BlackRock ETF Leads With $305 Million Inflows Amid Price Surge

On Monday, the Bitcoin price exceeded the psychological bar of $ 105,000, fueling renewed confidence among institutional investors and causing capital entries in Bitcoin (ETF) funds.

That day, the entries in these funds exceeded $ 650 million, led by Blackrock’s Ibit Etf.

BTC ETFS spot after the four -day entry sequence

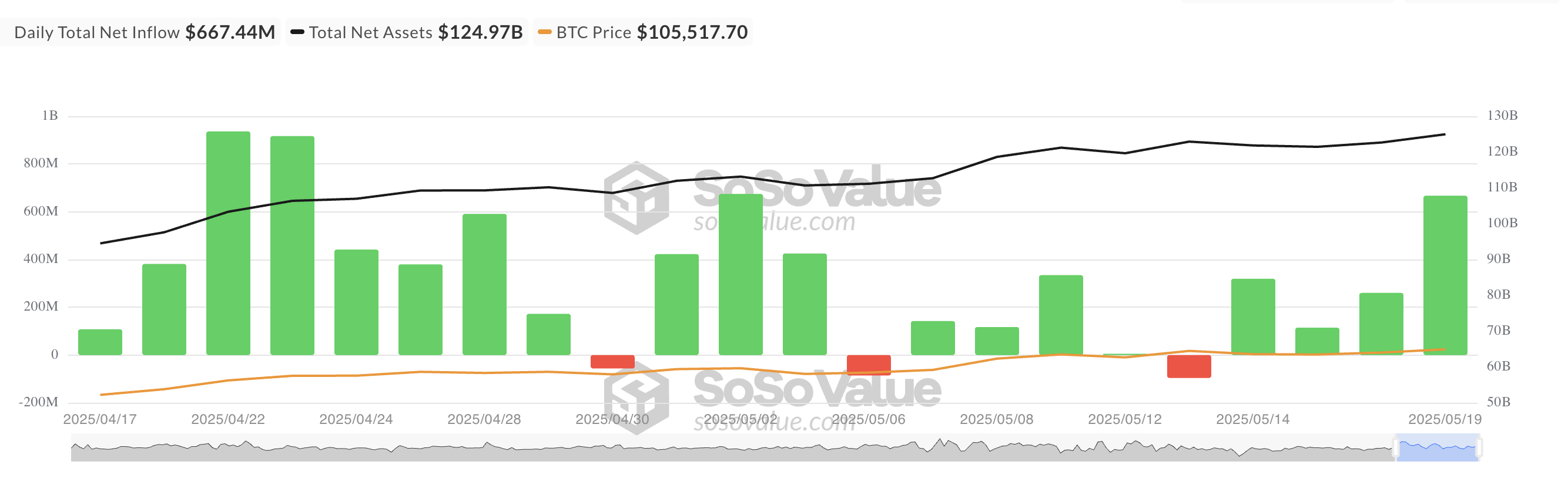

Yesterday, BTC ETFs on the point linked to the United States recorded a combined net entry of more than $ 667.44 million – their highest day entry since May 2. He also marked the fourth consecutive day of positive dishes in these funds, reflecting an increase in institutional appetite in the midst of signs of a broader market.

During the intra -day negotiation session on Monday, the BTC briefly joined a daily summit of $ 107,108. Although it had a slight withdrawal, the closure above the key level of $ 105,000 was sufficient to trigger a renewed confidence of investors and generate significant entries in punctual ETFs.

The ETF Ibit of BlackRock has recorded the largest net daily entrance, totaling $ 305.92 million, bearing its total cumulative entrances to 45.86 billion dollars.

The FIDLY FNB FBTC FBTC recorded the second highest net influx of the day, attracting $ 188.08 million. Total historic net entries of the ETF now amount to $ 11.78 billion.

BTC Rally brings vapor

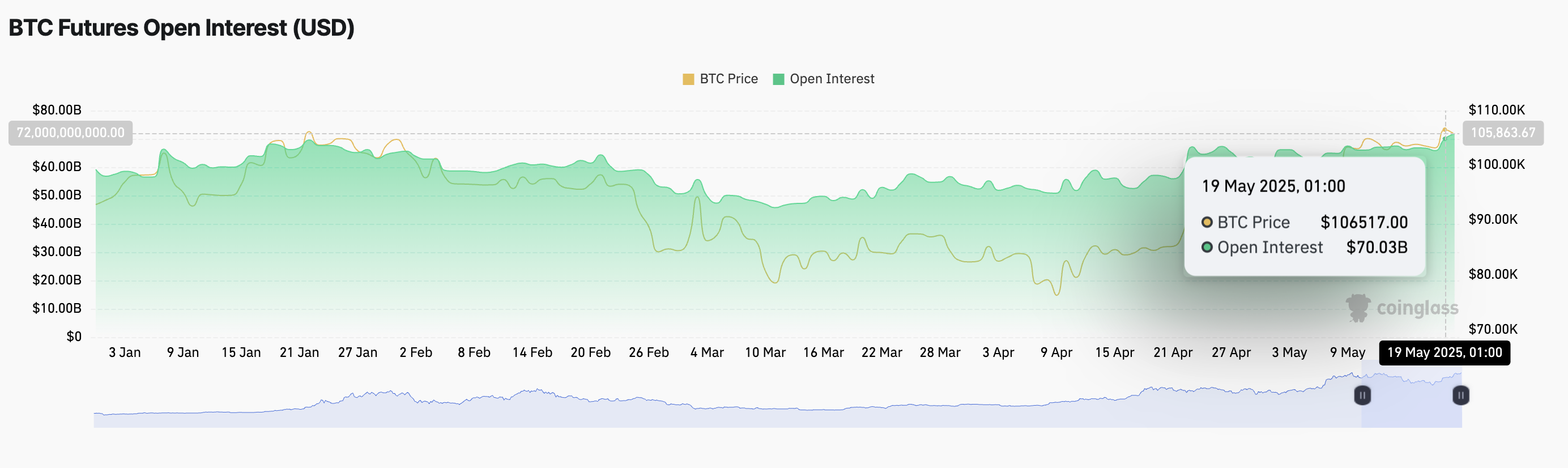

In addition to 3% in the last day, BTC is currently negotiating at $ 105,543 and attends bullish damage. This is reflected in its open interest in the long term, which has climbed to its highest annual level. At the time of the press, it is more than $ 70 billion, climbing 1% in the last 24 hours.

When the open interest of an asset increases alongside its price, new money enters the market to support the upward trend. This trend indicates a strong bullish feeling and the potential of a sustained BTC price rally.

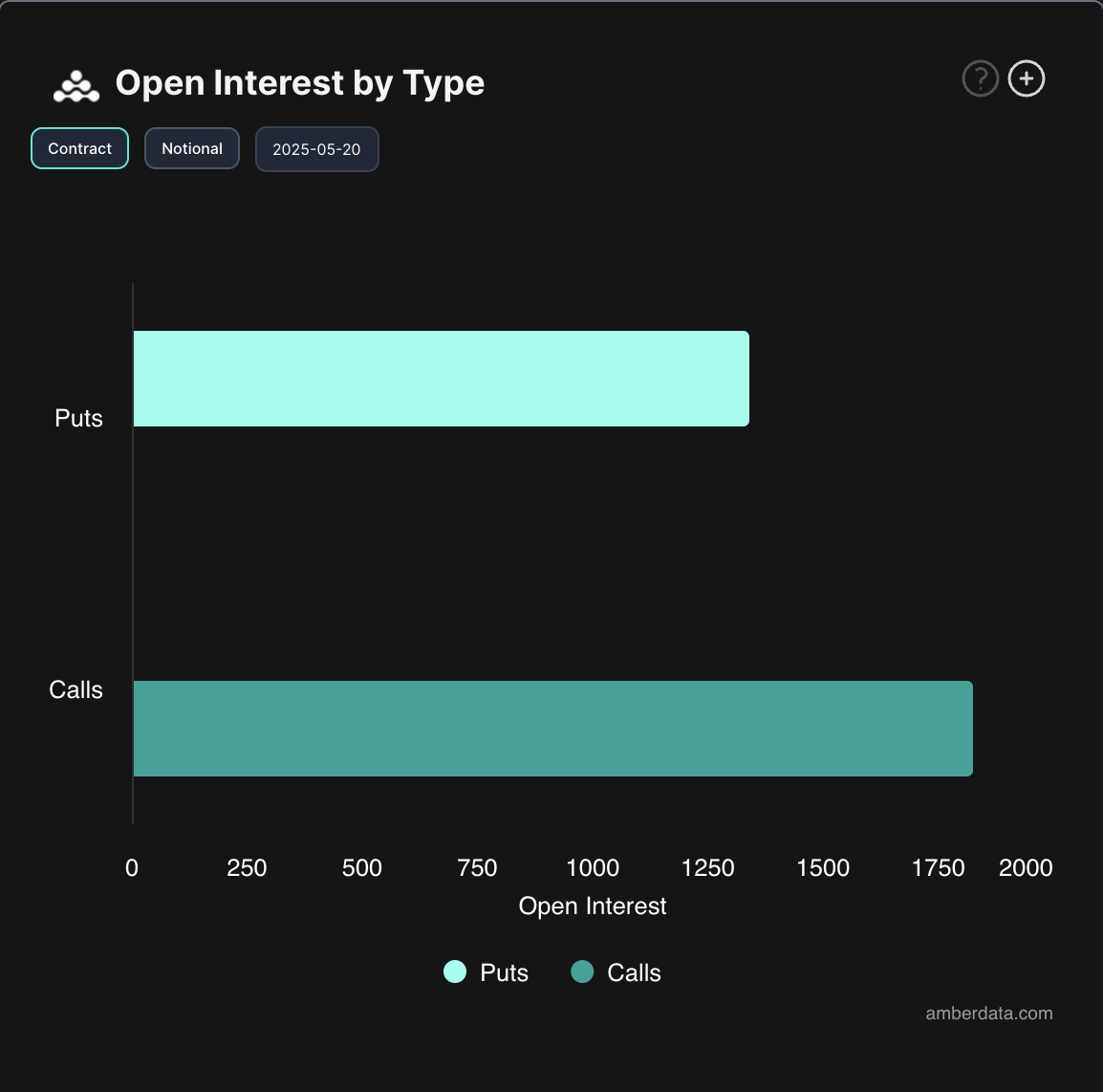

In addition, today, the options market has experienced an increased demand for appeal options – concludes who bet on higher prices, which confirms the optimism of the market in force.

We can say that the important ETF entries, the activity of climbing derivatives and BTC recovery of a key psychological price level indicate a potential change in feeling and refer to the probability that the king’s play affects a new summit of all time in the short term.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.