Bittensor (TAO) Momentum Slows Post 6.5% Gain

Bittensor (TAO) has increased by 6.5% in the last seven days, and its market capitalization now oscillates just below $ 4 billion despite the correction of 6.6% in the last three days. The recent decline has weakened key technical indicators, with a momentum and a trend force showing signs of deterioration.

While Tao has managed to have key support levels and remains more than $ 440, the lower signals are starting to emerge on several graphics. That the bulls can recover the control or the TAO shifts below $ 400 will probably define its next major movement.

The bittenseur trend is weakening while the lower time exceeds the bulls

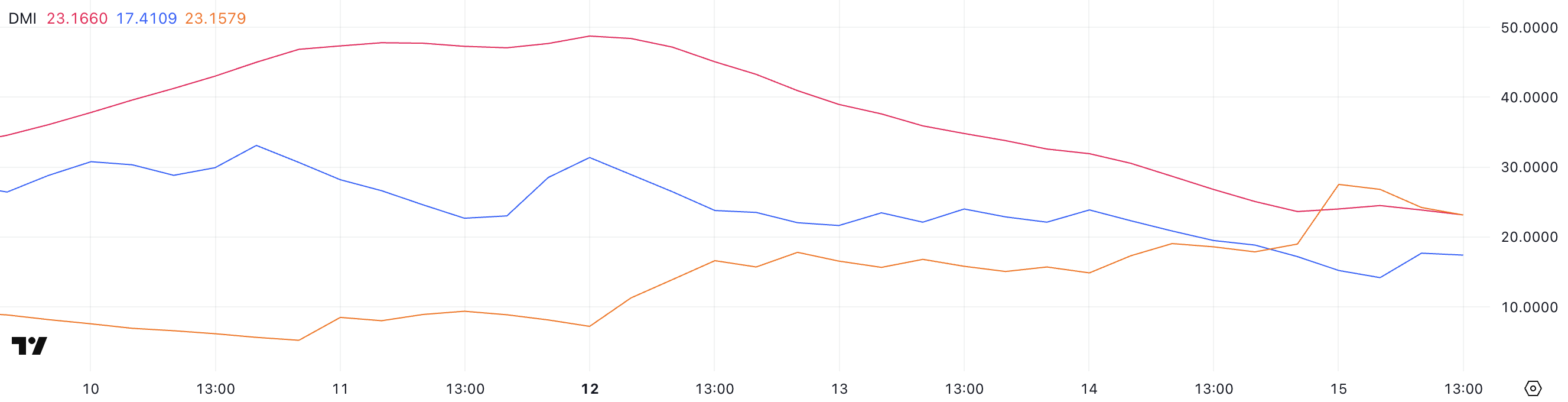

The DMI (Directional Movement Index) graph of TAO shows a weakening trend, with its ADX (average directional index) falling heavily from 47 to 23.16 in the last three days.

The ADX measures the strength of a trend – constantly steering – on a scale of 0 to 100. Values greater than 25 generally indicate a strong trend, while readings less than 20 suggest a low or varying market.

The current ADX of Tao is just above 23, suggesting that the recent trend loses strength and can approach a transition phase. Despite this, according to Coingecko data, Bittensor is the largest artificial intelligence piece on the market, going beyond players like Narch, ICP and Render.

Meanwhile, the + DI (positive directional indicator) increased from 23.87 to 17.41, signaling a drop in bullish pressure. At the same time, the -Di (negative directional indicator) went from 17.86 to 23.15, showing that the lower momentum takes control.

This crossover – where -Di exceeds + di – indicates that the sellers have exceeded buyers, and with ADX still greater than 20, the downward trend can continue to develop.

If this divergence persists, the price of TAO could face additional short -term drop, unless the bulls come back to change the momentum.

Tao recovers but lack of clear strength

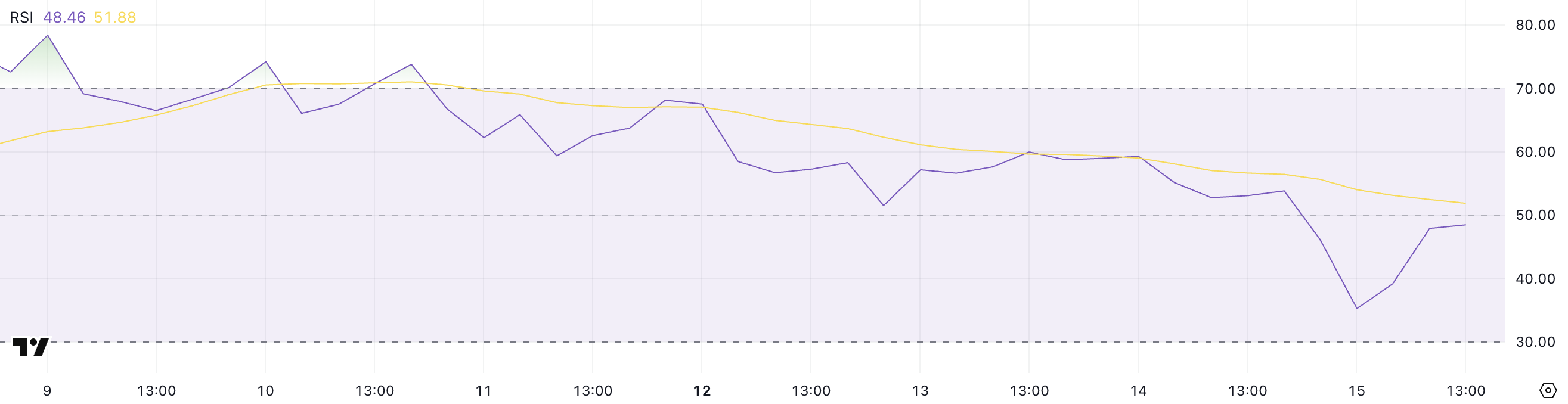

The Tao relative force index (RSI) is currently 48.46, after having experienced an intra -day drop of 53.82 yesterday at 35.25 just hours ago.

The RSI is a momentum indicator which measures the speed and extent of recent price movements on a scale of 0 to 100. As a rule, the values greater than 70 suggest too hidden conditions and the potential of a decline, while the values below 30 indicate the surveillance conditions and a possible rebound.

Readings between 30 and 70 are considered neutral, the brand 50 often acting as a point of balance between the optimistic and bearish momentum.

The current TAO RSI of 48.46 places it slightly below this median point, signaling a slight lower bias after a brief period of stronger sales pressure.

Recovering the bottom of 35.25 shows that buyers have intervened, but the 50-year-old non-compliance suggests that the bullish momentum remains low. This level could reflect consolidation or indecision on the market, where Tao can be negotiated on the side unless new catalysts emerge.

If RSI stabilizes or rises again above 50, this may indicate renewed resistance, while another drop around 30 would increase the more downward risk.

Tao holds the support but faces a key test for Momentum recovery

Tao recently tested key support around $ 417.6 and rebounded above $ 440, showing resilience after a brief decline. Its EMA lines always reflect an upward structure, with short-term mobile averages positioned above those in the long term.

However, the narrowing gap between them suggests that the momentum is weakening. If the sale of yield pressure, the trend could change, threatening Bittensor leadership as the largest part of AI.

If Bittensor takes up the strength, it could aim for a retess zone of $ 492.79, which would completely recover recent losses.

Lowering, not holding the support levels of $ 434 and $ 417.6 would put Tao at the risk of entering a clearer downward trend.

A break below these areas could drag the price to $ 380, pushing TAO below $ 400 for the first time in about a week.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.