Bitcoin’s New Phase: Glassnode Reveals Distribution Shift

According to Glassnode, Bitcoin (BTC) is experiencing a prolonged distribution phase. In addition, the momentum of the market and the flows of capital have moved to a negative territory, suggesting a reduction in demand.

This change, associated with an increase in the uncertainty of investors, contributes to a broader drop in the overall feeling of the market and confidence.

Bitcoin enters a prolonged distribution phase

In his latest weekly newsletter, Glassnode stressed that the Bitcoin market structure had entered a distribution phase after all time (ATH). This phase marks a natural progression of the cyclic behavior of Bitcoin.

The cycle is motivated by alternating periods of accumulation and distribution, the capital moving between the different groups of investors over time.

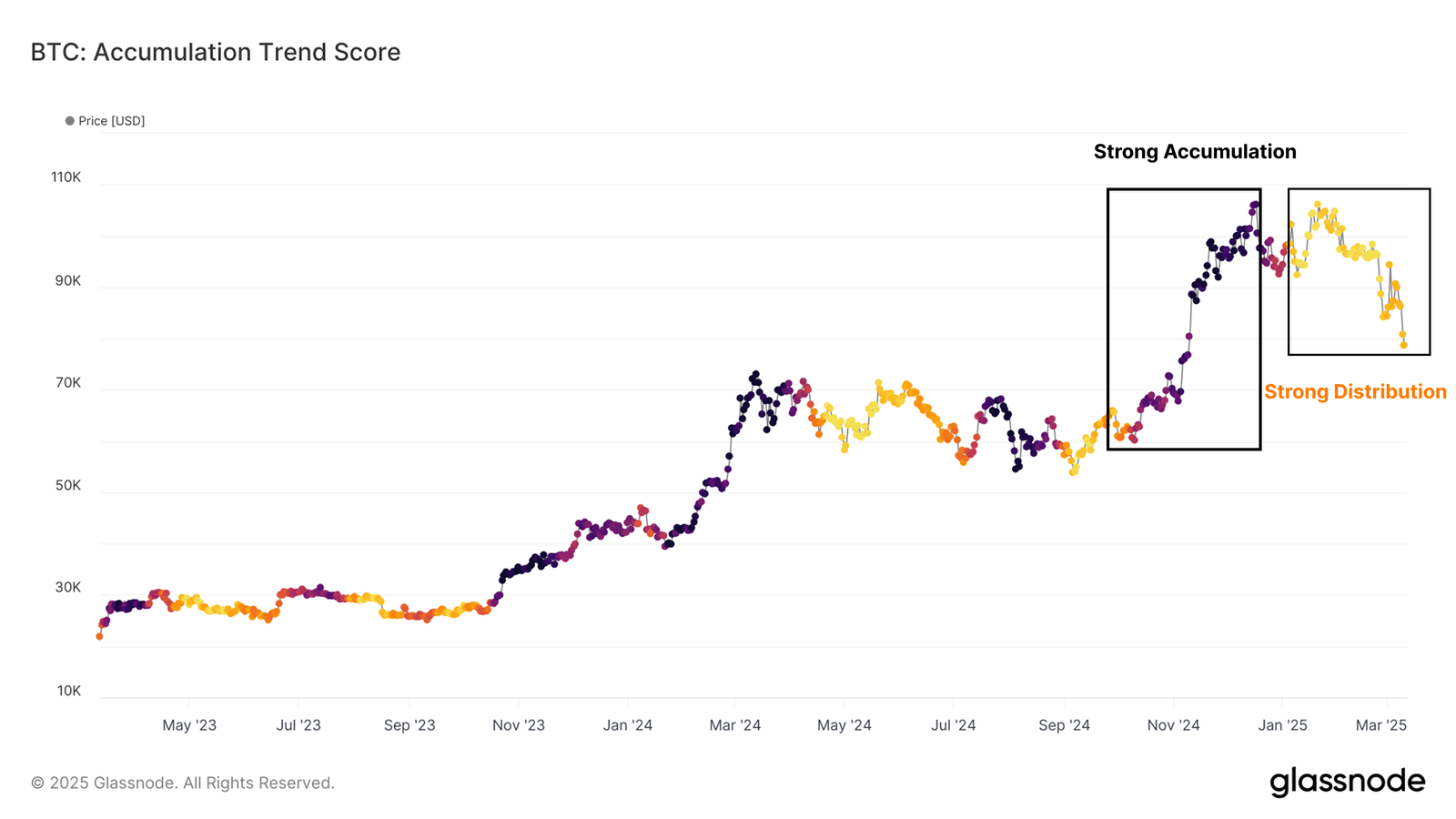

“The last distribution phase began in January 2025, corresponding to the net bitcoin correction from $ 108,000 to $ 93,000,” said the bulletin.

In addition, Glassnode stressed that the accumulation trend score remains less than 0.1.

This suggests that market players focus more on the liquidation of their assets rather than adding to their positions. Thus, until the trend is reversed, the market can cope with continuous decrease pressure.

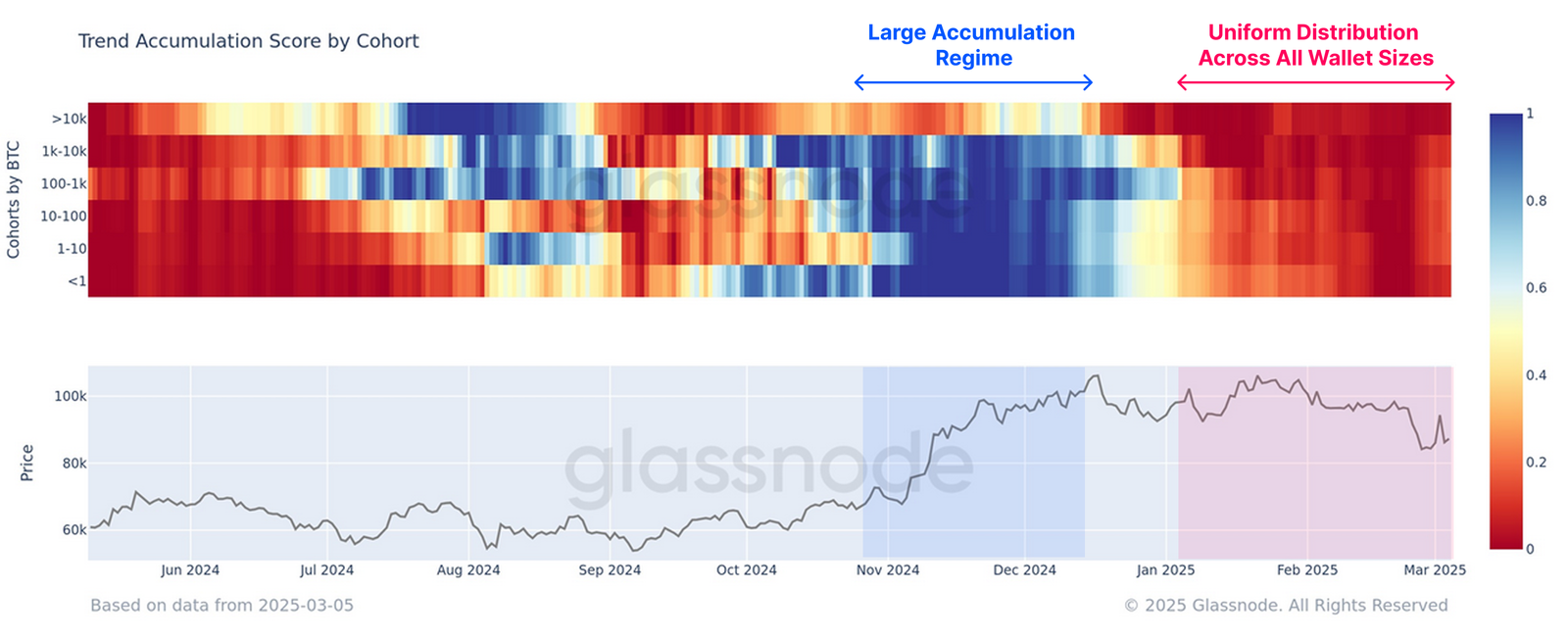

Meanwhile, distribution is not specific to a single group of investors. According to Glassnode, in the past two months, all portfolio size categories have been actively distributed.

This has considerably intensified the pressure on the market on the market. In addition, the newsletter added that the sales activity has become more pronounced since mid-January.

A substantial part of the sale pressure comes from coins sold at a loss. This has also weighed on the overall force of the market.

“This presents that the current slowdown in the market has been a difficult environment for investors, many of which leaving the market below their cost base under pressure from the dens,” said Glassnode.

In addition to distribution, the feeling of the market has also changed. The feeling of investors looked more careful. Glassnode revealed that accumulation decreased as macroeconomic uncertainty increased, in particular after events such as harassment of appeal and the increase in American tariff tensions.

The analysis company noted that when postponing prices between mid-December and February, investors bought bitcoin, especially in the range of $ 95,000 to $ 98,000. They thought that the trend of bulls would continue.

However, at the end of February, liquidity has tightened and external risks increased. Therefore, confidence in a new accumulation has started to fade.

“The lack of purchase of diving at lower levels suggests that the rotation of capital is underway, which potentially leads to a more prolonged consolidation or corrective phase before the market finds a firm support base,” added Glassnode.

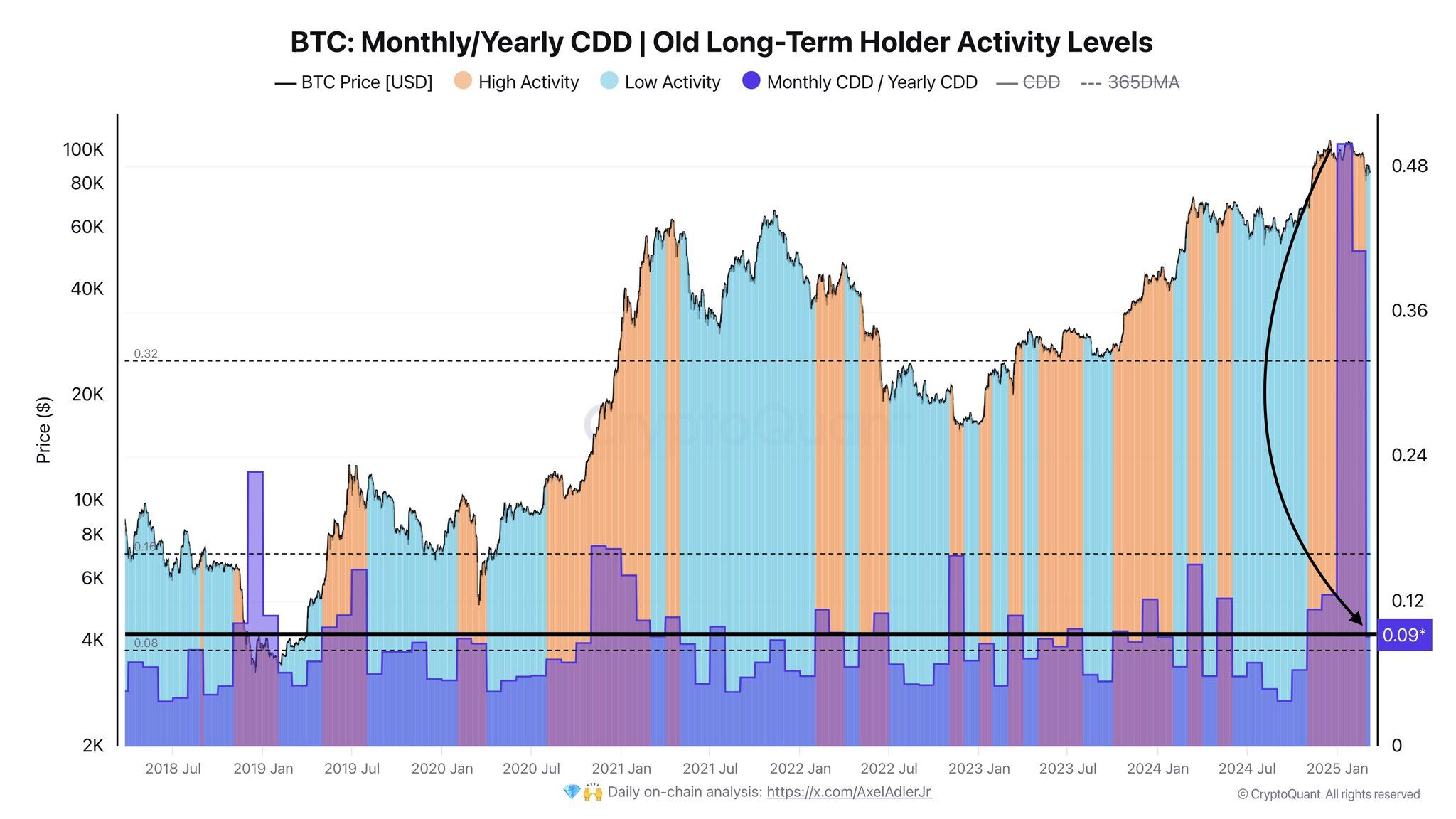

However, not everyone is pessimistic. A chain analyst – Axel Adler observed that the largest distribution of Bitcoin by long -term holders in recent years seems to have ended.

According to his analysis, activity measures have increased from high -sales activity to lower accumulation levels. This change suggests that long -term holders could regain confidence, potentially signaling stabilization or a future movement on the market.

“This reduction in supply generally precedes stabilization and a new market cycle, representing a potentially positive market signal,” he posted on X.

While Bitcoin continues to navigate this phase, its price has shown significant volatility. Beincryptto said the BTC was below $ 80,000 in the middle of recession fears. Nevertheless, he succeeded in a slight recovery while the pricing and geopolitical tensions were held.

At the time of the press, BTC was negotiated at $ 83,424. According to beincrypto data, this marked modest gains of 2.0% in the last day.

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.