Bitcoin’s $95,000 Support Tested by Overvaluation Risks

Bitcoin managed to maintain solid support at $ 95,000 for a while. However, this level could face challenges because the overvaluation of the cryptocurrency can cause correction.

If this support is broken, Bitcoin could be dropped, potentially reaching $ 92,000, which would arouse new concerns for investors.

Bitcoin is faced with trouble

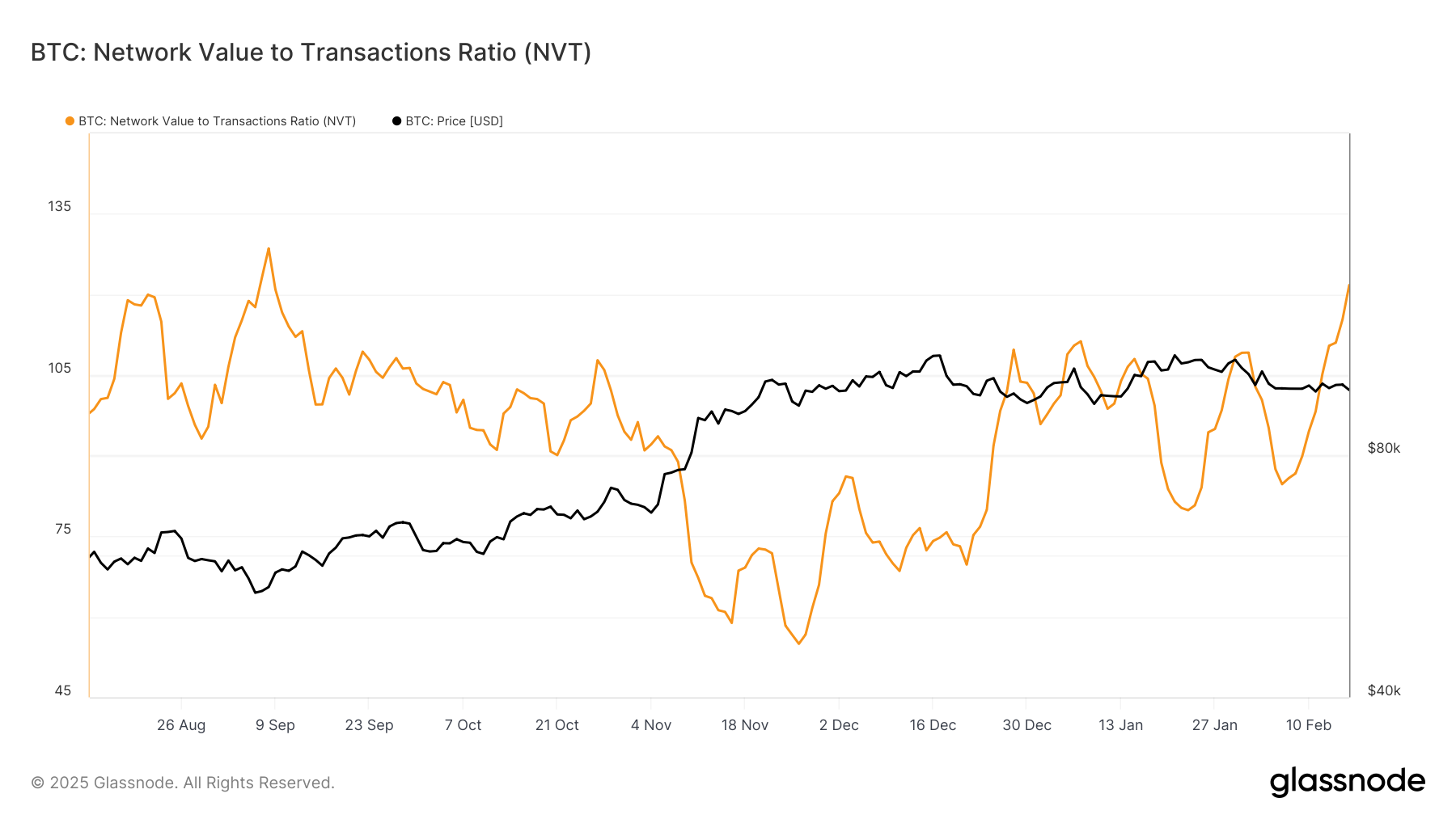

The network value ratio / transactions (NVT) is currently a five -month higher, a level given for the last time in September 2024. The NVT ratio, which measures the relationship between the value of the Bitcoin network and the volume of Transactions suggests that network value is much higher than real transactions. This imbalance generally indicates that Bitcoin is overvalued, acting historically as a trigger for price corrections.

The increase in the NVT ratio indicates that the price of bitcoin may not align with its underlying network activity, suggesting a poor potential evaluation. As this imbalance continues, the chances of an increase in prices correction, which means that Bitcoin could face a drop to lower support levels unless its network activity cannot catch up its evaluation.

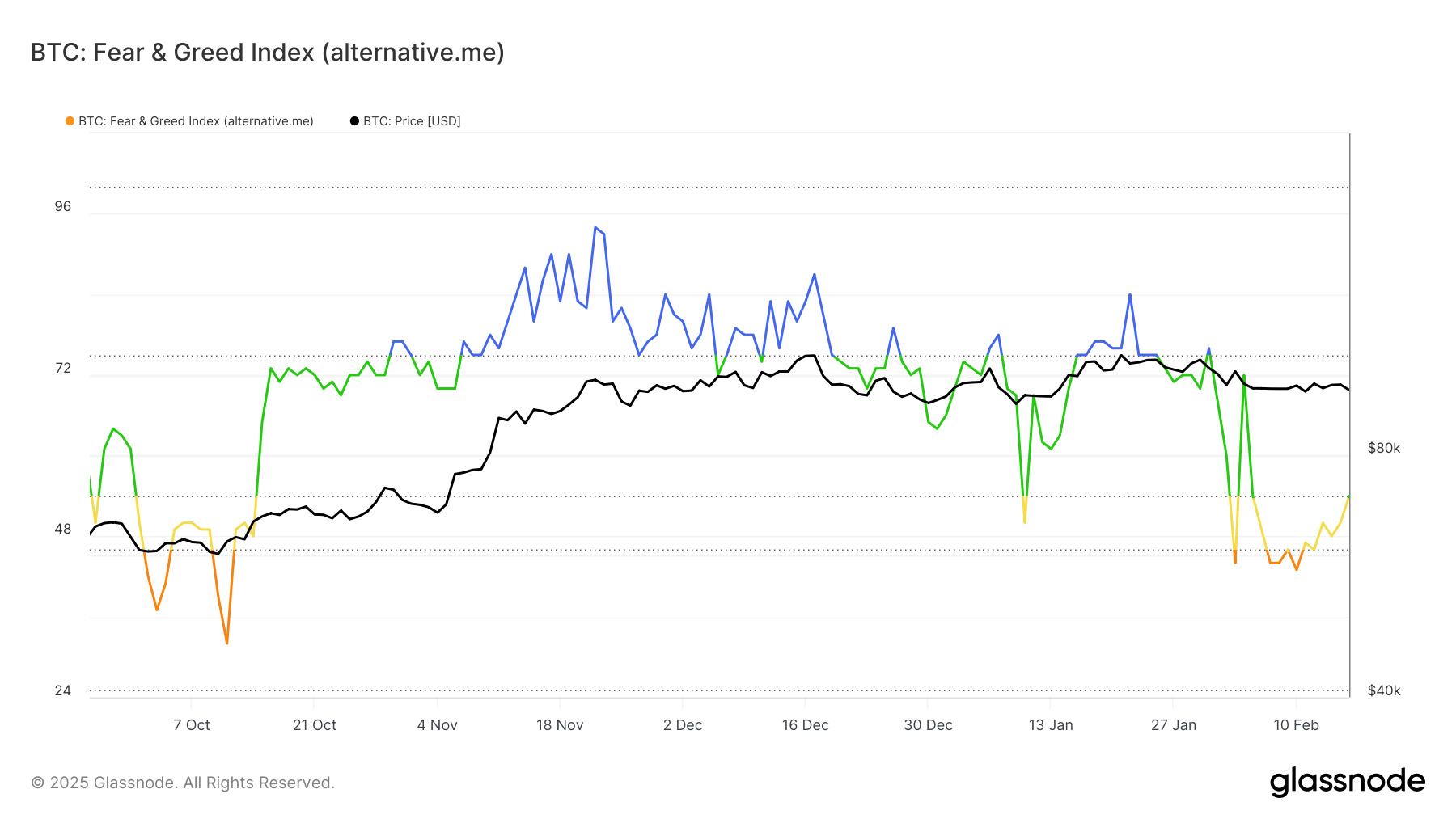

Bitcoin’s wider momentum shows mixed signals, with the fear and greed index approaching the greed area. The index, which follows the feeling of the market, is about to go from neutral to greed, often indicating that the market can approach local summits. This change suggests that Bitcoin could be overvalued, with the potential of a correction if the feeling overheats.

Historically, when the index of fear and greed enters the area of greed, Bitcoin has experienced withdrawals while the overvaluation triggers profits. The future of the Bitcoin Prize will depend on the evolution of feeling in the coming days.

Price prediction BTC: stay above the support

Bitcoin is currently negotiating at $ 96,273, holding above its level of critical support of $ 95,869. For the moment, Bitcoin also remains above its upward trend support line, which has provided a stamp against a new drop in prices. If these levels are maintained, Bitcoin could maintain stability and avoid breaking under the key support.

However, if the factors of overvaluation and change of feeling of the market exert pressure on bitcoin, it is likely to fall below the support of $ 95,869. This could trigger a decrease to $ 93,625, or even as low as $ 92,005, extending the losses for investors that are held during this uncertain phase.

If Bitcoin can find resilience above the support of $ 95,869, it could see a rebound towards $ 98,212. The successful violation of this level of resistance could provide a renewed bullish momentum, invalidating the current lower thesis. If Bitcoin exceeds $ 98,212, the market could see a renewed ascending trajectory, restoring confidence in its future potential.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.