Bitcoin’s Bounce Might Not Be Bullish Yet; $117,000 is the Line It Must Cross First

The price of Bitcoin shows certain signs of life, up 1.1% during the day and negotiating about $ 114,000. But zooming, and weekly performances always show a drop of -3.77%, letting the traders wonder: is it just a rebound, or the start of the next BTC rally?

To understand this, it helps to look beyond the graphic. The chain signals of long -term holders, the assessments of the evaluation and the feeling of the traffic begin to line up, and they all point to a key level of the BTC.

The former holders withdraw as the sale pressure is switched off

Most significant corrections start when holders start to sell. And that’s exactly why we are considering exit bands spent at the moment.

Between July 23 and August 1, exit bands from 7 to 10 years old have widened a bit. This means that long -dead portfolios, holding bitcoin for almost a decade, were moving parts. This type of sales pressure has already been met between July 10 and July 19, when Bitcoin prices were corrected from $ 123,000 to $ 117,000.

However, the sales pressure induced by long -term holders has decreased in a coherent manner since the peak carried out on July 4.

Note: The group from July 10 to July 19 was wider than the group from July 23 to August 1, showing a clear drop in the intention to sell long -term holders.

And during the current widening of the band (July 23 to August 1), Bitcoin maintained more than $ 113,000, which shows that the market absorbed this offer without decomposing. And it is a sign of BTC price force.

This sales pressure seems to be fading. The same spent exit bands are now thinning, which indicates that the great movements of the old holders have probably cooled. When these portfolios stop selling, this often signals the possible end of a correction phase.

The exhausted exit strips show when different age parts are moved. Larger bands and larger equivalent to more movement. When the ancients weaken, this means that the food pressure is fading.

For TA tokens and market updates: Do you want more symbolic information like this? Register for the publisher Daily Crypto newsletter Harsh Notariya here.

Signals of the MVRV undervaluation report, and it is historically optimistic

With the side of the offer, the following question is the evaluation. And for this, the MVRV report (market value of the value achieved) flashes a familiar model.

Currently, the MVRV is 2.19. It was the same area that has triggered several gatherings in recent months.

In June 2025, when it reached 2.16, the Bitcoin price increased from $ 101,000 to $ 110,000 in six days. In April, 2.12 led to a passage from $ 101,000 to $ 119,000. And in November 2024, 2.04 sparked a rally from $ 67,000 to $ 98,000.

All these races had one thing in common: they started when the MVRV hovered just above 2, and the supply of older holders had already been eliminated. This is exactly the configuration we see now.

MVRV compares the current BTC price at the base of the average cost of all holders. A low relationship means that there is still room to grow; A top often means overheated. Right now, we are in an ideal place.

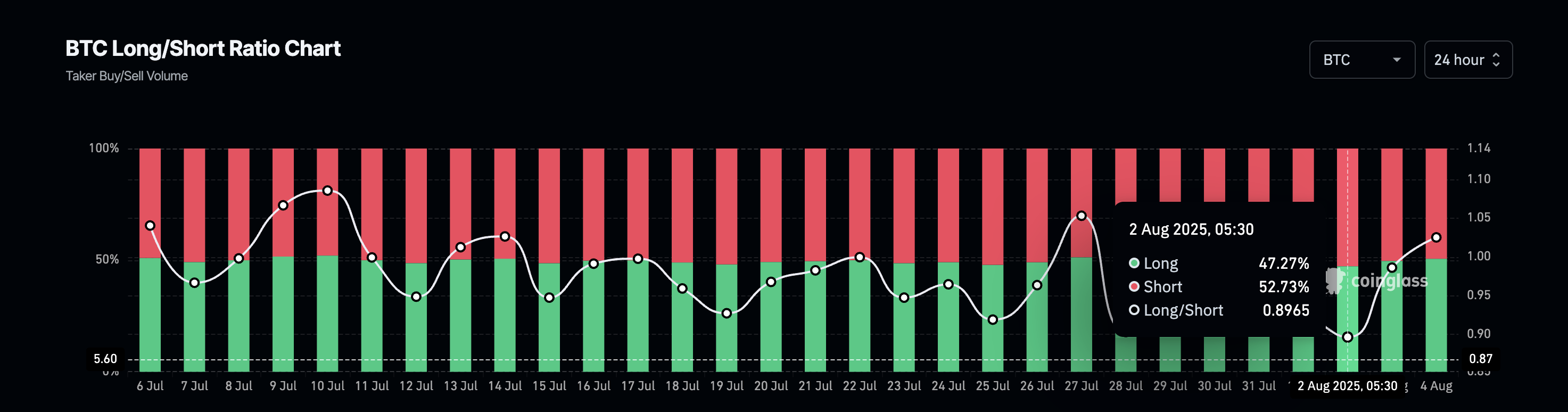

Even the positioning of traders moves in the same direction. The long / short ratio, which was down to 0.89 barely two days ago, has now changed 1.02. It is a subtle change, but it confirms that more traders position themselves for the rise, as are the evaluation signals say that there is room to run.

The point to take? We are in the same pocket; The power pressure slows down, the evaluation is seated in a launch area and the merchants are preparing quietly.

The price of Bitcoin must generate $ 117,000; Or it risks another trap

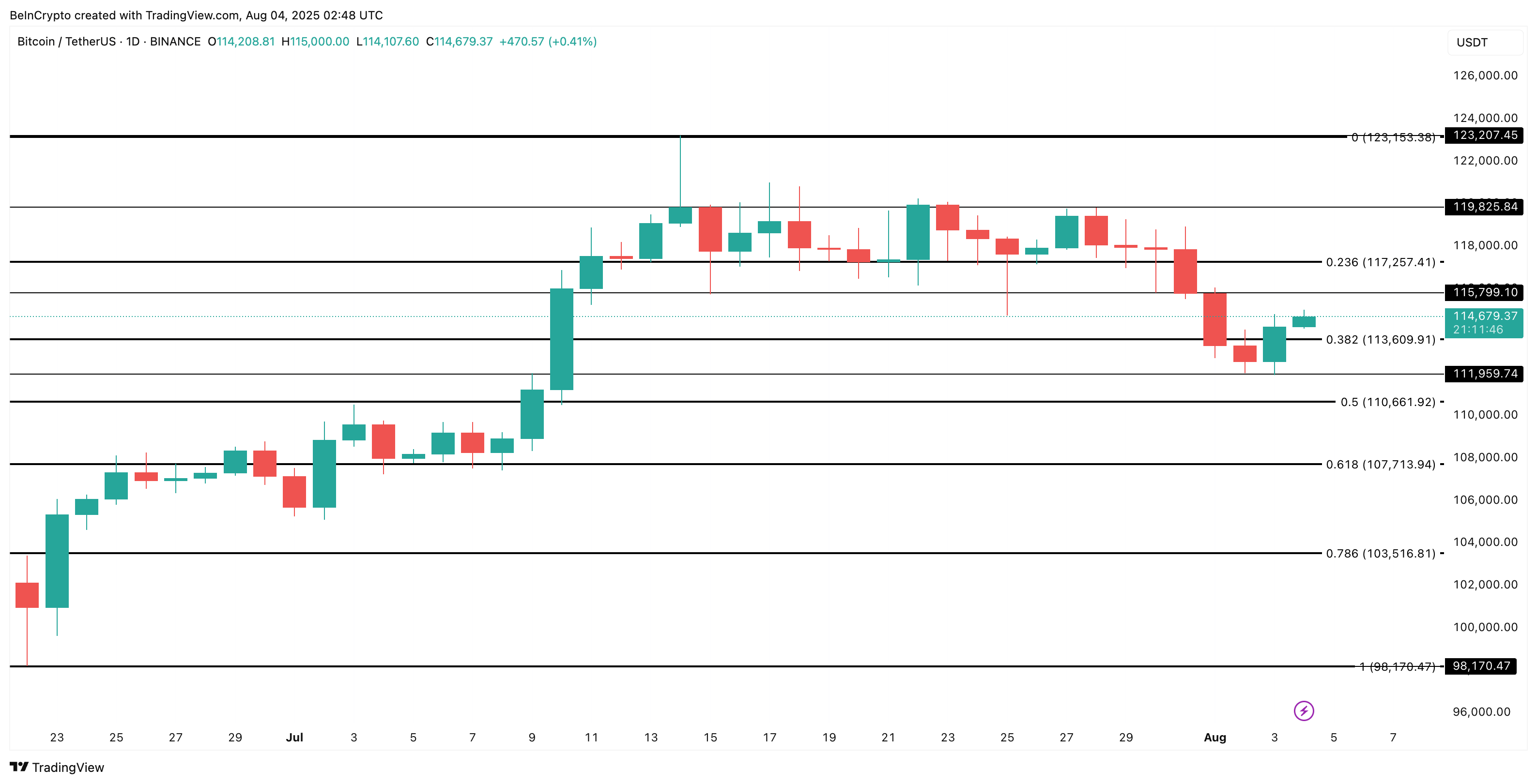

On the graph, the price of Bitcoin is held just above the level of trace of 0.382 Fibonacci at $ 113,600. This level was taken from the June 98,000 hollow at the top of all time of $ 123,000.

Below, the BTC price support structure is at $ 111,900 and $ 110,000. If the bulls lose these levels, the next serious soil is down to $ 107,000, which also acts as the invalidation of the bullish configuration.

But the large number that everyone looks at is $ 117,000. Depending on the graph, the area greater than $ 117,000 has the maximum candle crowd, showing how important it is to support / resistance.

If the price can return this level, it may trigger the next BTC rally. Otherwise, we are probably examining another missed movement in an agitated range.

Bitcoin’s rebound may not yet be bullish; $ 117,000 is the line he must first cross first appear on Beincrypto.