Bitcoin’s Future After Trump Tariffs

Welcome to the Briefing of American morning cryptography – your essential overview of the most important developments in the crypto for the coming day.

Take a coffee to see how Bitcoin holds the field while Wall Street Tresbuche, why Trump’s prices can push the Fed in the mode of printing money, and what it could mean for the next crypto chapter. Ethereum resilience testing the chances of an American recession, that’s all you need to know to stay in advance.

Bitcoin enters into its time at risk-dynamic in the midst of prices and disorders

Bitcoin reaction to recent macro shocks – in particular Trump’s Trump prices – was significantly calm compared to traditional markets, and that turns heads. While Wall Street stumbles stronger than expected, Crypto was held relatively stable.

The editor of Nexo Dispatch, Stella Zlatarev, told Beincrypto that it is not only resilience – is proof that Bitcoin could enter a new phase of maturity of the market.

“A 2 to 3% drop in crypto is a rounding error compared to past cycles,” she said, stressing that this stability in the middle of chaos suggests that Bitcoin is no longer just a speculative release kick. “Bitcoin’s ability to summarize macro-turbulence without the wild oscillations of previous years suggests that institutional investors treat it less as a speculative release boot and more as a strategic asset,” said Zlatarev.

Analysts also stressed that Bitcoin behavior does not align themselves with traditional asset categories.

“It is not gold, and it is not the yen. Instead, Bitcoin emerges as a dynamic asset at risk – which does not collapse as high growth stocks but does not attract the same safety flow flows as traditional paradise,” Zlatarev told Beincrypto.

This concept of “dynamic” assets positions bitcoin in a unique role: something that thrives in uncertainty but which does not collapse when the market turns.

Zlatarev de Nexo also noted that the reaction of Ethereum and other first -rate altcoins will be the key.

“If ETH reflects BTC’s performance, it strengthens the case that high -level cryptographic assets are changing towards a more predictable asset class. If Eth Borche, it strengthens that, for the moment, Bitcoin is in a separate league.”

Meanwhile, the macro backdrop moves quickly. The new prices of Trump’s “Liberation Day” frightened world trade partners and also sent training effects through prediction markets. Polymarket now gives almost 50% ratings of an American recession this year – a major change after the announcement.

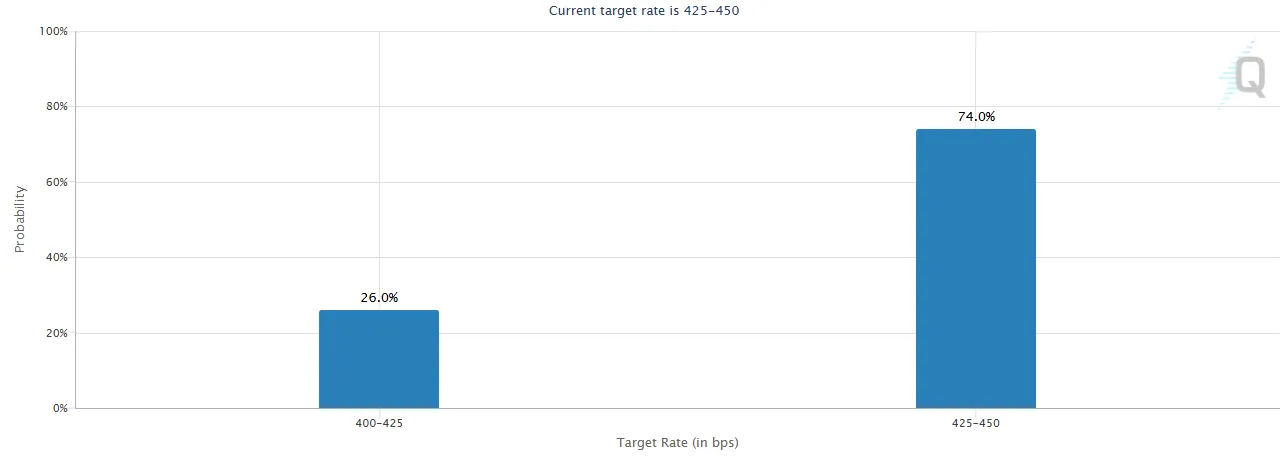

In addition, the CME Fedwatch tool shows that interest rate traders have increased the probability that the American federal reserve will make four rate drops this year. Finally, this could relieve the current macroeconomic pressure on Bitcoin.

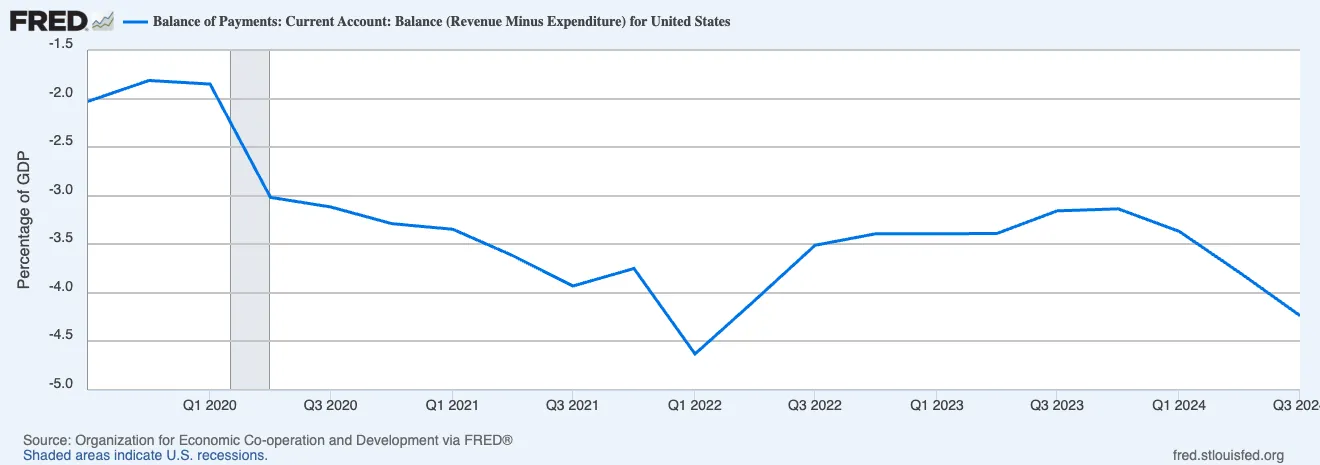

Old bitmex CEO Arthur Hayes said that Trump’s current tariff strategy could complicate the US bond market. In other words, The pressure is built for the Fed to take place, possible by activating the liquidity tap again.

All this puts Bitcoin under a new projector. Its stability is no longer rejected as a coincidence. It is perhaps the first sign that the crypto, or at least its most mature players, comes out of the speculation shadows and under the spotlight of strategic finance.

Graphic of the day

By reducing foreign demand for US Treasury bills, Trump prices can force the Fed to inject more liquidity – potentially weakening the dollar and stimulating bitcoin like another value store.

Alpha the size of an byte

– Trump’s “release day” applies 10% + prices on all imports, hitting China, EU and Israel, triggering market cuts and recession fears.

– According to Standard Charterd, Bitcoin could reach $ 500,000 at the end of Trump’s mandate, AVAX could 10 times by 2029, and Ethereum’s target in 2025 falls to $ 4,000.

– The stable act of 2025 progresses with bipartite support, aimed at tightening the rules of the stable to competition and regulatory pressure.

– The FNB Bitcoin saw $ 221 million in April, the entries by the ARKB, but the derivatives of the cool BTC with a drop in term interest and a feeling of lowering options.

– DXY reached a hollow in 2024 after the prices of the “Liberation Day”, fueling the hopes of Bitcoin over -term bitcoin in the midst of global tensions and the uncertainty of politicians.

– Bitcoin is struggling below $ 85,000 in the midst of a weak feeling, but long -term holders remain firm, keeping fears of remote capitulation.

– Polymarket sees almost 50% of American recession while Trump’s prices spread market fears and trade tensions.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.