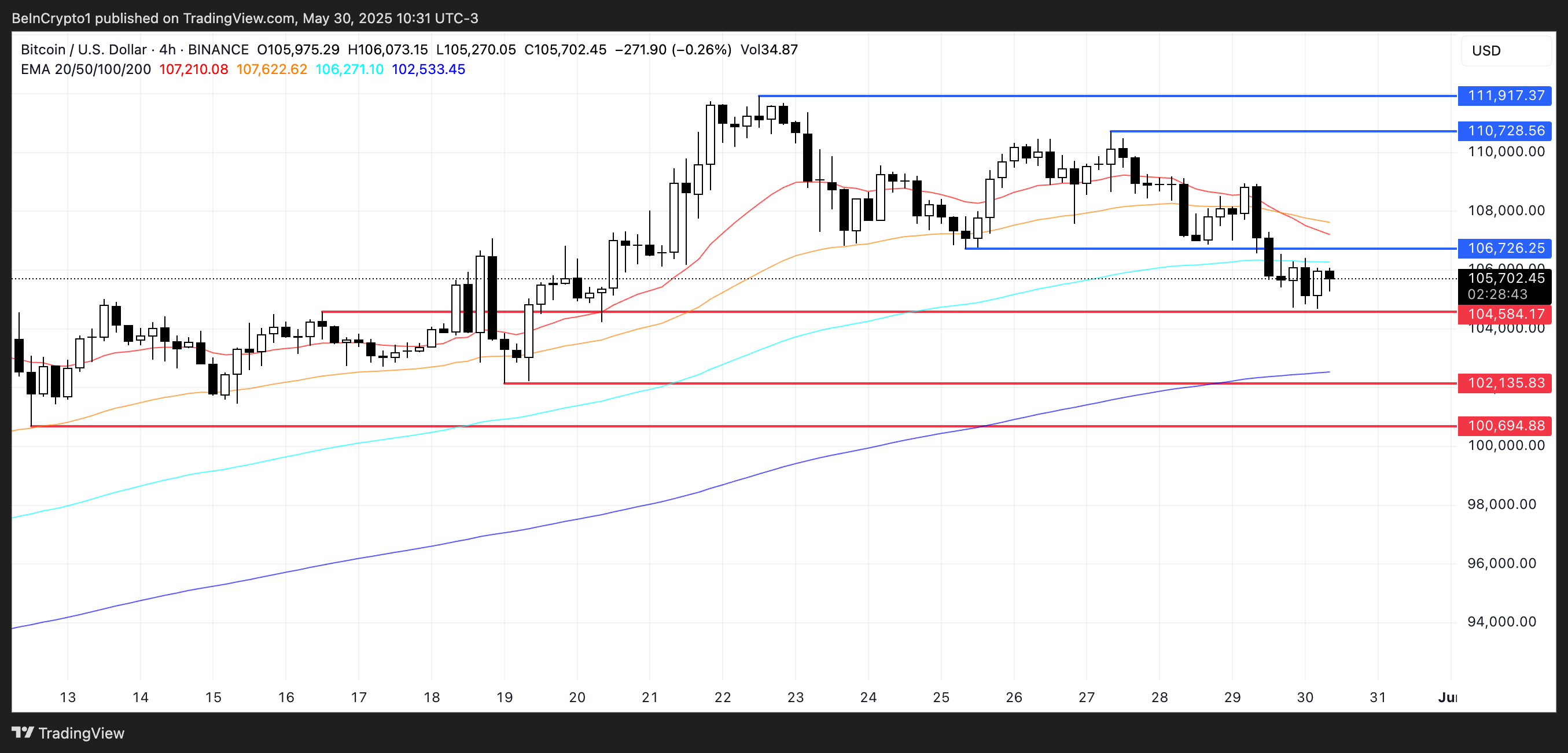

Bitcoin faces a potential death cross

The Bitcoin price recently formed a cross of death, and the technical indicators suggest that another could be on the horizon. The price is currently negotiated just above critical support at $ 104,584, which acted as a short-term floor.

If this support fails, the following drop targets are at $ 102,135 and potentially as low as $ 100,694 if the sales pressure is intensifying.

The presence of consecutive deaths of death, combined with a weakening of the action of prices near these levels, increases the probability of a deeper correction in the short term.

On the bullish side, if the bitcoin can set up recovery and establish a significant momentum, it can retain the resistance at $ 106,726.

A rupture above this level could trigger a clearer movement around $ 110,728, with another possibility up to $ 112,000 if the rally accelerates.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.