Bitcoiner sex trap extortion? BTS firm’s blockchain disaster: Asia Express

|

Spend the night with a BTC support cascade becomes scandalous after the extortion link

The stuntman of an influencer of Viral Crypto “Spending night with BTC holders” took a dark turn after the Chinese media linked his profile to a real extortion affair.

On March 25, Sina Finance reported that in 2024, a software engineer in Chengdu had been caught in an ambush and private of 6 BTC by a criminal gang posing as a crypto woman called “Bitcoin Cong’er”.

The group would have attracted the victim through an X profile which promised sexual favors after months of online communications. Once the victim agreed to meet in a high -end Chengdu hotel, the authors would have used evidence made to threaten the reputation of the victim, ultimately extorting a transfer of 6 BTC.

Police investigate the incident and have issued public warnings on similar scams targeting crypto users, according to Sina Finance.

The report quickly raised the eyebrows because a few days earlier, a Mandarine -speaking social media user going by BTCCGNER, formerly known as Lisaabuilder, had become viral for a surprisingly similar blow.

On March 20, the account published a message on X, urging users to delete their Bitcoin addresses in the responses. She said that she “spent the night” with anyone who has at least 0.1 BTC – no fees, no attached channel. She even described the note as a “suicide letter”, declaring that she no longer belonged to herself, but to all the holders and believers of Bitcoin. The tweet has collected more than 2 million views.

BTCCONGER has doubled, publishing photos and videos of herself by apparently meeting her disciples and stealing for Bangkok. In a tweet, she posted a selfie in a hotel mirror with a visible condom on the table, saying that someone did not show up at the promised location and time. In another video, she is seen on a bed with three men, reading and reciting the Bitcoin white paper, some sections in unison.

The reactions have been mixed. Some X users have played along the wallet addresses. Others called it an entertaining and intelligent method to attract attention. Some have urged her to reconsider security reasons, while several women criticized the position to perpetuate the damaging stereotypes on women in crypto.

After Sina’s finance article has surfaced, its campaign was the subject of a new control because the report included a screenshot of one of its tweets.

In a live interview on March 26 with the creator of local content Robert Lee, BTCCGER denied any involvement in the Chengdu affair. She said she was currently on the continent in Shenzhen and argued that if she was linked to a crime, she would already be in a state of arrest. She also pointed out that the extortion affair had taken place earlier in 2024, while her account was renamed from Lisaabuilder to BTCCONGER “a few days ago”. She said that she had gathered notarial evidence and plans to submit an official report to defend herself.

Parental company BTS HYBE draws the Blockchain subsidiary on the palate

Hybe, the K-POP power behind BTS, would have reduced its blockchain ambitions after a short and not profitable race. As indicated by News1 on March 27, Hybe plans to absorb its binary blockchain subsidiary, effectively drawing direct participation in web 3 companies.

Binary Korea was launched in 2022 as part of the broader hybian thrust in the economy of the digital creator. This decision followed the Hybé partnership in 2021 with the Upbit Dunamu operator, which included plans to issue non -fastible BTS tokens (NFTS). These plans were finally put aside after a generalized game.

BTS goods were already as a mastodon without blockchain gadgets. From the McDonald’s closed shopping meal to 2021 to the very popular à la carte Merch card – even after the cancellation of the visit due to the pandemic – BTS products have constantly generated millions of income. From derived lines like Tinytan, animated characters based on the group, have become autonomous brands, appearing in everything, from stationery and technological accessories to household appliances.

However, the NFT announcement sparked a fierce reaction from the members of the Fandom BTS known as Army, which raised concerns about environmental impact and over-commercialization.

Hybé has never published BTS NFTS, although it has advanced with other blockchain initiatives, including a joint venture with Dunamu in the United States called Levvels. This adventure launched Modica, an NFT platform with other Hybe artists – but in particular by excluding BTS. Without the involvement of the group, the platform failed to obtain a significant traction.

Binary Korea only posted 468,000 Korean won (around $ 350) in 2023, with a net loss of 4.28 billion Koreans (around $ 3.2 million), according to News1. Another HYBE platform, Theus, did not provide results either, despite a recent Coinbase partnership aimed at integrating fans’ commitment tools based on blockchain.

A Hybian spokesperson quoted by the point of sale minimized retirement and noted that the decision had not yet been finalized.

Read

Features

Can you trust the Crypto exchanges after the collapse of FTX?

Features

Programmable money: how crypto tokens could modify our experience entirely from the transfer of value

Japan proposes that we collaborate to establish standards of global tokens

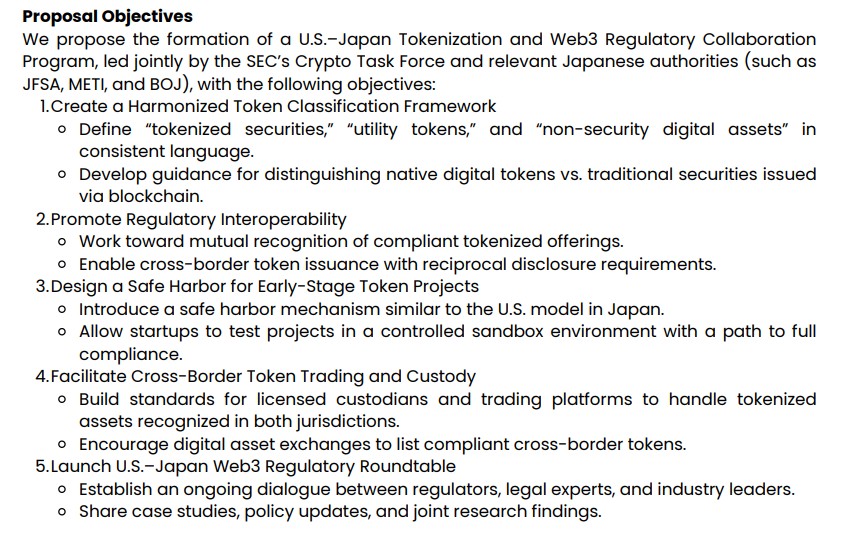

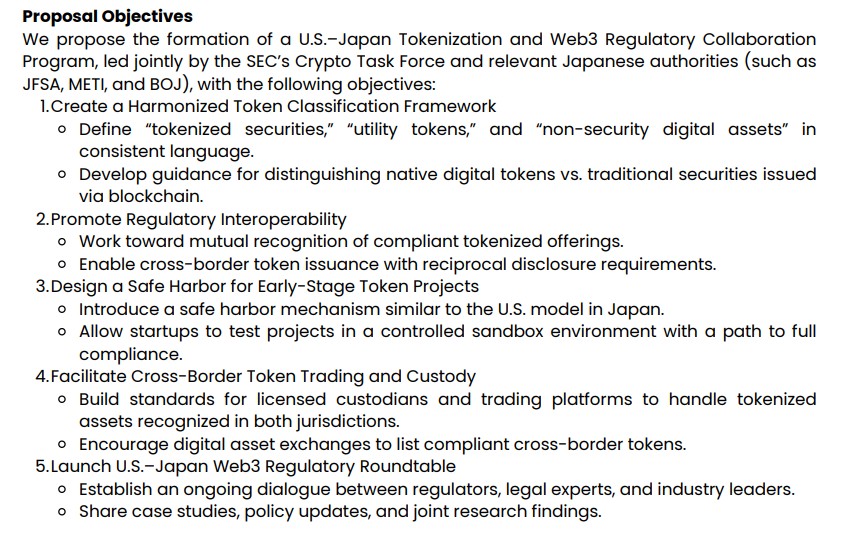

A new proposal from Japan calls on the United States and Japan to unite their forces on the regulation of Tokenized assets and the shaping of the global web3 economy. The five -part plan, submitted to the Commissioner of the American Securities and Exchange commission, Hester Peirce, explains a path to harmonized digital asset frames, mutual recognition of compliant offers and the creation of safe testing environments for blockchain startups.

The proposal, written by Hinza Asif, president of the Asia Web3 Alliance Japan, recommends a joint American-Japanese regulatory collaboration program with five fundamental objectives.

The letter, dated March 25 and addressed to Peirce in her capacity as president of the working group on the Crypto de la SEC, highlights the growing difficulties encountered by Japanese Web3 startups. Asif has written that despite a strong interest in blockchain and tokenization, real estate at points of loyalty, many projects are paralyzed by legal uncertainty and the processing of taxes and inconsistent securities.

Currently, Japan does not have a clear framework for tokens offers, leaving startups at risk of regulatory exceeding. Meanwhile, the United States has progressed thanks to discussions on wearing Safe Harbor to define the categories of digital assets. Asif said that this approach could serve as a model for international collaboration.

Read

Features

“Sic ais on each other” to prevent Ai Apocalypse: David Brin, author of science fiction

Features

The climb of Mert Mumtaz: “I probably fud solana the most anyone”

The circle extends the USDC imprint in Asia

The Stablecoin USDC of Circle is gaining momentum in Asia after two major developments in Japan and the Philippines.

The company announced the launch of March 26 of the USDC in Japan on the SBI VC Trade Crypto Exchange. The list follows the regulatory approval granted on March 4, when the SBI VC trade became the first exchange in Japan authorized by the Financial Agency for Services to list the USDC as part of the country’s regulatory framework of the country.

In the Philippines, Circle has teamed up with GCASH, the most used digital portfolio in the country, to provide USDC support to its nearly 100 million users.

While GCASH extends its financial services, discussions around a possible initial public offer (IPO) continue to generate buzz. The CEO of Globe Telecom, Ernest Cu, whose company has a participation in GCASH through the parent company MYNT, confirmed that an IPO was still considered in a February press conference. However, he said that the company was intended to float a lower share than the public minimum of 20% currently required by the Philippines Stock Exchange and the local dry.

The reports suggest that GCASH could target an assessment of at least $ 8 billion, although CU has noted that there is no fixed calendar for a public list. The SEC has expressed its management of an IPO GCASH and is open to examining an official request for exemption from the float requirement, potentially driving the way so that the giant Fintech can become public.

While the USDC continues to develop in the compliance markets, its main rival, the USDT of Tether, faces pressures in the European Union, where several exchanges have struck the token due to the new markets in the regulation of cryptocurrency (Mica). Tether, however, made his own progress and said he was in talks with a large accounting firm to make a long -awaited financial audit.

Get down

The most engaging can be read in the blockchain. Delivered once a week.

Yohan Yun

Yohan Yun has been a multimedia journalist covering the blockchain since 2017. He has contributed to Crypto Media Outlet Forkast as an editor and covered Asian technological stories as an assistant journalist for Bloomberg BNA and Forbes. He spends his free time cooking and experimenting with new recipes.